Negative Deferred Revenue On Balance Sheet

The irs prefers.

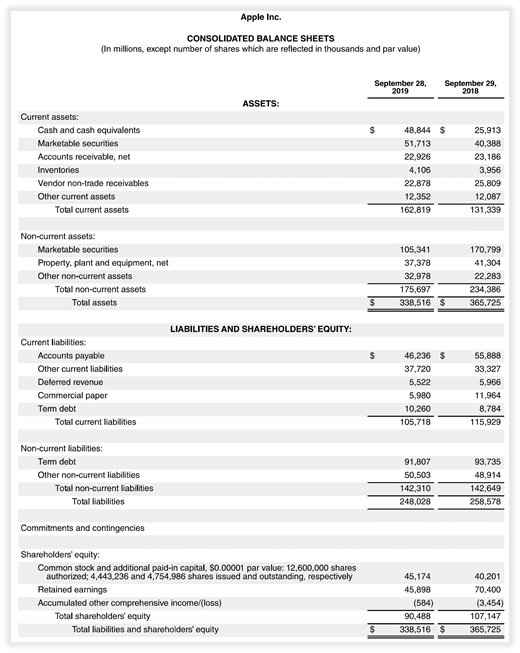

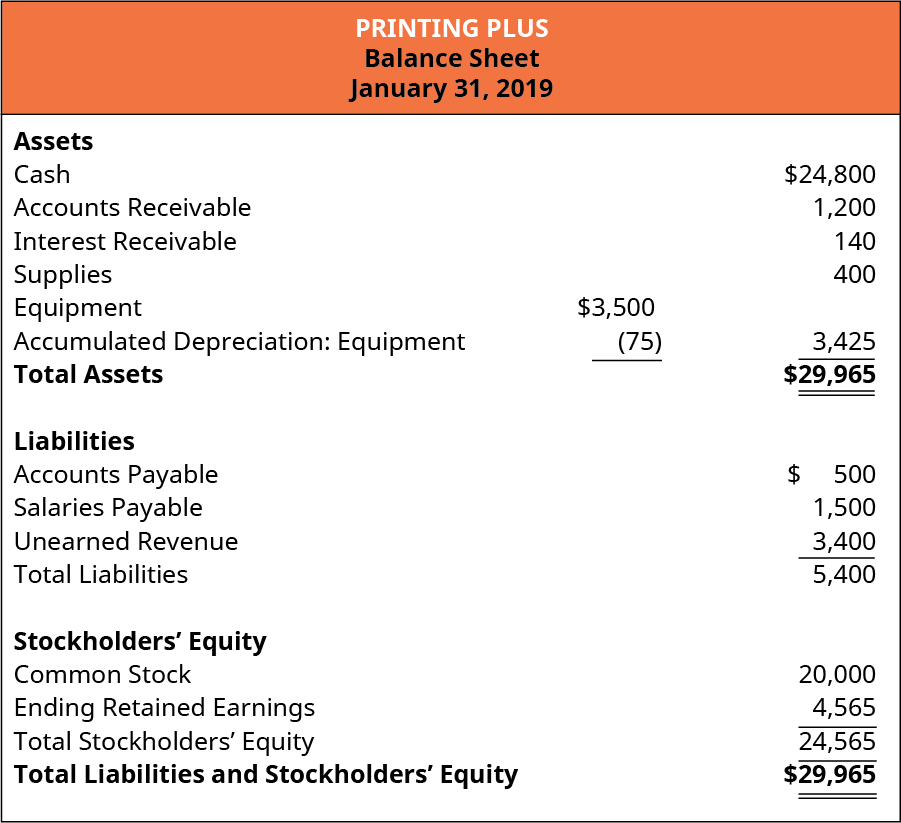

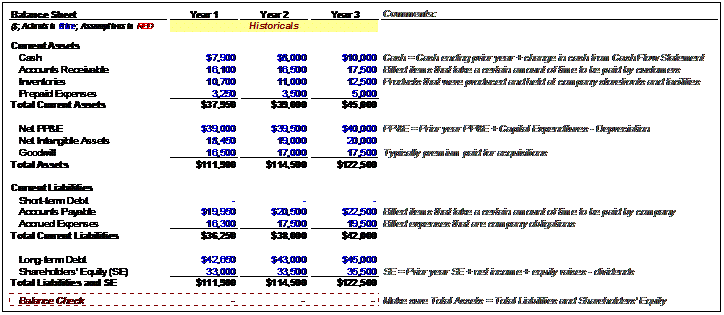

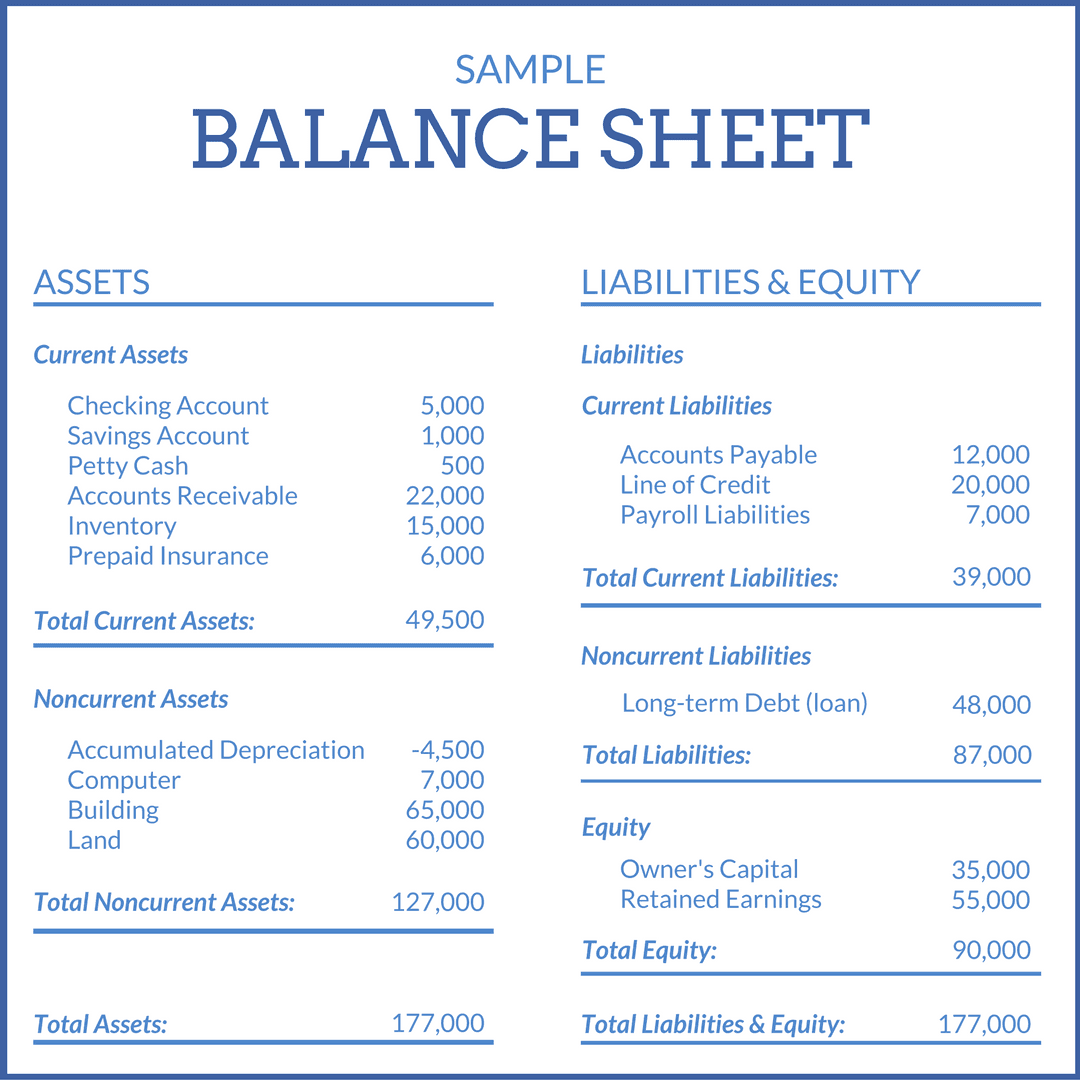

Negative deferred revenue on balance sheet. Thus it will accrue its earning. Business definition of deferred unearned revenue. Recording deferred revenue applies to the company s balance sheet. When a company receives cash for the goods or services that it will provide in future.

