Deferred Revenue Expenditure Journal Entry

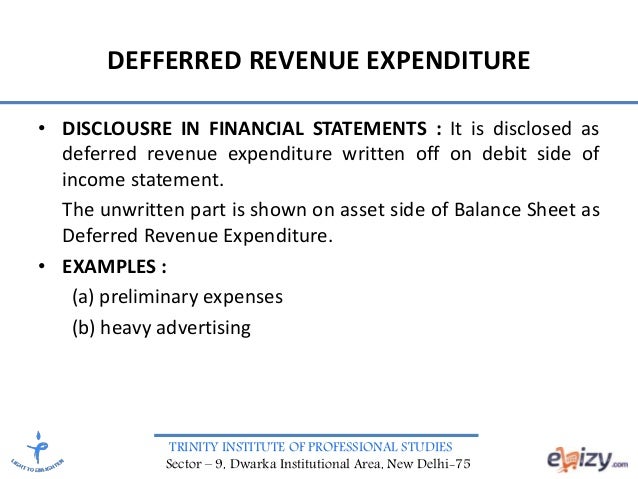

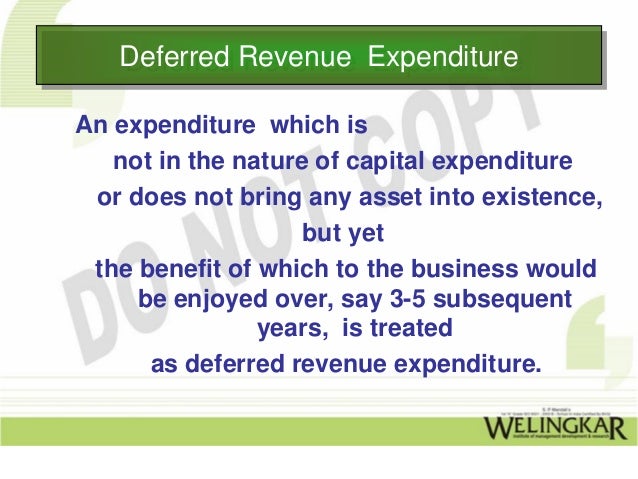

For example revenue used for advertisement is deferred revenue expenditure because it will keep showing its benefits over the period of two to three years.

