Hm Revenue Utr Number Registration

About hm revenue customs.

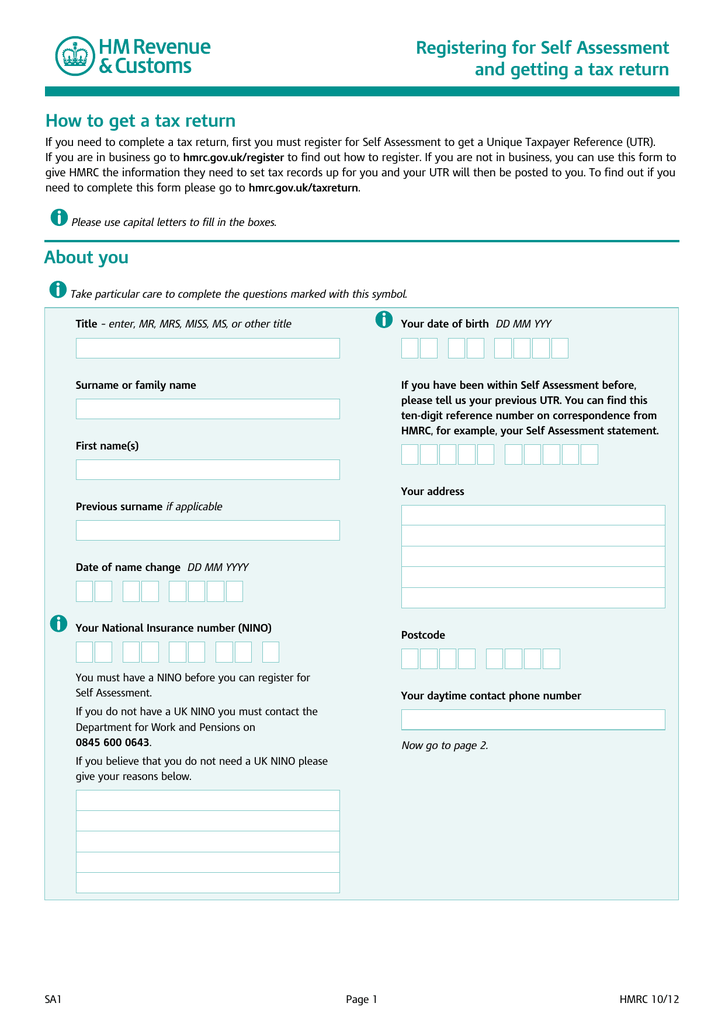

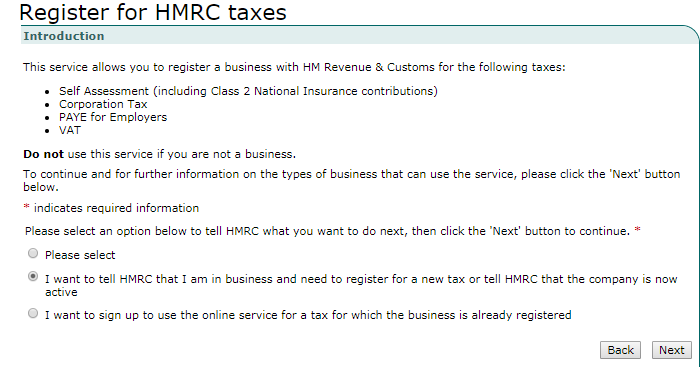

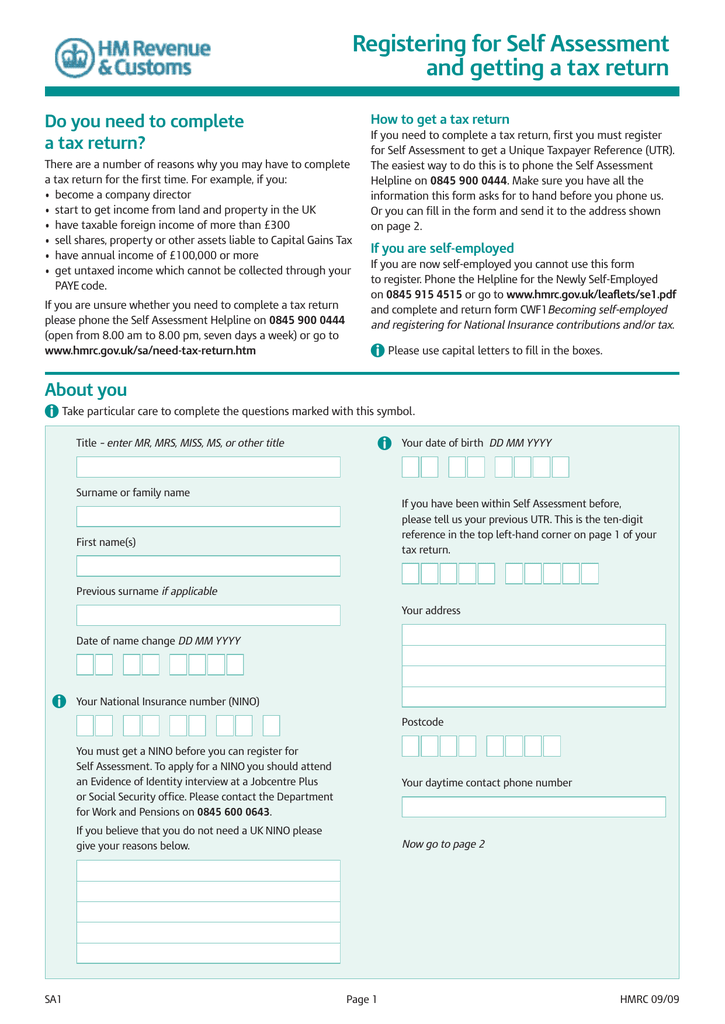

Hm revenue utr number registration. Are not self employed but you still send a tax return for example because you receive income from renting out a property. Utr number is issued to individuals companies partnerships trusts and organizations. You can file your self assessment tax return online if you. Utr number is used to identify individual taxpayers within the system.

