Deferred Revenue Debit Or Credit Balance

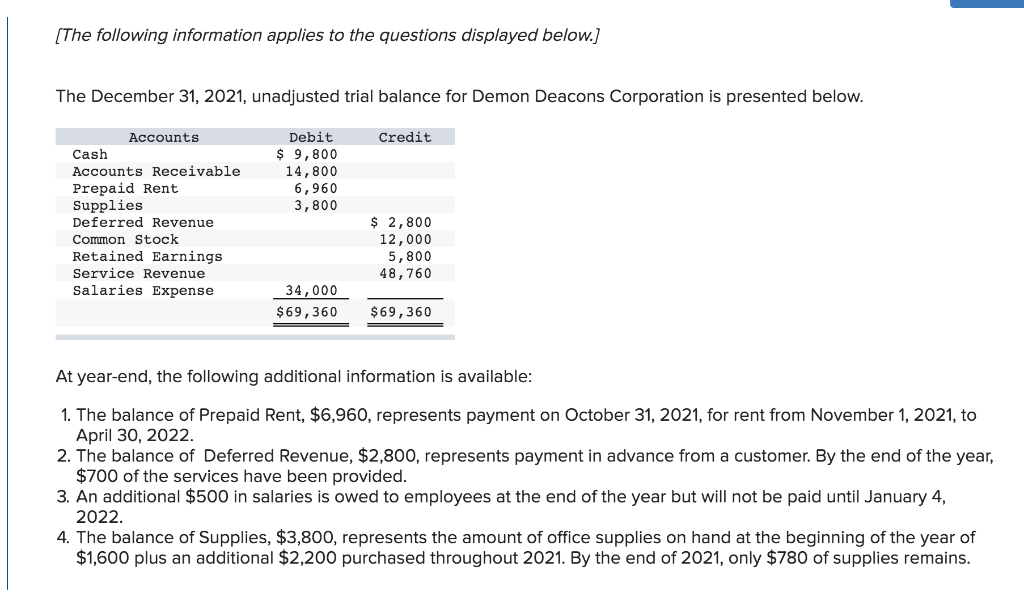

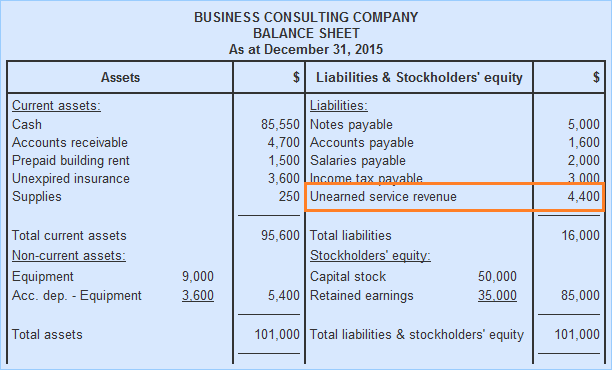

Depending on the contract terms the selling entity may not be allowed to recognize revenue until all goods have been delivered and or services completed.

