Service Revenue In Accounting Meaning

This revenue may be aggregated into a separate line item which appears near the top of the income statement.

Service revenue in accounting meaning. Revenue from sale of goods. An income statement is not concerned with cash flow it is concerned with revenues gains expenses and losses in both the operating and non operating activities of the business during a specific period of time. For example a set of items are sold in a month and the incoming cash earned by these sales is posted as revenue. Just a quick intro there are two streams through which revenue is earned as per ias 18.

Service revenues is an operating revenue account and will appear at. Services already rendered to which the fees are yet to be collected are considered as service revenue. In accounting revenue is the income or increase in net assets that an entity has from its normal activities in the case of a business usually from the sale of goods and services to customers. Debit revenue is a somewhat misleading term as it implies receiving revenues from debits.

Under the cash basis of accounting revenue is usually recognized when cash is received from the customer following its receipt of goods or services. Revenue may refer to income in general or it may refer to. Commercial revenue may also be referred to as sales or as turnover some companies receive revenue from interest royalties or other fees. What the term refers to is the act of posting a debit to a stream of revenue.

Revenue earned from rendering services eg. Legal advisory accounting auditing et. For example if a new company sold 75 000 of goods in december but allows the customer to pay 30 days later the company s december sales are 75 000 even though no cash was received in december. The best way to calculate a company s revenue during an accounting period year month etc is to sum up the amounts earned as opposed to the amounts of cash that were received.

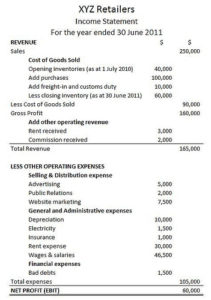

Service revenue appears at the top of an income statement and is separated but added to the product sales for a revenue total. Debit revenue and accounting. The revenue recognition concept is part of accrual accounting meaning that when you create an invoice for your customer for goods or services the amount of that invoice is recorded as revenue at. Service revenues include work completed whether or not it was billed.

Under the accrual basis of accounting the service revenues account reports the fees earned by a company during the time period indicated in the heading of the income statement. Service revenue is recognized when earned regardless of when the amount is collected. Service revenue is the sales reported by a business that relate to services provided to its customers this revenue has usually already been billed but it may be recognized even if unbilled as long as the revenue has been earned.