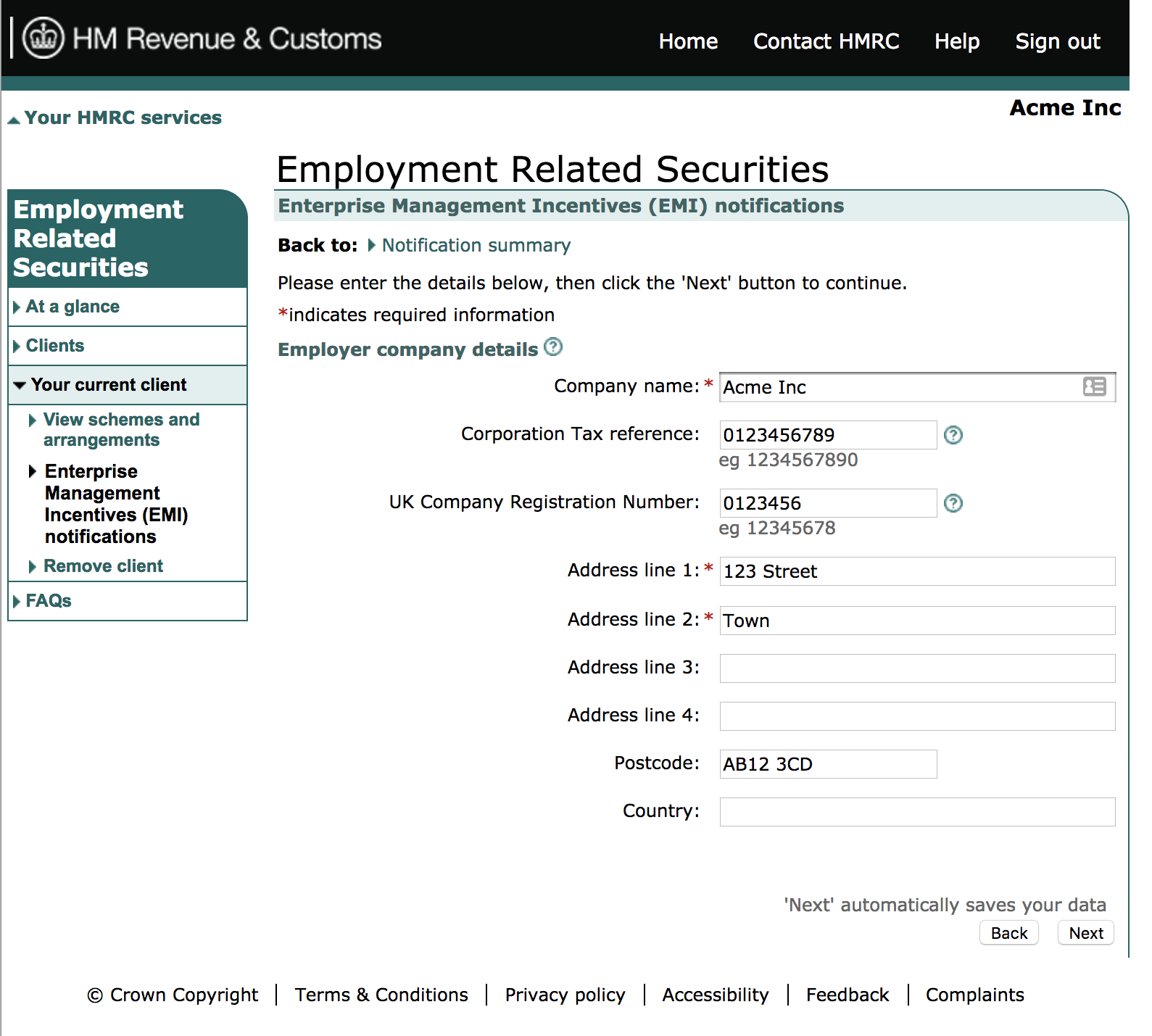

21527 06368 company name. Utr numbers are issued to individuals companies partnerships trusts and other types of organisations. You will find this on your personal tax return or other personal correspondence from your hm revenue customs office. Hm revenue customs subcontractor verification details for new cis company ec ex limited.

Utr numbers consist of 10 numbers crns consist of 8 numbers or 2 letters followed by 6 numbers and british vrns consist of 2 letters gb followed by 9 numbers. It might just be called tax reference. A unique taxpayer reference number is assigned to uk companies by the hm revenue and. A utr number unique taxpayer reference is a ten digit number issued directly by hm revenue customs and is used to identify individual tax payers within their system.

