Revenue Nsw Stamp Duty Calculator Property

All amounts entered must be numbers.

Revenue nsw stamp duty calculator property. To access the office of state revenue stamp duty calculator click on the following link. Do not include dollar signs commas full stops spaces or cents. From 1 july 2016 the nsw government abolished transfer duty on the sale of business assets including intellectual property goodwill and statutory licences. To calculate the amount of duty and surcharge purchaser duty payable on nsw residential land acquired by a foreign person on or after 21 june 2016 complete the details below.

Nsw state revenue office for example if you were purchasing a 600 000 house in new south wales you would fall within the 310 000 to 1 033 000 category. The nsw government charges stamp duty on property transfers. Stamp duty faq how much is australian stamp duty. In new south wales you must pay stamp duty within 30 days after the liability arises to pay transfer duty on the transaction.

How much is the stamp duty on a 650 000 house in nsw. However to get accurate stamp duty for your situation please use our calculator. Data is sourced directly from the relevant state or territory office of state revenue to ensure the most accurate figures. As a rule of thumb it s 3 4 of the property value.

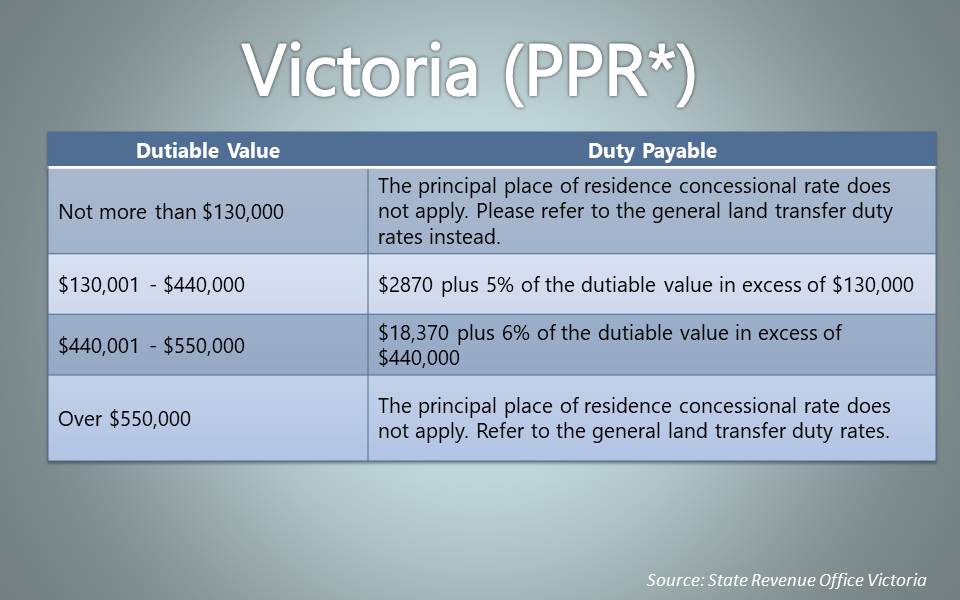

Stamp duty is a tax on a property transaction that is charged by each state and territory the amounts can and do vary. 650 000 is the most popular property value entered into our stamp duty calculator for new south wales. Motor vehicle registrations and transfers insurance policies mortgages the sale and transfer of real estate businesses and certain shares. In uk stamp duty is known as sdlt or stamp duty land tax.

The stamp duty rate will depend on factors such as the value of the property if it is your primary residence and your residency status. Therefore you would be charged an upfront stamp duty of 9 285 plus an additional charge of 13 050 for a total of 22 335. On or after 1 july 2017. How much is stamp duty on a 500k house.

The amount payable can vary depending on the state or territory and is also known as transfer duty or general duty. Stamp duty or transfer duty is a tax imposed by state and territory governments on transactions such as.