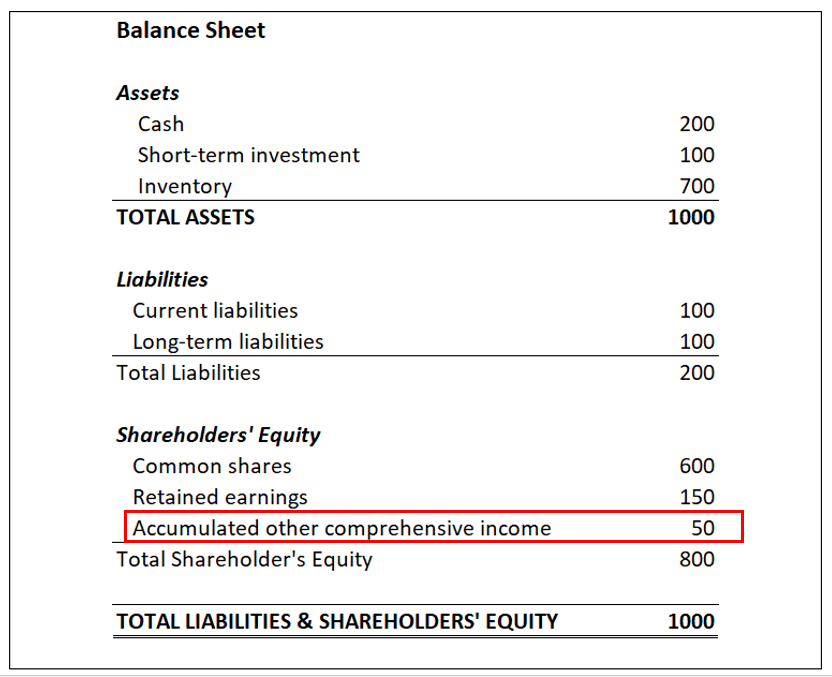

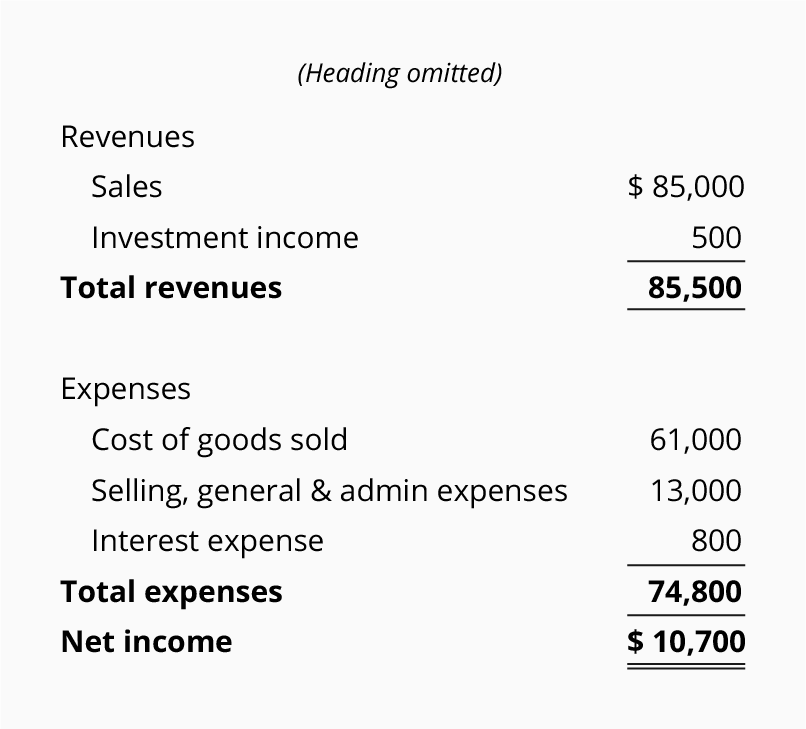

Deferred revenue or unearned revenue refers to advance payments for products or services that are to be delivered in the future. It leads to an increase in cash balance of the company since the goods or service is to be provided in future the unearned income is shown as a liability in the balance sheet of the company which resulted in a proportional increase on both sides. In the example from part 1 the company receives a 120 advance payment relating to a twelve month magazine subscription. Hence 1000 of deferred income will be recognized as service revenue.

