Licensing Revenue Model Definition

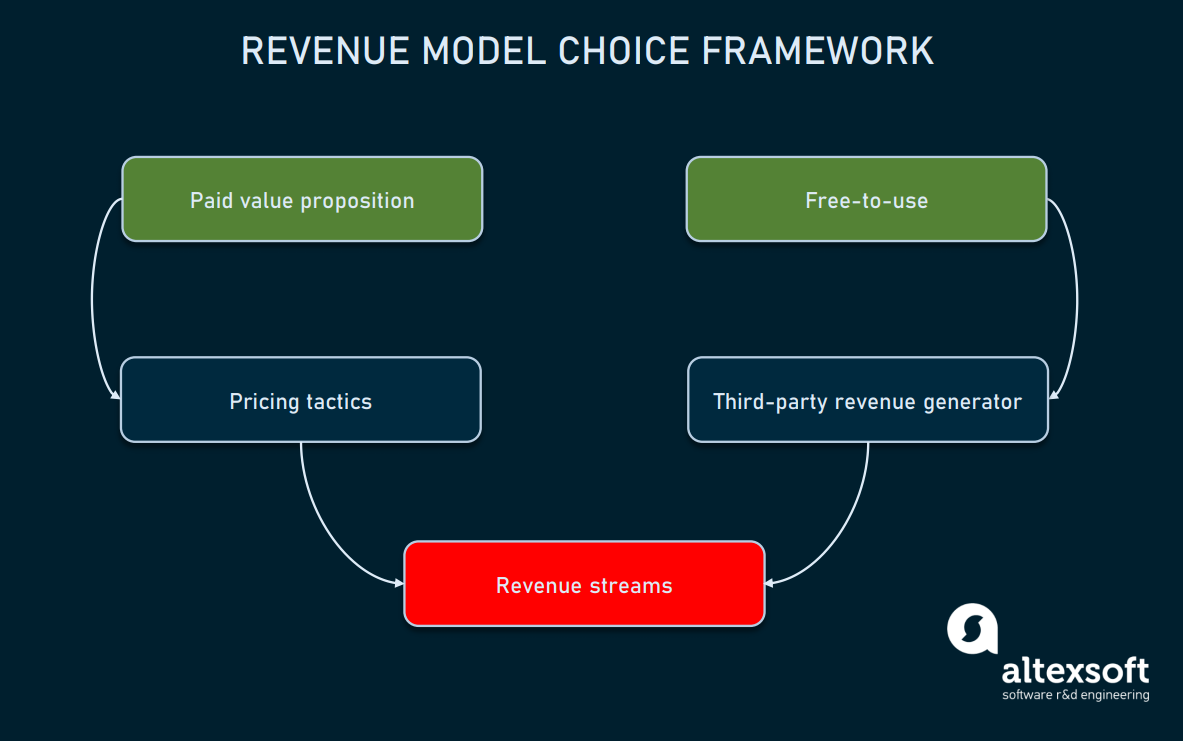

It identifies which revenue source to pursue what value to offer how to price the value and who pays for the value.

Licensing revenue model definition. This is a compelling testament to the licensing business model. Ifrs 15 specifies how and when an ifrs reporter will recognise revenue as well as requiring such entities to provide users of financial statements with more informative relevant disclosures. Licensing revenues are a significant source of revenue for several publicly traded companies. It is a key component of a company s business model.

A licensing revenue model allows technology producers to monetize their new technology products by licensing them to other companies so that they may be integrated into an end product. It primarily identifies what product or service will be created in order to generate revenues and the ways in which the product or service will be sold. Qualcomm makes most its revenue from selling their processors. Be aware of the downsides.

Charging for usage is the right approach if the licensor is in a line of business that is different from yours. Licensing your content or product can be a great revenue generator for your business. A business arrangement in which one company gives another company permission to manufacture its product for a specified payment. A revenue model is a framework for generating financial income.

This may be done either by charging the licensor for usage or for revenue generated. The licensing revenue model is applicable to most industries including. The standard provides a single principles based five step model to be applied to all contracts with customers. Arbitrage revenue model makes use of the price difference in two different markets of the same good.

Ifrs 15 was issued in may 2014 and applies to an annual reporting period beginning on or. It involves buying security currency and or commodity in one market and simultaneously selling the same in another market at a higher price and making profits from the temporary price difference.