Revenue Recognition Principle Effective Date

For annual periods beginning after dec.

Revenue recognition principle effective date. Ifrs 15 was issued in may 2014 and applies to an annual reporting period beginning on or. Revenue recognition is an accounting principle that outlines the specific conditions under which revenue sales revenue sales revenue is the income received by a company from its sales of goods or the provision of services. 15 2017 the following entities must apply asc 606. We conclude the series with this article discussing effective dates and transition methods including the related guidance.

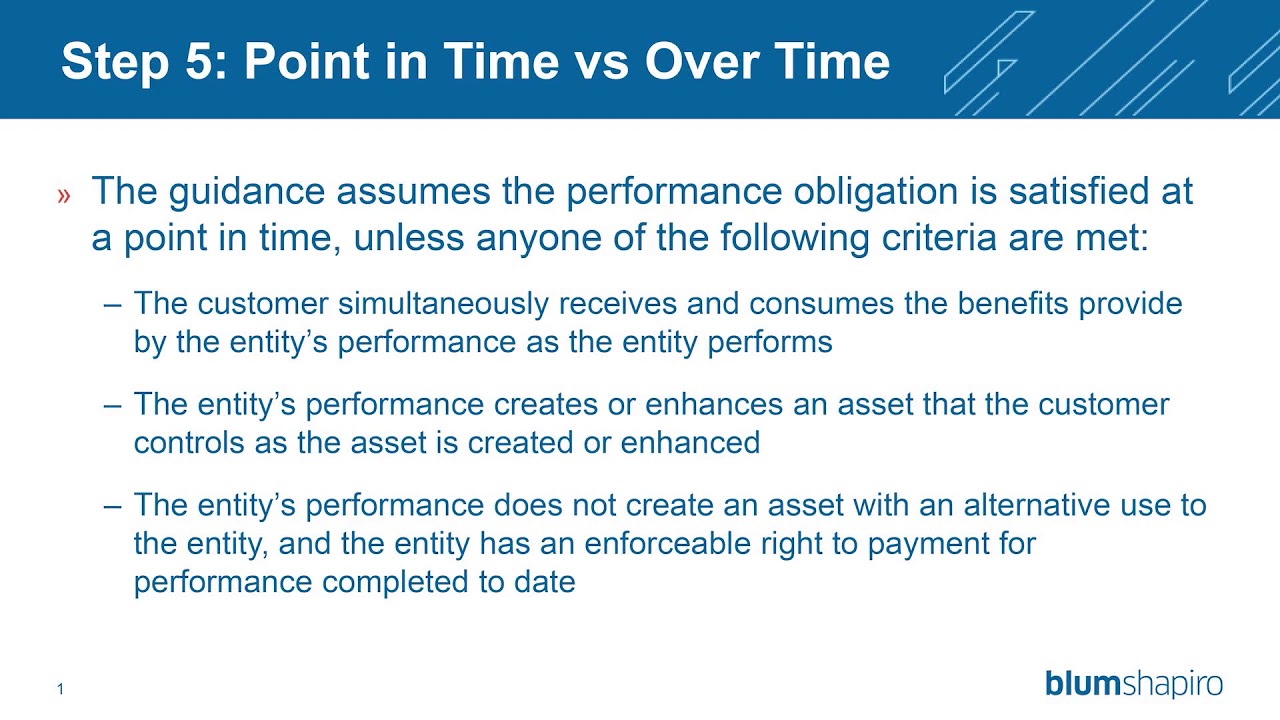

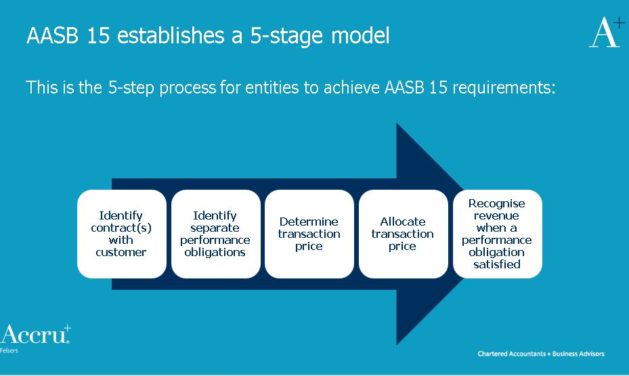

However in june 2020 the fasb deferred the effective date for nonpublic entities that had not yet issued or made available for issuance. On june 3 2020 the fasb issued asu 2020 05 1 which amends the effective dates of the board s standards on revenue asc 6062 and leasing asc 8423 to give immediate relief to certain entities as a result of the widespread adverse economic effects and business disruptions caused by the coronavirus disease 2019 covid 19 pandemic. The standard provides a single principles based five step model to be applied to all contracts with customers. The new revenue recognition standard was approved by fasb in 2014 for public and private companies that file under the generally accepted accounting principles gaap.

