Revenue Calculation For Banks

For example if a bank has a net revenue of 100 million and expenses of 65 million the efficiency ratio would be.

Revenue calculation for banks. The main operations and source of revenue for banks are their loan and deposit operations. Using this along with the bank s 23 billion in net income shows a roe of 12 1. Bank specific ratios such as net interest margin nim provision for credit losses pcl and efficiency ratio are unique to the banking industry. We can see that bofa s revenue is well balanced with roughly half of the bank s revenue coming from fee and service income.

The bank then lends funds out at a much higher rate profiting from the difference in interest rates. Let us calculate the cost to income ratio for hdfc bank for fy13 from the below data extracted from its fy13 audited standalone financial results. Similar to companies in other sectors banks have specific ratios to measure profitability and efficiency that are designed to suit their unique business operations. The amount of revenue earned depends on two things the number of items sold and their selling price.

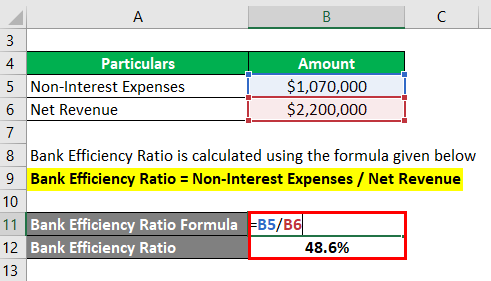

Revenue is the income earned by a business over a period of time eg one month. The ratio equals non interest expense divided by the sum of net interest income and non interest income and shows as a percentage how much money a bank spends to generate each dollar of revenue. You can find the information needed to calculate a bank s efficiency ratio on its income statement. There is a standard way that most companies calculate revenue.

Net interest margin finally to calculate the net interest margin you need to determine the bank s net interest. What s left in the net afterwards is the net income or net profit. Calculating a bank s efficiency ratio can be as easy as. Investors and analysts commonly use the efficiency ratio or expense to revenue ratio to compare a bank s expenses to its revenues.

65 million 100 million 0 65 65 parts of the efficiency ratio. Net income of 18 2 billion is the profit earned by the bank for 2017. Customers deposit money at the bank for which they receive a relatively small amount of interest. A company s net income is what remains of its revenue or takings once all expenses have been accounted for.

Thus there is an inverse relationship between the cost to income ratio and the bank s profitabilit y. Imagine a net trawling a bank account and all the money for costs such as rent electricity wages insurance marketing etc slipping through the holes.