Increase To Interest Revenue Debit Or Credit

In accounting terminology crediting cash means reducing company money.

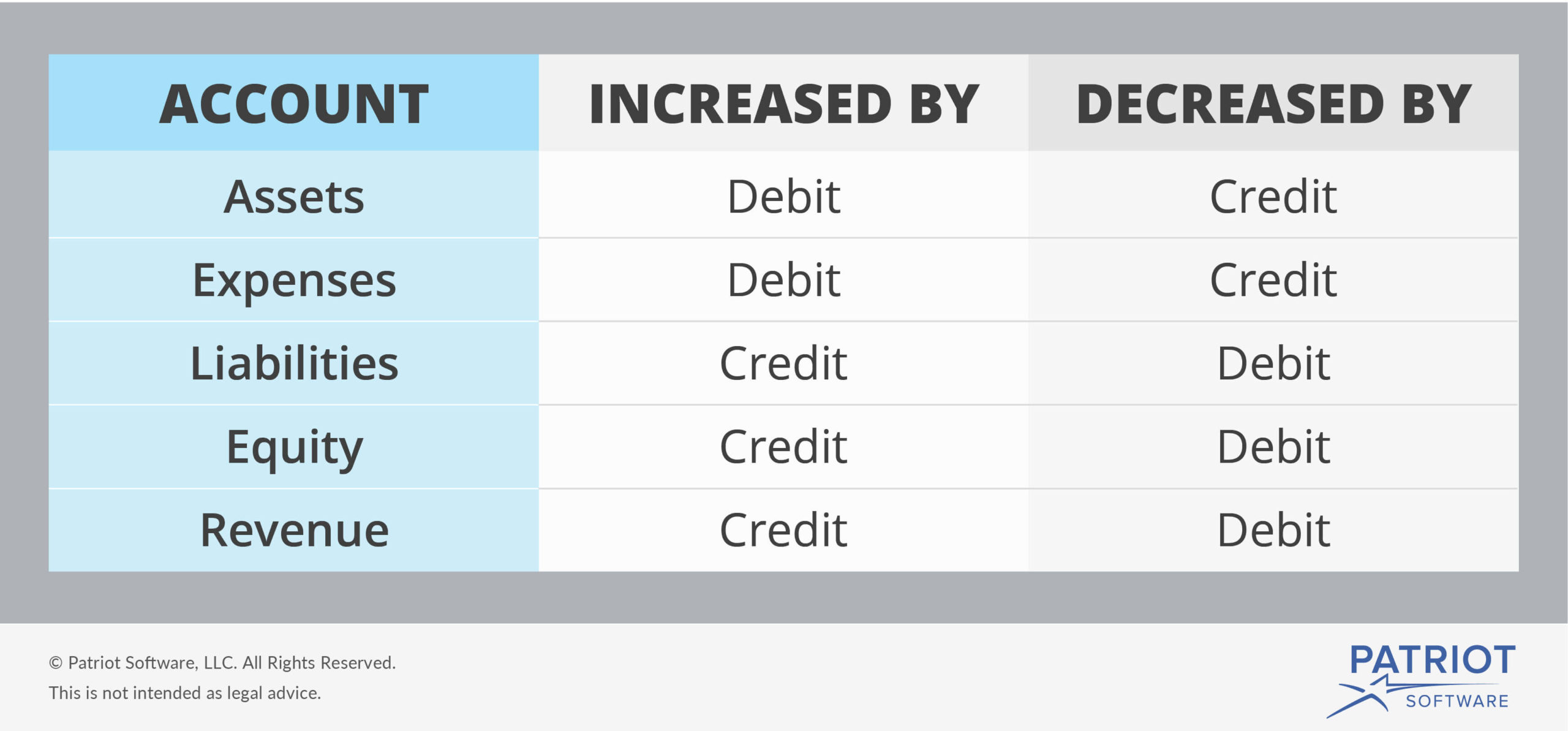

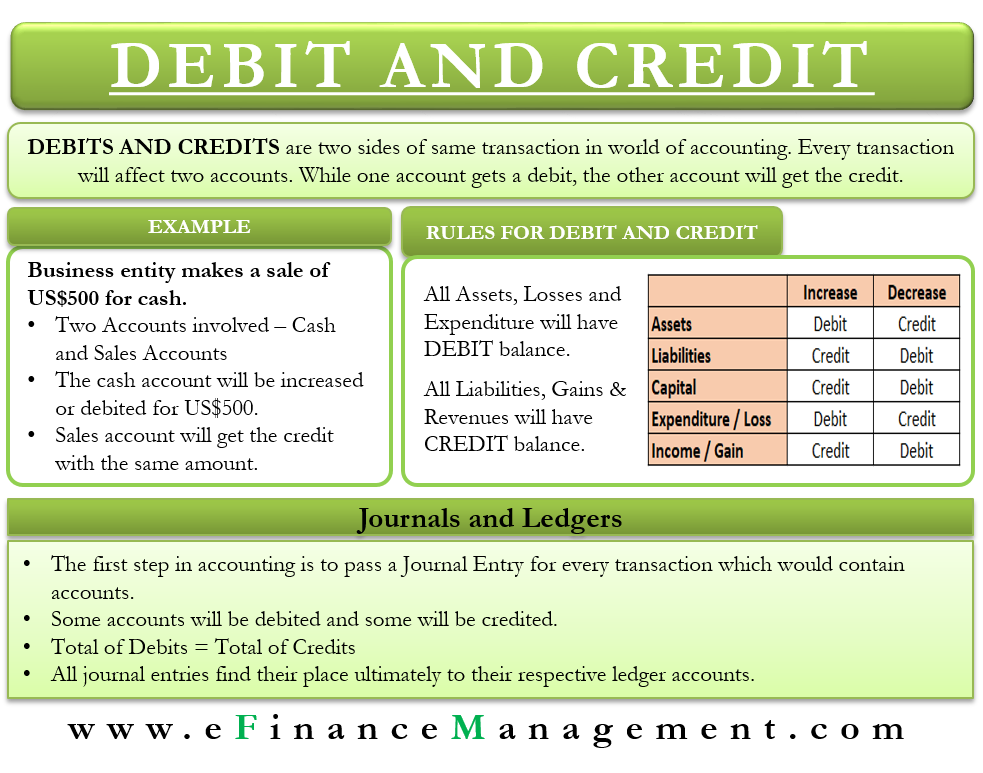

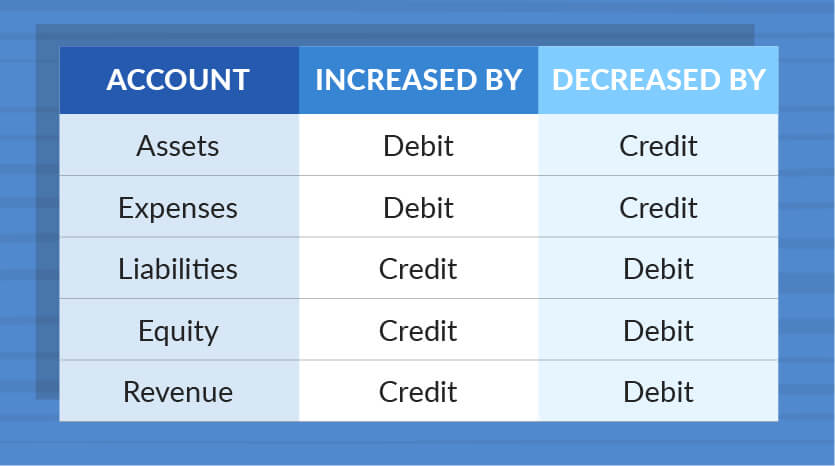

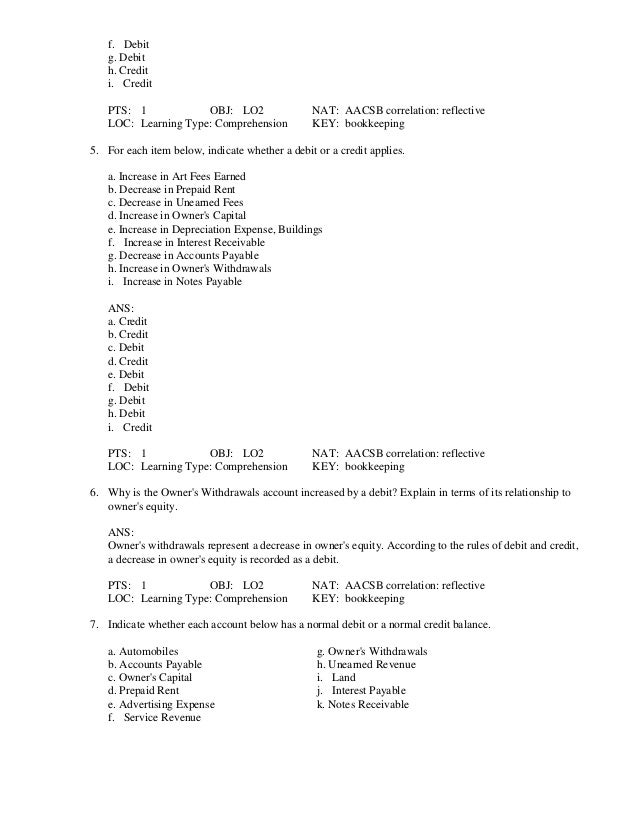

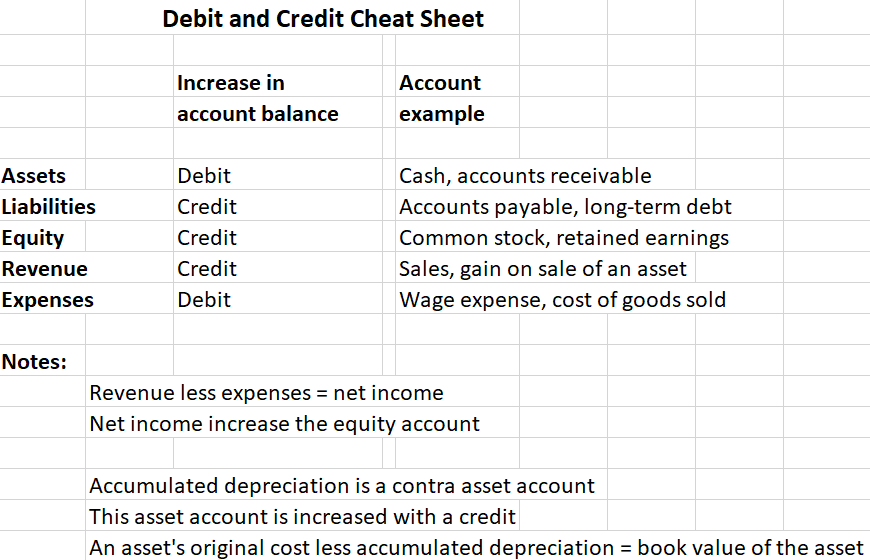

Increase to interest revenue debit or credit. Interest income would be a credit entry as it increases a form of revenue. Debits increase the balance of the interest expense account. Debt transactions generally give rise to interest payments. You will increase debit.

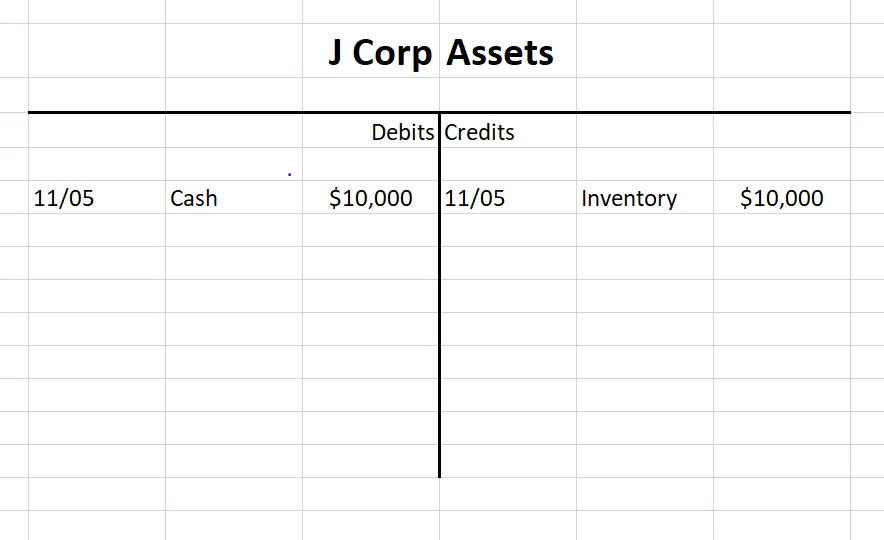

Interest expense is a debit. The accounting requirement that each transaction be recorded by an entry that has equal debits and credits is called double entry procedure or duality. Credits usually