Government Revenue And Deadweight Loss Graph

Deadweight loss is generally illustrated on a graph with a triangle formed by the 3 points of the allocatively efficient point where the marginal benefit to society equals to the marginal cost to society the marginal benefit to society for the current quantity the demand curve if there are no externalities and the marginal cost to society for the current quantity the supply curve if.

Government revenue and deadweight loss graph. Relationship between tax revenues deadweight loss and demandelasticity the government is considering levying a tax of 100 per unit on suppliers of either leather jackets or smartphones. It also transfers a portion of the consumer surplus earned in the competitive case to the monopoly firm. Now suppose that all the firms in the industry merge and a government restriction prohibits entry by any new. The deadweight loss in this diagram is given by area h the shaded triangle to the right of the free market quantity.

Deadweight loss of taxation is a measurement of the economic loss that can be caused by a tax due to its damaging effects3 on supply and demand. Taxes reduce both consumer and producer surplus. Overall the policy created a deadweight loss equal to area b and d. Economic inefficiency is created by a subsidy because it costs a government more to enact a subsidy than the subsidy creates additional benefits to consumers and producers.

However taxes create a new section called tax revenue this is the revenue collected by governments at the new tax price. With this new tax price there would be a deadweight loss. Conclusion in chapter 4 we looked at a number of policies that resulted in gains for some market players but overall deadweight loss for society. The supply curve for each of these two goods is identical as you can see on each of the following graphs.

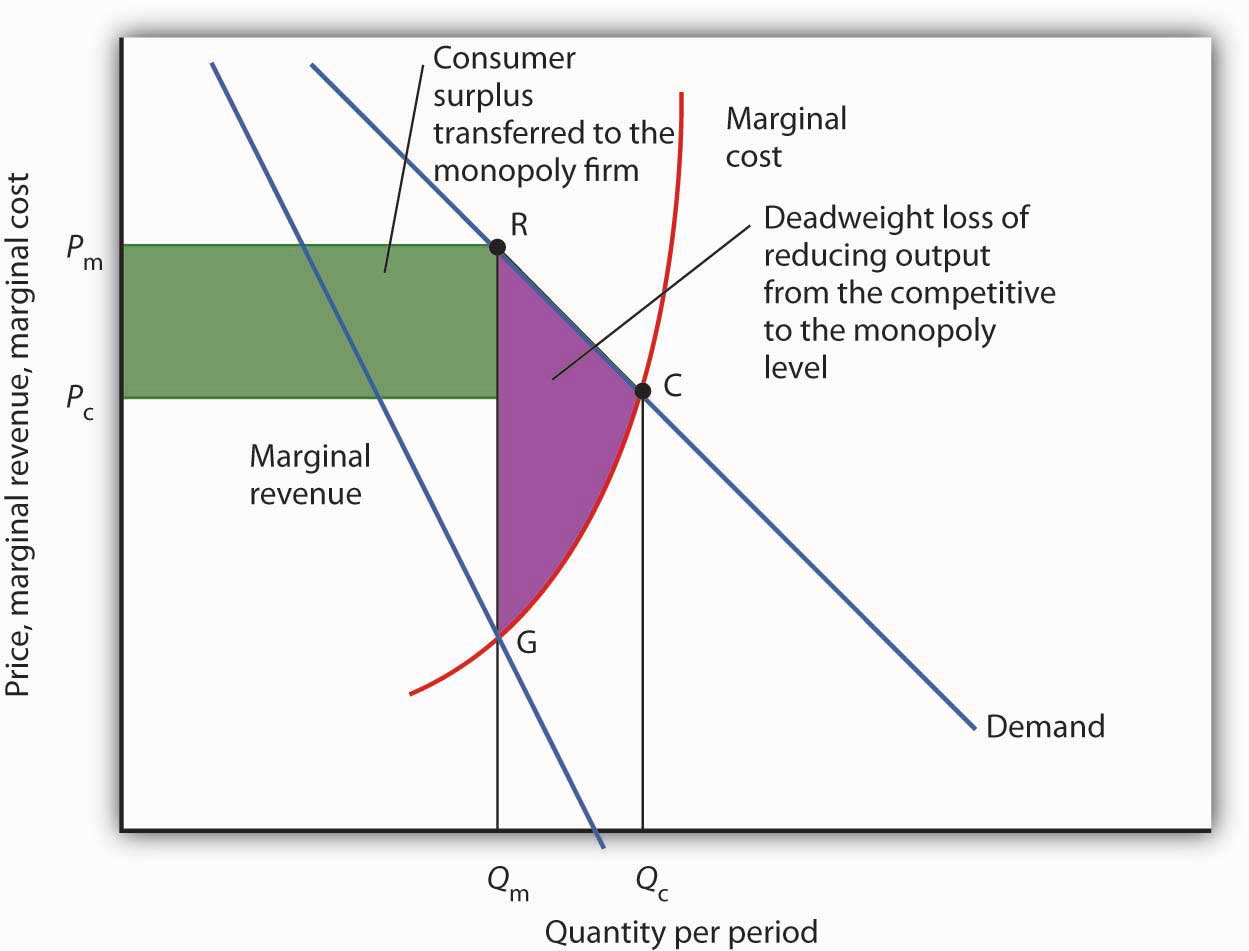

Reorganizing a perfectly competitive industry as a monopoly results in a deadweight loss to society given by the shaded area grc.