Municipal Bonds Revenue Vs General Obligation

Jayden sangha nov 11 2020.

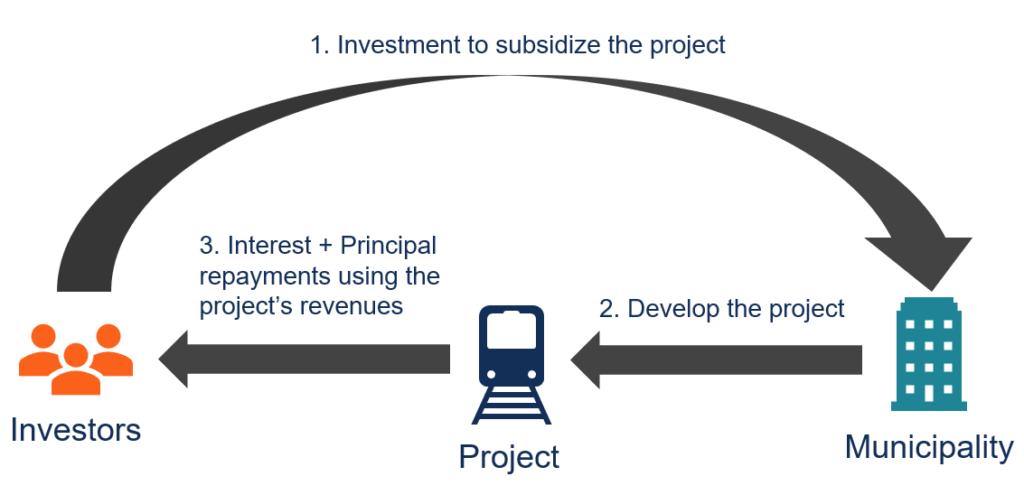

Municipal bonds revenue vs general obligation. The difference between them lies in how the government issuer secures the money to repay the bondholders. General obligation or go bonds are backed by the general revenue of the issuing municipality while revenue bonds are supported by a specific revenue source such as income from a toll road hospital or higher education system. Both types of bonds promise regular interest payments to investors along with a return of principal at maturity. A general obligation bond go bond is a municipal bond backed solely by the credit and taxing power of the issuing jurisdiction rather than the revenue from a given project.

Revenue and general obligation bonds aren t the only type of municipal securities. Municipal bonds generally can be classified into two camps general obligation bonds and revenue bonds. A revenue bond could be issued for for example the drilling of an oil site. General obligation bonds or gos are municipal bonds that are financed by the municipal tax revenue.

Gos have debt limits to protect taxpayers from higher taxes. In this case it depends on the specifics of the municipal bond issue you are considering buying or selling as well as the price at which you enter into a transaction. General obligation bonds and revenue bonds are two types of bonds issued by municipalities such as cities. However all other things being equal general obligation municipal bonds are safer and less likely to default than revenue municipal bonds.

Revenue bonds which are also called municipal revenue bonds differ from general obligation bonds go bonds that can be repaid through a variety of tax sources. The two types of municipal bonds are general obligation bonds and revenue bonds. Municipal bonds 101 what does president elect joe biden s presidency mean for municipal debt markets. Anticipation notes which are short term bonds municipalities may offer in anticipation of a larger longer term bond offering for the same project generally issued later in the project s development.

Investors also can choose from.

/MunicipalBondTipsfortheSeries7Exam3-0172a9bddeea4d0f9ab3426044d08b6a.png)

/cars-travelling-through-toll-booth-at-bridge--high-angle-view-683731863-8c43e6265ca04f9ab7c605b795c2a791.jpg)