Revenue Journal Entry Invoice

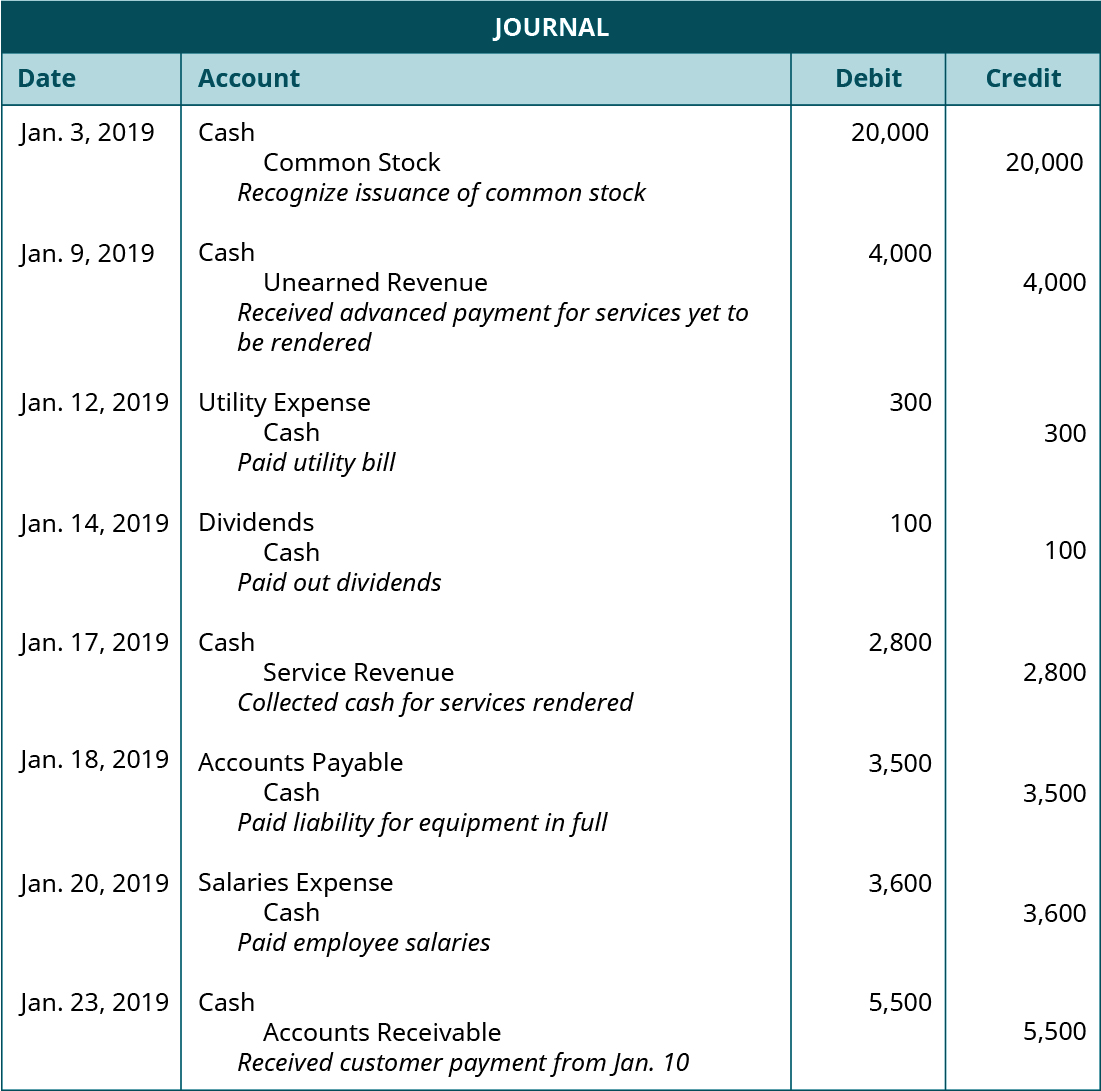

Under cash basis accounting customer sales are recognized as sales revenue as soon as the cash payment is received from the customer.

