Revenue Recognition Matching Principle Example

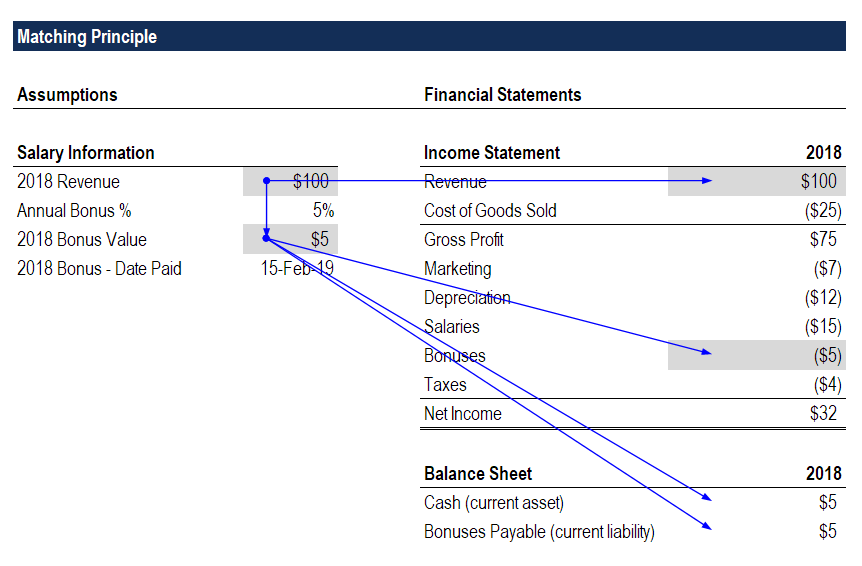

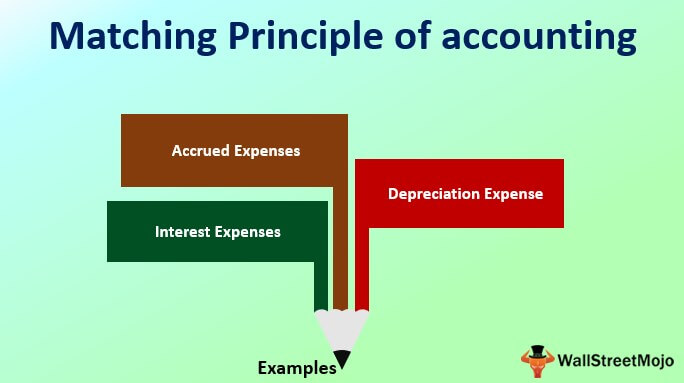

In this sense the matching principle recognizes expenses as the revenue recognition principle recognizes income.

