Do You Record Unearned Revenue On Income Statement

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

On 1 st april a customer pays 5 000 for installation services which are to be rendered in the next five months.

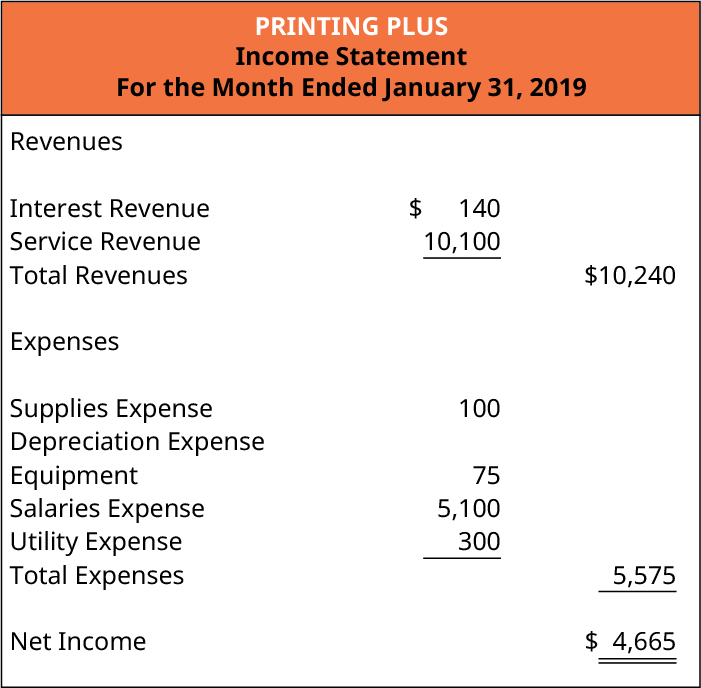

