Unrecorded Revenue Journal Entry

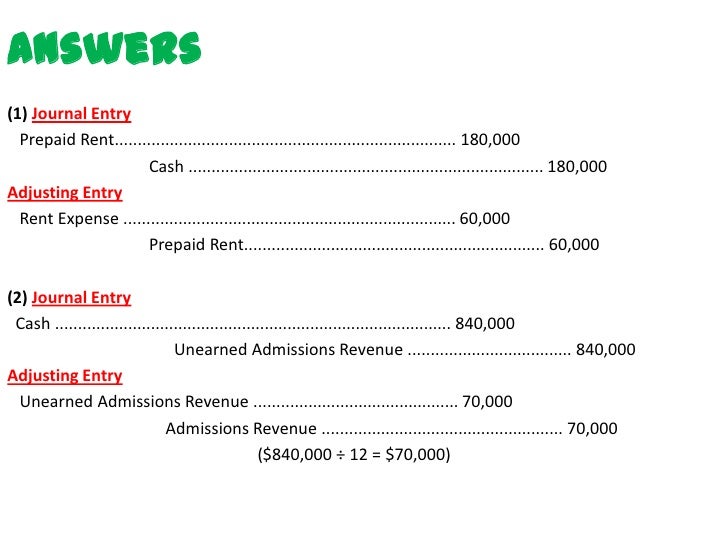

At the end of the accounting period you should make an adjusting entry in your general journal to set up property taxes payable for the amount of taxes incurred but not yet paid.

Unrecorded revenue journal entry. Accounting equation for unearned revenue journal entry. If a business has done work for a client but has not yet created an invoice there is unrecorded revenue that must be recorded. At each balance sheet date the utility should accrue for the revenues it earned but had not yet recorded. As a result the electric utility will have up to one month of unrecorded revenue.

