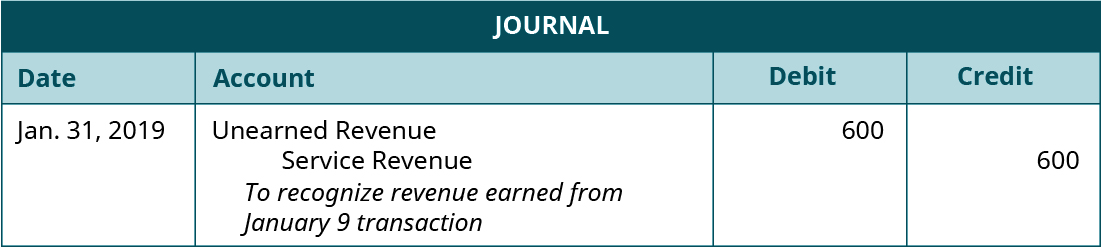

Journal Entry To Recognize Revenue

The recordation of a reduction in the inventory that has been sold to the customer.

Journal entry to recognize revenue. The company would make the following journal entry to adjust its original estimate of returned goods i e sales of 5 000 and cost of sales of 3 000. Theoretically there are multiple points in time at which revenue could be recognized by companies. These journal entries will close the right of return estimates for units sold in january 20x2. This journal entry needs to record three events which are.

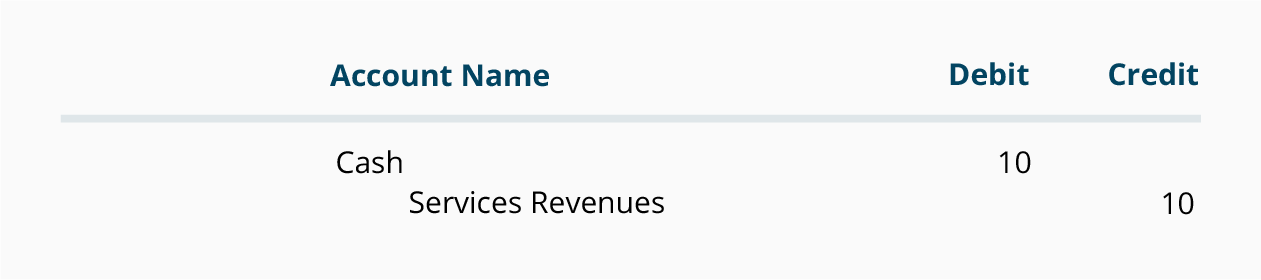

Let s walk through the process of recording revenue recognition journal entries with the following journal entries. An accrual journal entry is made to record the revenue on the transferred goods as long as collection of payment is expected. It s time to identify how to make a more accurate journal entry for revenue recognition. In simple terms deferred revenue means the revenue that has not yet been earned by the products services are delivered to the customer and is receivable from the same.

The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company s financial statements. In accrual accounting expenses incurred in the same period that revenues are earned are also accrued for with a journal entry. At the same it is also made to recognize the revenue that the company earns after it has delivered goods or performed the services during the period. The recordation of a sale.

The recordation of a sales tax liability. Journal entry of deferred revenue the following deferred revenue journal entry provides an outline of the most common journal entries in accounting. Recognize revenue as the performance obligations are satisfied. Same as revenues the recording of the expense is unrelated to the payment of cash.

This journal entry is to eliminate the liability after the company has fulfilled its obligation. How to recognize revenue when rights of return are present. The following journal entries are made to account for the contract.