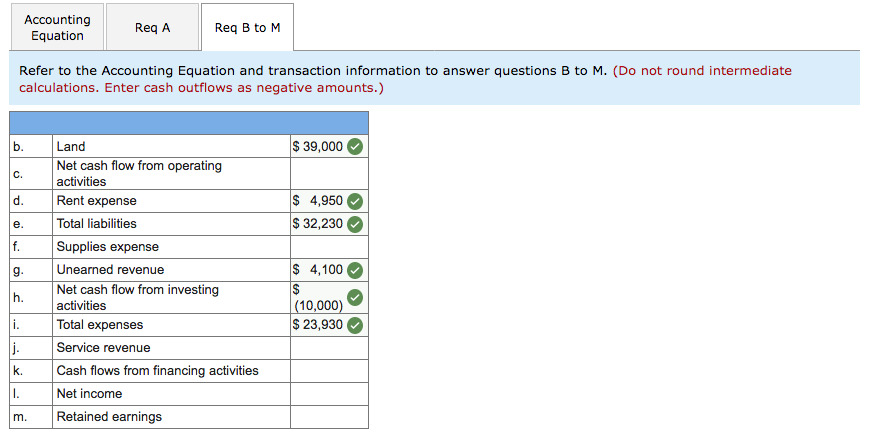

Unearned Revenue Accounting Equation

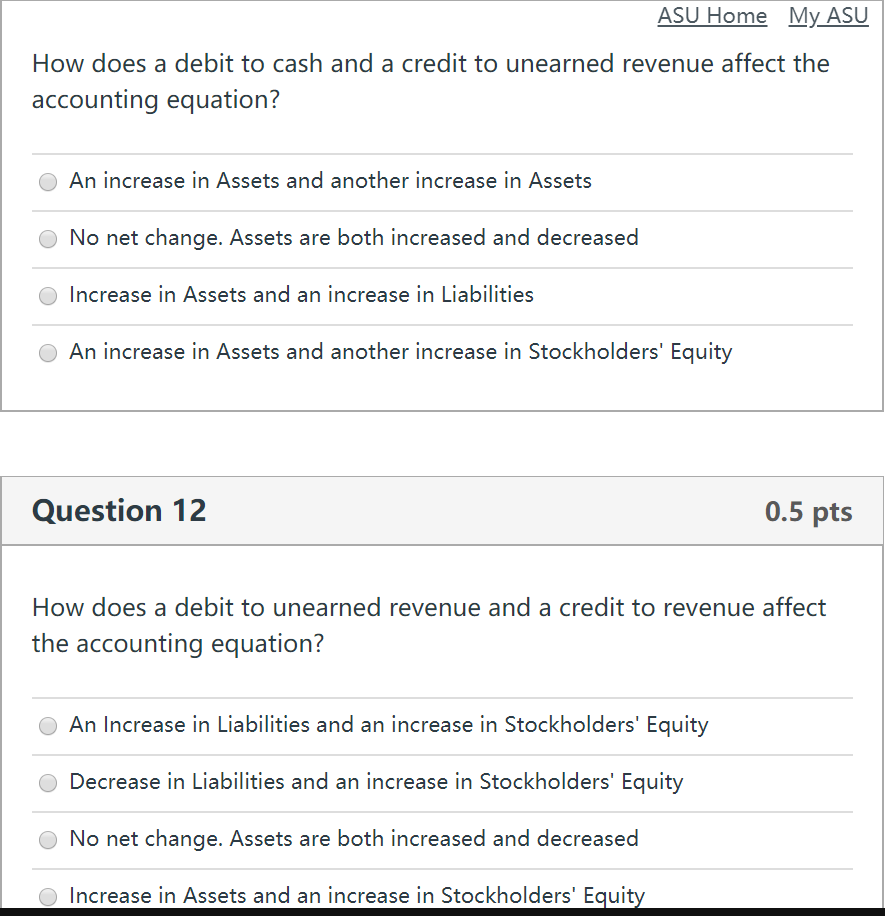

Unearned revenue is money received from a customer for work that has not yet been performed.

