How To Calculate Tax Revenue Economics

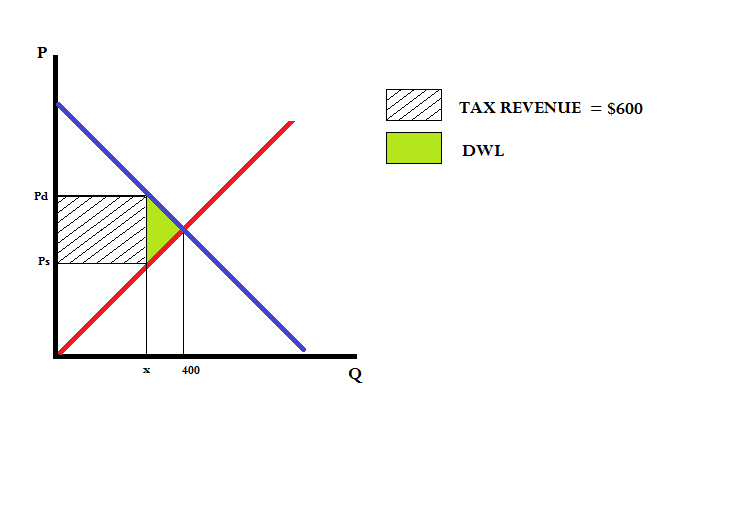

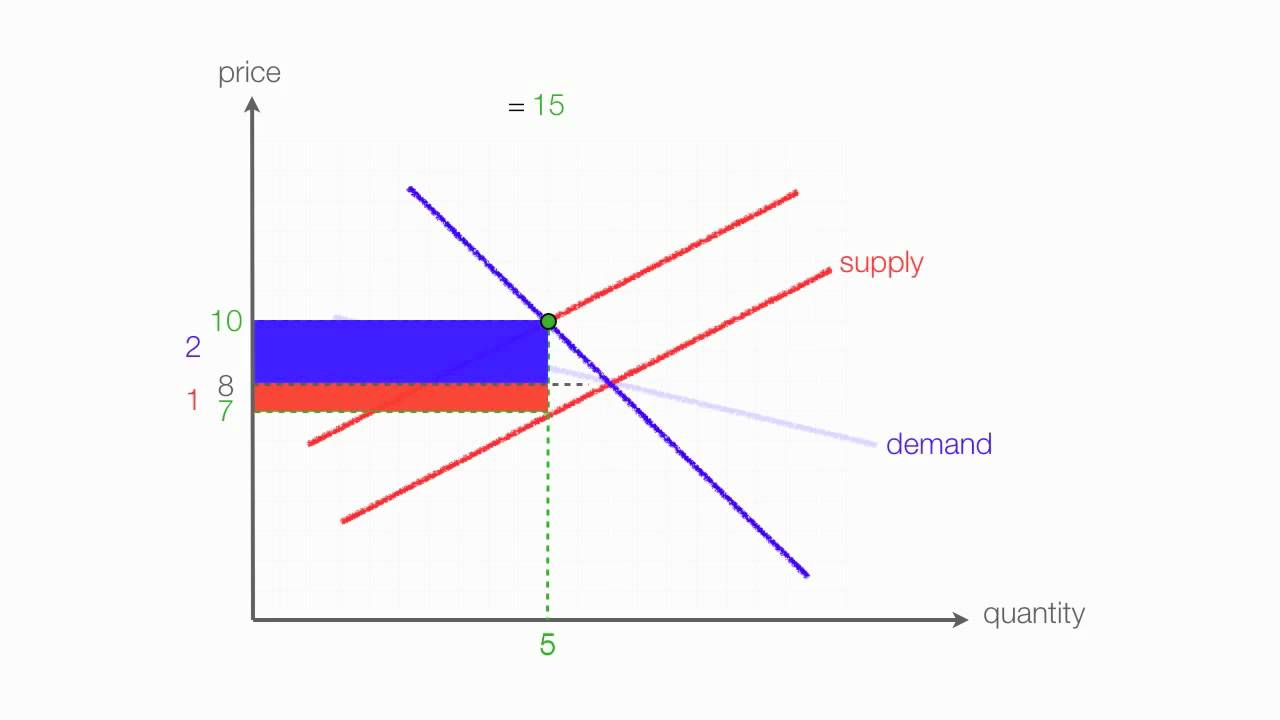

Calculate the total tax revenue in this economy by finding the area of the rectangle border.

