Revenue Recognition Principle Definition Simple

Revenue recognition vs cash accounting.

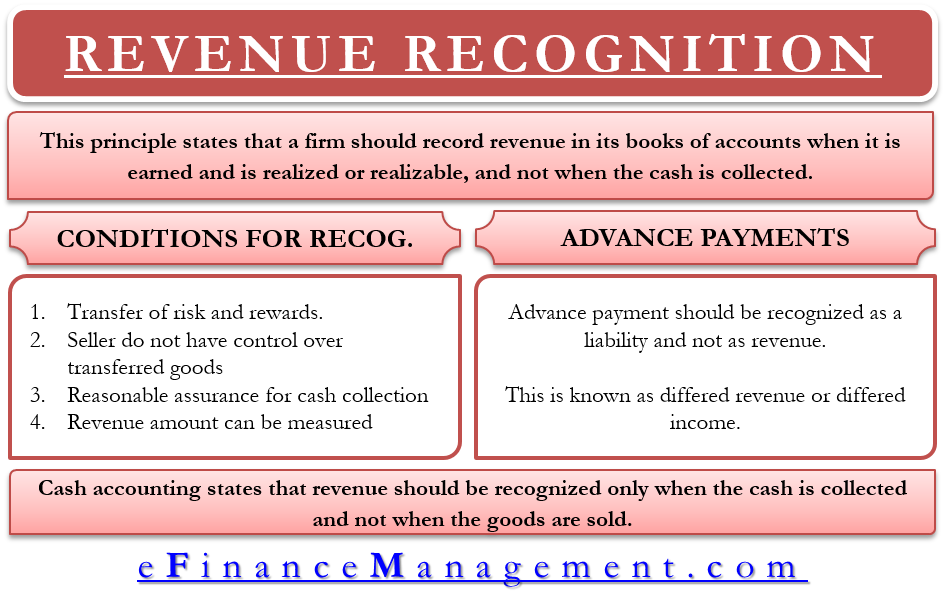

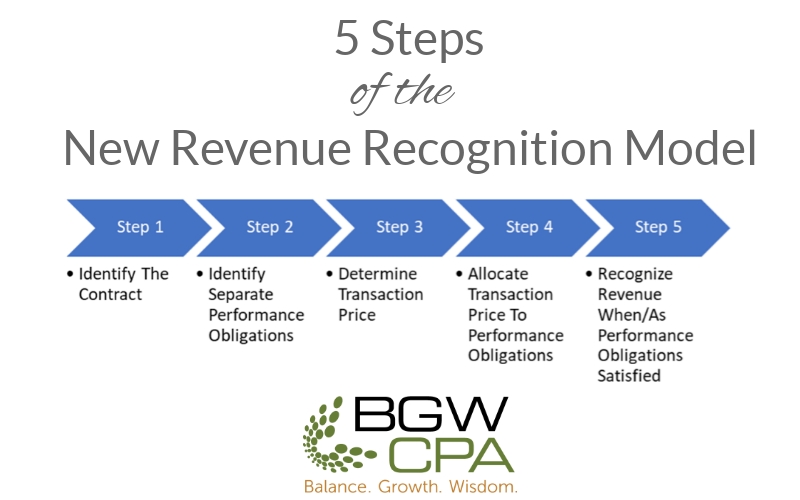

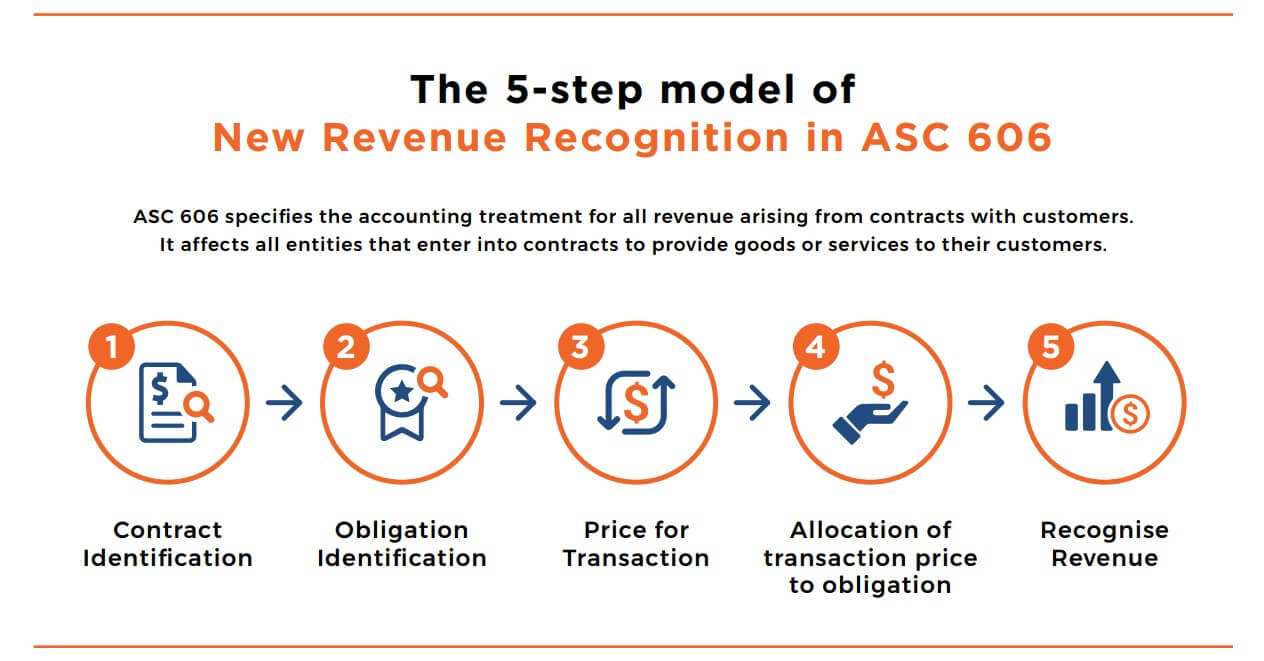

Revenue recognition principle definition simple. Revenue should be recorded when the business has earned the revenue. According to this concept the revenue is not recognized until it is earned and it is realized or at least realizable. Before exploring the concept of revenue recognition further through a few examples we. The revenue recognition principle states that revenue should be recognized and recorded when it is realized or realizable and when it is earned.

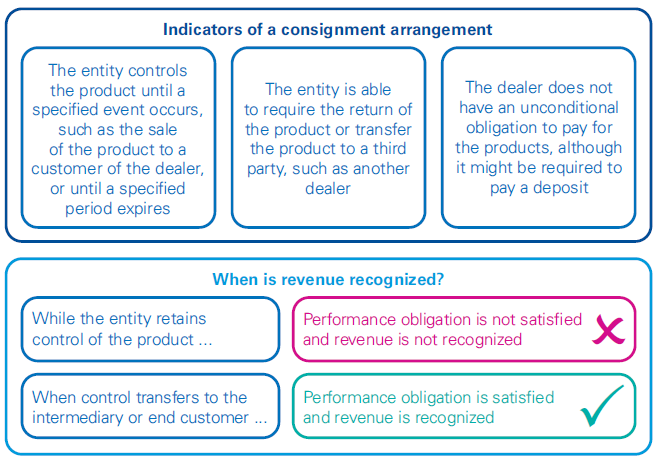

This concept is a cornerstone of accrual basis of accounting as revenue is recognized only when an item is sold and not when the. Revenue recognition principle states that revenue should only be recognized when the risk and rewards associated with the goods and services has also been transferred to the buyer. Revenue recognition is a generally accepted accounting principle gaap that stipulates how and when revenue is to be recognized. Definition and explanation revenue recognition principle of accounting also known as realization concept guides us when to recognize revenue in accounting records.

