Revenue Recognition Principle Accrual Basis

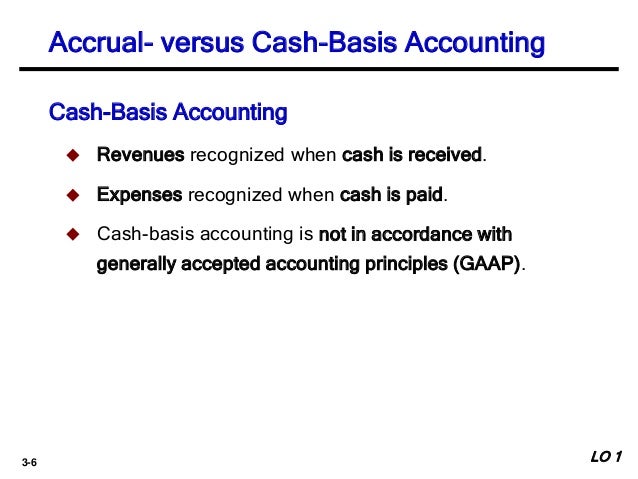

Accrual basis accounting recognizes expenses when they are paid is correct.

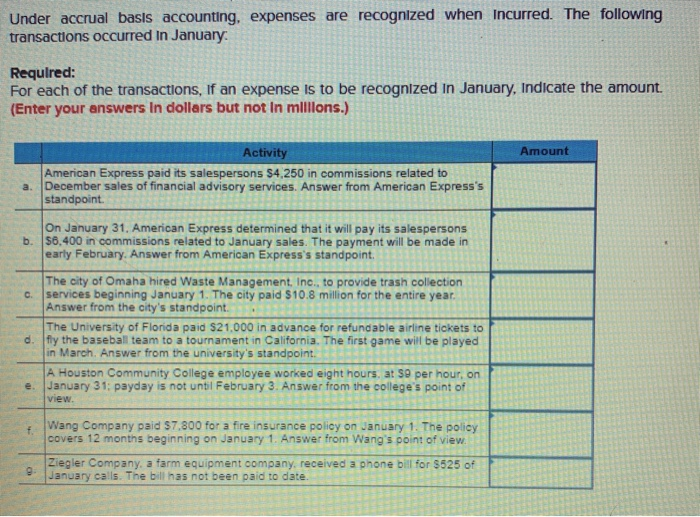

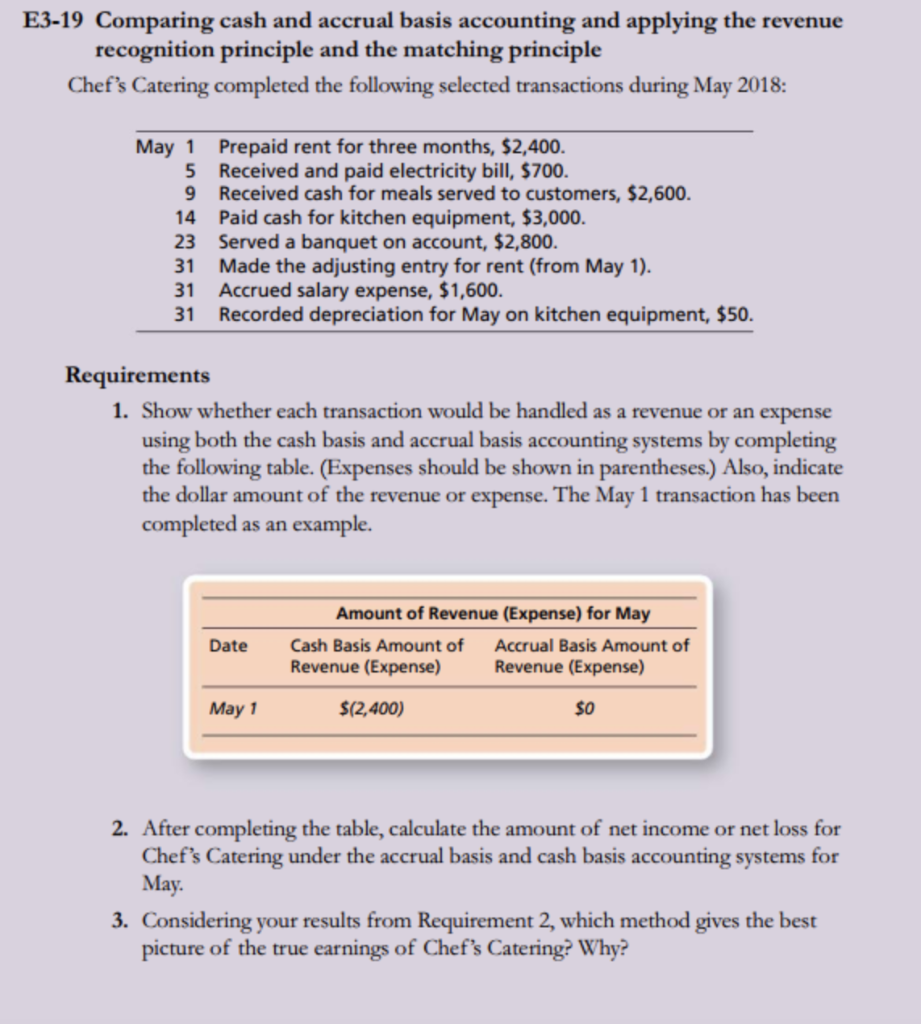

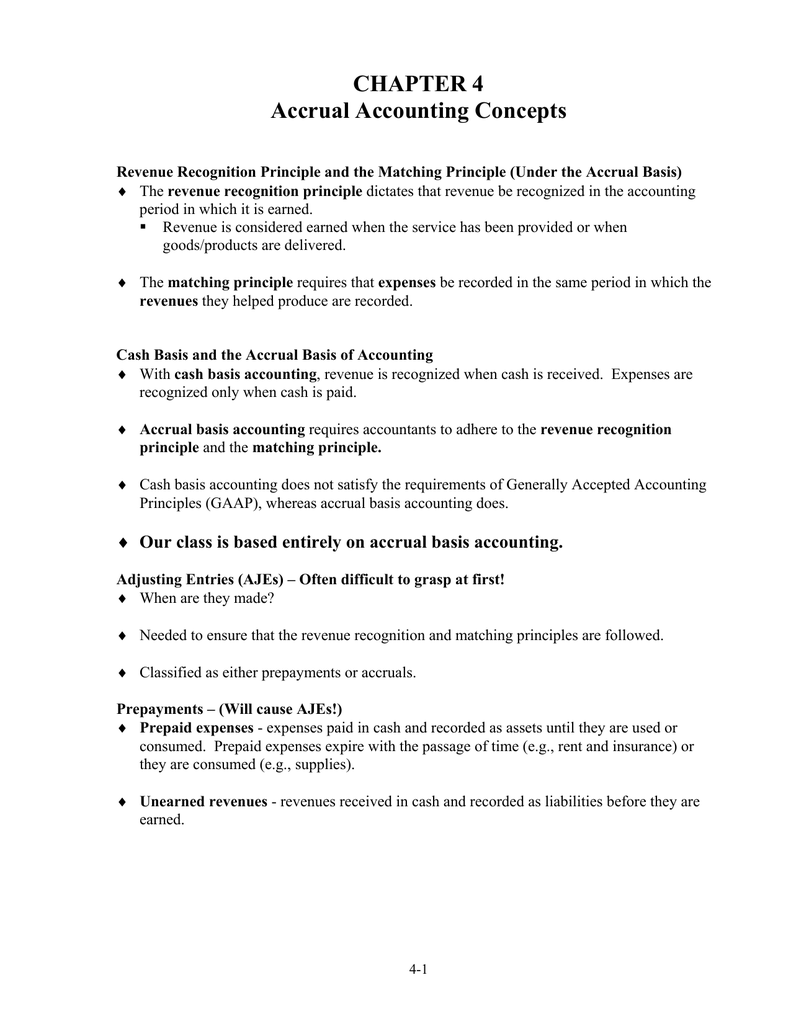

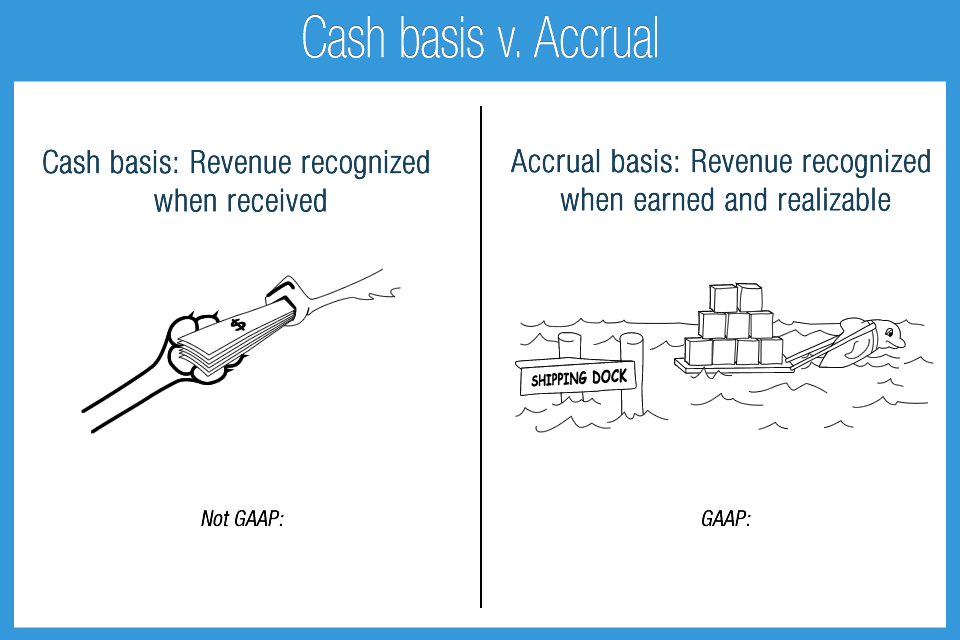

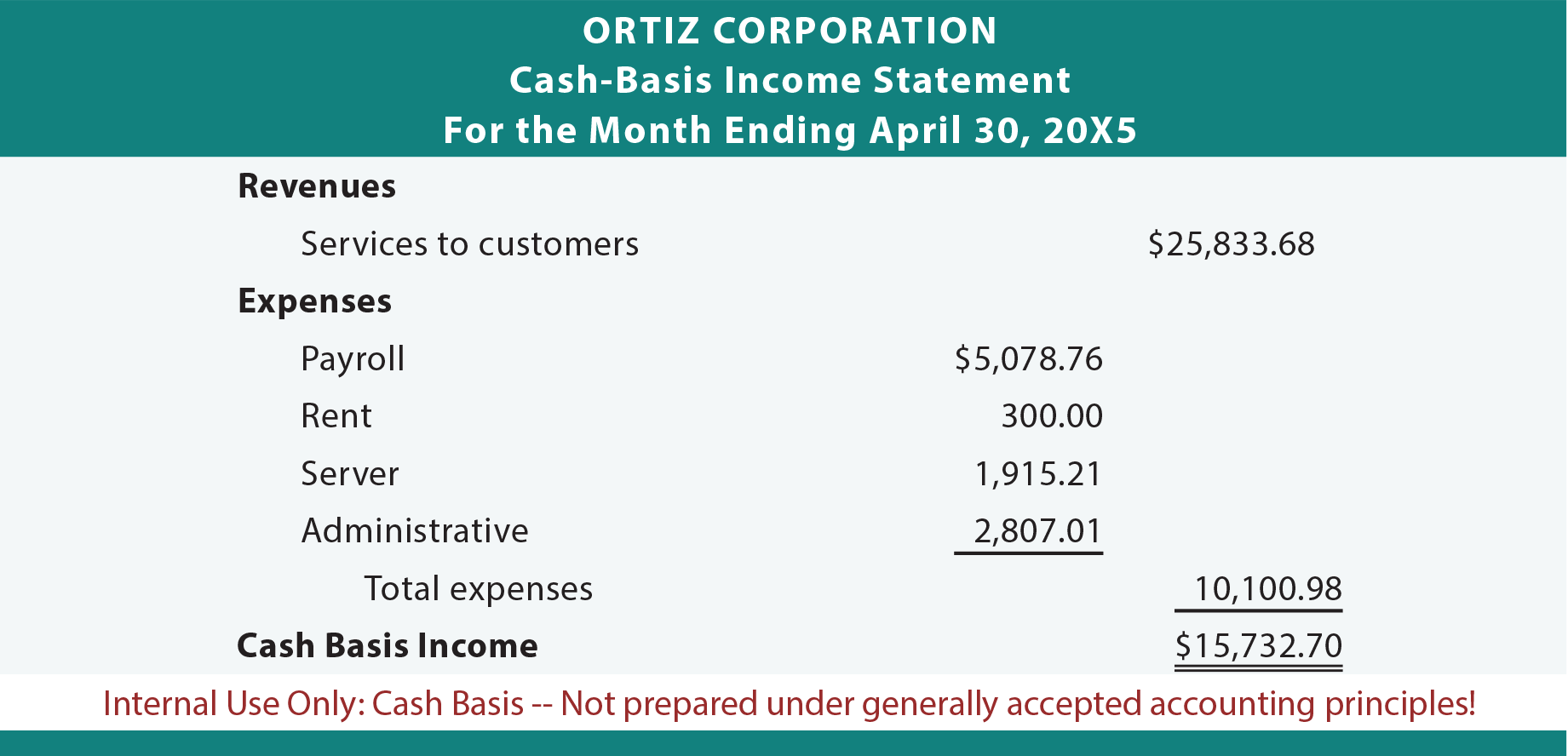

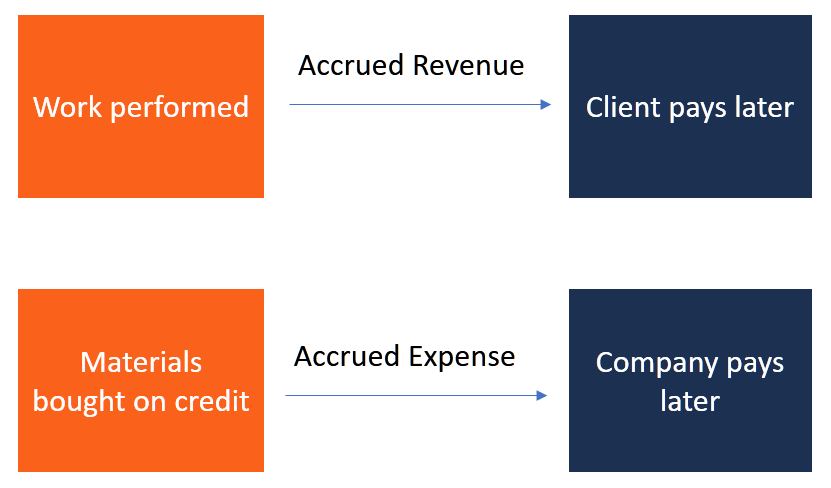

Revenue recognition principle accrual basis. Principles of revenue recognition and accrual accounting revenue is reported on the top line of the income statement. Under the accrual basis accounting the expenses are recorded when they occur