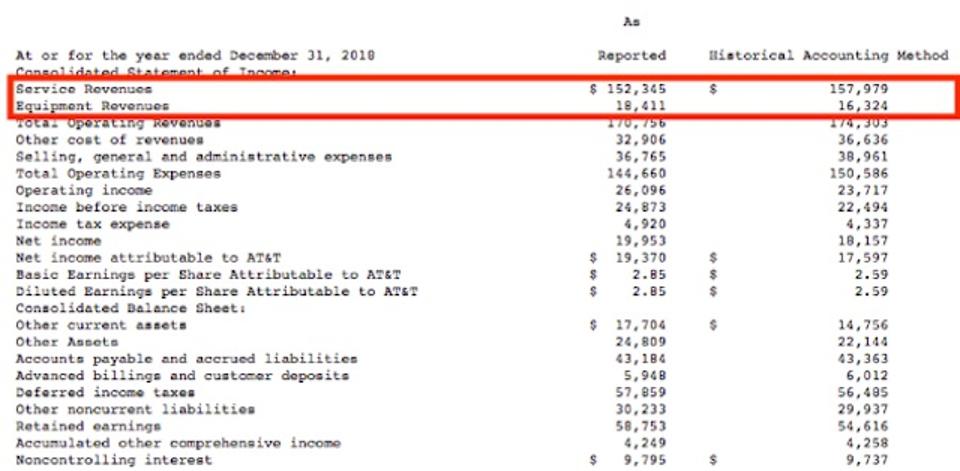

Sweeping changes in the fasb s revenue recognition model became effective q1 2018 for most calendar year end public business entities pbes and 2019 for many non pbes. Public organizations should apply the new revenue standard to annual reporting periods beginning after december 15 2017. Meanwhile fasb considered but rejected feedback asking for a delay in the effective date for asu no. Ifrs 15 specifies how and when an ifrs reporter will recognise revenue as well as requiring such entities to provide users of financial statements with more informative relevant disclosures.

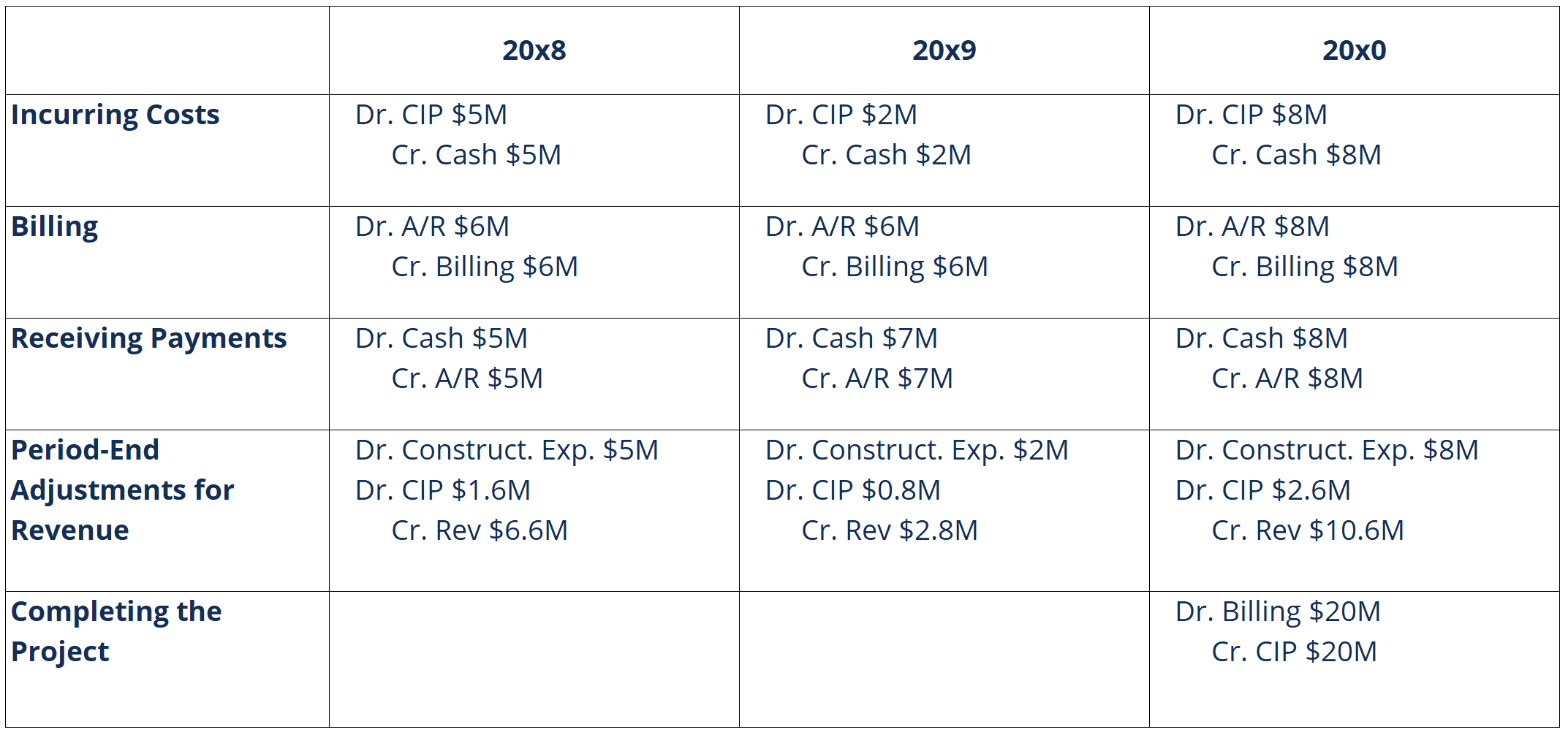

In accounting the terms sales and revenue can be and often are used interchangeably to mean the same thing. Below are effective dates for major financial accounting and reporting standards on revenue recognition leases credit losses and not for profit financial reporting. While some companies have adopted asc topic 606 prior to the recent issuance of asu 2020 05 which deferred the effective date others have yet to implement the new accounting standard. The revenue recognition principle of asc 606 requires that revenue is recognized when the delivery of promised goods or services matches the amount expected by the company in exchange for the.

Effective date and what is changing. 2018 08 would have aligned that guidance with the revenue recognition deferral. 2018 08 not for profit entities topic 958. Here are four considerations for your entity as it begins its revenue recognition implementation efforts.

Over these last several months we have explored the new revenue recognition standard asc 606 in great detail.