Revenue Nsw Land Tax

D is the maximum basic land tax payable 61 876.

Revenue nsw land tax. Land tax revenues have historically been a relatively stable source of revenue and between 2005 06 and 2015 16 provided in the order of around 4 of total nsw government revenue each year. Proposed tax reform consultation the nsw government is currently undertaking a public consultation process to seek feedback on this proposal. Revenue nsw has announced the land tax thresholds for 2020 are as follows. 5 000 000 4 616 000 x 2 61 876 69 556.

For more information about the proposed changes visit the nsw treasury website. Relief is available to landlords. 2020 land tax thresholds. Land tax is an annual tax charged on all property you own that is above the land tax threshold.

The nsw government wants to help the people of nsw achieve the australian dream of home ownership and grow the nsw economy. If you re a commercial or residential landlord who has reduced your tenants rent due to covid 19 you may be eligible for the nsw government s land tax relief. 1 april 2020 and 30 september 2020 and or 1 october 2020 and 31. Whose tenants can prove financial distress due to covid 19 and who have reduced their tenants rent for any period between.

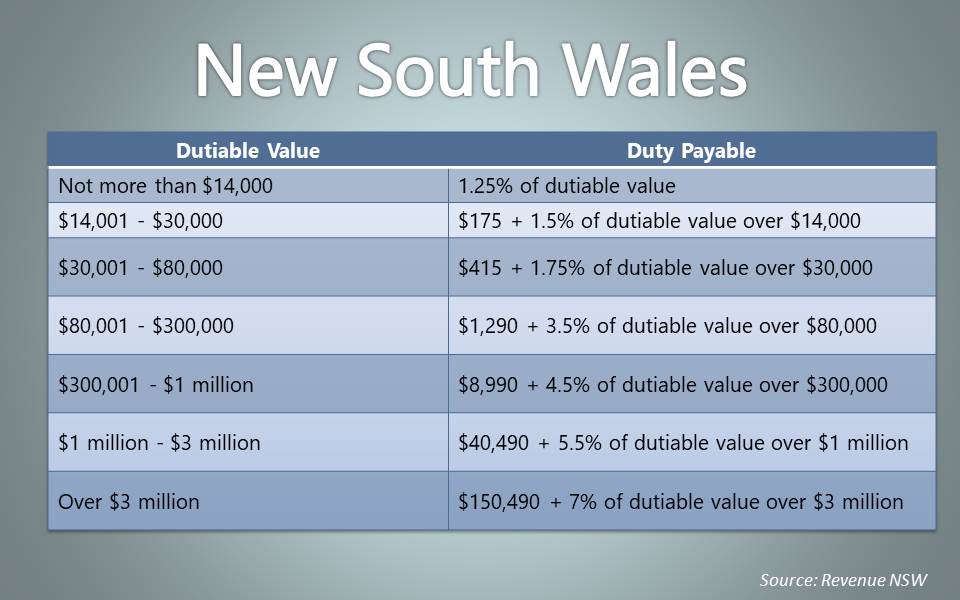

To help make this happen the government is considering a once in a generation change of giving home buyers the choice to pay either stamp duty and land tax where applicable or a new smaller annual property tax. If you do not have a client id or a correspondence id please contact us during business hours. On 31 december each year it uses an average of land values over three years to determine how much tax nsw landholders must pay. A premium land tax marginal rate of 2 applies for special trusts on the total taxable land value above 4 616 000.

Revenue nsw uses land values to calculate land tax. Nsw has chosen the optional route because it doesn t want people to be subject to double taxation whereby they ve paid stamp duty but then have to pay property tax on the same house as well. B is the premium land tax threshold for 2021 4 616 000. Some online services will be unavailable this weekend.

Generally speaking your principal place of residence is exempt. If you are liable to pay revenue nsw will give you a land tax assessment that shows the land values it used to calculate your land tax. Land tax covid 19 relief. In july 2016 surcharge land tax was introduced on the holders of residential land by foreign persons which will take effect for the 2017 land tax year.

The 2020 land tax covid 19 relief will be made available via application through service nsw. What is land tax.