irrespective of there payment. Revenue recognition at the time of sale is a primary component of accrual accounting. In other words companies shouldn t wait until revenue is actually collected to record it in their books.

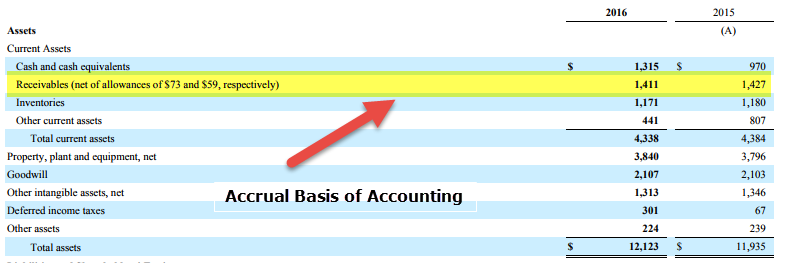

The revenue recognition concept is part of accrual accounting meaning that when you create an invoice for your customer for goods or services the amount of that invoice is recorded as revenue at. Accrual accounting allows revenue to be recognized i e reported on the income statement when it is earned and not necessarily when cash is received. The accrual basis of accounting recognizes revenues when earned a product is sold or a service has been performed regardless of when cash is received. The deferred principle of accounting results in a correct reporting of assets and liabilities as well as guards against treating unearned income as an asset.

The revenue recognition principle is the concept of how the revenue should be recognized in the entity s financial statements. Revenue recognition principle home accounting principles revenue recognition principle the revenue recognition principle states that revenue should be recognized and recorded when it is realized or realizable and when it is earned. For example a snow plowing service completes the plowing of a company s parking lot for its standard fee of 100. The revenue recognition principle states that one should only record revenue when it has been earned not when the related cash is collected.

Under accrual accounting any event that generates a sale constitutes the requirement for recognition of. The revenue recognition principle a feature of accrual accounting requires that revenues are recognized on the income statement in the period when realized and earned not necessarily when cash is. The accrual principle of revenue recognition in accounting aids in understanding the actual level of economic activity within a business.