Revenue Sharing Definition Local Government

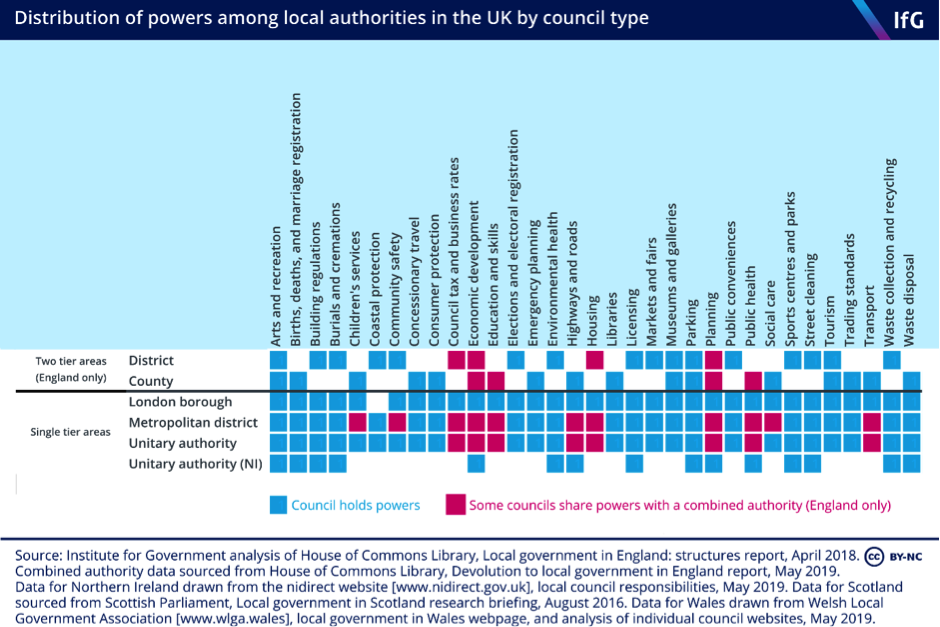

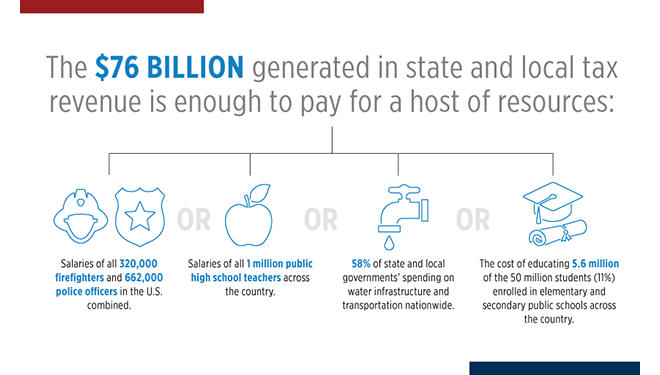

Unlike categorical grants that are program specific revenue sharing provides flexibility to subnational political jurisdictions in using federal funds tailored to their special needs.