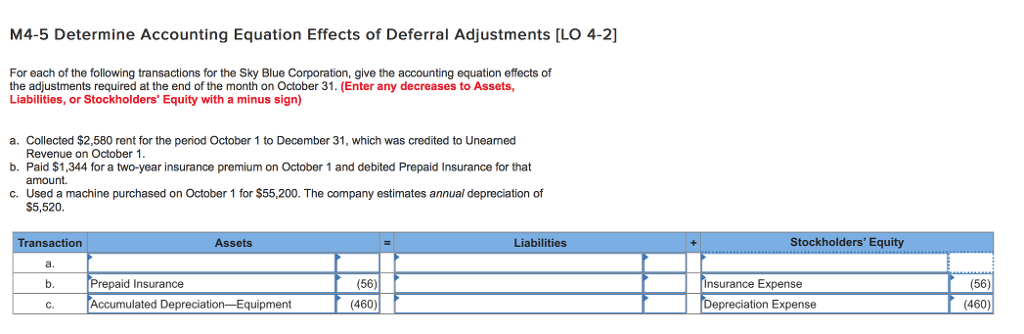

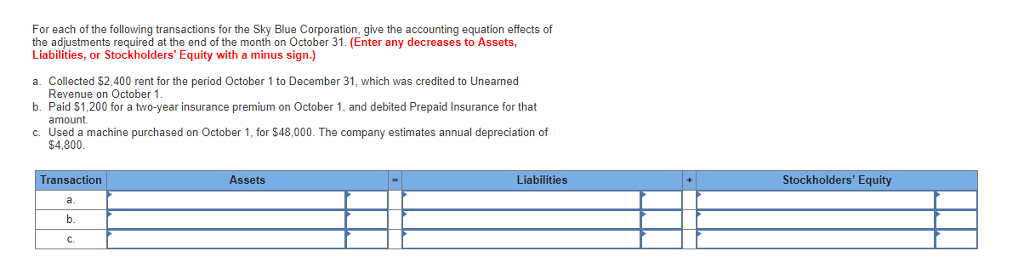

Unearned revenue accounting equation. The effect of this advertising transaction on the accounting equation is. Unearned revenue also known as unearned income deferred revenue or deferred income represents revenue already collected but not yet earned. Then as you stated the recognition of the revenue earned in october would be. On december 5 2019 accounting software co.