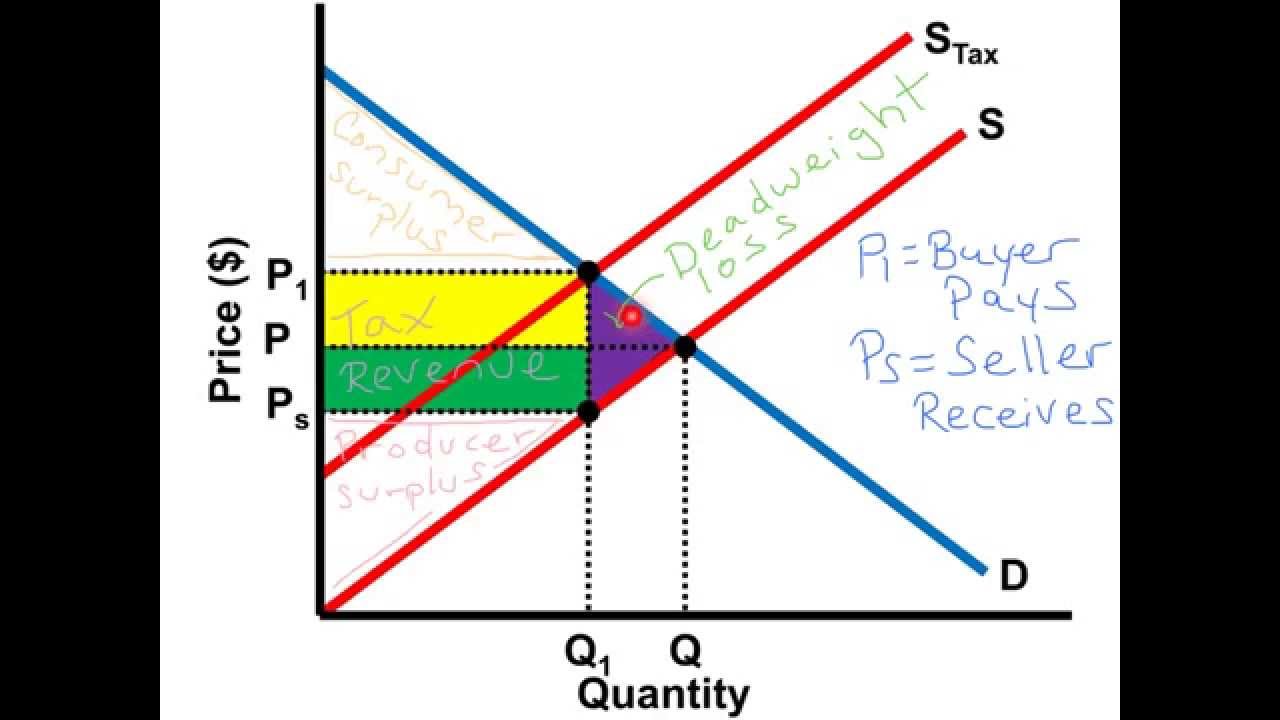

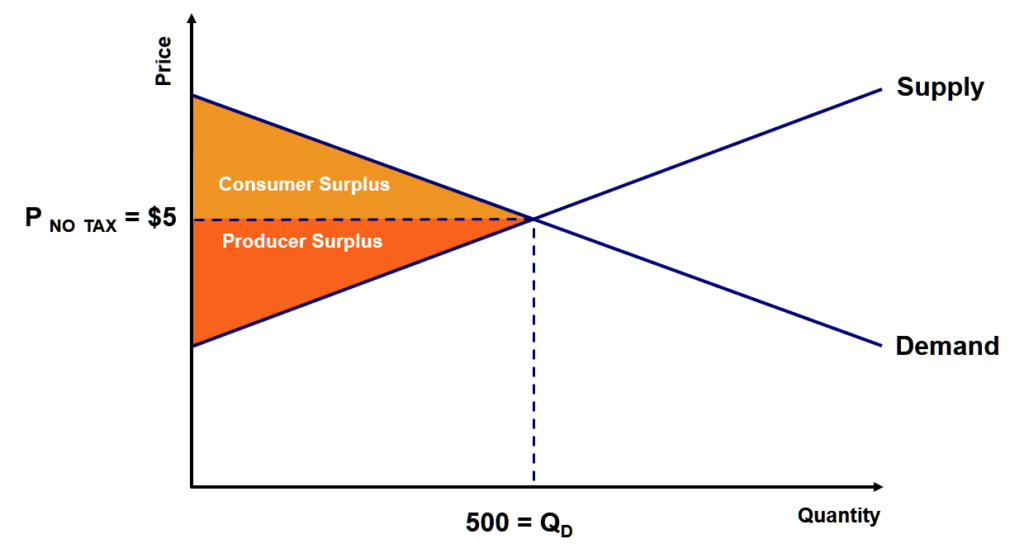

How to calculate tax revenue economics. Revenue when t 0. Tax revenue is the result of the application of a tax rate to a tax base. Units are selling at 20 per unit and 400 sell. Impact of a on consumer surplus and producer surplus.

