Deferred Revenue Income Journal Entry

Debit deferred revenue 30.

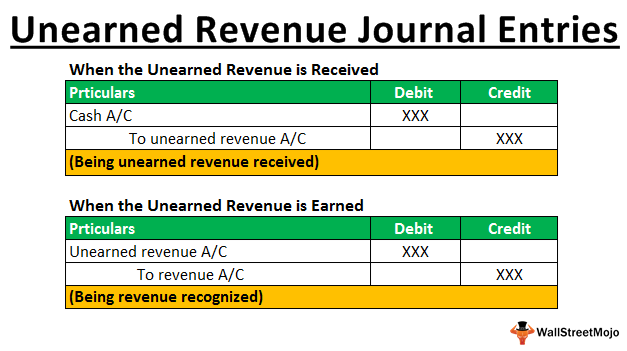

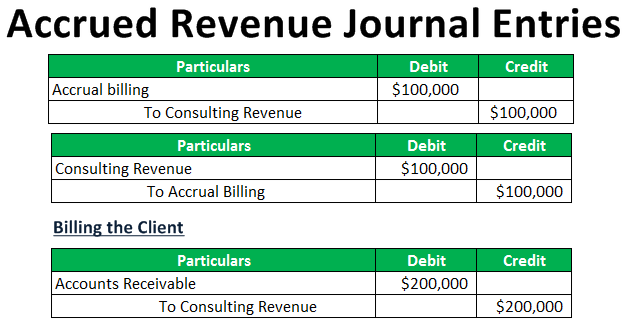

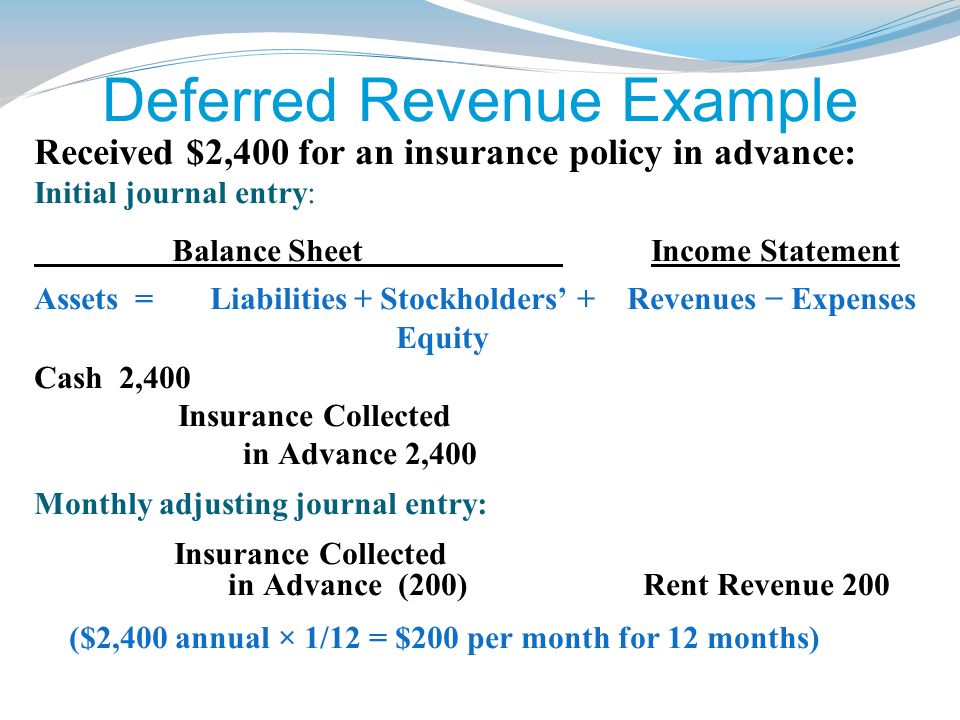

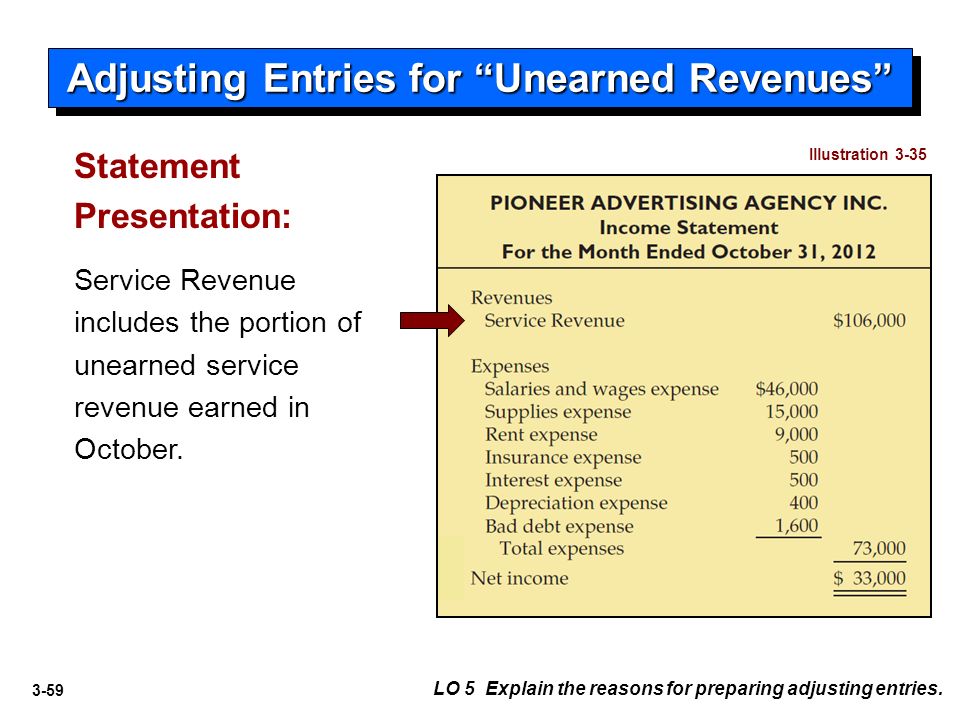

Deferred revenue income journal entry. For example suppose a business provides web design services and invoices for annual maintenance of 12 000 in advance. Journal entries of unearned revenue. The following unearned revenue journal entry example provides an understanding of the most common type of situations where such a journal entry account for and how one can record the same as there are many situations where the journal entry for unearned revenue pass it is not possible to provide all the types of examples. In simple terms deferred revenue means the revenue that has not yet been earned by the products services are delivered to the customer and is receivable from the same.