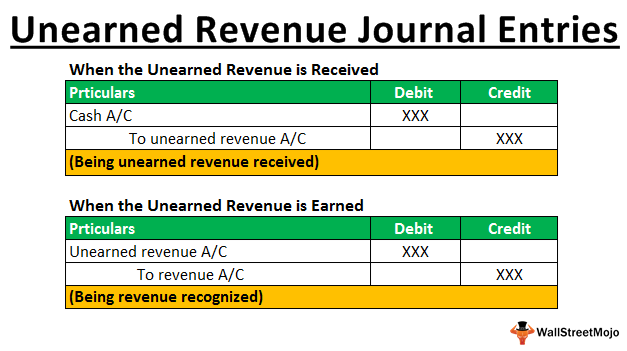

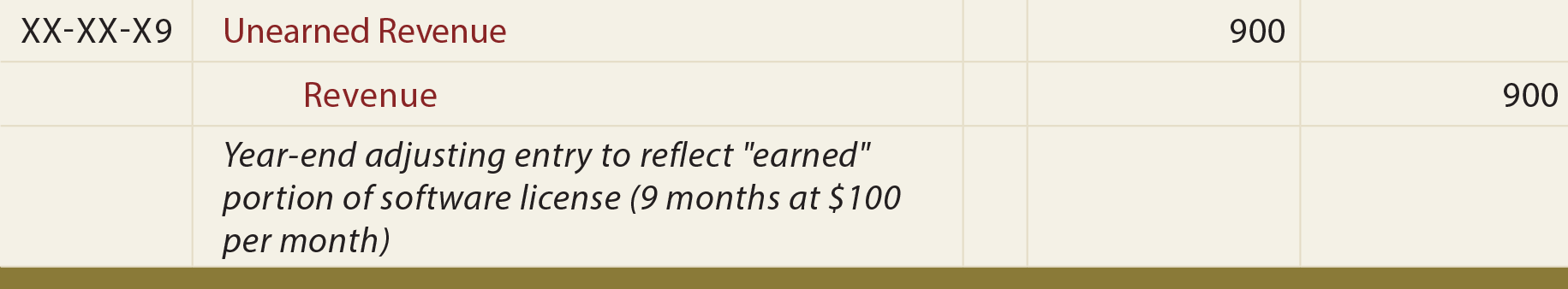

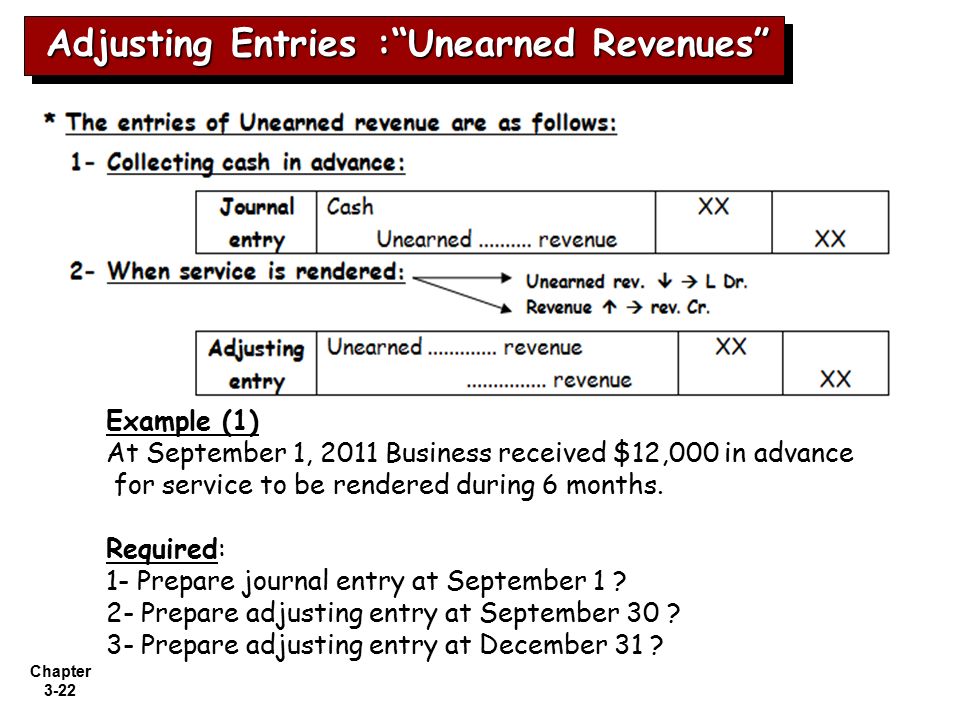

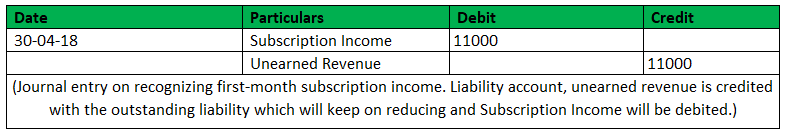

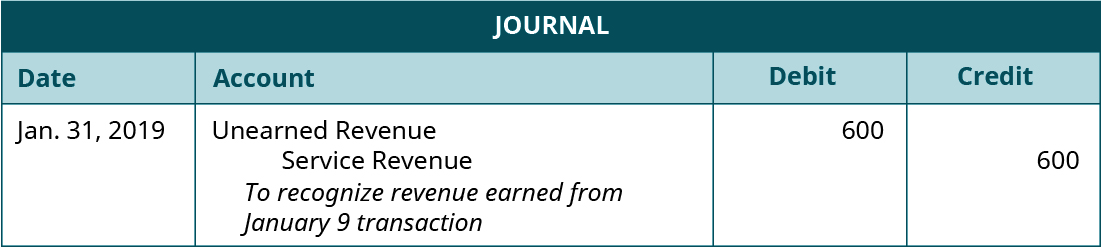

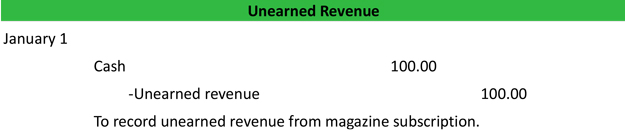

As the company supplies the goods or services owed and starts performing its obligations the revenue is gradually earned. The journal entry to record unearned revenue is as follows. The accounting equation assets liabilities owners equity means that the total assets of the business are always equal to the total liabilities plus the total equity of the business. An example of unrecorded revenue is when an employee.

The following unearned revenue journal entry example provides an understanding of the most common type of situations where such a journal entry account for and how one can record the same as there are many situations where the journal entry for unearned revenue pass it is not possible to provide all the types of examples. Unearned revenue is credit in nature and is reported as a real account in the books of the company. Example estimated property taxes of 5 200 were assessed on july 1 2013 for the 12 month period to end on june 30 2014. The following deferred revenue journal entry provides an outline of the most common journal entries in accounting.

Maybe the business just hasn t gotten around to completing the invoice yet or maybe the work is partially done but not completely finished. Unearned revenue cr xx. The adjusting entry for unearned revenue depends upon the journal entry made when it was initially recorded. Cash is never an account in an adjusting entry.

1 the liability method and 2 the income method. This is done through an adjusting entry that debits a balance sheet receivable account and credits an income statement revenue account. Unrecorded revenue is revenue that an entity has earned in an accounting period but which it does not record in that period the business typically records the revenue in a later accounting period which is a violation of the matching principle where revenues and related expenses are supposed to be recognized in the same accounting period. There are two ways of recording unearned revenue.

Journal entries of unearned revenue. This is true at any time and applies to each transaction.