Revenue Accounts Are Increased By Credits Always

Other names for revenue are income or gains.

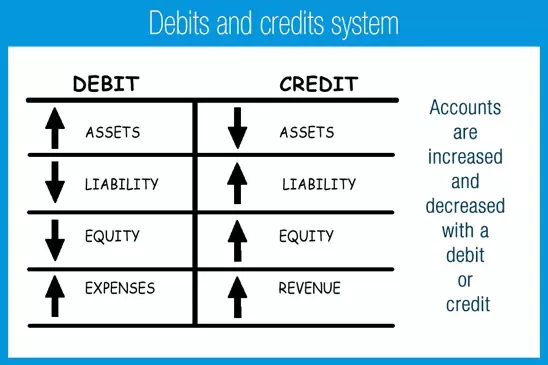

Revenue accounts are increased by credits always. The credit entry in service revenues also means that owner s equity will be increasing. Revenues increase with credits and decrease with debits. To determine the balance in an account always subtract credits from debits. Debits and credits occur simultaneously in every financial transaction in double entry bookkeeping.

Revenue accounts are increased by credits. Is decreased by credits. Liability accounts are increased by debits. Is increased by debits.

Which accounts normally have debit balances. Whenever an accounting transaction is created at least two accounts are always impacted with a debit entry being recorded against one account and a credit entry being recorded against the other account. Revenues occur when a business sells a product or a service and receives assets. A revenue account is increased by credits.

The right hand side of a t account is known as a debit and the left hand side is known as a credit. This means that a credit in the revenue t account increases the account balance. The reasoning behind this rule is that revenues increase retained earnings and increases in retained earnings are recorded on the right side. In a t account their balances will be on the right side.

Revenues and gains are recorded in accounts such as sales service revenues interest revenues or interest income and gain on sale of assets. Assets expenses and dividends 109. There is no upper limit to the number of accounts involved in a transaction but the minimum is no less than two accounts. Has a normal balance of a debit.

In recording an accounting transaction in a double entry system the amount of the debits must equal the amount of the credits. Unlike other accounts revenue accounts are rarely debited because revenues or income are usually only generated. Is increased by credits. Expenses decrease retained earnings and decreases in retained earnings are recorded on the left side.

If the company earns an additional 500 of revenue but allows the customer to pay in 30 days the company will increase its asset account accounts receivable with a debit of 500. We will also add a very common account called dividends as the final piece to the debits and credits puzzle. It must also record a credit of 500 in service revenues because the revenue. As shown in the expanded accounting equation revenues increase equity.

In the accounting equation assets liabilities equity so if an asset account increases a debit left then either another asset account must decrease a credit right or a liability or equity account must increase a credit right in the extended equation revenues increase equity. The revenue account is an equity account with a credit balance. These accounts normally have credit balances that are increased with a credit entry.