Revenue And Expenditures Difference

Which are incurred for meeting day today requirements of a business and the.

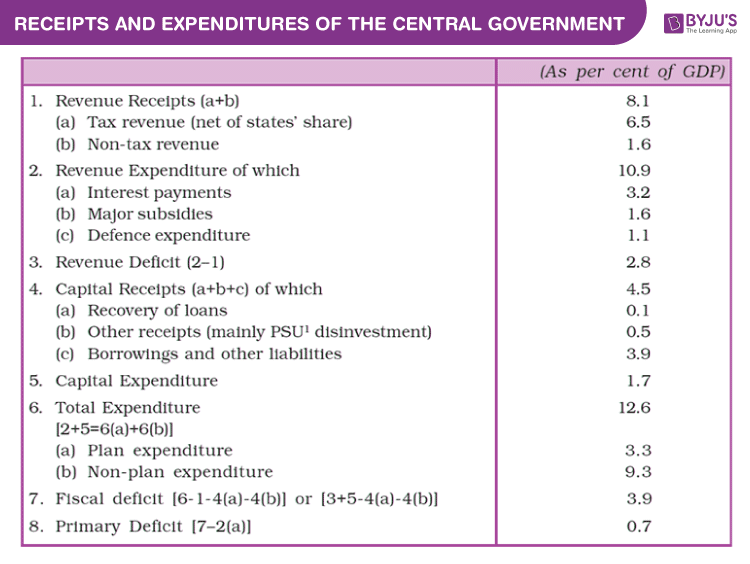

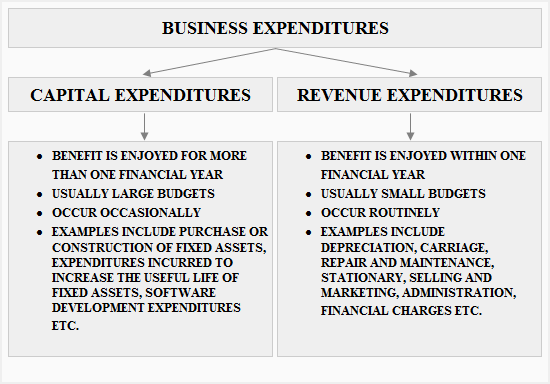

Revenue and expenditures difference. In order to achieve consistency between on the one hand the national accounts logic expressed in the sequence of accounts for production generation distribution redistribution and use of income accumulation and financing and on the other hand a government budget perspective government spending and receipts two additional concepts about national accounts. Revenue expenditures are often discussed in the context of fixed assets. The difference between revenue expenditures and capital expenditures is another example of two similar terms that are easily mixed up. Capital expenditures are for fixed assets which are expected to be productive assets for a long period of time.

