Increase In Service Revenue Debit Or Credit

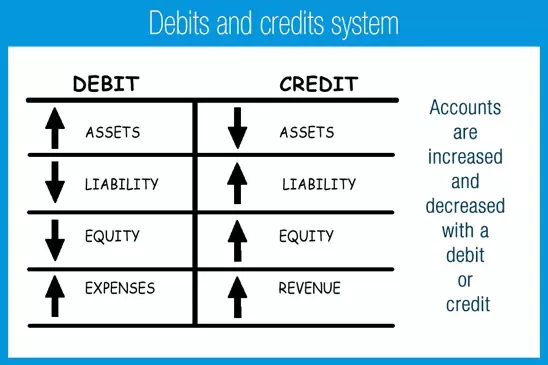

Actually all types of revenue must be credited.

Increase in service revenue debit or credit. You will increase debit your accounts receivable balance by the invoice total of 107 with the revenue recognized when the transaction takes place. Looking at another example let s say you decide to purchase new equipment for your company for 15 000. This would result in 500 of revenue and cash of 500. The other side of the entry is a credit to revenue which increases the shareholders equity side of the balance sheet.

If the company earns an additional 500 of revenue but allows the customer to pay in 30 days the company will increase its asset account accounts receivable with a debit of 500. Since the service was performed at the same time as the cash was received the revenue account service revenues is credited thus increasing its account balance. Under the double entry system in accounting the revenue from a service provided to a client is a credit entry. See below 2 examples.

The recording is again based on the information provided in the table above where it can be seen that an increase in asset is debit and an increase in revenue is credit. The credit entry in service revenues also means that owner s equity will be increasing. Example of revenue being credited. Paid monthly utility bill of 70.

Let s illustrate how revenues are recorded when a company performs a service on credit i e the company allows the client to pay for the service at a later date such as 30 days from. 1 company abc ltd provided accounting servic. For example a company sells 5 000 of consulting services to a customer on credit. One side of the entry is a debit to accounts receivable which increases the asset side of the balance sheet.

Cost of goods sold is an expense account. Thanks for the a2a.