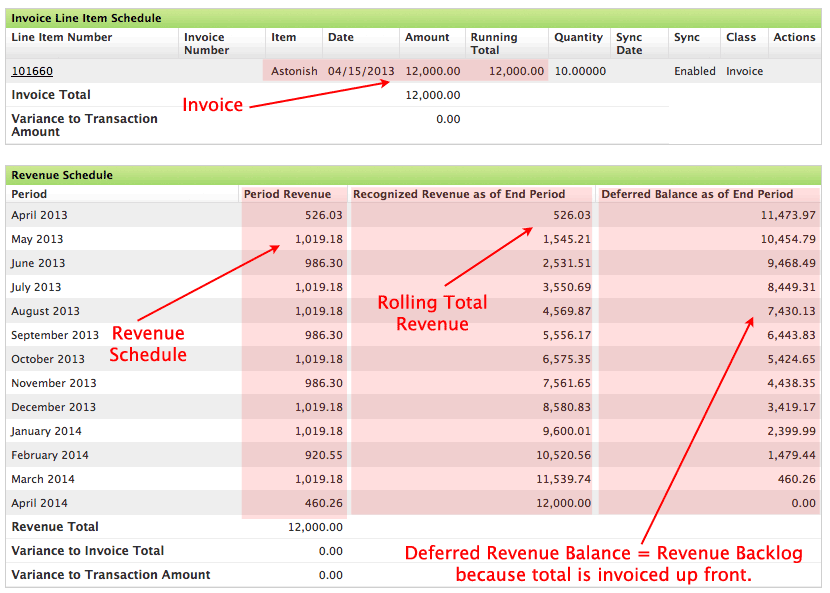

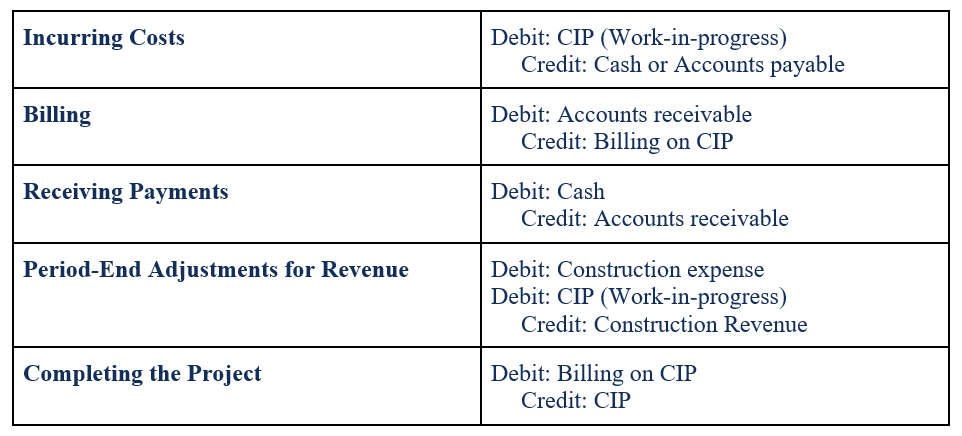

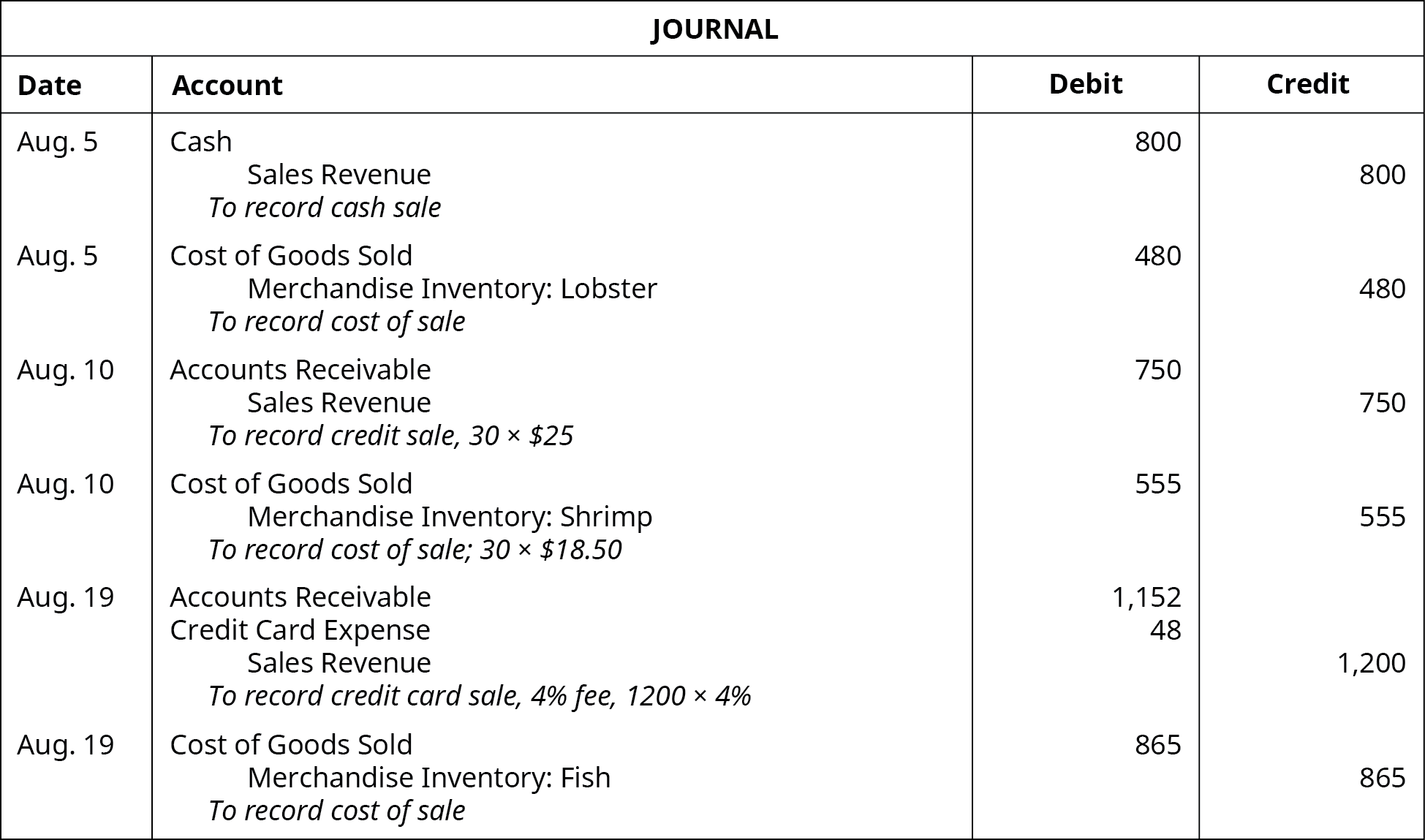

Revenue journal entry invoice. A deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance. The recordation of a sale. The ledger accounts for the work in progress are usually created as balance sheet accounts. This journal entry needs to record three events which are.

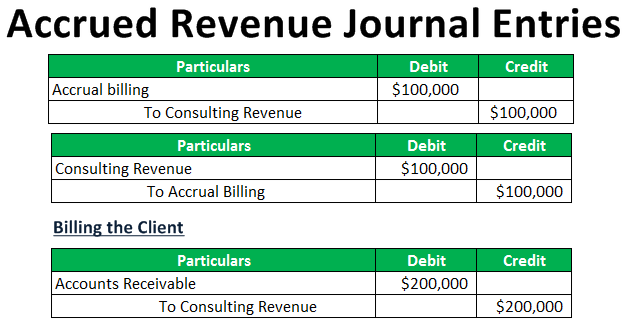

The coverage accounts and the account for the provisional revenue are usually profit and loss accounts. No invoice entry is created at this point because the invoice for the revenue has already been processed in the accounts