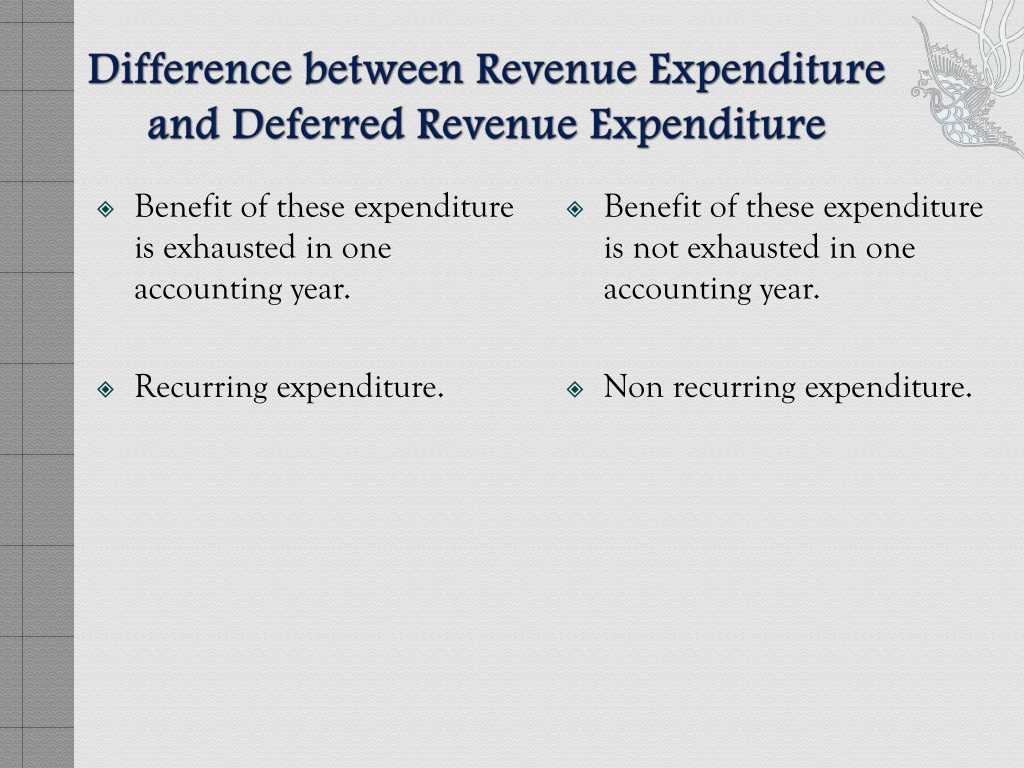

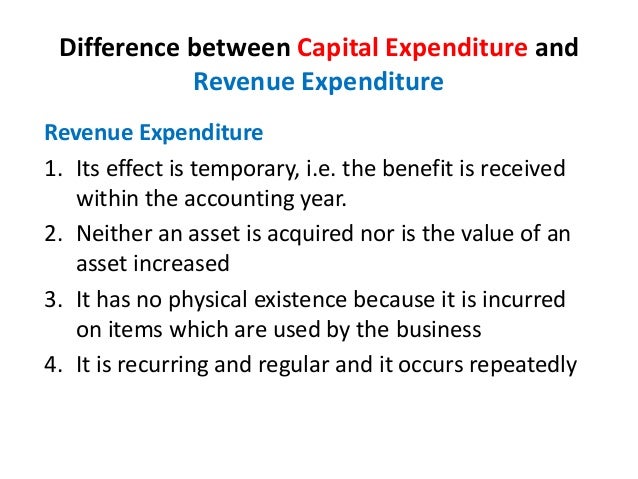

The first and foremost difference between the two is capital expenditure generates future economic benefits but the revenue expenditure generates benefit for the current year only. The differences between capital expenditures and revenue expenditures include whether the purchases will be used over the long term or short term. Definition of revenue expenditure. Revenue expenditures are for costs that are related to specific revenue transactions or operating periods such as the cost of goods sold or repairs and maintenance expense thus the differences between these two types of expenditures are as follows.

Capital expenditures capex are funds used by a. The key difference between expense vs expenditure is that expense refers to the amount spent by the business organization for the ongoing operations of the business in order to ensure the generation of the revenue whereas the expenditure refers to the amount spent by the business organization for the purpose of purchasing the fixed assets or for increasing fixed assets value. The revenue expenditures take place after a fixed asset had been put into service and simply keeps the asset in working order. All the expenditures which are incurred in the day to day conduct and administration of a business and the effect of which is completely exhausted within the current accounting year are known as revenue expenditures these expenditures are recurring by nature i e.

Both revenue and capital expenditure are concerned with spending money to help a business survive and grow. They are also recognized immediately for example stationery printing electricity costs wages and salary postage insurance repairs and maintenance inventory taxes etc. The key difference between the two is the intent of the expenses and where the money goes. The difference between capital expenditure and revenue expenditure are expained in tabular form.

A revenue expenditure is a cost that will be an expense in the accounting period when the expenditure takes place.

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)