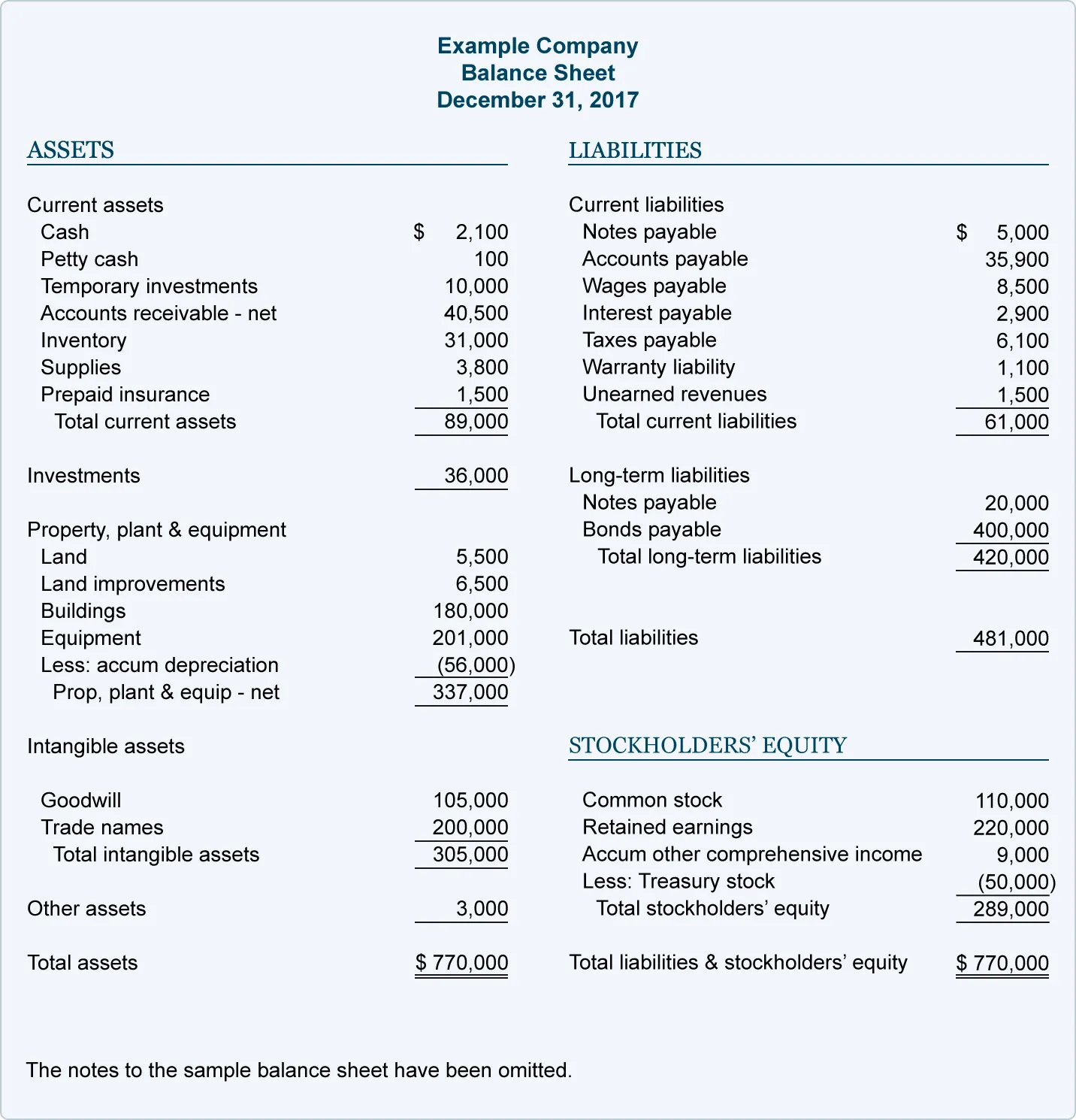

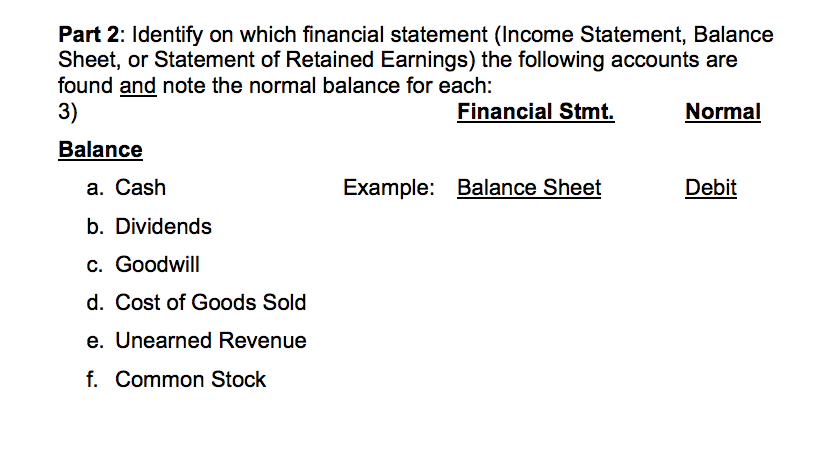

Freshbooks has online accounting software for small businesses that makes it easy to generate balance sheets and view your unearned revenue. Unearned revenue accounts for money prepaid by a customer for goods or services that have not been delivered. You see revenue or income is on the right side of the accounting equation as it results in more profit and more for the owner owners equity increases. Hence they are also called advances from customers.

