Revenue Recognition Principle Accounting Definition

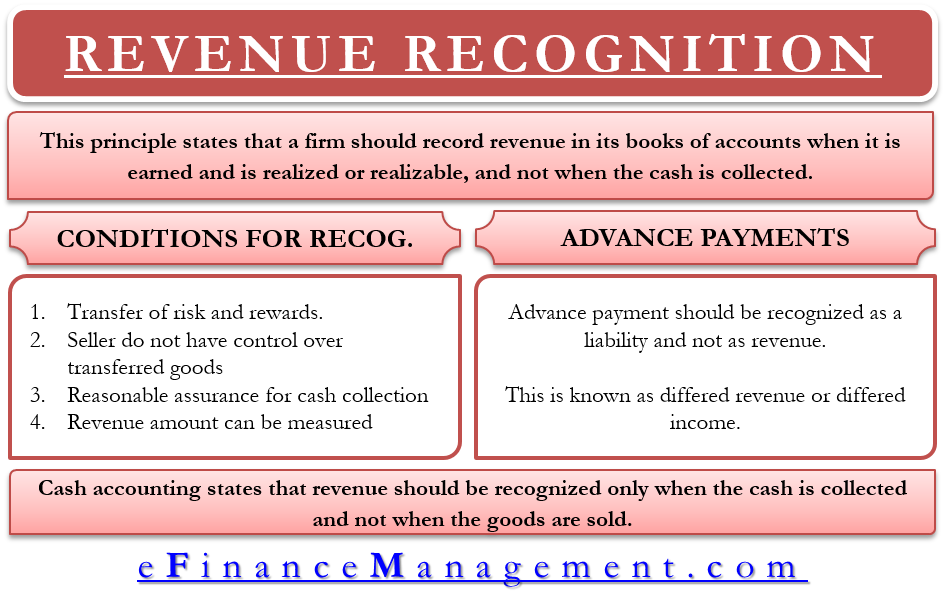

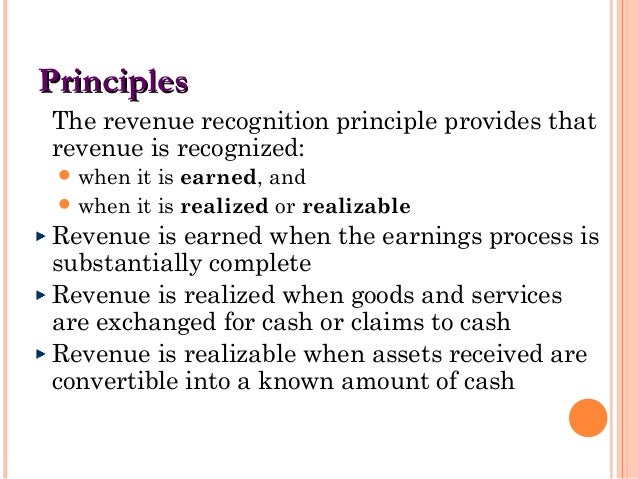

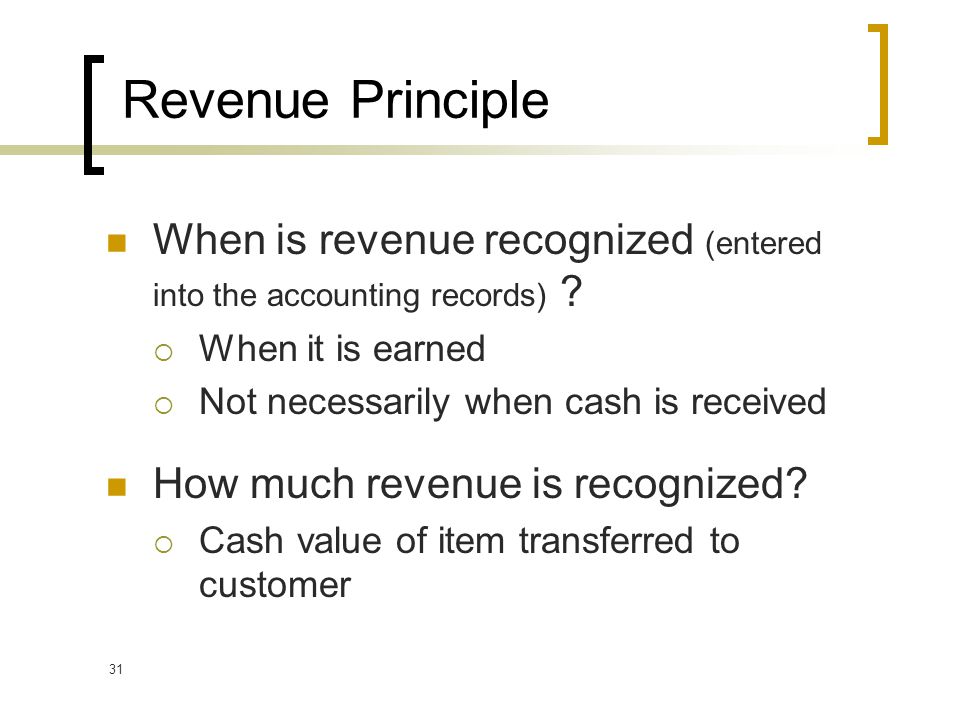

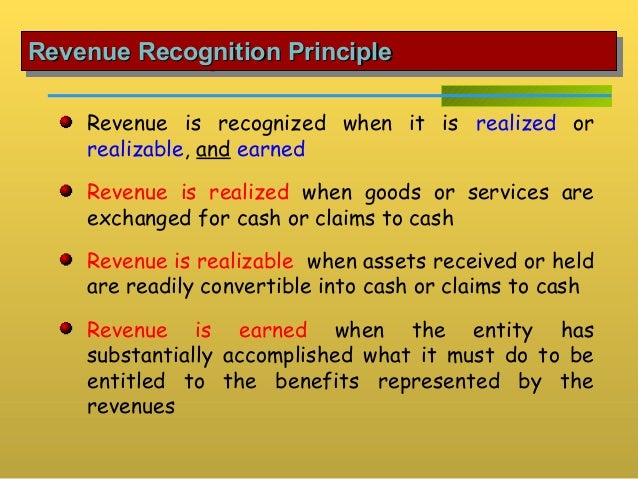

The revenue recognition principle states that revenue should be recognized and recorded when it is realized or realizable and when it is earned.

Revenue recognition principle accounting definition. The revenue recognition principle states that one should only record revenue when it has been earned not when the related cash is collected. Revenue recognition principle definition. According to this concept the revenue is not recognized until it is earned and it is realized or at least realizable. It means that revenues or income should be recognized when the services or products are provided to customers regardless of when the payment takes place.