directly. The recordation of a reduction in the inventory that has been sold to the customer. The recordation of a sales tax liability.

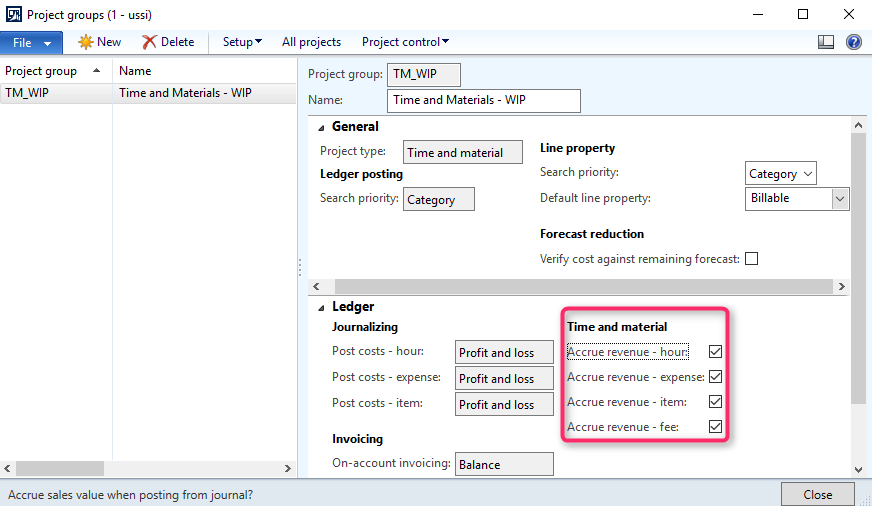

For example suppose a business provides web design services and invoices for annual maintenance of 12 000 in advance. At the time of invoicing the service has not been provided and. To journalise wip completion. However this depends on how the accounting has been configured.

You use revenue recognition to create g l entries for income without generating invoices. Deferred revenue journal entry. To work in progress revenue.

%20(1).png?width=780&name=unbilled-receivable%20(1)%20(1).png)