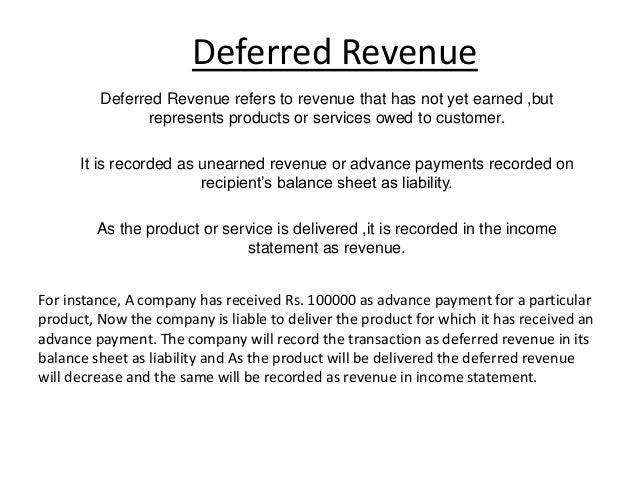

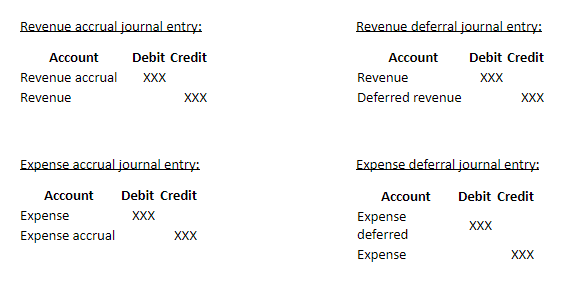

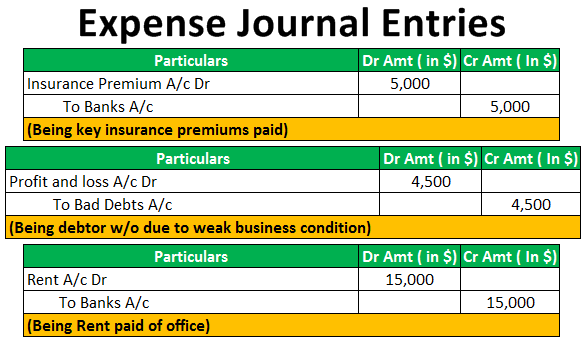

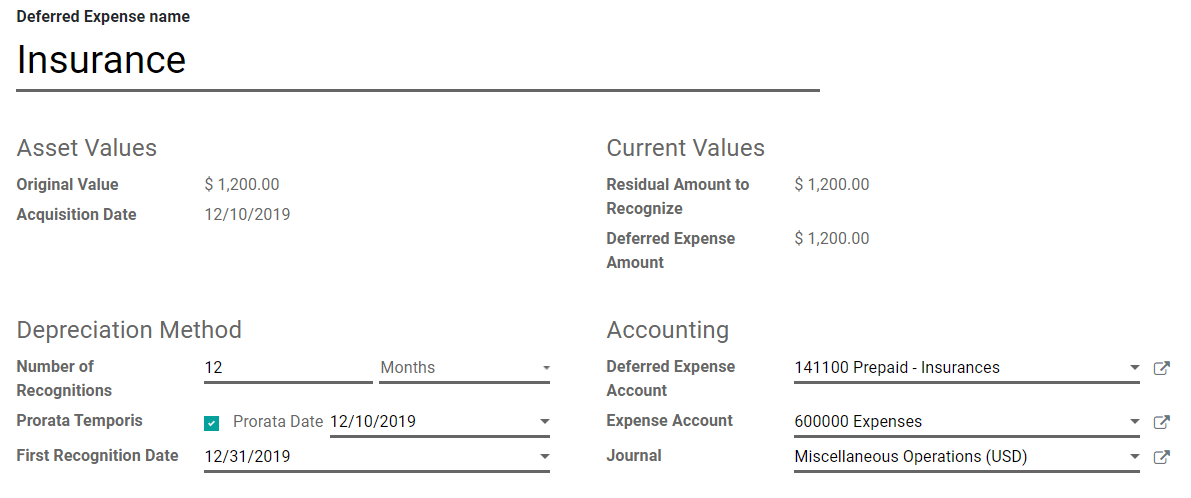

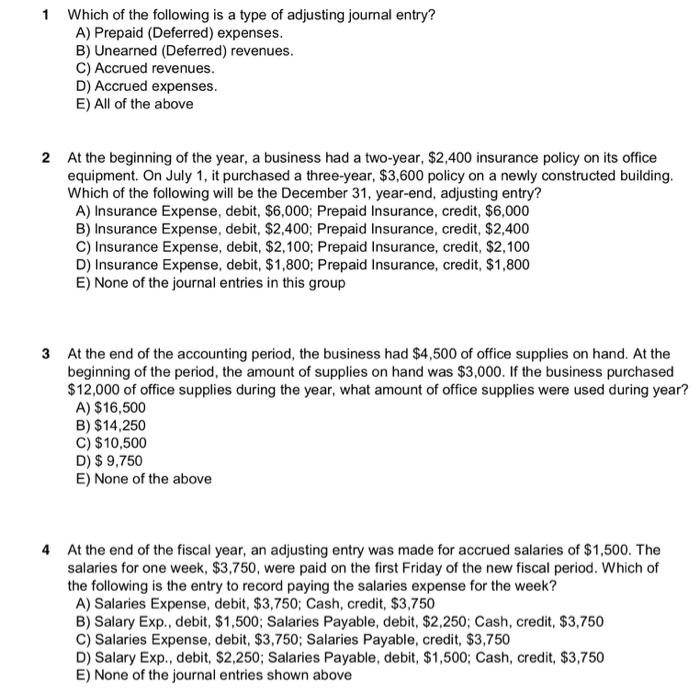

Deferred revenue expenditure journal entry. Likewise the company needs to properly make the journal entry for this type of advance payment as deferred revenue not revenue. There are two methods of recording revenue and expenditure deferrals this first is the asset and liability method shown immediately below and the second is the revenue and expenses method detailed later in this post. The expenditure has to be fully charged to p l in the first year itself. In simple terms deferred revenue means the revenue that has not yet been earned by the products services are delivered to the customer and is receivable from the same.

You may also learn more about accounting from the following recommended articles deferred revenue expenditure. For example suppose a business provides web design services and invoices for annual maintenance of 12 000 in advance. Deferred revenue expentuure journal enteries this query is. Deferred revenue and expenditure asset and liability method.

A deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance. In some cases the benefit of a revenue expenditure may be available for period of two or three or even more years. Also we discuss the differences between pre paid expenses vs. Here we discuss deferred expenses examples of house rent expense consultancy fees and insurance fees.

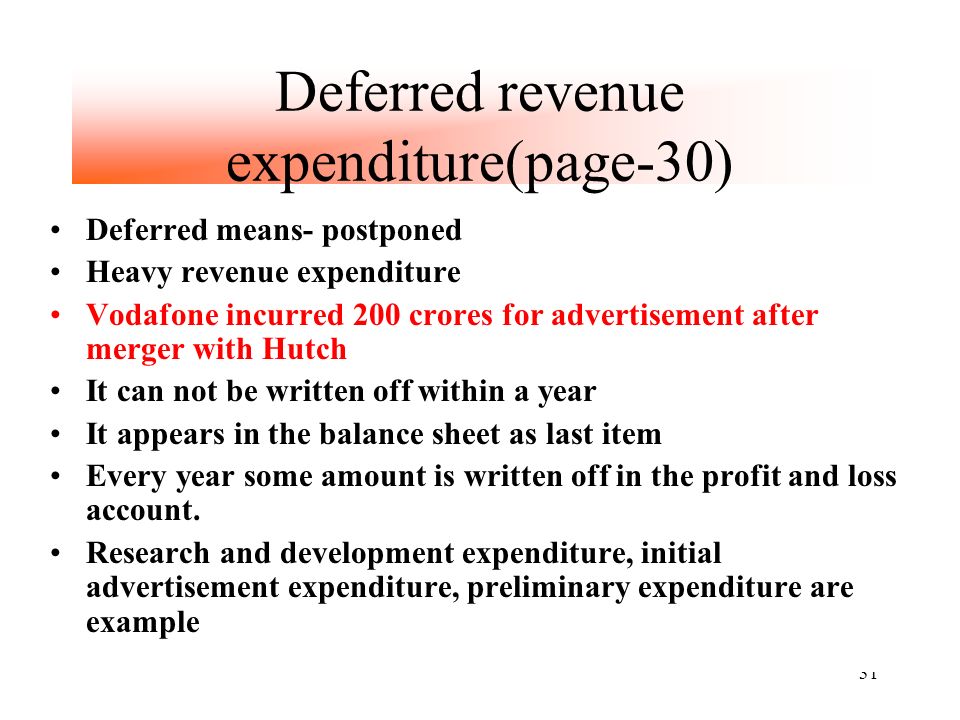

Such expenditure should normally be written off over a period of 3 to 5. It will be easier to understand the meaning of deferred revenue expenditure if you know the word deferred which means holding something back for a later time or postpone. Resolved report abuse follow query ask a query. Deferred revenue is the payment the company received for the goods or services that it has yet to deliver or perform.

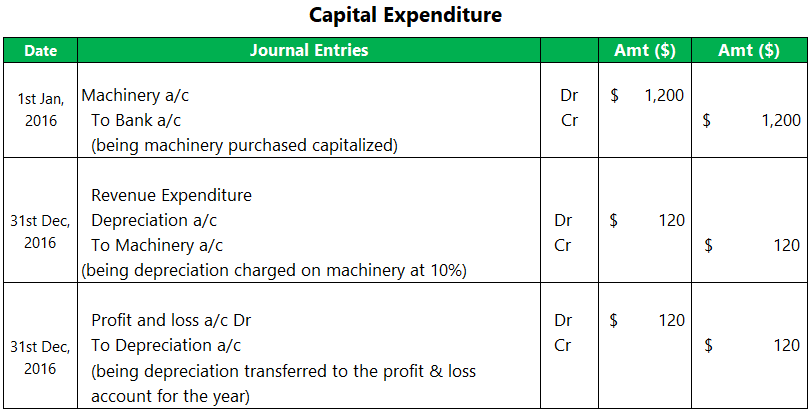

Deferred revenue expenditure is that expenditure which yields benefits which extend beyond a current accounting period but no relatively a short period as compared to the period for which a capital expenditure is expected to yields benefits. In business deferred revenue expenditure is an expense which is incurred while accounting period. Deferred revenue expenditure is an expenditure which is revenue in nature and incurred during an accounting period however related benefits are to be derived in multiple future. And the result and benefits of this expenditure are obtained over the multiple years in the future.

Deferred revenue journal entry overview. Deferred revenue examples top 4. 13 october 2009 deferred revenue expenditure concept is no more in existence as per as 26.