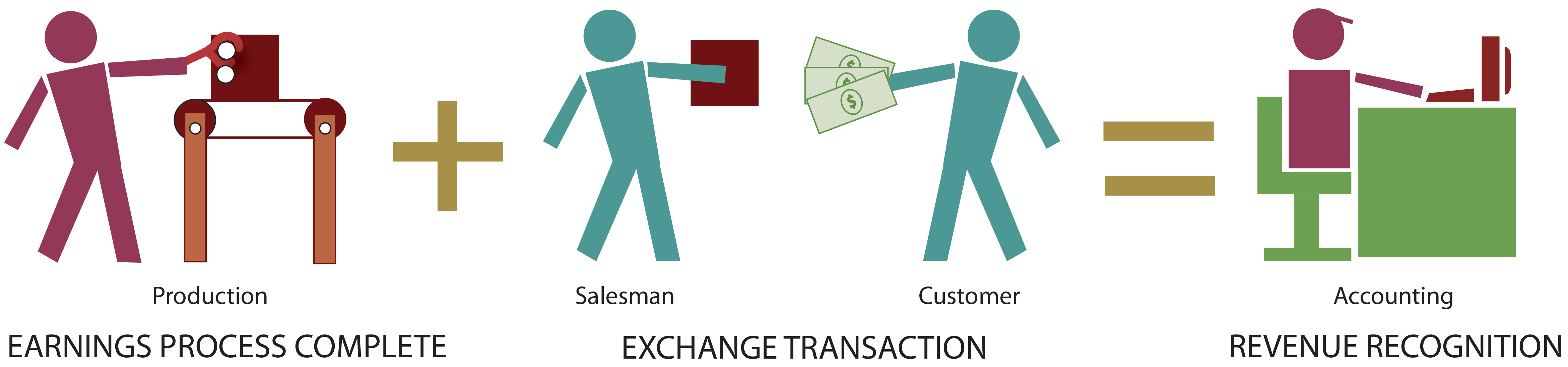

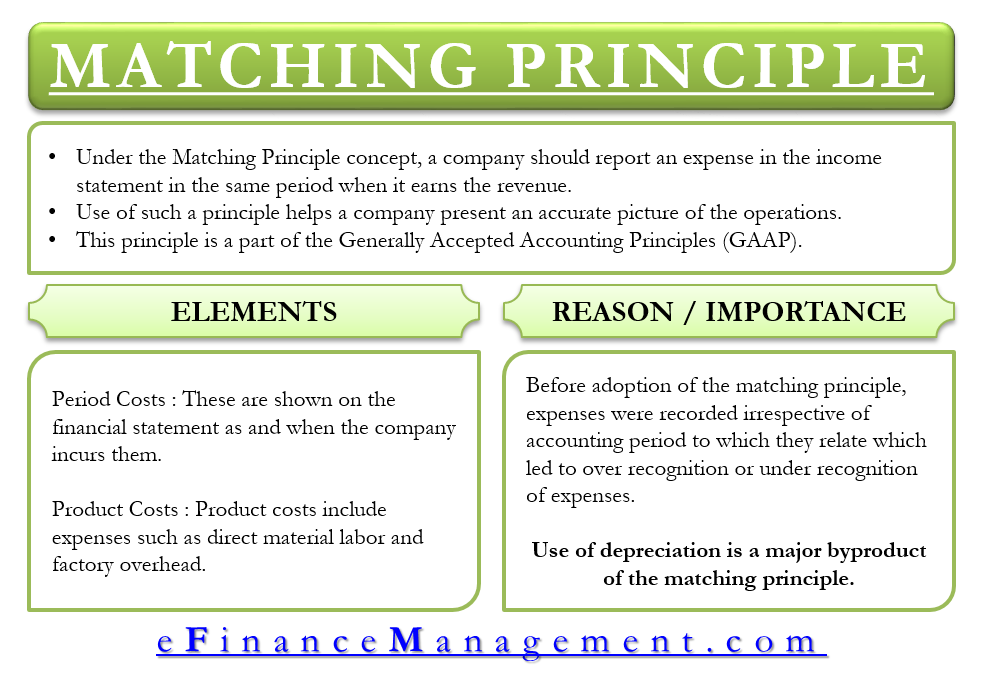

For example a snow plowing service completes the plowing of a company s parking lot for its standard fee of 100. Revenue should be recorded when the business has earned the revenue. This is part of the accrual basis of accounting as opposed to the cash basis of accounting. The blueprint breaks down the rrp.

The revenue recognition principle or just revenue principle tells businesses when they should record their earned revenue. Revenue recognition is an accounting principle that outlines the specific conditions under which revenue is recognized. The accounting guideline requiring that revenues be shown on the income statement in the period in which they are earned not in the period when the cash is collected. Revenue recognition is a generally accepted accounting principle gaap that identifies the specific conditions in which revenue is recognized and determines how to account for it.

The revenue recognition could be different from one accounting principle to another principle and one standard to another standard. Revenue recognition principle definition. The accounting guideline requiring that revenues be shown on the income statement in the period in which they are earned not in the period when the cash is collected. The revenue recognition principle is the concept of how the revenue should be recognized in the entity s financial statements.

The revenue recognition principle is an accounting principle that requires revenue to be recorded only when it is earned. This is part of the accrual basis of accounting as opposed to the cash basis of accounting. In other words companies shouldn t wait until revenue is actually collected to record it in their books.