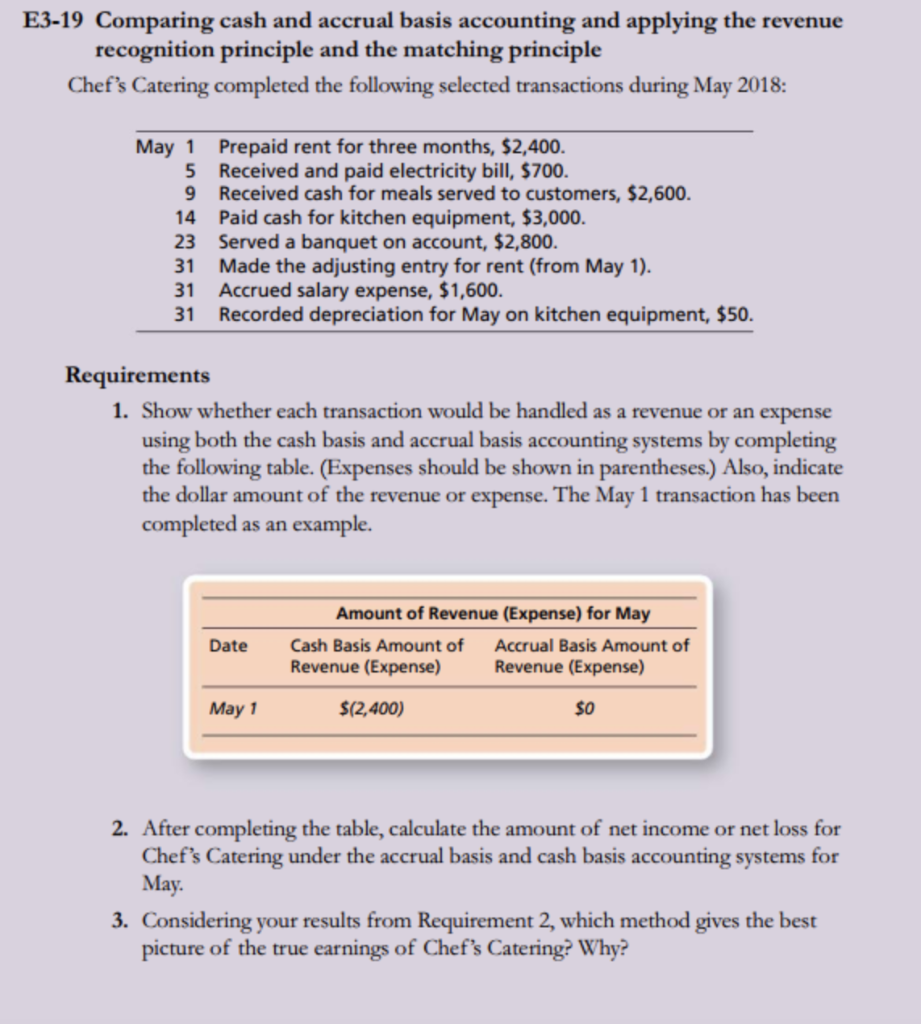

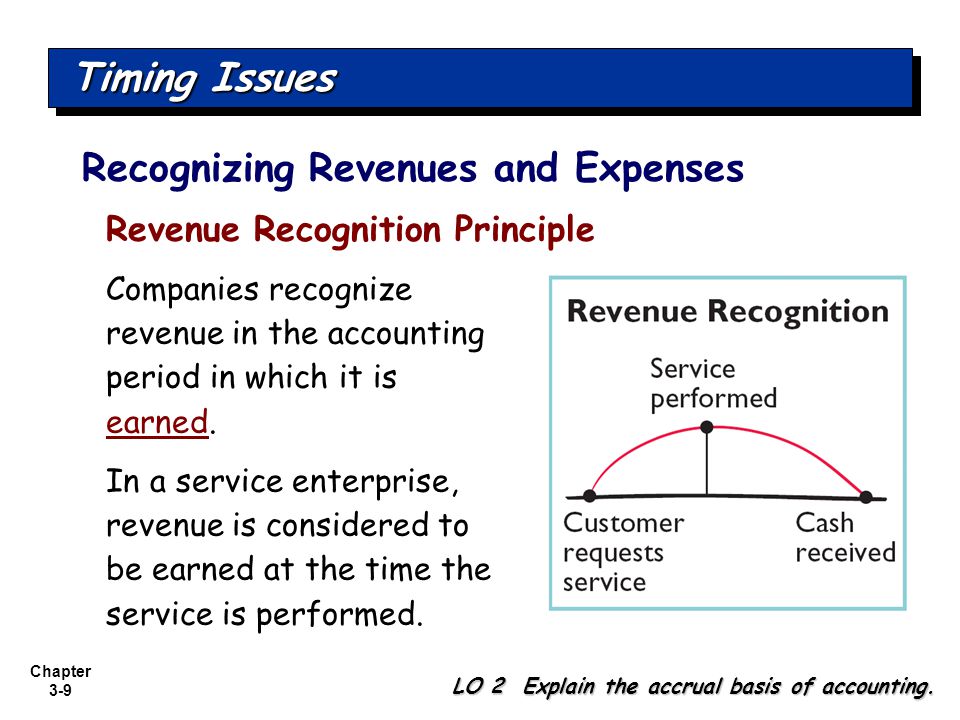

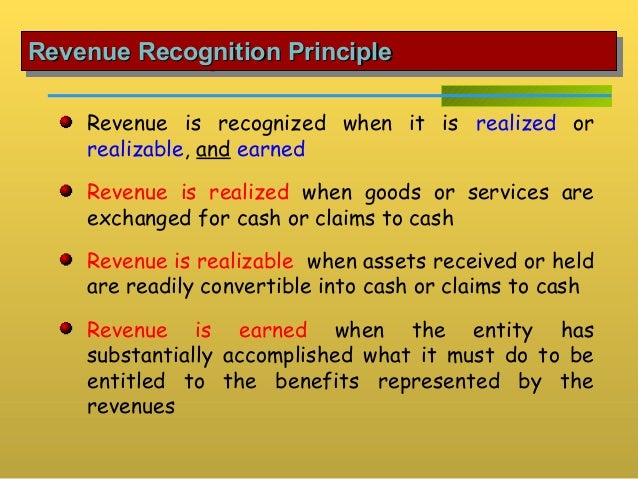

Revenue recognition matching principle example. The revenue recognition principle states that revenue should only be realized once the goods or services being purchased have been delivered. Product costs can be tied directly to products and in turn revenues. The revenue recognition principle states that revenue should be recognized and recorded when it is realized or realizable and when it is earned. The opposite of the revenue recognition principle is cash accounting.

The revenue recognition principle is an accounting principle that requires the revenue be recognized and recorded when it is realized and earned regardless of when the payment is made. This concept states that the costs that are associated with. The matching principle states that expenses should be matched with the revenues they help to generate. These goods have the cost of goods sold the amount of 40 000.

In other words businesses don t have to wait to receive cash from customers to record the revenue from sales. Matching between expenses and revenues. This superiority can be understood with the help of an example. Product and period costs.

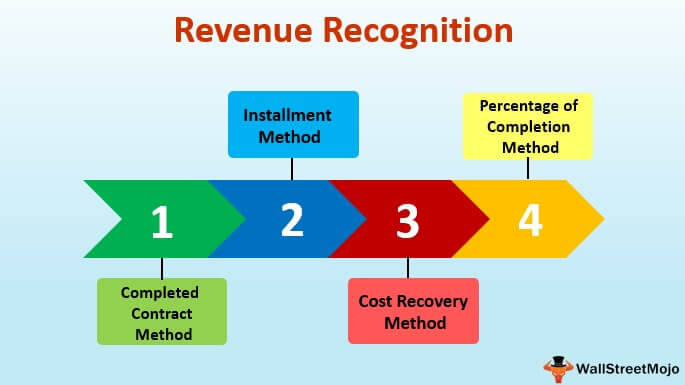