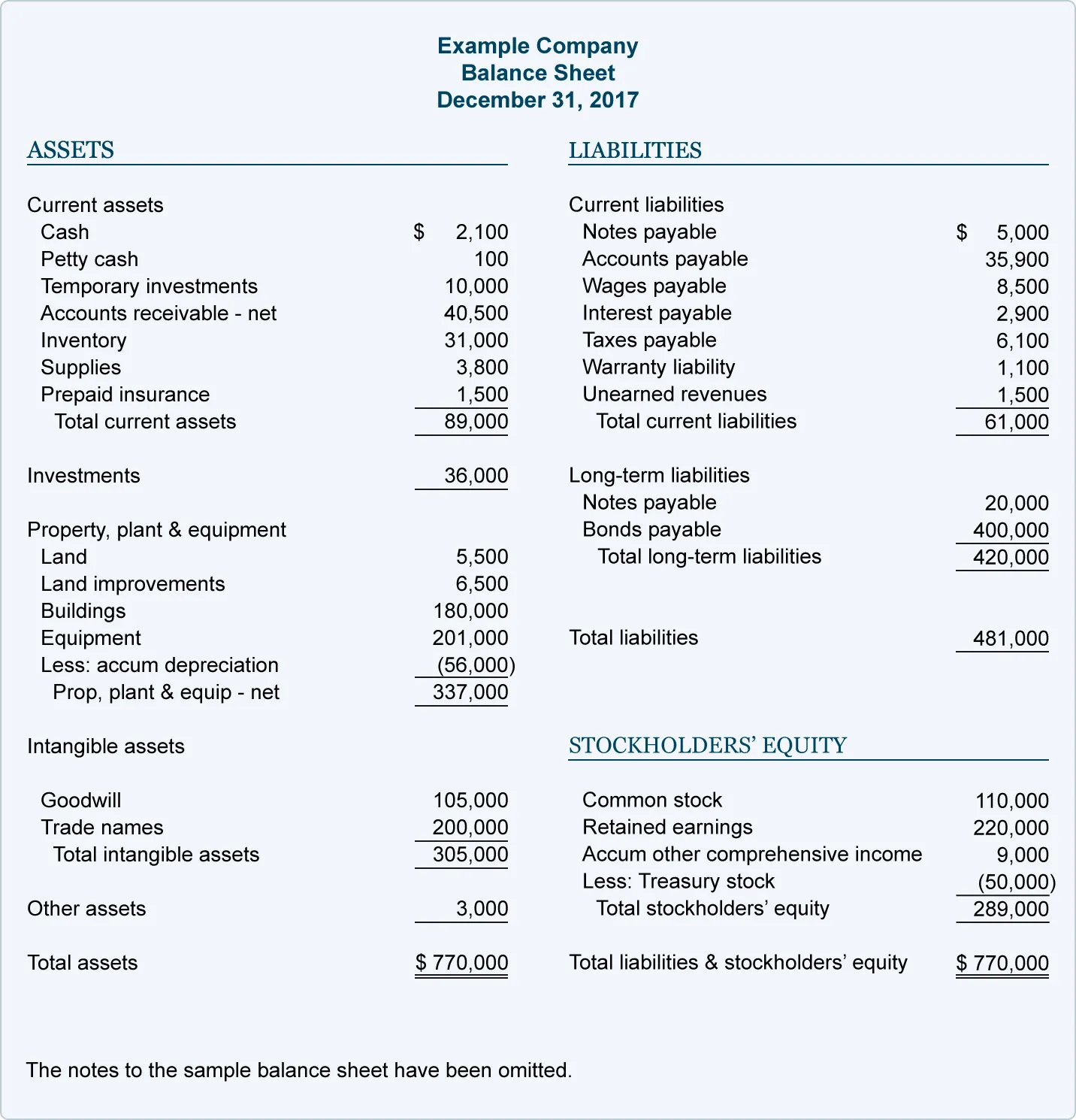

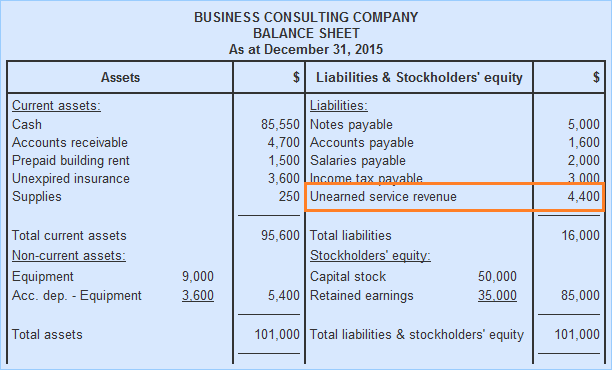

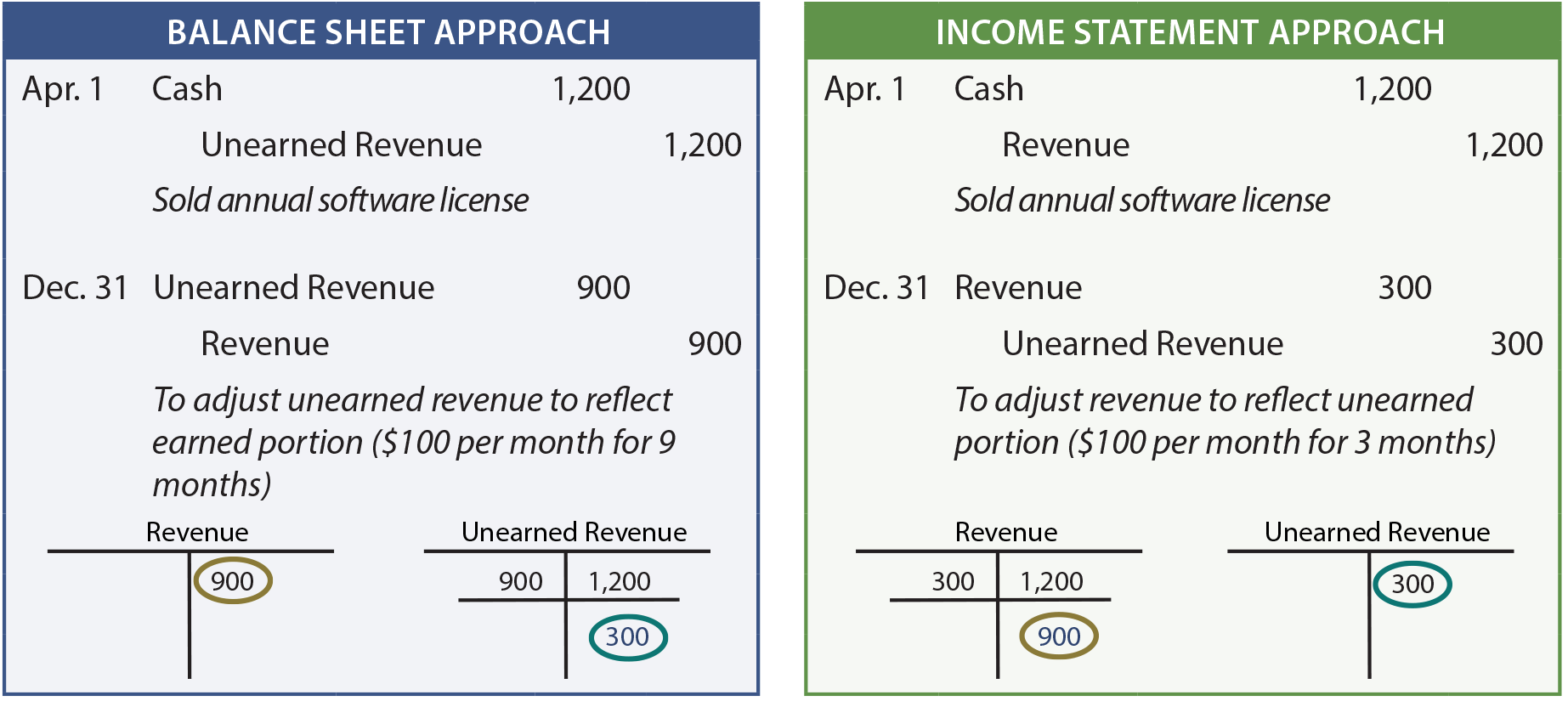

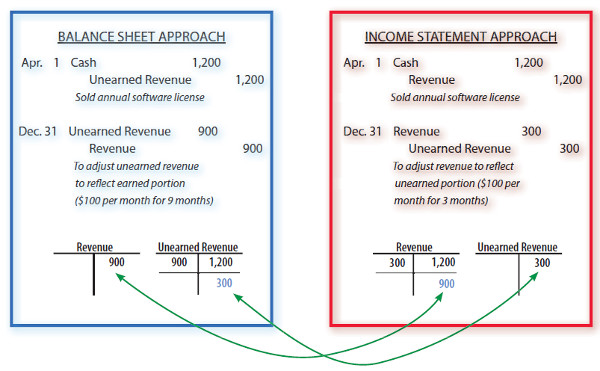

Do you record unearned revenue on income statement. The balance of unearned revenue is now at 24 000. At that time the unearned revenue will be recognized as revenue on your income statement. Only when the revenue is recorded in the balance sheet this transaction isthen also reflected in the income statement. Accounting process of unearned income or revenue.