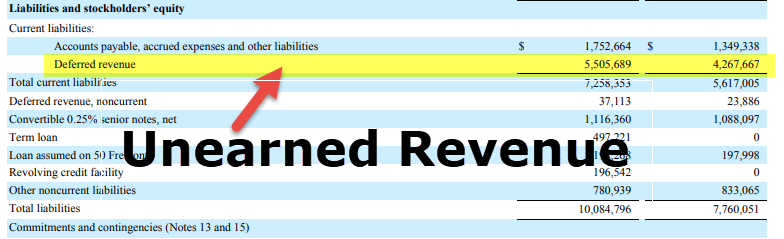

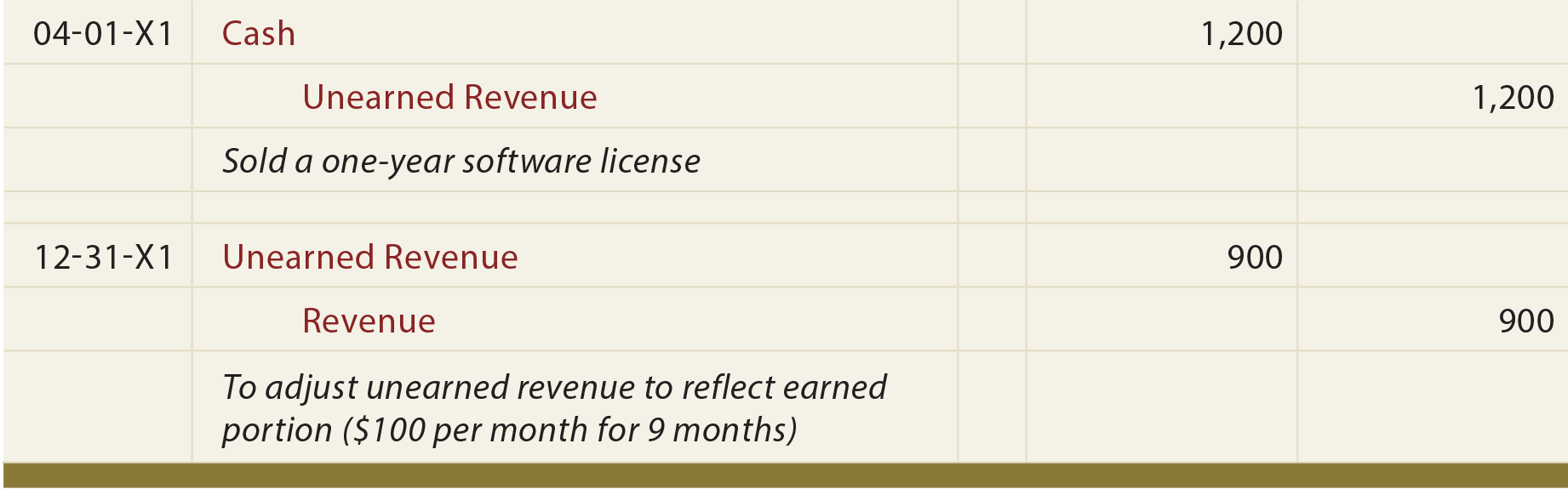

For one it keeps the balance sheet and the accounting equation in. Following the accrual concept of accounting unearned revenues are considered as liabilities. Unearned revenue is a liability for the recipient of the payment so the initial entry is a debit to the cash account and a credit to the unearned revenue account. This is true at any time and applies to each transaction.

It leads to an increase in cash balance of the company since the goods or service is to be provided in future the unearned income is shown as a liability in the balance sheet of the company which resulted in a proportional increase on both sides. The accounting equation assets liabilities owners equity means that the total assets of the business are always equal to the total liabilities plus the total equity of the business. This makes sure the equation continues to balance. Pays 600 for ads that were run in recent days.

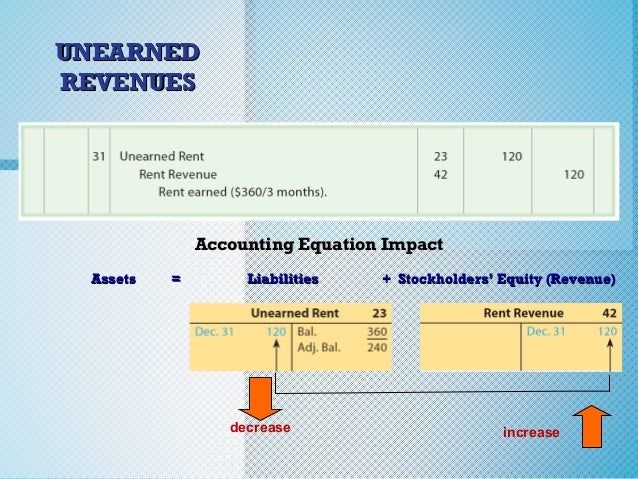

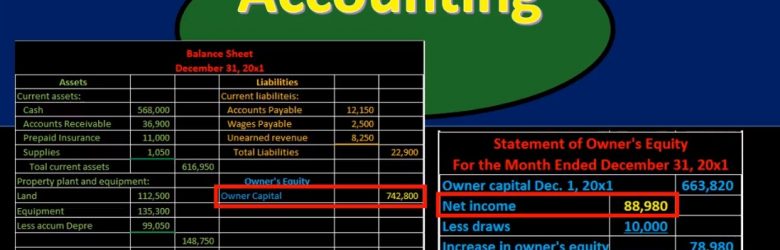

This is why unearned revenue is recorded as an equal decrease in unearned revenue a liability account and increase in revenue an asset account. The accounting equation for recording the liability when the cash is received would be. Companies must maintain the timeliness and accuracy of their accounts payable process. For this transaction the accounting equation is shown in the following table.

It is a prepayment received by an individual supplier or a company from a customer who ordered the delivery of goods or services at a later date. Salesforce sec filings unearned revenue accounting. 1 200 cash 1 200 unearned revenue. The second effect is a 600.

Transactions 5 6 sole proprietorship transaction 5. This is advantageous from a cash flow perspective for the seller who now has the cash to perform the required services. Since asc is paying 600 its assets decrease. Since they are on the same side of the accounting equation the reduction to unearned revenue is negative.

Delayed accounts payable recording can under represent the total liabilities. Unearned revenue is when you get paid for services or products before you ve actually delivered the service or products. Accounting equation for a sole proprietorship.