The revenue recognition principle states that revenues should be recognized or recorded when they are earned regardless of when cash is received. Revenue recognition is a generally accepted accounting principle gaap that determines the process and timing by which revenue is recorded and recognized as an item in the financial statements. Revenue recognition principle a part of accrual accounting is superior to cash accounting. The revenue recognition principle using accrual accounting.

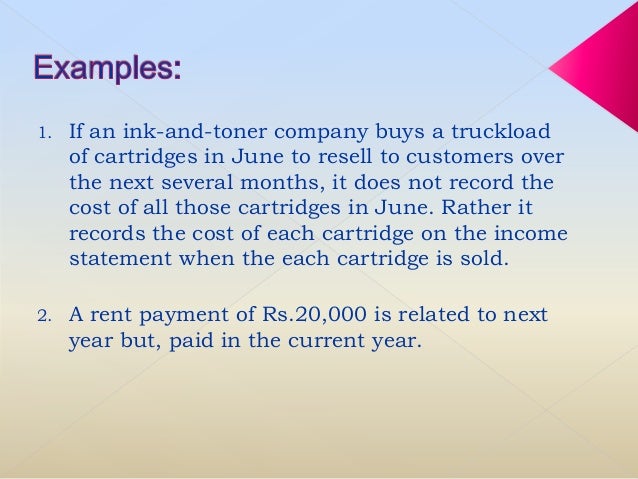

The following are the examples of matching principle. Revenue recognition is a generally accepted accounting principle gaap that stipulates how and when revenue is to be recognized. In general there are two types of costs. Revenue should be recorded when the business has earned the revenue.

The third criterion in regards to revenue recognition is in conjunction with another gaap principle called the matching principle. Cash accounting states that revenue should be recognized only when the cash is collected and not when the goods are sold. The matching principle is a crucial concept in accounting which states that the revenues and any related expenses are realized and recognized in the same accounting period in other words if there is a cause and effect relationship between revenue and expenses they should be recorded at the same time.