This is part of the accrual basis of accounting as opposed to the cash basis of accounting. The blueprint breaks down the rrp. Revenue recognition principle a part of accrual accounting is superior to cash accounting. Revenue recognition principle definition.

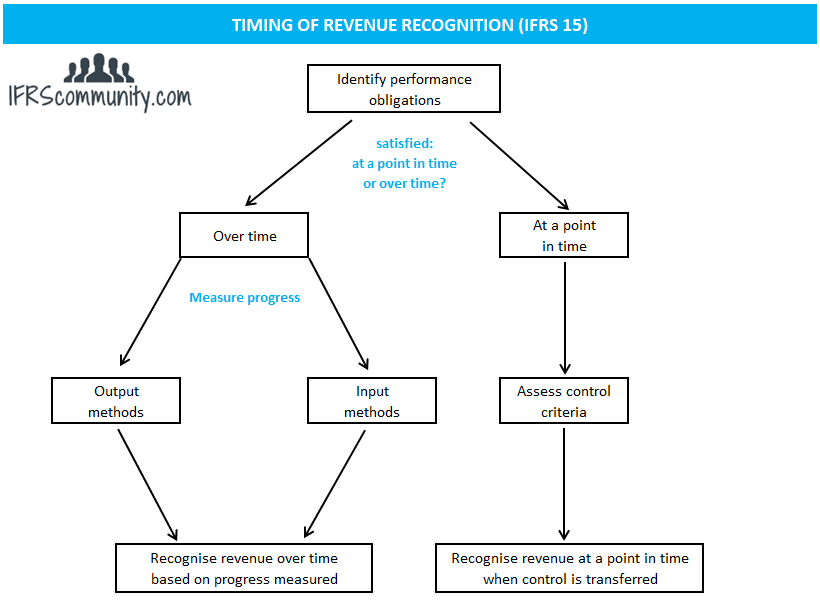

The accounting guideline requiring that revenues be shown on the income statement in the period in which they are earned not in the period when the cash is collected. The opposite of the revenue recognition principle is cash accounting. In other words companies shouldn t wait until revenue is actually collected to record it in their books. Revenue recognition principle for the provision of services one important area of the provision of services involves the accounting treatment of construction contracts.

These are contracts dedicated to the construction of an asset or a combination of assets such as large ships office buildings and other projects that usually span multiple years. It means that revenues or income should be recognized when the services or products are provided to customers regardless of when the payment takes place. The literal definition of revenue recognition is that it s the principle that states that revenue is recorded when it is realized or realizable and earned not necessarily when it is received. Cash accounting states that revenue should be recognized only when the cash is collected and not when the goods are sold.