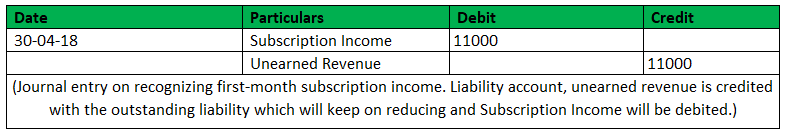

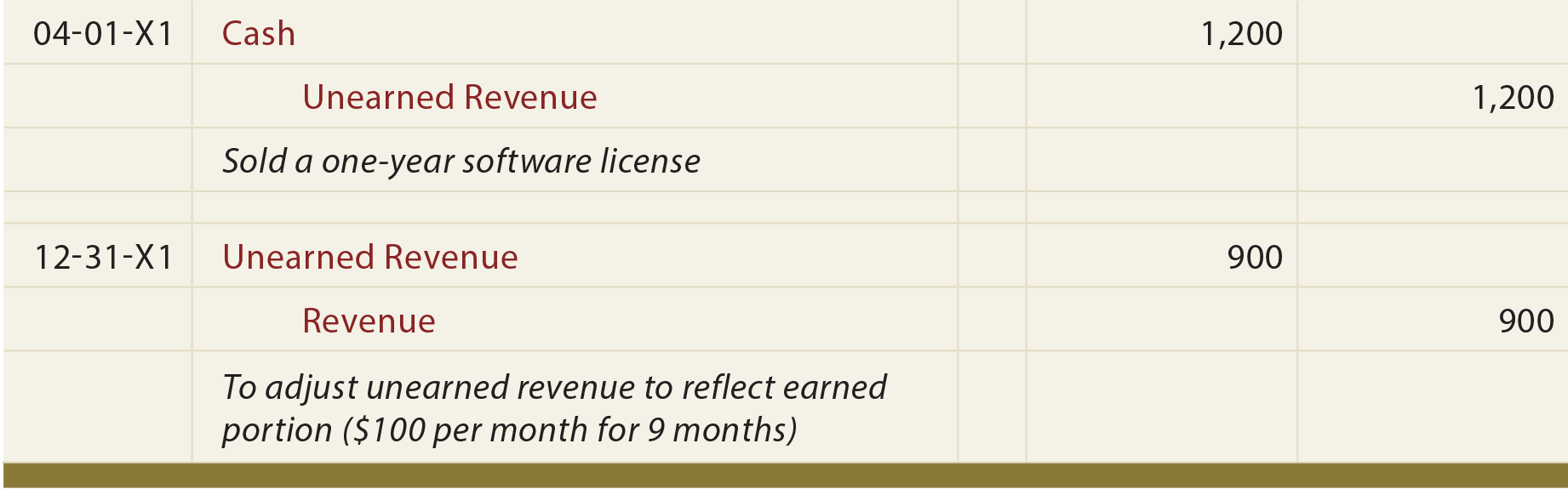

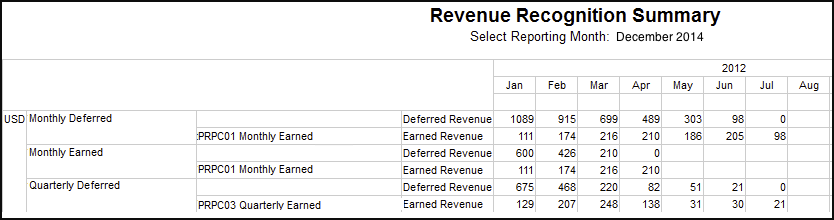

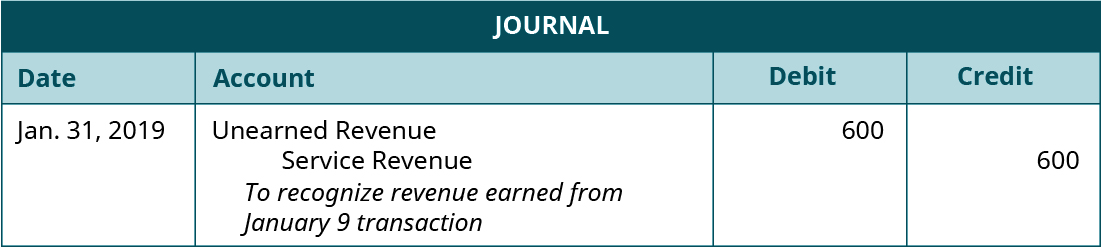

A deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance. Journal entry of deferred revenue the following deferred revenue journal entry provides an outline of the most common journal entries in accounting. Credit subscription revenue 30. Your accountants will need to transfer 30 from the deferred revenue account to the earned revenue account using such a journal entry.

