How To Calculate Pre Revenue Valuation

Valuing a startup without any existing revenue can be difficult.

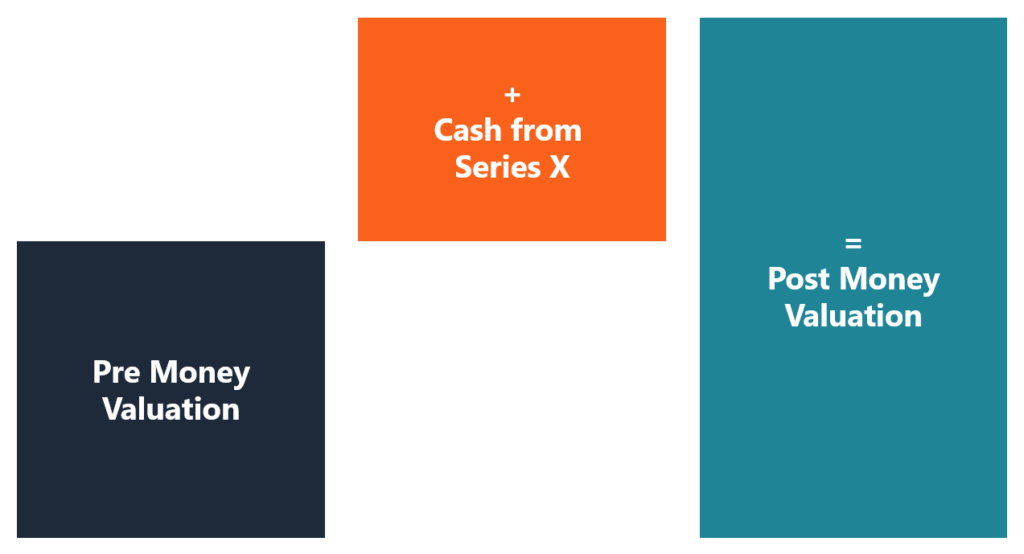

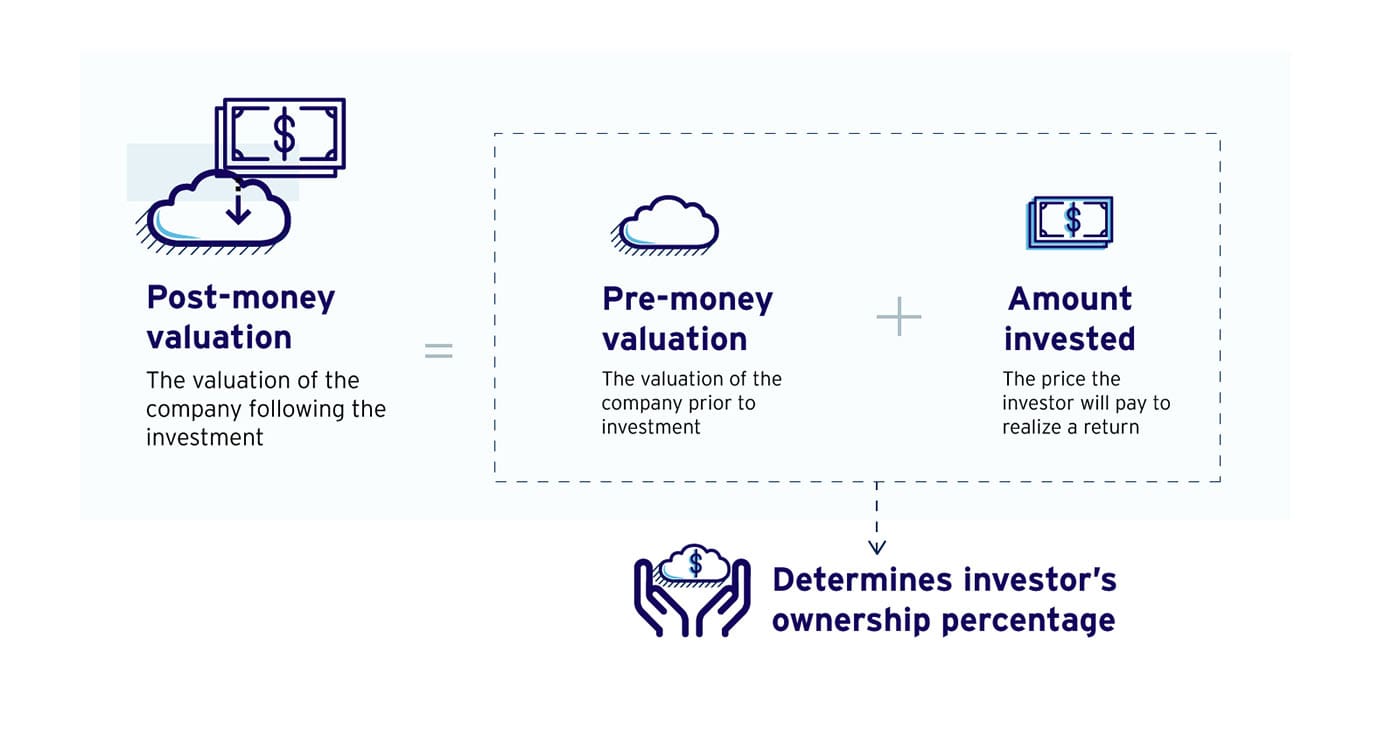

How to calculate pre revenue valuation. We can calculate. 1 npv 20 this technique suffers from three fundamental problems when used to value a pre revenue company. If you add the funds raised from an investor to the pre money valuation you get the post money valuation. The first step is to determine the average pre money valuation for pre revenue startups.

