Revenue Recognition Principle Uk Definition

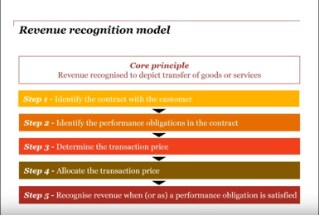

The blueprint breaks down the rrp.

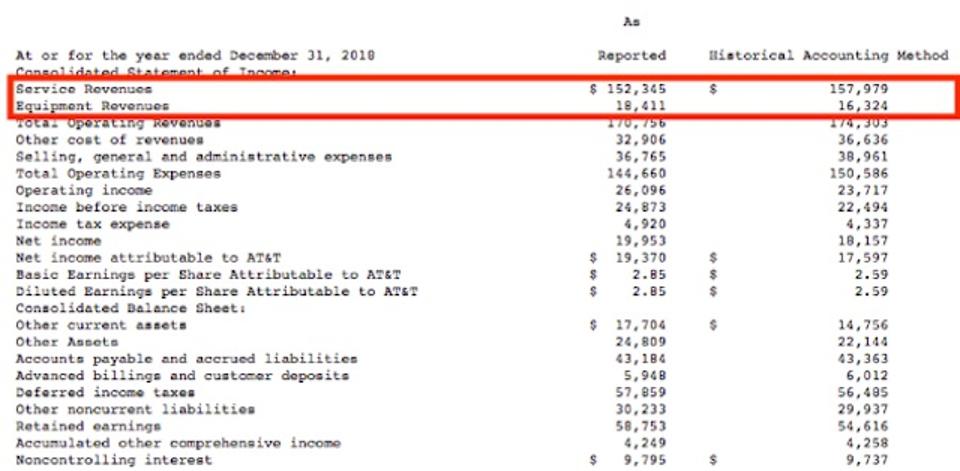

Revenue recognition principle uk definition. The revenue recognition could be different from one accounting principle to another principle and one standard to another standard. Principles underpinning recognition of revenue. The revenue recognition principle is the concept of how the revenue should be recognized in the entity s financial statements. The revenue recognition principle states that revenue should be recognized and recorded when it is realized or realizable and when it is earned.

The revenue recognition principle is a cornerstone of accrual accounting together with the matching principle they both determine the accounting period in which revenues and expenses are recognized. The revenue recognition principle using accrual accounting. It means that revenues or income should be recognized when the services or products are provided to customers regardless of when the payment takes place. The revenue recognition principle or just revenue principle tells businesses when they should record their earned revenue.

Revenue is recognised when all the following conditions have been satisfied 2. A the seller has transferred the significant risks and rewards of ownership of the goods to the buyer. In accounting the terms sales and revenue can be and often are used interchangeably to mean the same thing. Definition and explanation revenue recognition principle of accounting also known as realization concept guides us when to recognize revenue in accounting records.

The revenue recognition principle is an accounting principle that requires revenue to be recorded only when it is earned. Revenue is generally measured or recognized when sometime crucial might have happened to the firm and the revenue amount is calculable. Revenue should be recorded when the business has earned the revenue. Revenue recognition is a generally accepted accounting principle gaap which decides on the particular requirements for the recognition of or the accountancy of revenue.

Revenue recognition is a generally accepted accounting principle gaap that stipulates how and when revenue is to be recognized. According to the principle revenues are recognized when they are realized or realizable and are earned usually when goods are transferred or services rendered no matter when cash is received. In other words companies shouldn t wait until revenue is actually collected to record it in their books. Revenue recognition is an accounting principle that outlines the specific conditions under which revenue sales revenue sales revenue is the income received by a company from its sales of goods or the provision of services.