Revenue And Deadweight Loss

Bus passes market 120 110 s tax supply 100 tax revenue 90 1 80 deadweight loss 70 price dollars per pass 60 50 40 30 20 10 d.

Revenue and deadweight loss. We discuss how taxes affect consumer surplus and producer surplus and discuss the concept of deadweight lo. The varying deadweight loss from a tax also affect the government s total tax revenue. The deadweight loss created due to overproduction is the grayed out area in the picture below. The tax has neither an effect on quantity nor any deadweight loss.

Why do taxes exist. Minimum wage and living wage laws can create a deadweight loss by causing employers to overpay for employees and preventing low skilled workers from securing jobs. English economist alfred marshall 1842 1924 is widely credited as the. The statement a tax that has no deadweight loss cannot raise any revenue for the government is incorrect.

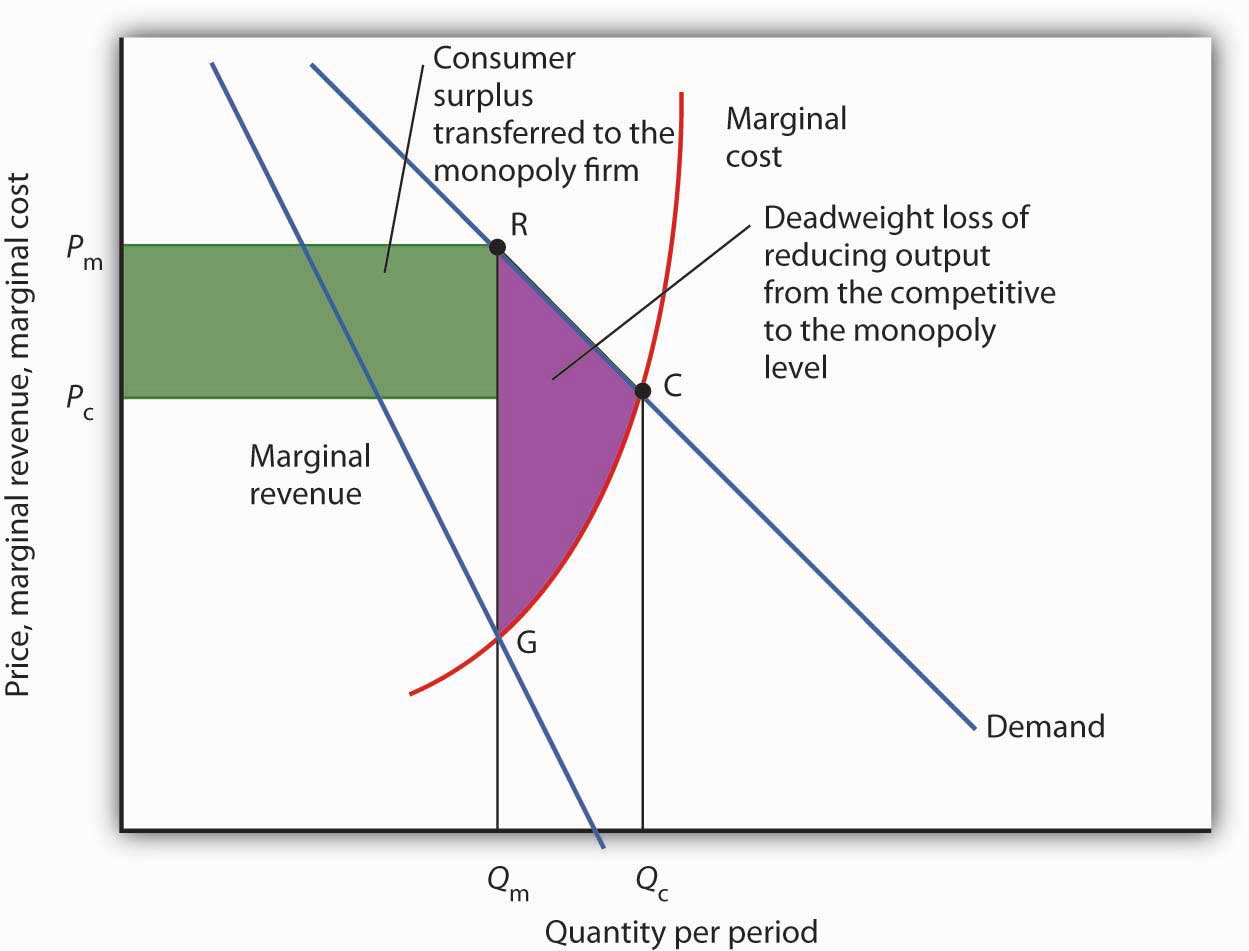

Where a tax increases linearly the deadweight loss increases as the square of the tax increase. Deadweight loss deadweight loss is the lost welfare because of a market failure or intervention. In this case it is caused because the monopolist will set a price higher than the marginal cost. The deadweight loss of taxation is a measurement of the economic loss that is caused by the imposition of a new tax.

Deadweight loss price difference quantity difference. On the other hand if producers produce only 1000 units of x there will be a bigger portion of the population which won t get the product but also the revenue won t be maximized. Unlike sellers in a perfectly competitive market a monopolist exercises substantial control over the market price of a commodity product. The concept of deadweight loss is important from an economic point of view as it helps is the assessment of the welfare of society.

What are the effects of taxes. 0 0 50 100 150 200 250 300 350 400 450 500 550 600 quantity passes complete the following table with the tax revenue collected and deadweight loss caused by each of the tax proposals. An example is the case of a tax when either supply or demand is perfectly inelastic. This means that when the size of a tax doubles the base and height of the triangle double.

Dead weight loss the second problem. Deadweight loss also arises from imperfect competition such as oligopolies and monopolies monopoly a monopoly is a market with a single seller called the monopolist but many buyers. Relevance and use of deadweight loss formula. Examples of deadweight loss.