Revenue Recognized Point In Time

Revenue is never recognized because gaap does not allow such arrangements.

Revenue recognized point in time. Revenue recognition is an accounting principle that outlines the specific conditions under which revenue is recognized. Revenue is recognized at a point in time or over time c. When the company typically satisfies its performance obligations e g at shipment at delivery as services rendered etc 2. Customers using customer contracts might use services on a fixed price base.

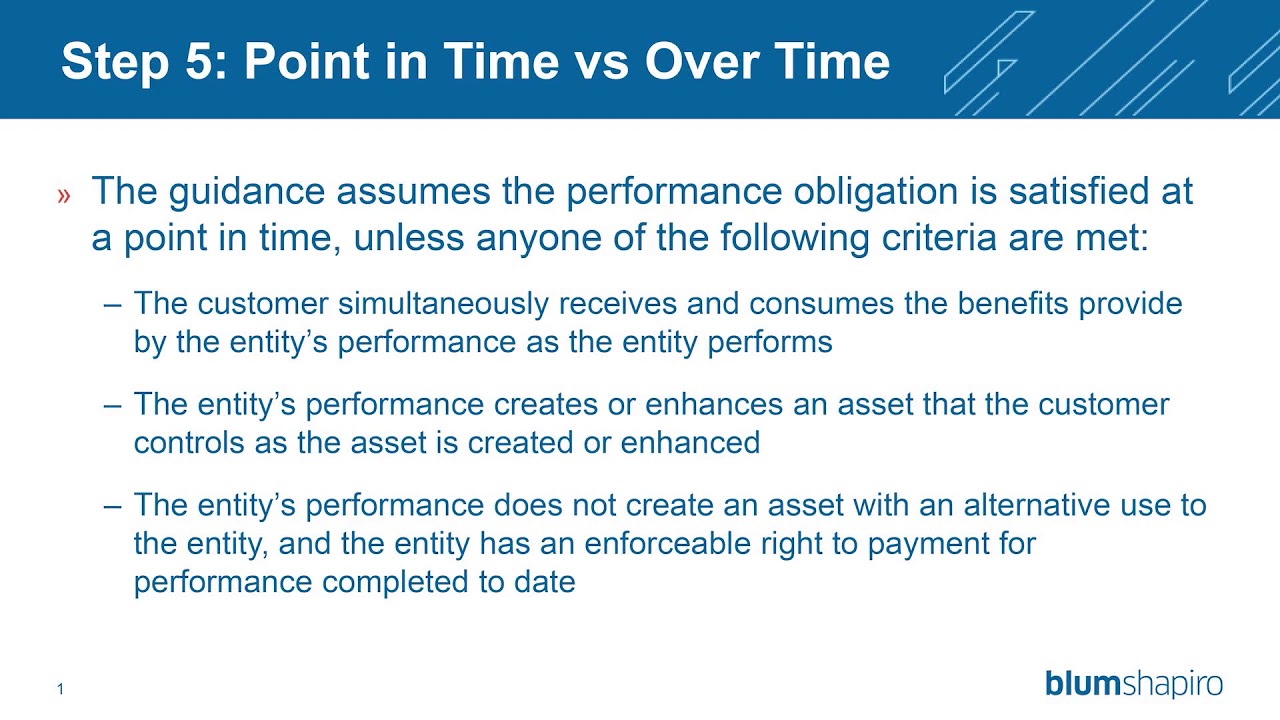

One of the principal considerations used in this determination is whether the performance obligation is satisfied at a point in time when or over a period of time as. Revenue is recognized at the point in time when the consignment arrangement is made. This guide addresses recognition principles for both ifrs and u s. But the accrual methods provided there are not easy to understand.

Point in time 3. Revenue is recognized when collected d. Revenue is recognized upon sale by the consignee to an end customer. Revenue from selling an asset other than inventory is recognized at the point of sale when it takes place.

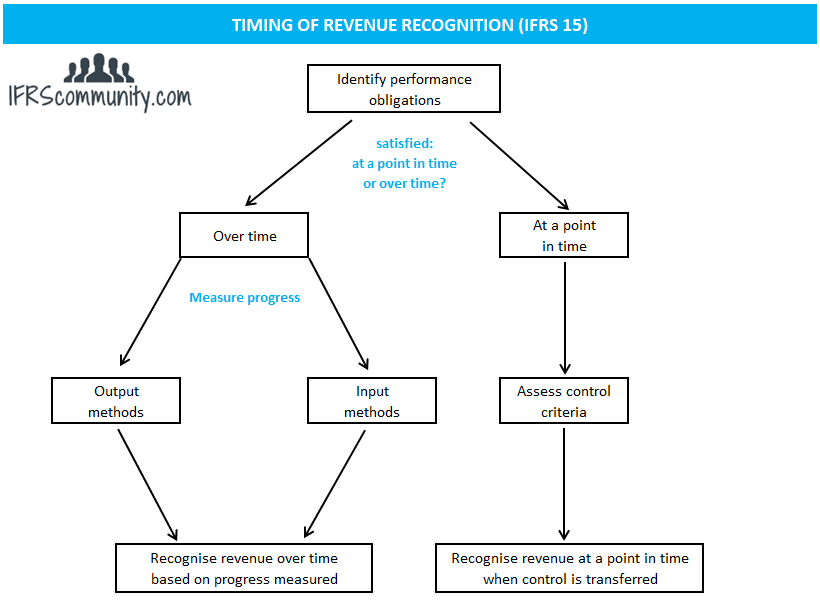

Revenue versus cash timing. Interest for using money rent for using fixed assets and royalties for using intangible assets is recognized as time passes or as assets are used. Therefore i d like to provide an explanatory example. If an entity transfers control of a good or a service over time then that entity satisfies the performance obligation and recognizes revenue over time asc 606 10 25 27.

Revenue from permission to use company s assets e g. Point in time disclosure should include. Recognizing revenue at a point in time or over a period of time. Revenue must be presented disaggregated on how control of goods and services transfers i e.

Revenue can be recognized either over a period of time or at a point in time depending on when a performance obligation is fulfilled. In revenue recognition those are realized over time. This applies on these sales document item types which are available in the customer contract. The last step of the process addresses at what time revenue from contracts with customers should be recognized.

Revenue is recognized in a manner that depicts the transfer of good or service to a customer and the revenue reflects the consideration to which an entity expects to be entitled.