Revenue Recognition Principle Definition For Dummies

Enacted in the wake of corporate mismanagement and accounting scandals sarbanes oxley sox offers guidelines and spells out regulations that publicly traded companies must adhere to.

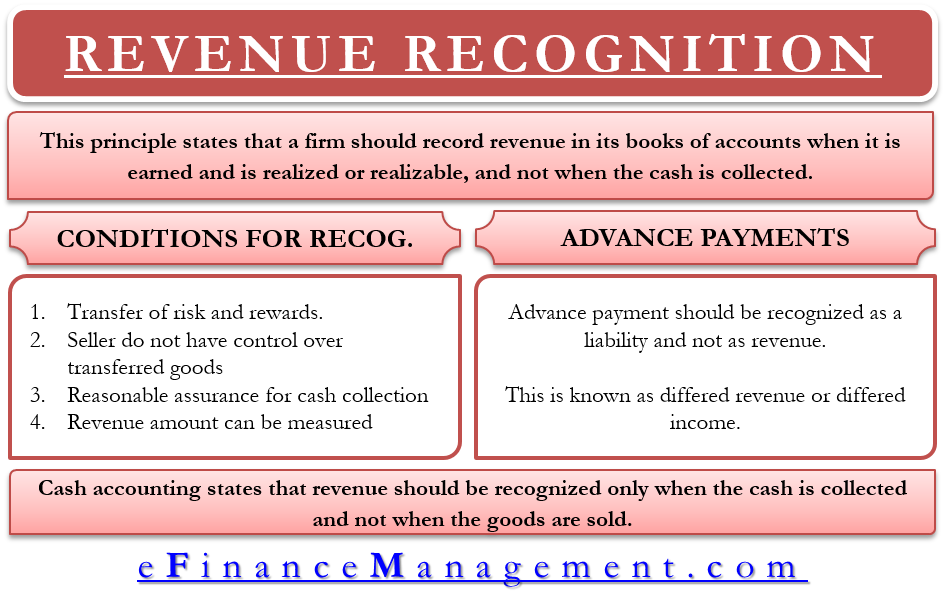

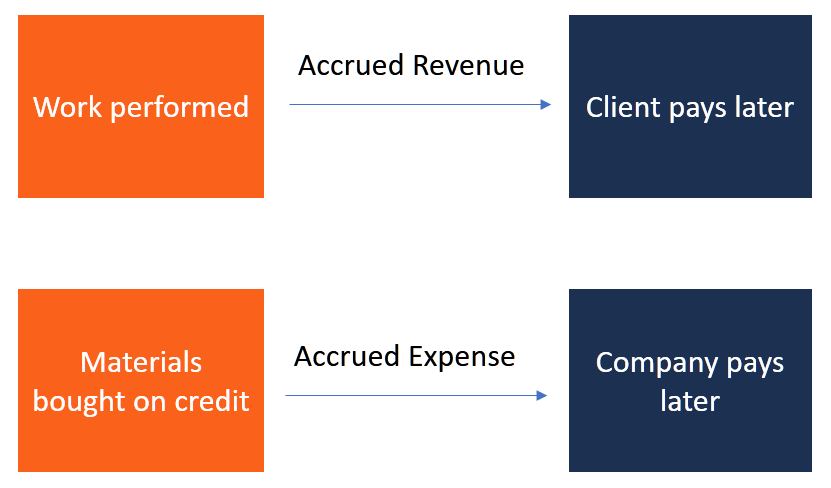

Revenue recognition principle definition for dummies. Revenue recognition is a generally accepted accounting principle gaap that determines the process and timing by which revenue is recorded and recognized as an item in the financial statements. Revenue is recorded when it has been earned revenue is considered earned when the revenue generation process is. The revenue recognition principle states that revenue should only be realized once the goods or services being purchased have been delivered. Revenue recognition is a generally accepted accounting principle gaap that stipulates how and when revenue is to be recognized.

