Revenue Is Generally Recognized At The Point Of Sale Which Principle Is Applied

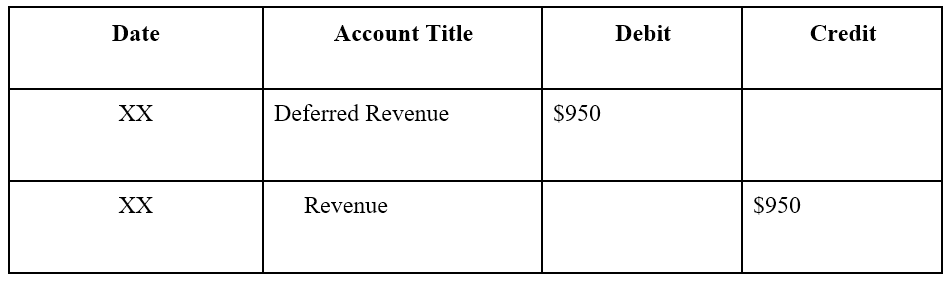

Revenue recognition is a generally accepted accounting principle gaap that stipulates how and when revenue is to be recognized.

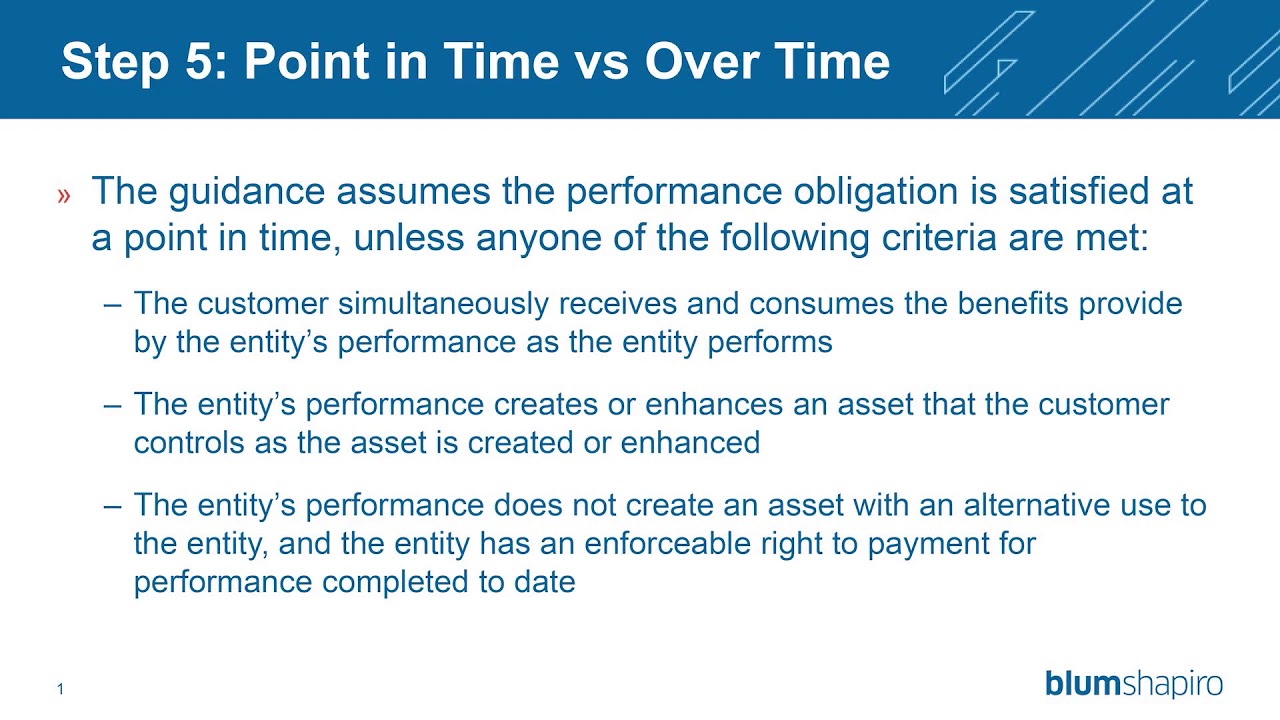

Revenue is generally recognized at the point of sale which principle is applied. 3 revenue is generally recognized at the point of sale denotes the concept of revenue recognition because the revenue recognition concept deals with the revenue that getting to be recognized during a point of sale. Theoretically there are multiple points in time at which revenue could be recognized by companies. Revenue is generally recognized at the point of sale. Revenue pas no 28 defines revenue as the gross inflow of economic benefits during period arising in the course of ordinary activities of an enterprise when those inflows result in increase in equity other than.