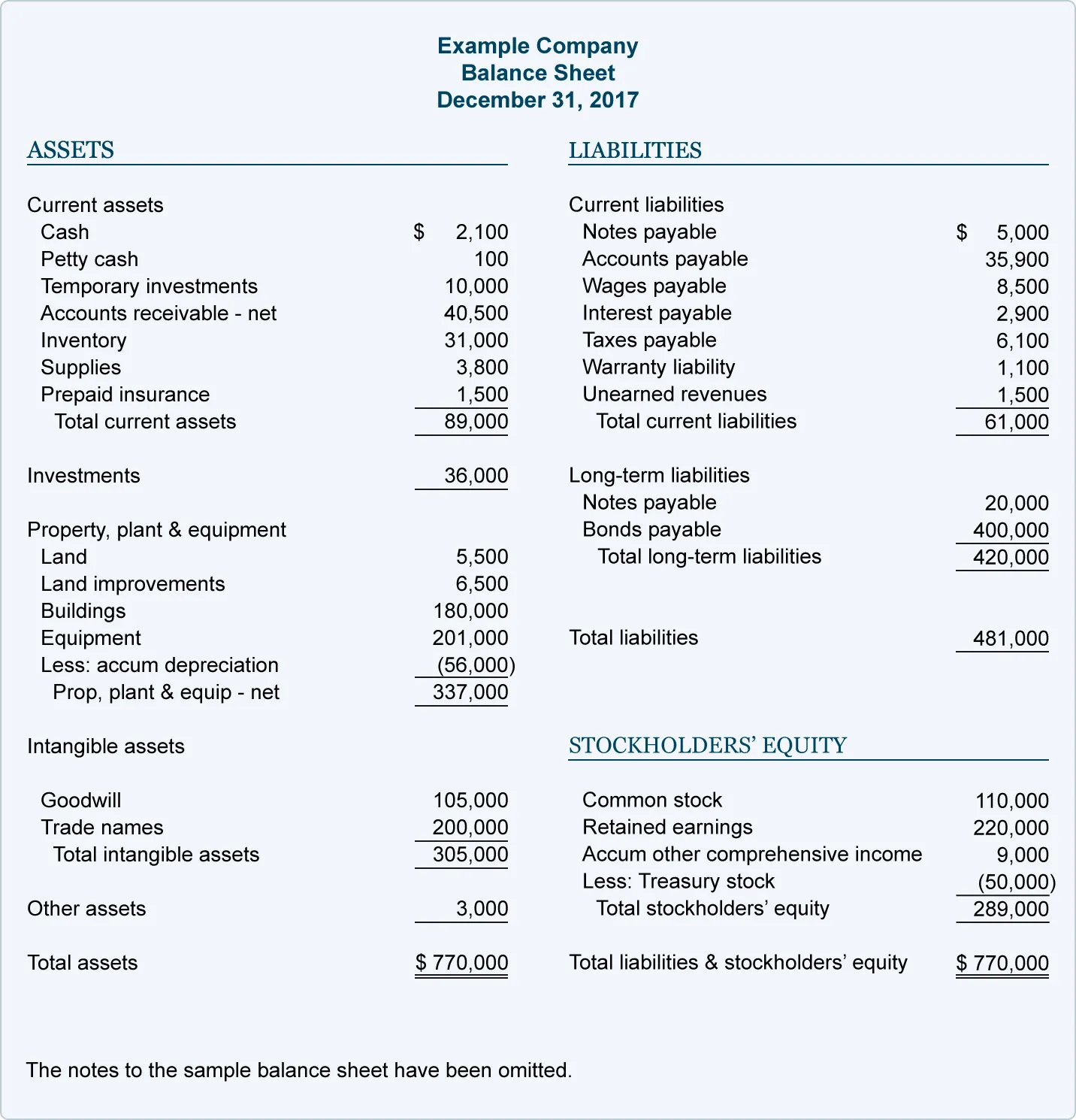

Deferred revenue journal entry overview. Now the deferred revenue amount will be 330 360 30. Deferred revenue is the payment the company received for the goods or services that it has yet to deliver or perform. Example 2 orange inc.

These service level agreements cover the period from 12 to 24 months and the customer requires to pay the warranty fees upfront as per the agreement. After the first month of your client s using it you will earn 30 360 12 of revenue. For example if you charge a customer 1 200 for 12 months of services 100 per month will turn into earned revenue while the remaining amount will still be deferred revenue. Debit cash total amount credit deferred revenue total amount upon completion debit deferred revenue total amount credit subscription revenue total amount if you recognize this revenue within a monthly period which should be done to facilitate your annual returns then you simply repeat step 2 with the partial amount until the credit subscription revenue is 0.

As you deliver goods or perform services parts of the deferred revenue become earned revenue. Likewise the company needs to properly make the journal entry for this type of advance payment as deferred revenue not revenue. The deferred revenue will realize as income upon the delivery of goods or services over a period of time.