Revenue Health Tax Back

These can be your own health expenses or any individual s as long as you have paid for them.

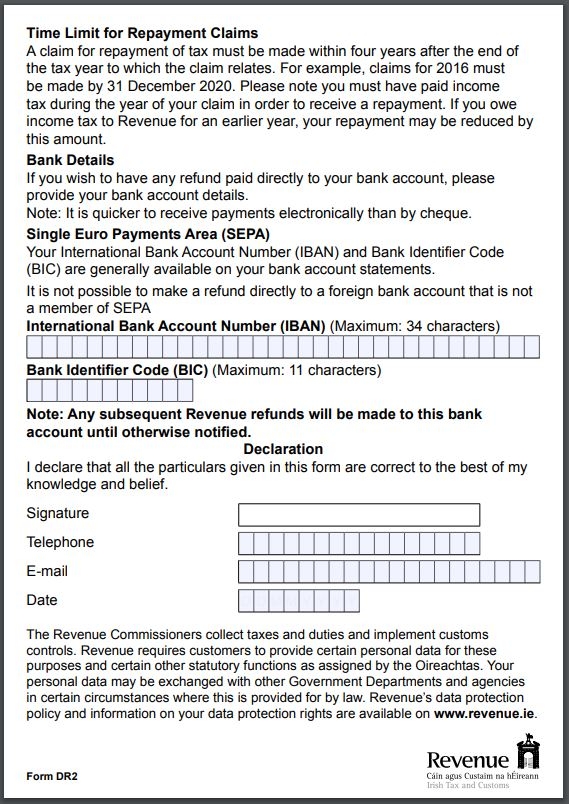

Revenue health tax back. Nursing home expenses are given at your highest rate of tax up to 40. Option 2 you can claim 700 for the 2018 tax year and 300 for the 2019 tax year. The insurance company grants this tax relief at source. Revenue s public offices remain closed while public health measures are in place.

Have a form med 2 completed by your dentist. Health expenses are explained in more detail in the personal tax credits reliefs and exemptions section. To claim tax relief on additional diet expenses you must include the amount in your health expenses. You can check if a practitioner is registered by checking their registration through the irish medical council or the dental council of ireland.

Your health expenses cost 1 000 in total. Tax can also be claimed on non routine dental work. You do not need to claim the tax relief from revenue. How to make a claim.

Qualifying health expenses are for health care you have paid for. Revenue are currently sending out reminders to the public to claim their tax back in time for christmas. This is known as tax relief at source trs. Health expenses you can claim relief on the cost of health expenses.

To qualify for relief your health care must be carried out or advised by a registered practitioner such as a doctor or a dentist. A public or local authority for example the health service executive hse any other source such as a compensation payment. To claim your health expenses you will need to complete your tax return form. Option 1 you can claim 1 000 for the 2018 tax year.

Tax relief is also available for premiums paid for health insurance and for long term care insurance. You have two options when claiming tax relief for these health expenses. The relief is given as a discount on the cost of the policy regardless of who the policy is for. Your dentist will normally give a med 2 to you after your treatment.

Include this amount in your health expenses claim under the non routine heading. You pay 700 in 2018 and the remaining 300 in 2019. The public are entitled to various claims back in areas including health expenses tuition a. Please see page how do you claim health expenses for more information.

Health and dental insurance combined. Receipts can be stored on the revenue receipt tracker app rrta. You generally receive tax relief for health expenses at your standard rate of tax 20. While food intolerances are not covered those who have been diagnosed as coeliac can claim tax back on the food that they buy.

Ivf treatment also comes under the tax back scheme as does laser eye surgery.

:max_bytes(150000):strip_icc()/1040-Page1-e7bbe01bc7824e54a552dfab83fff0b6.jpg)