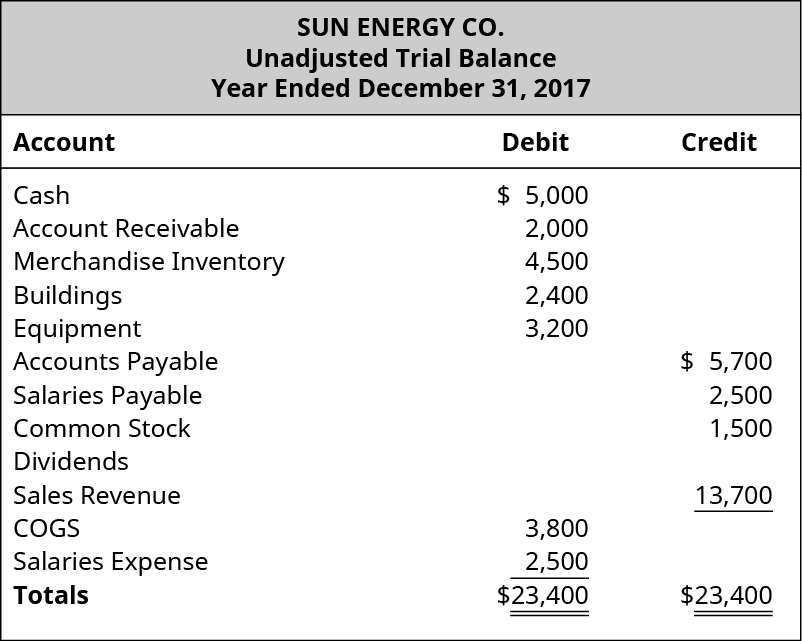

The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company s financial statements. The revenue recognition principle is a cornerstone of accrual accounting together with the matching principle. They must be realized or realizable and earned. The revenue recognition concept is part of accrual accounting.

The revenue recognition principle is a cornerstone of accrual accounting together with the matching principle they both determine the accounting period in which revenues and expenses are recognized. According to the principle revenues are recognized when they are realized or realizable and are earned usually when goods are transferred or services rendered no matter when cash is received. Name the time for each exception give two qualifications or criteria for the use of each exception and give an example for each exception. According to the principle revenues are recognized if they are realized or realizable the seller has collected payment or has reasonable.

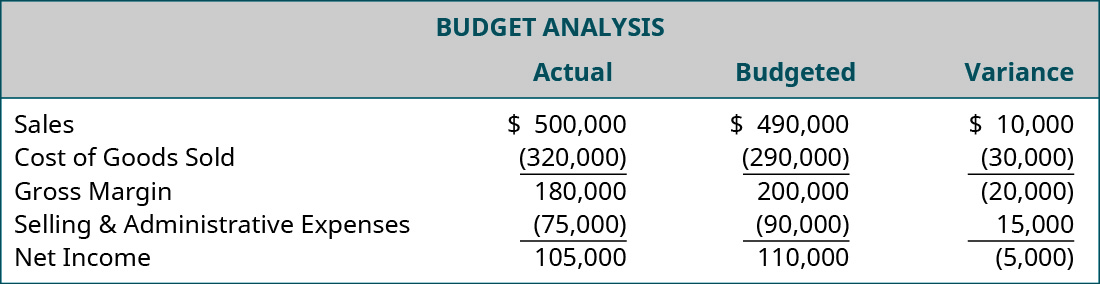

Revenue recognition is an accounting principle that outlines the specific conditions under which revenue sales revenue sales revenue is the income received by a company from its sales of goods or the provision of services. They both determine the accounting period in which revenues and expenses are recognized. In accounting the terms sales and revenue can be and often are used interchangeably to mean the same thing. The revenue recognition principle using accrual accounting.

There are three exceptions however. The revenue recognition principle states a company can record revenue when two conditions are met. The revenue is known contract or dependably estimable.

:max_bytes(150000):strip_icc()/GettyImages-172163302-8cde291c996048ccb8aa271e7ce82269.jpg)