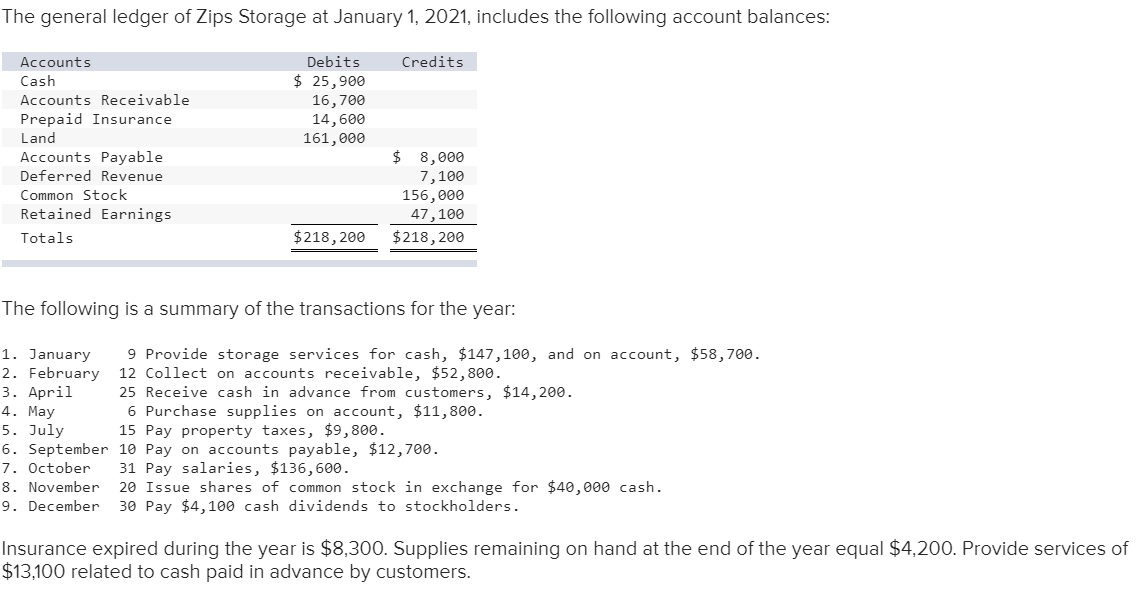

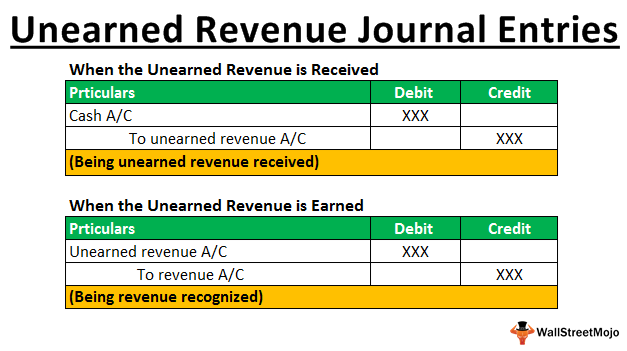

Deferred revenue debit or credit balance. The recipient of such prepayment records unearned revenue as a. Your accountants will need to transfer 30 from the deferred revenue account to the earned revenue account using such a journal entry. What is deferred revenue deferred income. In this case company a will recognize the revenue as per the completion of the project.

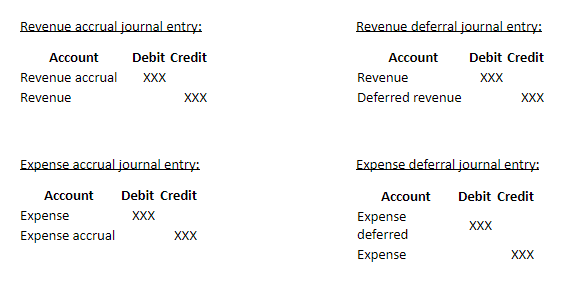

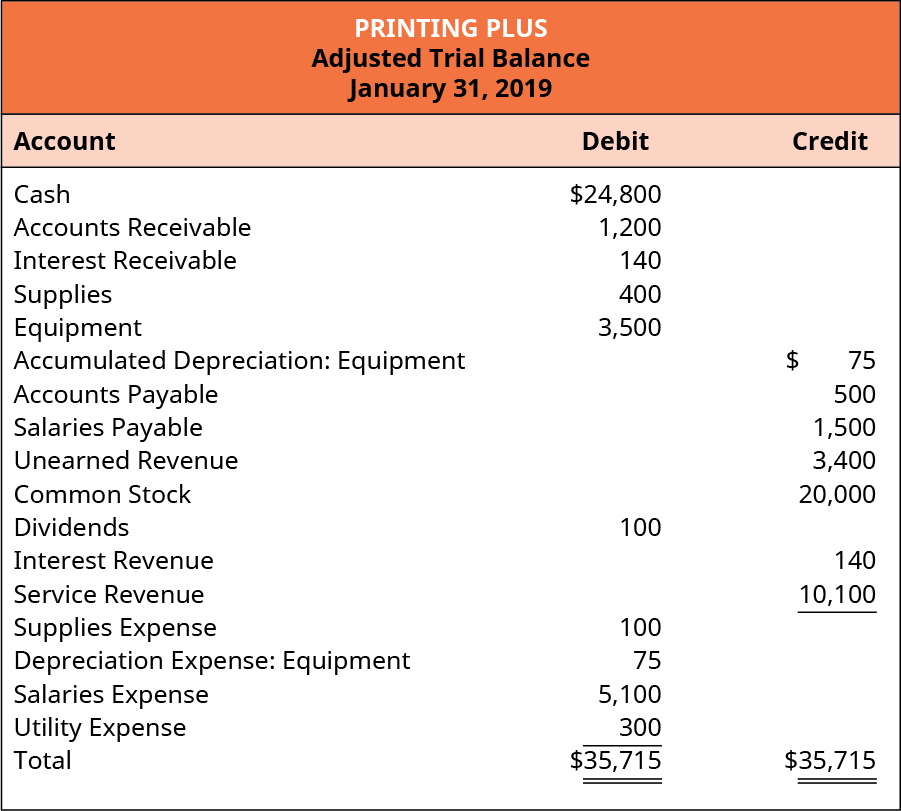

Asset bad debts balance sheet credit credit balance current asset debit debit or credit examples final accounts financial statements formula inventory journal entry liabilities liability list provision for doubtful debts suspense account trial balance working capital. That debit is reconciled with a 225 credit to revenues. Now the deferred revenue amount will be 330 360 30. Debit the decrease in a liability.

As the recipient earns revenue over time it reduces the balance in the deferred revenue account with a debit and increases the balance in the revenue account with a credit. Deferred revenue journal entry bookkeeping explained. 75 of deferred revenue recognized as real revenue 0 75 300 225 debit to deferred revenue liability. Debit deferred revenue 30.

Deferred revenue or unearned revenue refers to advance payments for products or services that are to be delivered in the future. Since the service was performed at the same time as the cash was received the revenue account service revenues is credited thus increasing its account balance. All sorts of businesses implement deferred revenue as a part of their business model either on a. If 50 of the project is completed at the end of year 1 5 00 000 will be recorded as revenue and balance 5 00 000 will be shown as deferred revenue and will be recognized when the balance 50 of the project gets complete.

This continues until the service 12 months of a magazine issue is completed. After the first month of your client s using it you will earn 30 360 12 of revenue. Credit subscription revenue 30. Deferred revenue is the amount of income earned by the company for the goods sold or the services however the product or service delivery is still pending and examples include like advance premium received by the insurance companies for prepaid insurance policies etc.

Let s illustrate how revenues are recorded when a company performs a service on credit i e the company allows the client to pay for the service at a later date such as 30 days from.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)