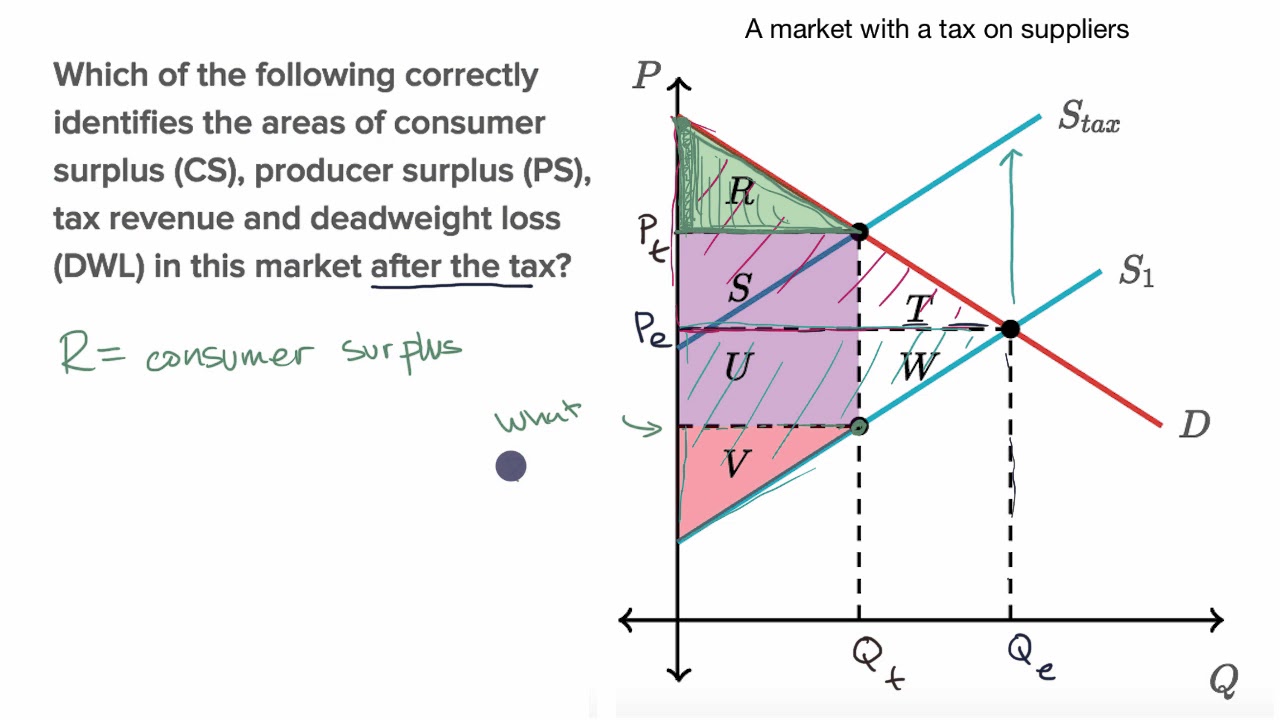

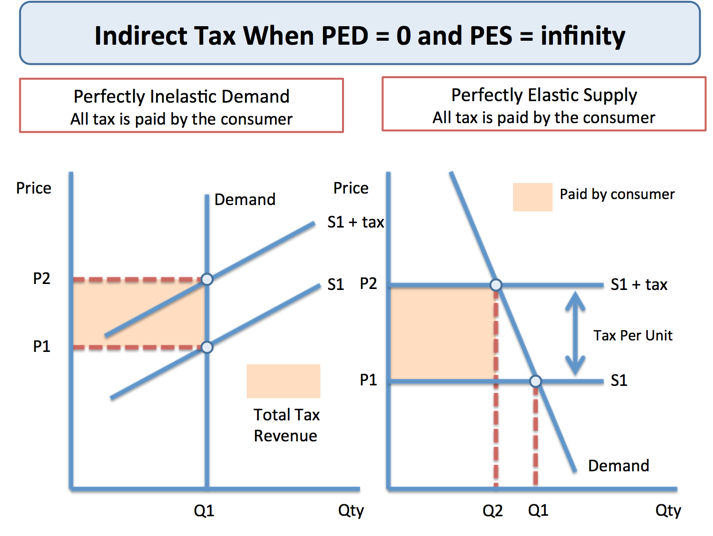

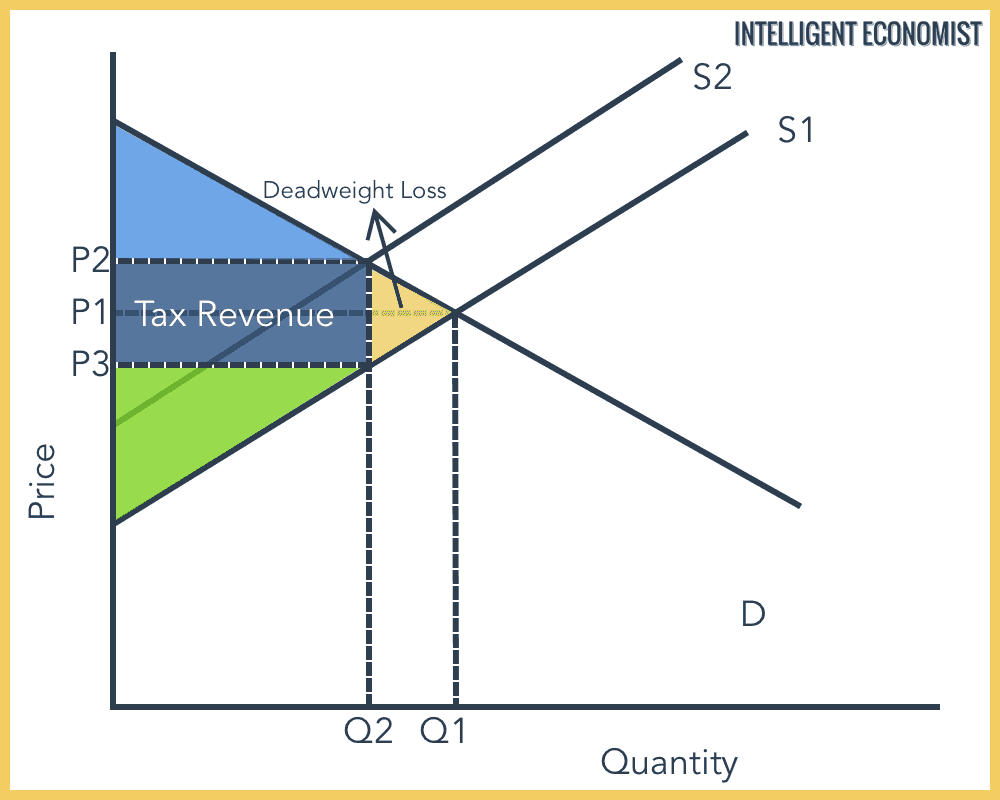

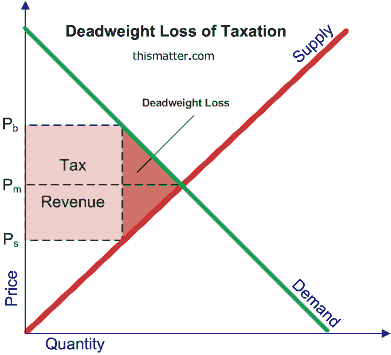

In economic theory tax incidence which refers to the distribution of a tax burden between buyers and sellers only depends on the elasticity of supply and demand. The linear growth rate of tax revenue lgr y from the above equation will be estimated as follows. Calculating revenue often means combining multiple revenue streams into one. You will be able locate the area of deadweight loss revenue consumer surplus.

The animation shows changes with elasticity it share between producer. Companies have both net and gross revenue along with money from multiple revenue streams. Write your answer at the bottom of the page and identify the specific color used to show total tax revenue. To calculate tax incidence we first have to find out whether the tax shifts the supply or the demand curve.