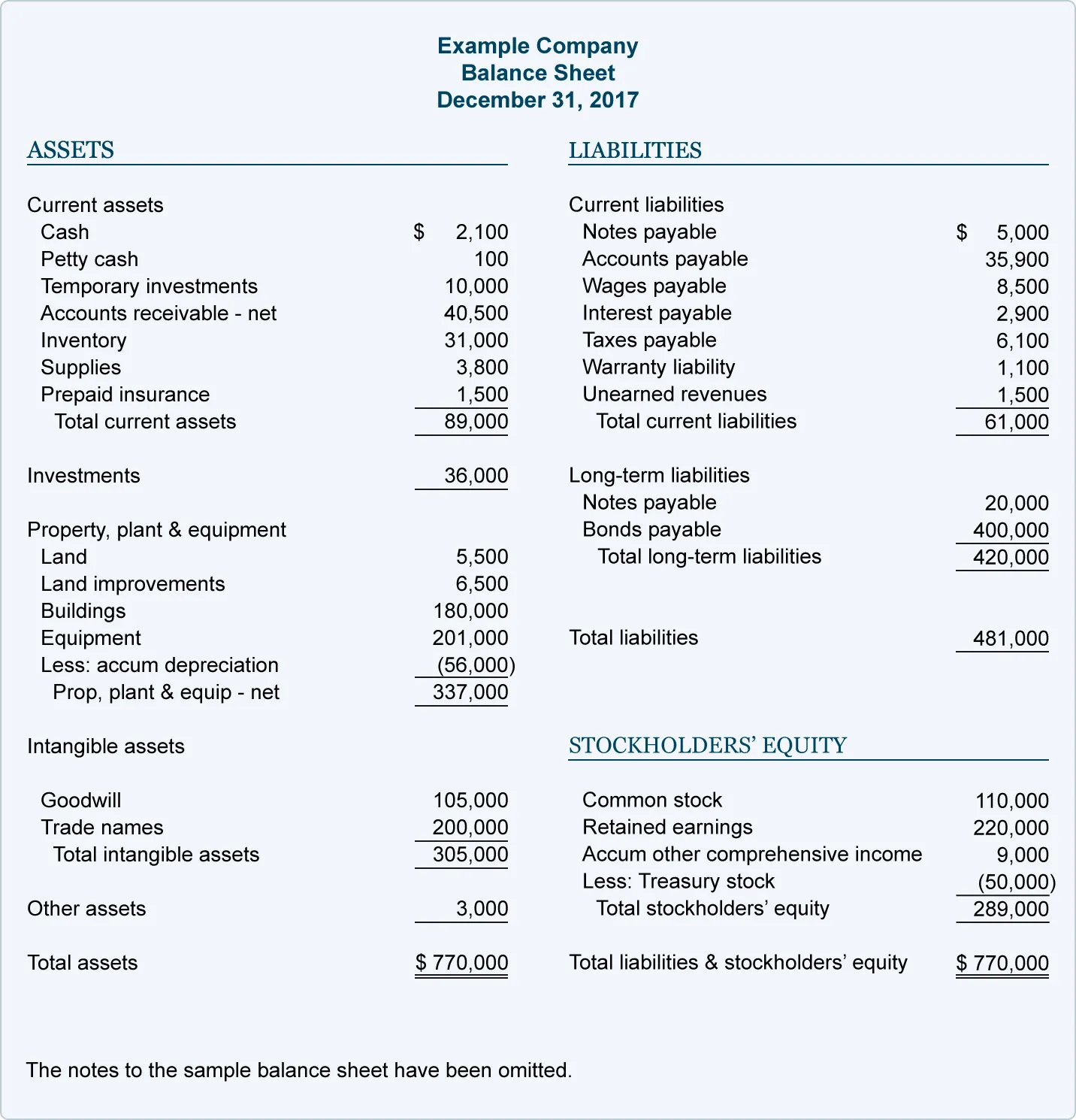

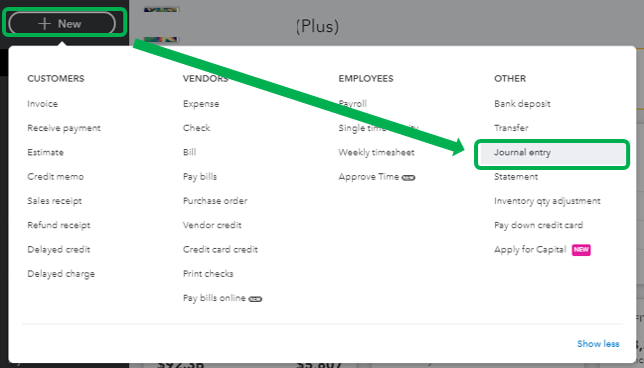

I have some cases like this when a billing schedule is associated with a revenue amortization schedule and there are periods where future invoicing is greater. Deferred revenue is listed as a liability on the balance sheet because under accrual accounting the revenue recognition process has not been completed. Before defining deferred revenue an understanding of the terms used is necessary. The company receives cash an asset account on the balance sheet and records deferred revenue a liability account on the balance sheet.