belong to the interest payable account. When you pay the interest in december you would debit the interest payable account and credit the cash account.

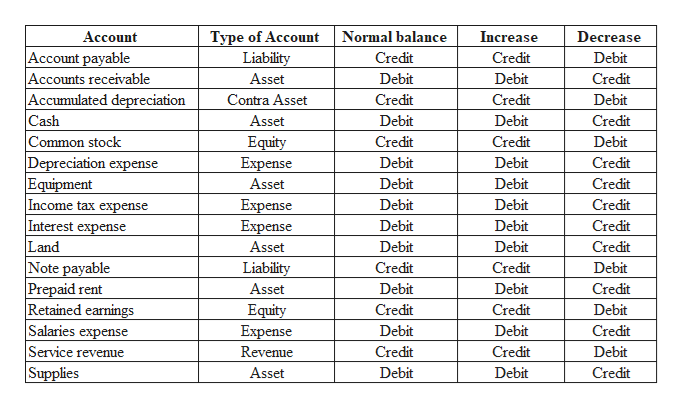

The entry to record a debt payment is. In a t account their balances will be on the right side. In accounting a debit or credit can either increase or decrease an account depending on the type of account. Is interest expense a debit or credit.

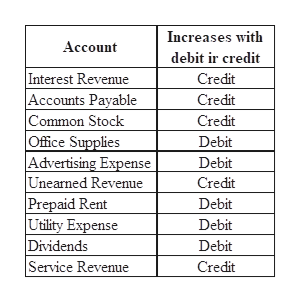

These accounts normally have credit balances that are increased with a credit entry. Interest revenue is the earnings that an entity receives from any investments it makes or on debt it owns. Revenue is the money. This is done with an accrual journal entry under the cash basis of accounting interest revenue is only.

Revenues and gains are recorded in accounts such as sales service revenues interest revenues or interest income and gain on sale of assets. How to increase cash with a debit. This is credited because. When we debit one account or accounts for 100 we must credit another account or accounts for a total of 100.

To record interest the bookkeeper debits the interest expense account and credits the interest payable account. Dr cash cr interest income if the income was not yet. Credit the cash account and debit the liability account. Under the accrual basis of accounting a business should record interest revenue even if it has not yet been paid in cash for the interest as long as it has earned the interest.

Asset a liability l or equity e increases with a debit dr or credit cr explanation. If the interest income is received in cash the entry would be.