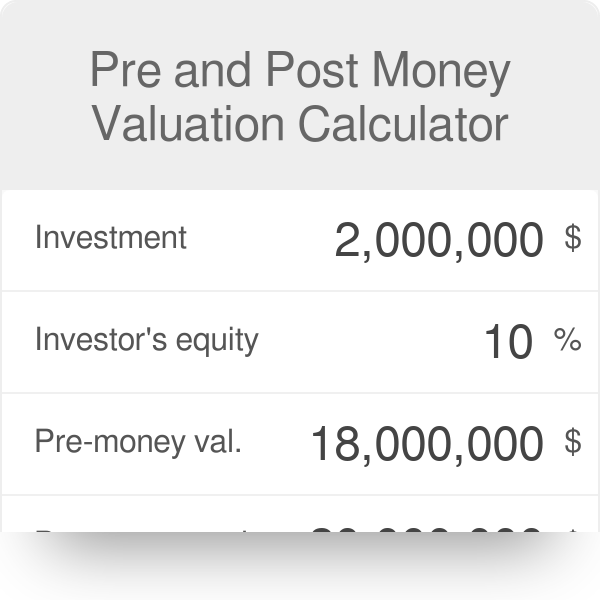

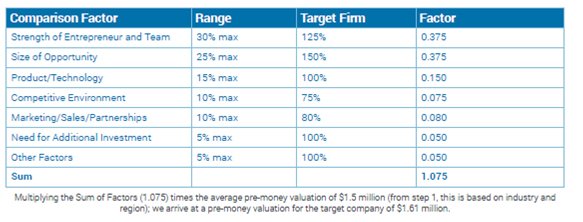

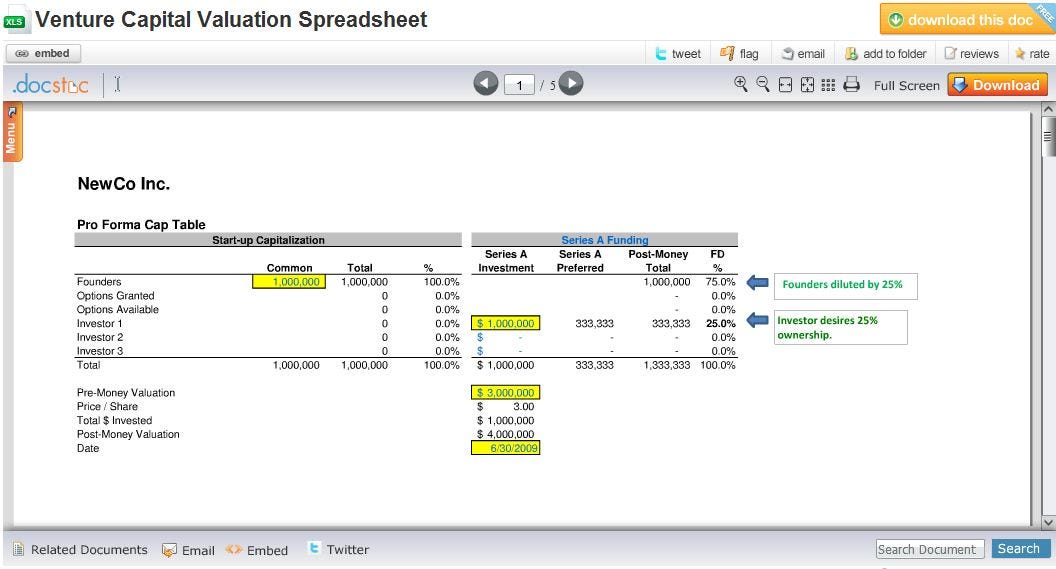

The average pre money valuation of pre revenue companies within the same market is then adjusted positively by 250 000 for every 1 500k for a 2 and negatively by 250 000 for every 1 500k for a 2. Pre money valuation is the valuation of your startup before an investor puts money in. The tool has been developed in consultation with venture capitalists and angel investors and uses industry standards to calculate the valuation. Pre money and post money valuation formulas.

Here is the formula. Pre revenue startup valuation calculator for startups. To calculate the post money valuation use the following formula. Pre money and post money valuations help investors calculate the risk of working with you and the amount they re willing to invest.

There is no single formula to calculate a company s pre money valuation because it s entirely subjective. Post money valuation when learning how to calculate the value of a startup it s important to have a clear understanding of these two startup valuation methods. Angel groups tend to examine pre money valuations across regions as a good baseline. Use a free pre money valuation calculator 2.

What the business is worth may be a function of any of the three valuation methods outlined above. Formula to calculate pre money valuation and post money valuation 1 pre money valuation post money valuation venture capital investment 2 post money valuation venture capital investment venture capital ownership percentage. You can calculate. It is better to negotiate pre money valuations with investors.

How does a pre money valuation calculator differ from a post money valuation calculator. Do the formula by hand. At valuation in an ongoing business and an accurate method for making the decision to invest in a fixed asset it is less useful when used to measure the value of a pre revenue company. Our free startup valuation calculator will help you calculate the valuation of your pre money startup in 2 minutes.

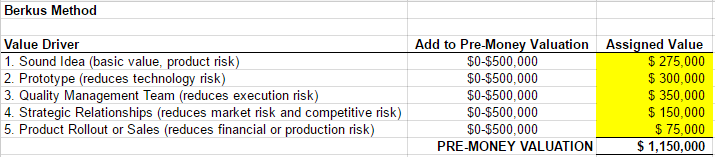

Dave berkus valuation method.

:max_bytes(150000):strip_icc()/dotdash_Final_Pre_Money_vs_Post_Money_Whats_the_Difference_Sep_2020-01-0a7184fe21204088baa6bfaa52db3217.jpg)