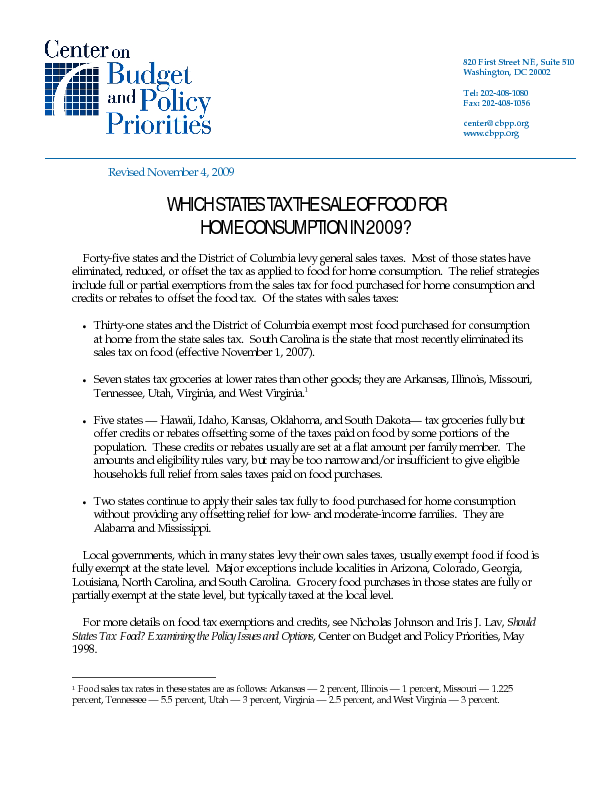

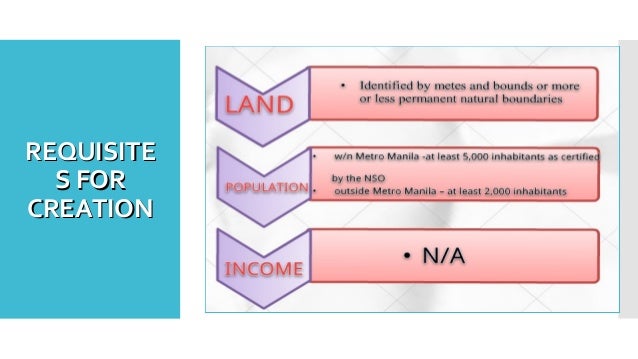

Revenue sharing definition local government. Revenue sharing is a type of fiscal federalism whereby the federal government allocates revenue to state and local governments with little or no strings attached. A local government advocacy group laid out its legislative agenda monday and called on lawmakers to fully fund a program that shares state income tax revenue with local municipalities. The local government financial information handbook is a reference for many of the revenue sources available to local governments and contains items useful for local government budgeting purposes including descriptions of revenue sources estimated revenue distributions and adjusted population estimates used for revenue sharing calculations. System of government in which sovereignty is wholly in the hands of the national government so that the state and local governments are dependent on its will.

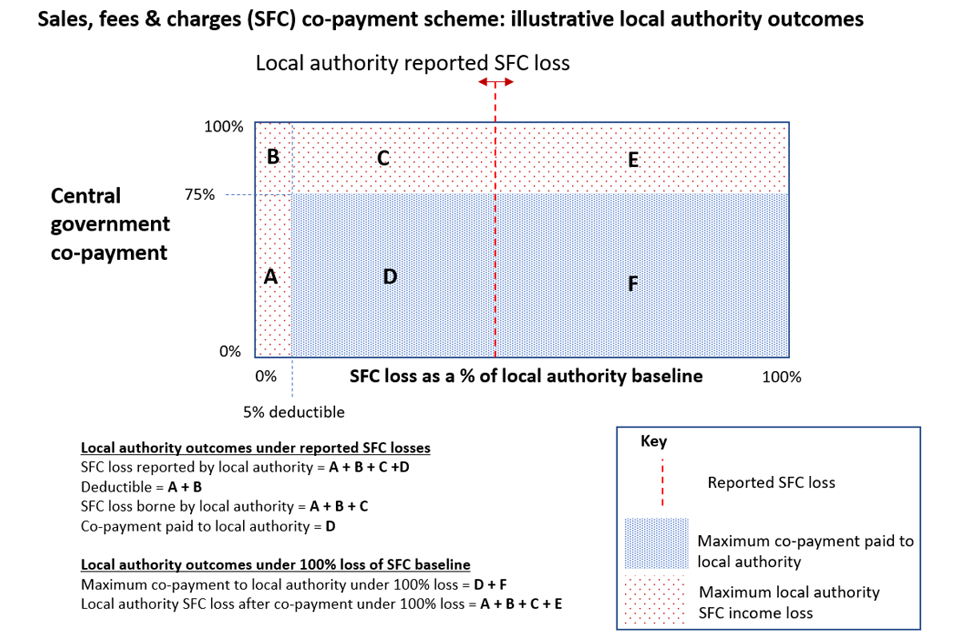

For example provinces or states may share revenue with local governments or national governments may share revenue with provinces or states. Resources to share in addition to collecting revenue government currently borrows to meet its expenditure requirements. Government has also set aside a contingency reserve for each of the mtef years. Decades ago states set up the funds in lieu of granting localities broad taxing authority.

It is the balance of national revenue plus borrowing less debt obligations which represents the total pool of resources available for sharing. States have the obligation power to maintain public safety security morality. The revenue realized is paid into a the consolidated revenue fund. Revenue sharing a government unit s apportioning of part of its tax income to other units of government.

In our previous post on the major sources of government revenue and government expenditures we ve talked about how the federal government derives its revenue from different sources. Federal sharing of a fixed percentage of its revenue with the states. Transfers may be in the form of surcharges or revenue sharing whereby a local government receives a share of the revenues from particular taxes collected by the central government within its jurisdiction mclure 1999 p. The president muhammadu buhari regime says it will set up a committee to review the revenue sharing formula for federal state and local governments due to current economic realities.

The main mechanism for intergovernmental.

/ExxonMobilCashflowstatement09-30-2018-5c671f2e46e0fb0001a20a17.jpg)