Revenue Canada Labour Laws

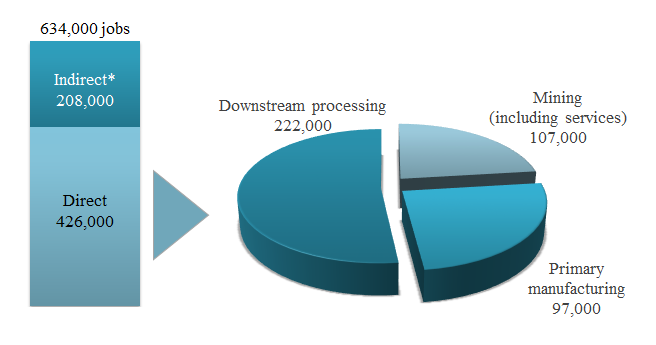

According to canada s constitution act labour and employment is most often a matter of provincial jurisdiction and each province has its own employment standards and legislation.

Revenue canada labour laws. The year of employment is the period beginning on the date an employee is hired or on any anniversary of that date and ending 12 consecutive months later. Canada employment laws can be quite different to their counterparts in the united states. Be or expect to be without employment or self employment income for at least 14 consecutive days in the initial four week period and for subsequent periods expect to have no employment income. In response to the covid 19 pandemic the ontario government made a regulation that changed certain employment standards act esa rules during the covid 19 period.

These may include any at home business expenses such as telephone internet and other utilities business use of vehicle costs meals purchase of equipment and even entertainment in accordance with the canada revenue agency s cra guidelines. Act means part iii of the canada labour code. Us employers with operations in canada need to be well versed in these differences to stay in legal compliance on both sides of the border. Extension of the covid 19 period.

Director repealed sor 94 668 s. Employment relationships in canada are generally governed by employment contracts subject to labour and employment legislation as well as the common law or in québec the civil code. During the covid 19 period march 1 2020 to january 2 2021. This regulation has been amended extending the covid 19 period to january 2 2021.

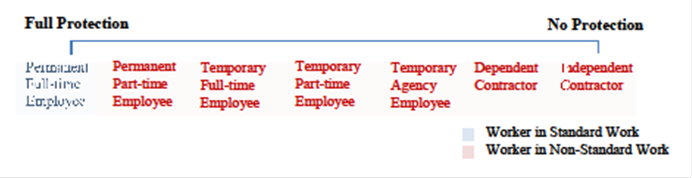

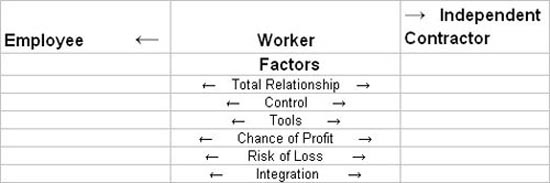

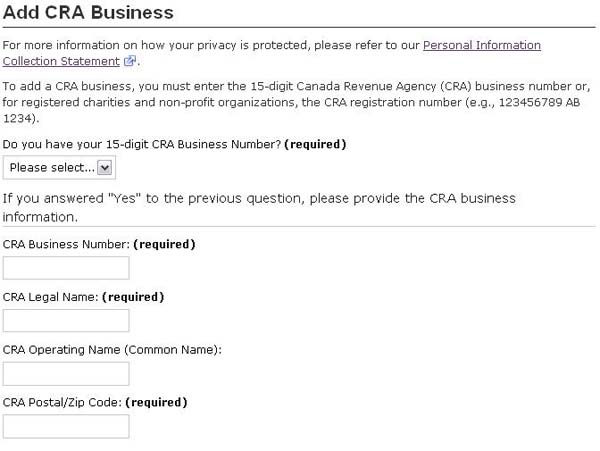

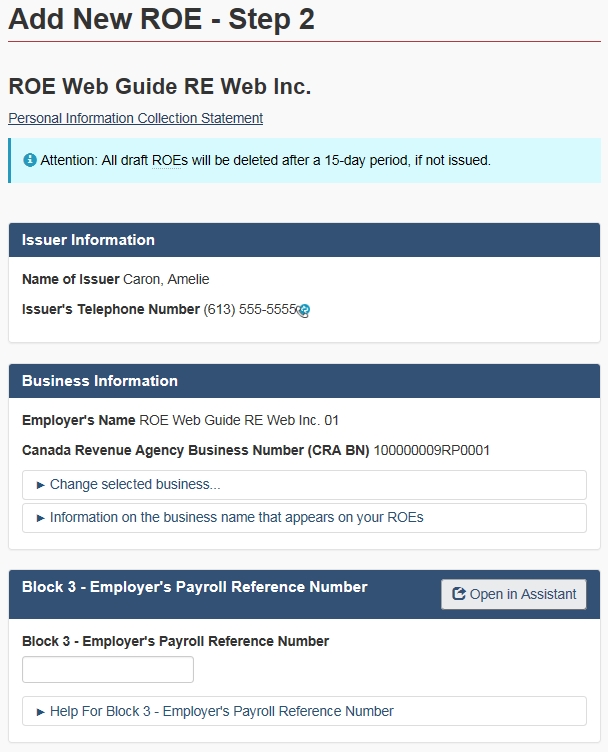

Federal laws of canada. This document provides information on what the canada revenue agency cra looks at when determining if employment of a casual nature is pensionable under the canada pension plan cpp and insurable under the employment insurance act eia. Self employment allows you to claim any valid expense needed to operate your business. Here are some of the big picture differences of which to be aware.

It may also be a calendar year or other period of 12 consecutive months as determined by the employer in accordance with the canada labour standards regulations relating to an industrial establishment. Canada labour standards regulations. It is possible for an employer to require that the employee work more than this but in this case an agreement must be made in writing and the employee must be provided with this information sheet about hours of work and overtime pay first. Post means in respect of a document to post in readily accessible places where the document is likely to be seen by the employees to whom it applies and to keep the document posted for the period during which it applies.

2 1 in these regulations. It is currently expected that qualifying participants will receive 2 000 per 4 week block from march 15 to october 3 2020 up to a maximum of 16 weeks.