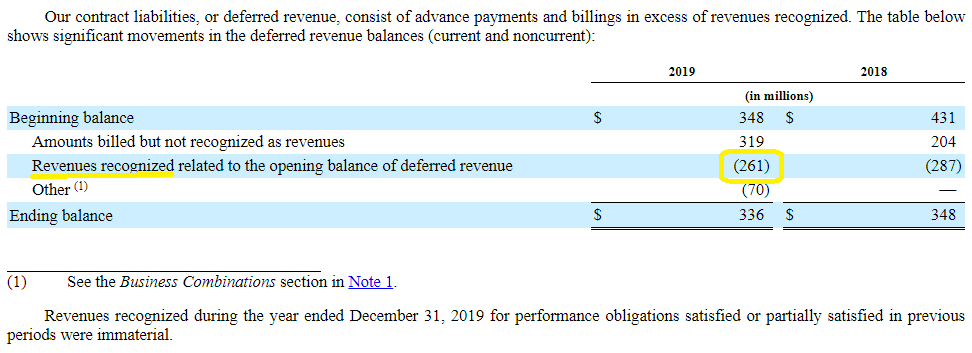

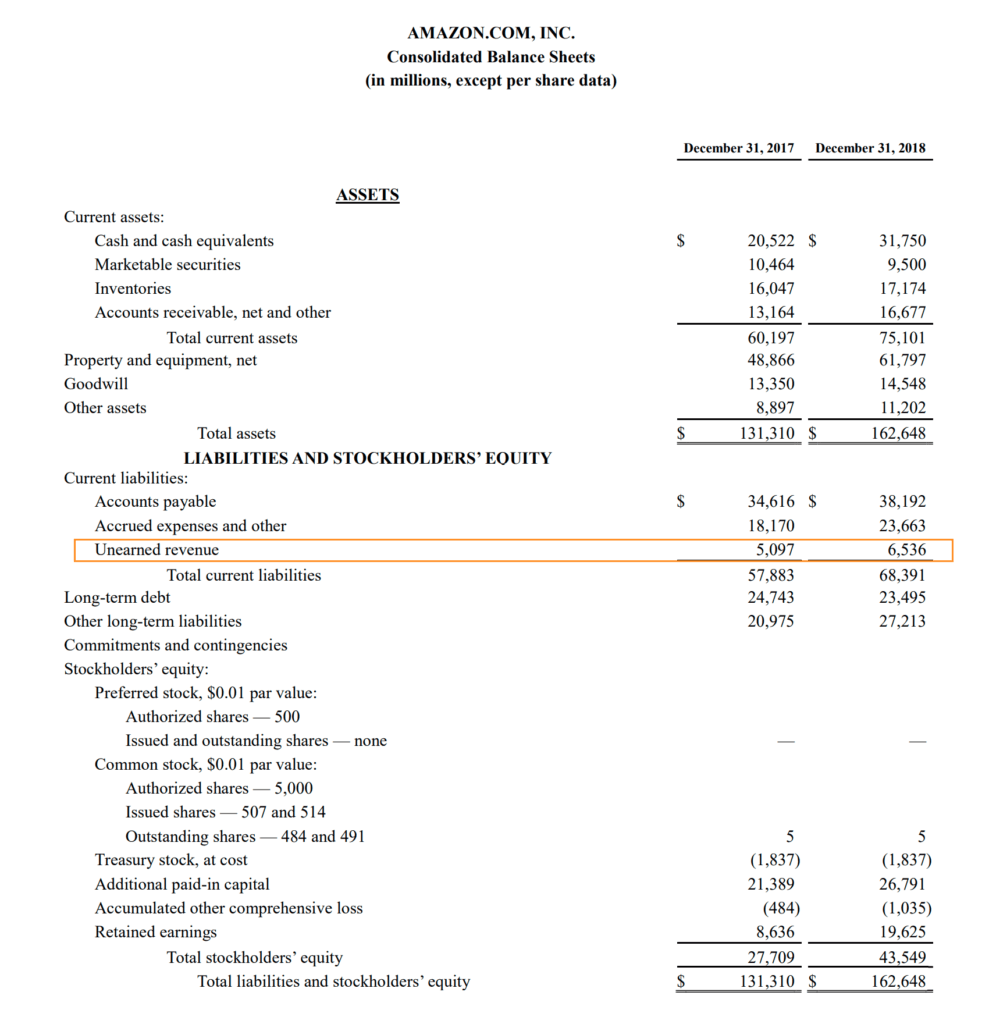

If the estimate was over accrued guessed to high there would be a negative entry to deferred revenue but for there to be a negative balance the overstatements would have to exceed the balance. With accounting accountants use the term unearned revenue on a balance sheet in the liabilities section the term deferred revenue means exactly the same thing except it is more commonly used as it relates to tax return preparation i e. Salesforce sec filings unearned revenue accounting. Now after working for a month mnc has earned 1000 i e it has provided its services to xyz.

The recipient of such prepayment records unearned revenue as a. Negative deferred revenue balance for a customer how do you account for deferred revenue of a customer when you have recognized more revenue than you have invoiced for. The deferred revenue account is normally classified as a current liability on the balance sheet. I can t see a situation like that arising since deferred revenue can t exceed cash or the down payment cash and other assets.

When the company receives payment.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)