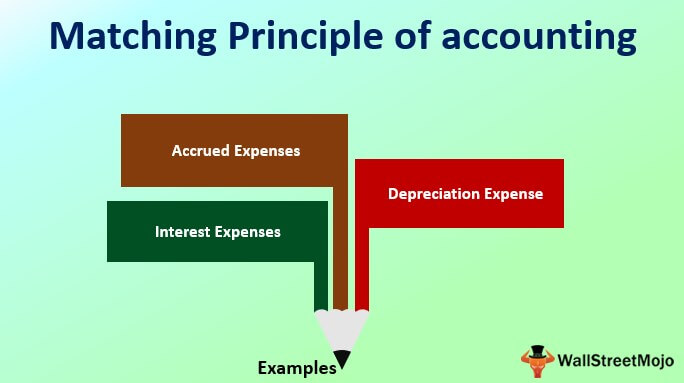

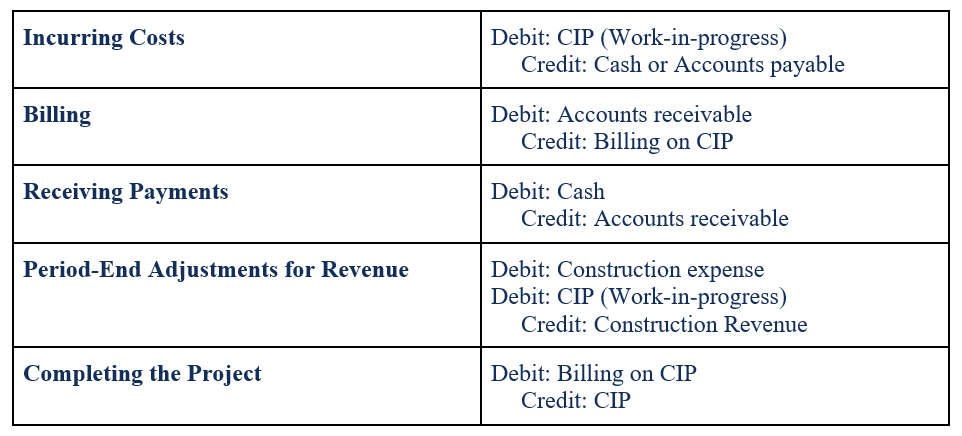

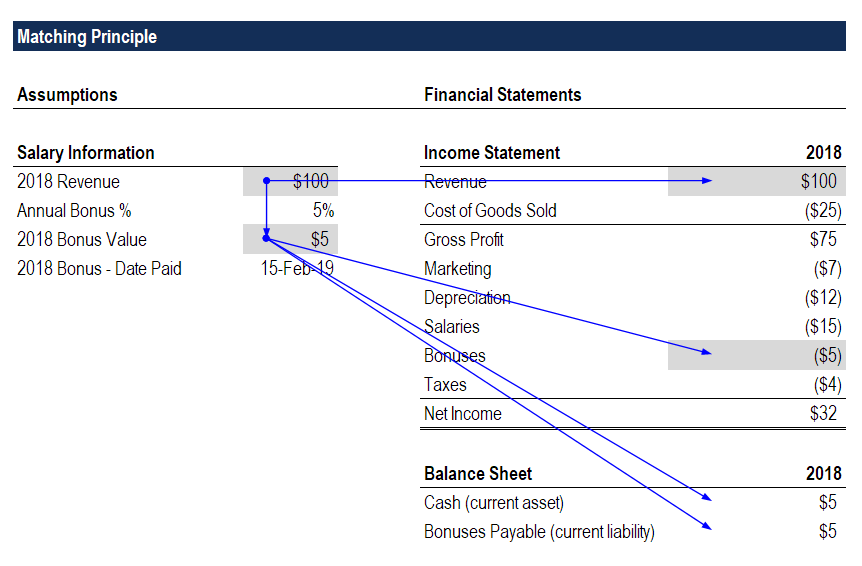

The matching principle requires that you match costs incurred with the revenue a company generates. The revenue recognition principle or just revenue principle tells businesses when they should record their earned revenue. November 2016 updated june 2019 we have prepared a white paper revenue recognition. The revenue recognition principle requires that if you use the accrual basis of accounting you recognize revenue by using these two criteria.

The revenue recognition principle using accrual accounting. The revenue recognition could be different from one accounting principle to another principle and one standard to another standard. The revenue recognition principle is an accounting principle that requires revenue to be recorded only when it is earned. The blueprint breaks down the rrp.

