Unearned Service Revenue Is An Asset

Unearned revenue is also known as deferred revenue or deferred income.

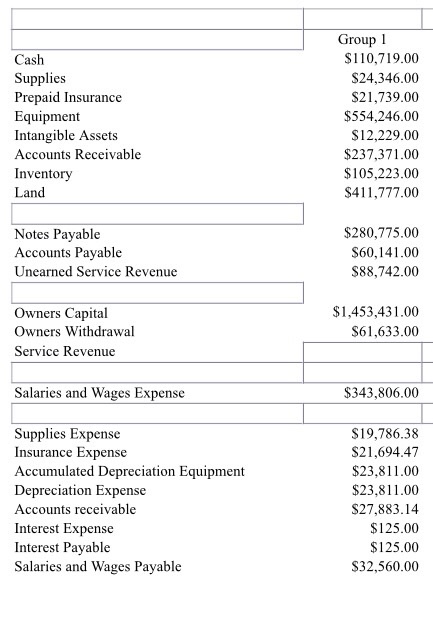

Unearned service revenue is an asset. This is a liability amount which is an obligation over the company. At the end of the period unearned revenues must be checked and adjusted if necessary. It is recorded on a company s balance sheet as a liability. The charges for such revenue are recorded under the accrual method of accounting.

Unearned revenue is a phenomenon in accrual basis accounting when a business has received payment for goods or services that it has not yet rendered to its customers. There are two ways of recording unearned revenue. The adjusting entry for unearned revenue depends upon the journal entry made when it was initially recorded. It is an advance payment from a customer that is expecting the delivery of services or products at a later date.

The company cannot recognize a revenue amount in the financial statements until the revenue is. Unearned revenue is a liability for the recipient of the payment so the initial entry is a debit to the cash account and a credit to the unearned revenue account. Service revenue is income a company receives for performing a requested activity. If a business entered unearned revenue as an asset instead of a liability then its total profit would be overstated in this accounting period.

Unearned revenue is the money received in advance for the services or products that are still to be delivered to the customer at a future date. The revenue recognition principle under generally accepted accounting principles or gaap requires a business to record revenue when it completes a service or sells a product regardless of when payment occurs. Unearned revenue is the cash proceeds received by a company or individual for a service or product that the company or individual still has to deliver to the customer. Unearned revenue is listed on the business s balance sheet as a current liability not a contra asset.

This means a small business must record its unearned fees as revenue in portions as it earns the revenue not when it receives the cash. One example of unearned revenues would be prepayments on a long term contract. Unearned revenue is money received from a customer for work that has not yet been performed. It is a prepayment received by an individual supplier or a company from a customer who ordered the delivery of goods or services at a later date.

This is advantageous from a cash flow perspective for the seller who now has the cash to perform the required services. Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. Asset accounts for example can be divided into cash supplies equipment deferred expenses and more. 1 the liability method and 2 the income method.