The Revenue Recognition Principle States That Revenue Quizlet

B revenue should be recognized in the period earned.

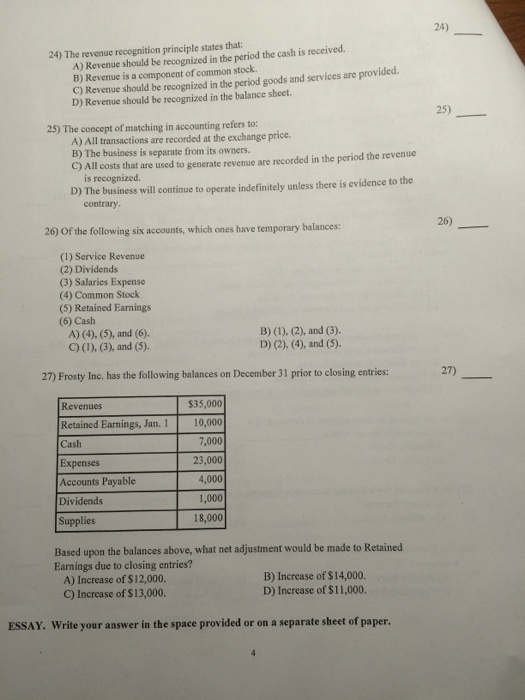

The revenue recognition principle states that revenue quizlet. Revenue recognition principle and accounting principles. The matching principle states that expenses should be matched with the revenues they help to generate. Revenue recognition principle states that revenue is recognized when it is realized received in cash or realizable will be received in cash and earned the firm has performed its part of the deal. False revenue is recognized when it is earned and it is realized or realizable.

Accounting principles are laid out in order to provide a. Revenue should be recognized in the period the cash is received. The revenue recognition principle states that revenues should be recognized or recorded when they are earned regardless of when cash is received. The revenue recognition principle states that.

The concept of matching in accounting refers to. For example a snow plowing service completes the plowing of a company s parking lot for its standard fee of 100. Common sources of revenue and point at which recognition occurs. False revenue is.

3 the employees of neat clothes work monday through friday. It can recognize the revenue immediately. All transactions are. The revenue recognition principle states that one should only record revenue when it has been earned not when the related cash is collected.

Sales of products. Revenue should be recognized in the period earned. 2 the revenue recognition principle states that. According to the revenue recognition principle the consulting company should record the revenue of 3 000 in their accounting books in january 2018 as opposed to june 2018 since this is when the revenue was realised.

The revenue recognition principle state that. As of date of sale or delivery to customers. Revenue is a component of common stock. C revenue should be recognized in the balance sheet.

Revenue is realized when assets a company receives in exchange for goods or services are readily convertible to known amounts of cash or claims to cash. D revenue is a component of common stock. Revenue should be recognized in the balance sheet. Revenue should be recognized in the balance sheet.

A revenue should be recognized in the period the cash is received. Revenue recognition is a generally accepted accounting principle gaap that stipulates how and when revenue is to be recognized. Which accounting principle states that a company should record revenues when they are earned. Revenue should be recognized in the period the cash is received revenue is a component of common stock revenue should be recognized in the period goods and services provided.

The revenue recognition principle states that revenue is recognized when it is earned and realized or realizable.