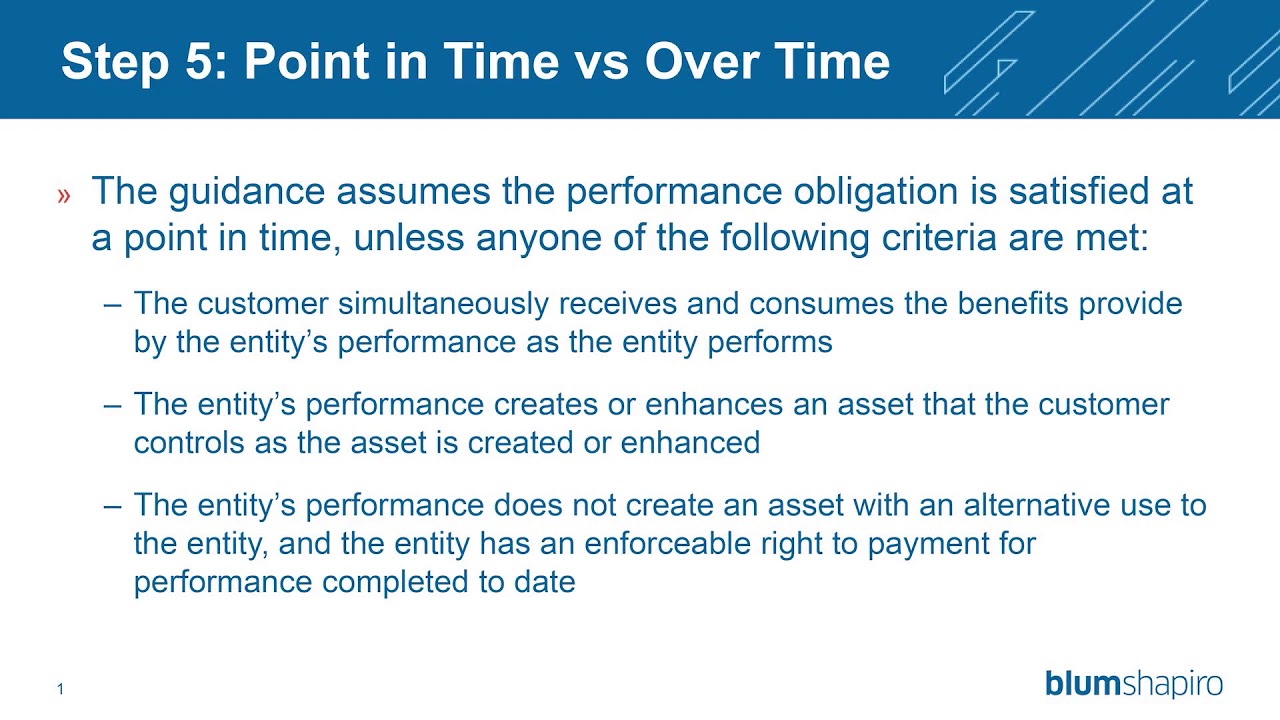

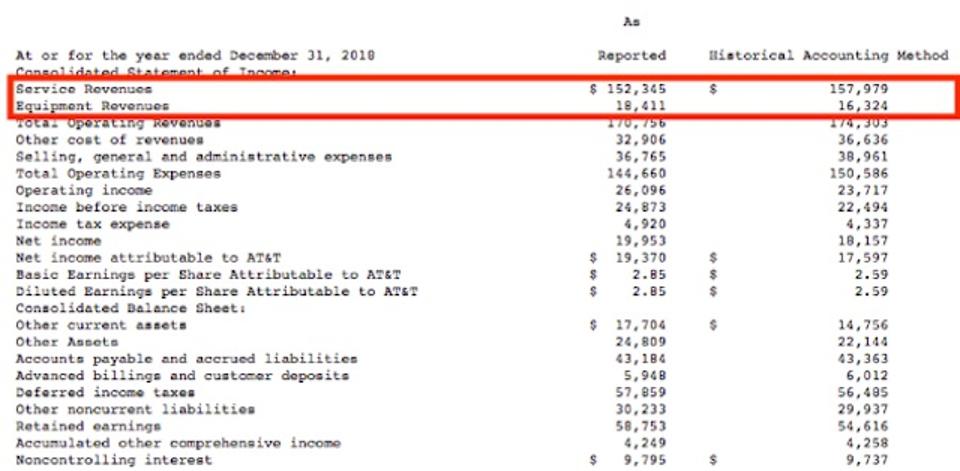

Overview of asc 606 which provides a high level summary of the guidance in topic 606 revenue from contracts with customers of the financial accounting standards board s fasb accounting standards codification asc the guidance in asc 606 was originally issued by the fasb in may. You need to know the impact. Sarbanes oxley guidelines offer best practice principles for any company especially those providing services to other businesses bound by sox. Asc 606 ifrs 15 accounting standards promise international alignment on how companies recognize revenue from contracts with customers.

Revenue recognition is an accounting principle that outlines the specific conditions under which revenue sales revenue sales revenue is the income received by a company from its sales of goods or the provision of services. Revenue from contracts with customers. In accounting the terms sales and revenue can be and often are used interchangeably to mean the same thing. The full name is asc 606.