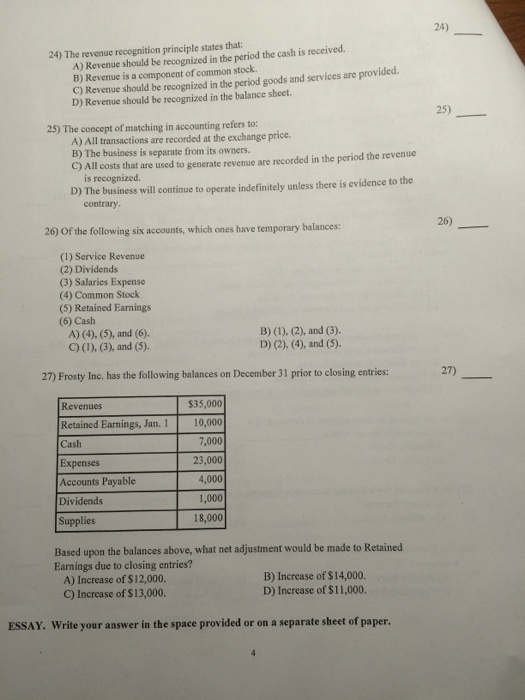

The Revenue Recognition Principle States That Revenue Should Be Recognized In The Accounting Records

This is especially the case whenever revenue is recognized before or after goods are delivered or services are rendered.

The revenue recognition principle states that revenue should be recognized in the accounting records. The revenue recognition principle states that revenue should only be realized once the goods or services being purchased have been delivered. The revenue recognition principle using accrual accounting. Revenue should be recorded when the business has earned the revenue. Revenue recognition is a generally accepted accounting principle gaap that stipulates how and when revenue is to be recognized.

In a service type business revenue is considered recognized a. In accounting the terms sales and revenue can be and often are used interchangeably to mean the same thing. The matching principle states that expenses should be matched with the revenues they help to generate. In other words companies shouldn t wait until revenue is actually collected to record it in their books.

Revenue recognition is an accounting principle that outlines the specific conditions under which revenue sales revenue sales revenue is the income received by a company from its sales of goods or the provision of services. Revenue recognition is a generally accepted accounting principle gaap that determines the process and timing by which revenue is recorded and recognized as an item in the financial statements. When cash is received. The opposite of the revenue recognition principle is cash accounting.

Revenue recognition vs cash accounting. In some instances revenue recognition is more difficult to determine than outlined by the general principles. The revenue recognition principle states that revenues should be recognized or recorded when they are earned regardless of when cash is received. Revenue recognition principle a part of accrual accounting is superior to cash accounting.

Cash accounting states that revenue should be recognized only when the cash is collected and not when the goods are sold. This is the case for long term contracts installment sales and barter. At the end of the month. In other words expenses should be recorded when they are incurred.

Specific revenue recognition applications. Expense recognition is closely related to and sometimes discussed as part of the revenue recognition principle. When the performance obligation is satisfied. The revenue recognition principle states that revenue should be recognized and recorded when it is realized or realizable and when it is earned.

At the end of the month. An expense is the outflow or using up of assets in the generation of revenue.