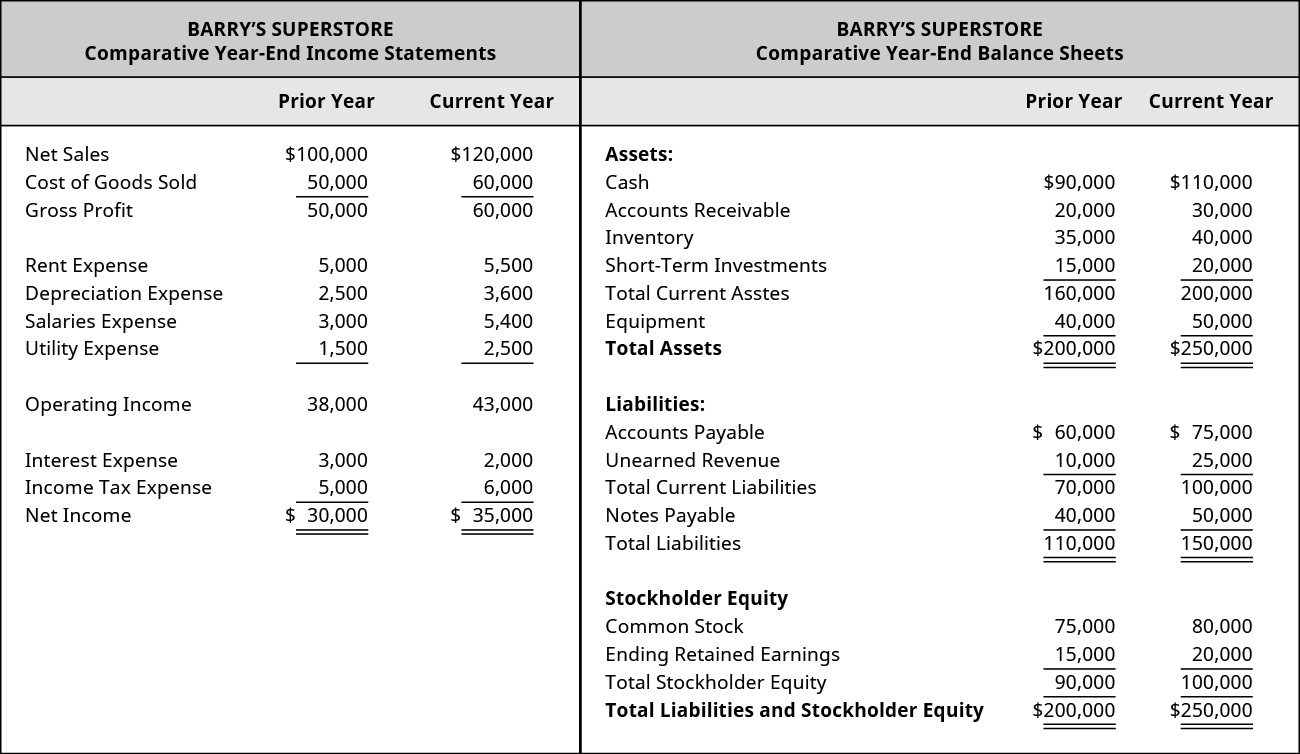

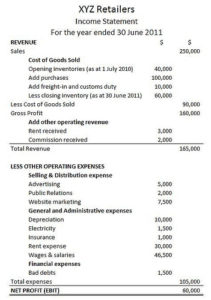

It is essential to understand that while analyzing a company unearned sales revenue should be taken into consideration as it is an indication of the growth visibility of the business. Hence 1000 of unearned income will be recognized as service revenue. The amount received would be recorded as unearned income current liability in books. After each monthpasses the unearned revenue account is reduced by 1 500 and the revenue isincreased by the same amount to maintain the balance and recognize the earnedrevenue.

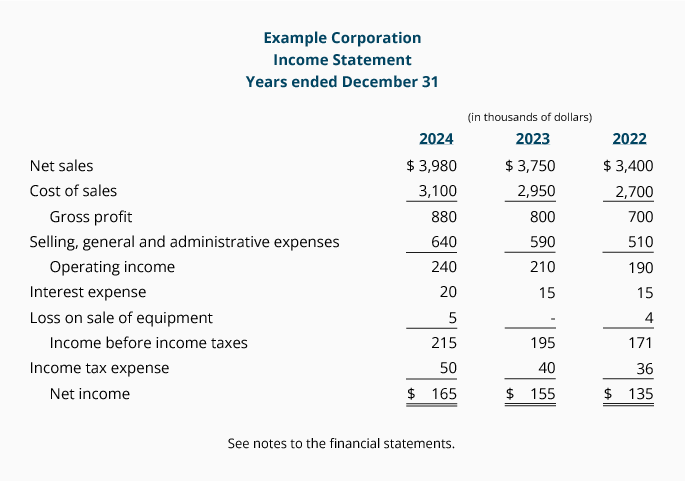

The other 2 000 is still unearned because it is for work you re going to perform in february and march so you do not include it in the income statement for january. Service revenue will in turn affect the profit and loss account in the shareholders equity section. Examples of unearned income. Accrual based accounting requires you to defer unearned revenue because of a principle called the revenue recognition principle.

Instead the company would record the amount as unearned revenue on the balance. The journal entry to record a prepayment would be. We are simply separating the earned part from the unearned portion. In the entry above we removed 6 000 from the 30 000 liability.

The revenue recognition principle requires accountants to show revenues on the income statement in the period in which they are earned not in the period when the cash is collected. Subsequently the liability of unearned revenue would decrease and revenue would be recognized each month. Any income or revenue received before the completion of such process is considered unearned income or revenue. Of the 30 000 unearned revenue 6 000 is recognized as income.

The income or revenue received before it is earned is known as unearned income or revenue or income received in advance income or revenue is earned when the process of the provision of goods or services has been completed.

:max_bytes(150000):strip_icc()/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)