Revenue Recognition Principle Le

This follows the accrual accounting concept which we have looked in a previous article.

Revenue recognition principle le. What is revenue recognition. The revenue recognition could be different from one accounting principle to another principle and one standard to another standard. The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company s financial statements. Pengakuan pendapatan revenue recognition 03 nov 2015.

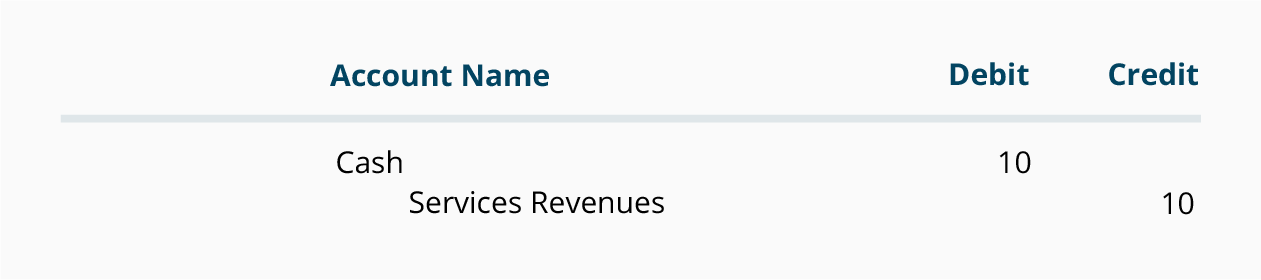

The revenue recognition principle enables your business to show profit and loss accurately since you will be recording revenue when it is earned not when it is received. This means that the company has carried out its part of the deal. For example based on a cash basis or cash accounting principle revenue is recognized in the financial statements at the time cash is received. Generally speaking the earlier revenue is recognized it is said to be more valuable.

The revenue recognition principle helps you better understand the ways through which your startup can generate revenue which in turn helps you communicate with your accountants and bookkeepers. Theoretically there are multiple points in time at which revenue could be recognized by companies. In accounting the terms sales and revenue can be and often are used interchangeably to mean the same thing. The revenue recognition principle states that a company should record and recognize revenue when it is earned and not when the actual cash proceeds are received.

Revenue recognition is an accounting principle that outlines the specific conditions under which revenue sales revenue sales revenue is the income received by a company from its sales of goods or the provision of services. Prinsip pengakuan pendapatan memberikan perusahaan pengetahuan bahwa mereka harus mengakui pendapatan 1 pada saat pendapatan tersebut telah direalisasikan dan 2 pada saat telah diterima didapatkan. In other words companies shouldn t wait until revenue is actually collected to record it in their books. The revenue recognition principle states that revenue should be recognized and recorded when it is realized or realizable and when it is earned.

The revenue recognition principle a feature of accrual accounting requires that revenues are recognized on the income statement in the period when realized and earned not necessarily when cash is. Revenue recognition principle revenue recognition principle states that a firm should record revenue in its books of accounts when it is earned and is realized or realizable and not when the cash is collected. Secara umum pedoman untuk pengakuan pendapatan sangat luas.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)