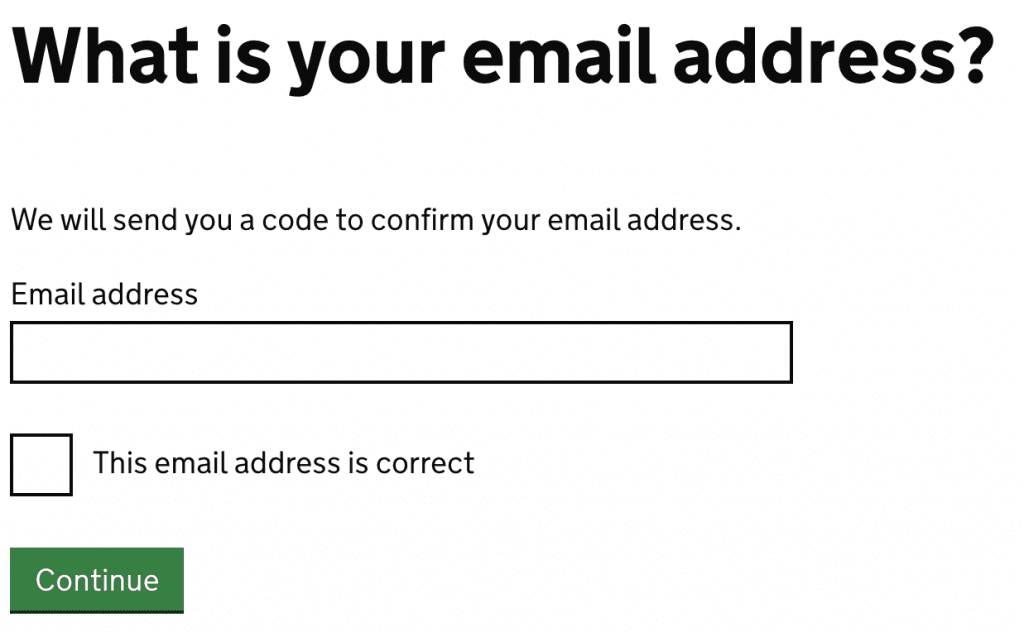

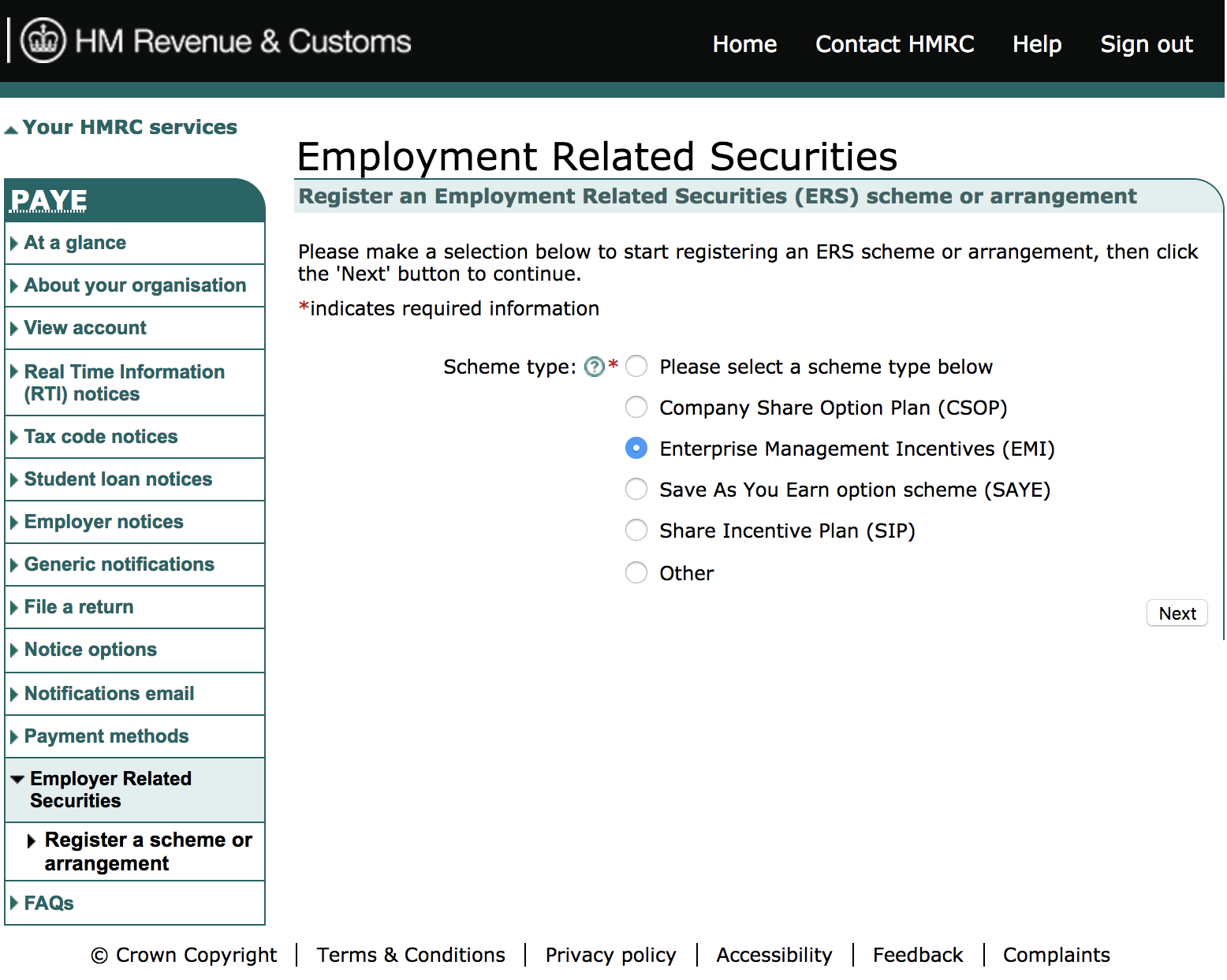

Company unique tax reference utr. A utr number is the unique taxpayer reference number issued to anyone in the uk who needs to complete a tax self assessment. From wikipedia her majesty s revenue and customs hm revenue and customs or hmrc 3 is a non ministerial department of the uk government responsible for the collection of taxes the payment of some forms of state support and the administration of other regulatory regimes including the national minimum wage. You ll automatically be sent a unique taxpayer reference utr when you register for self assessment.

A unique taxpayer reference is not the same as a company registration number crn or a vat registration number vrn and there are a few key differences. Set up a limited company. What is utr number and why do we need it. Ec ex engineering company registration number.

Cis301 notes cis individual registration for payment under deduction unique tax reference utr the utr is the 10 digit tax reference number given to you when you register as self employed. In this article we will focus on obtaining a utr number for your uk business. Ec ex limited company trading name. Where to apply for a utr number.

030021 34 cis 365c hmrc 01107 q hm revenue subcontractor verification details for checked.