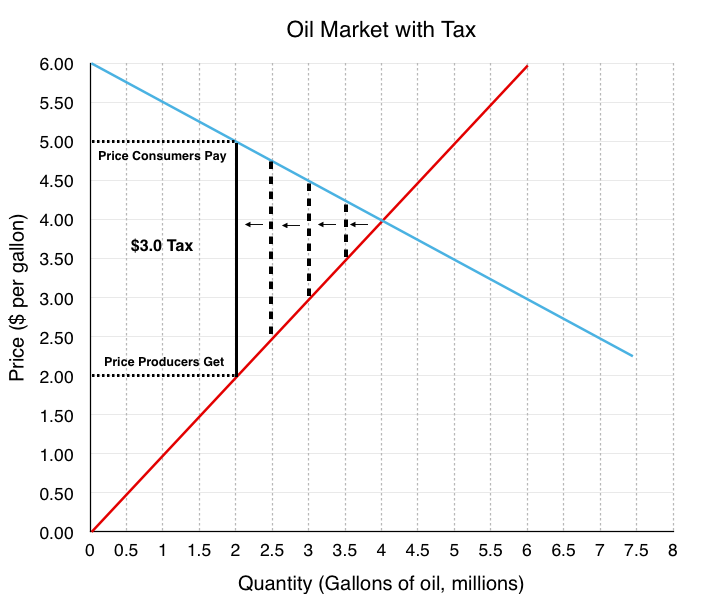

Assume that the tax on beer is 20 per unit a unit is a carton of drinks assume the demand and supply functions for cartons of beers per week are. Quantity is the number of units sold. Y t gross tax revenue dependent variable in a simple linear tax revenue function t time in years. P 200 0 5q and p 0 5q.

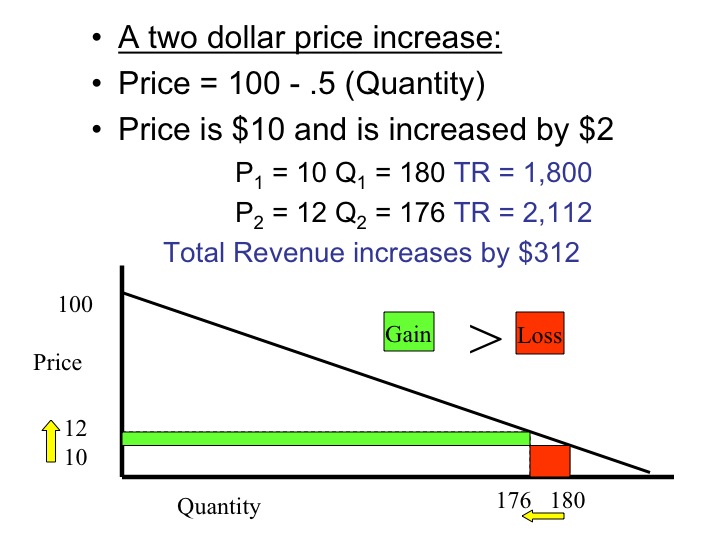

Gross revenue concerns all income from a sale with no consideration for any expenditures from any source. B 0 trend value of tax. Formula how to calculate total revenue. For instance in 2013 the state of new jersey collected a total of 8 235 billion in sales and use tax revenues which was approximately 30 5 percent of the 27 billion the state government collected from all taxes and fees for the same period.

How to calculate excise tax and determine who bears the burden of. Total revenue price x quantity. Price is the price each unit sells for. Misconceptions about net and gross revenue can significantly affect a company s income tax.

Total revenue is 8 000. Calculate the amount of tax revenue collected by the government and the distribution of tax payments between buyers and sellers. This is the imposed tax per gallon of gas. Total revenue 20 x 400 8 000.

Increases in tax base result in more socially acceptable increase in revenue than an increase in the rate which in turn in certain macroeconomic conditions could even backfire. Therefore it s important to be able to distinguish between the two. B 1 rate of change in tax revenue per year. Add each tax payment made during the legally defined tax collection period to arrive at total tax revenue.

The first part of the total tax revenue equation is 3 3 2 9. Cash flow is the life of any business. Taxes are ranked according to the tax rate. But for the professionals who run the business revenue is more complicated than simply looking at a bank balance.

:max_bytes(150000):strip_icc()/graph_laffercurve-dfef22d55c9c4bb19d461cd95d546cb4.png)