What Is Deferred Revenue Normal Balance

The normal balance of any account is the balance debit or credit which you would expect the account have and is governed by the accounting equation.

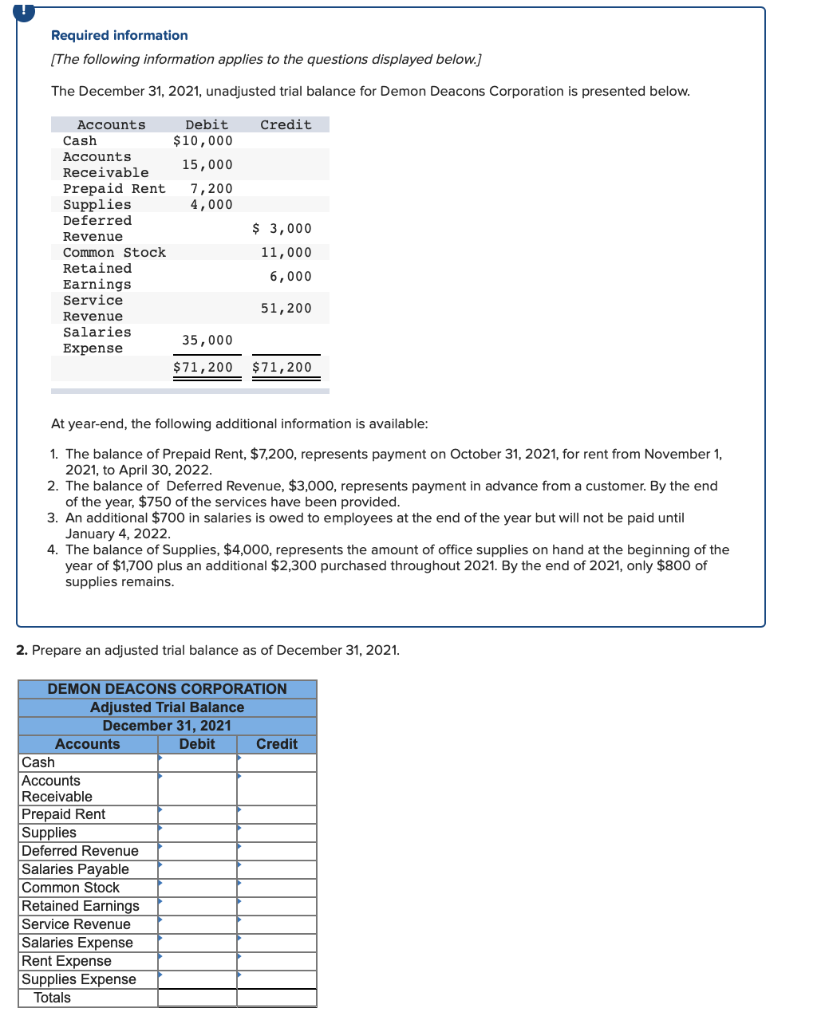

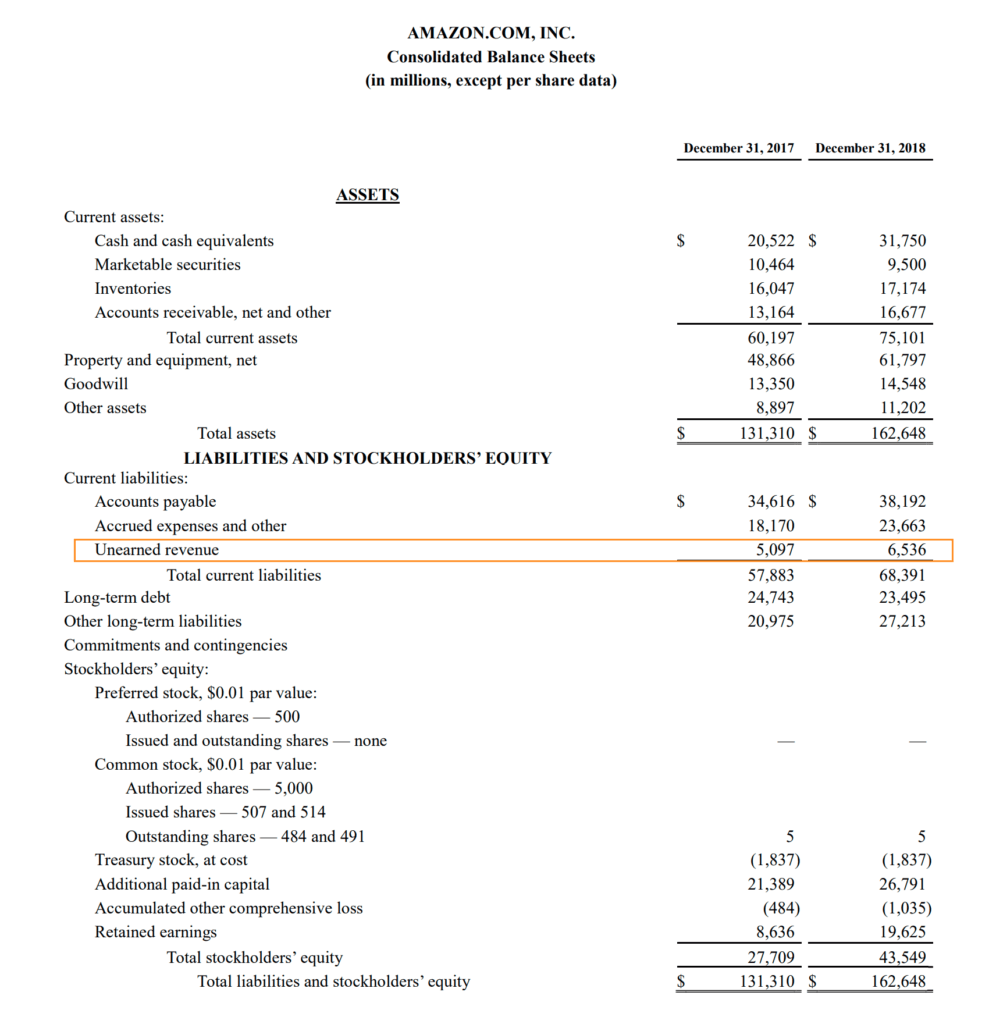

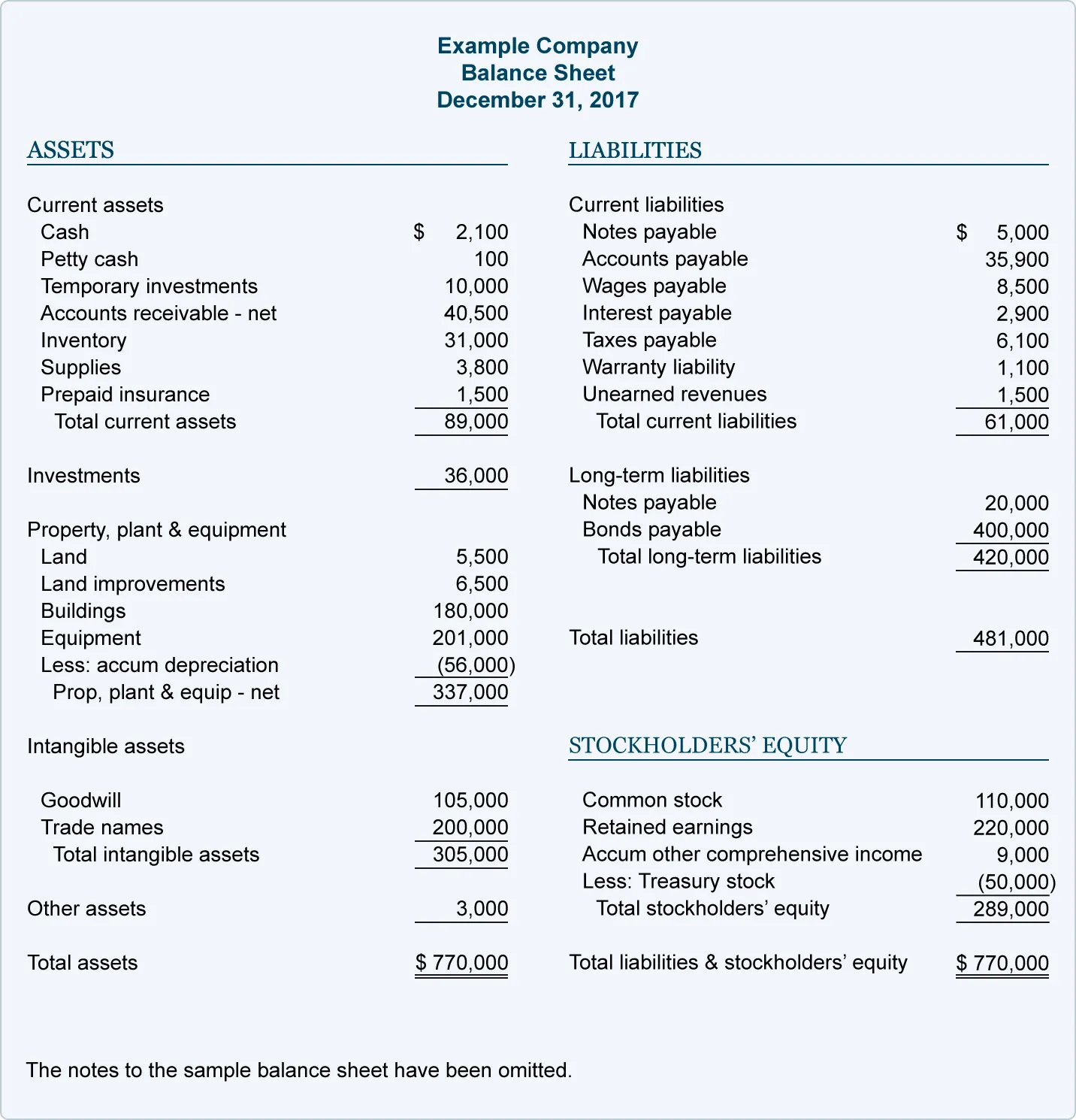

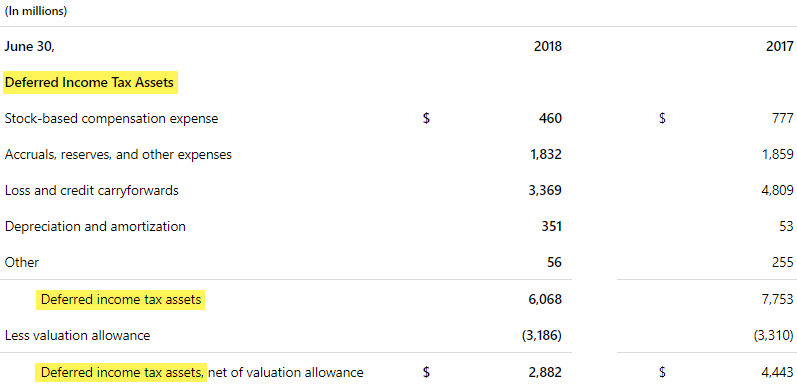

What is deferred revenue normal balance. What is deferred revenue. If your company has deferred revenue even for longer than a 12 month period it would follow the relevant accounting guidance to report its deferred revenue on the financial statements. How business combinations affect deferred revenue valuation. It is how deferred revenue on the balance sheet will look like.

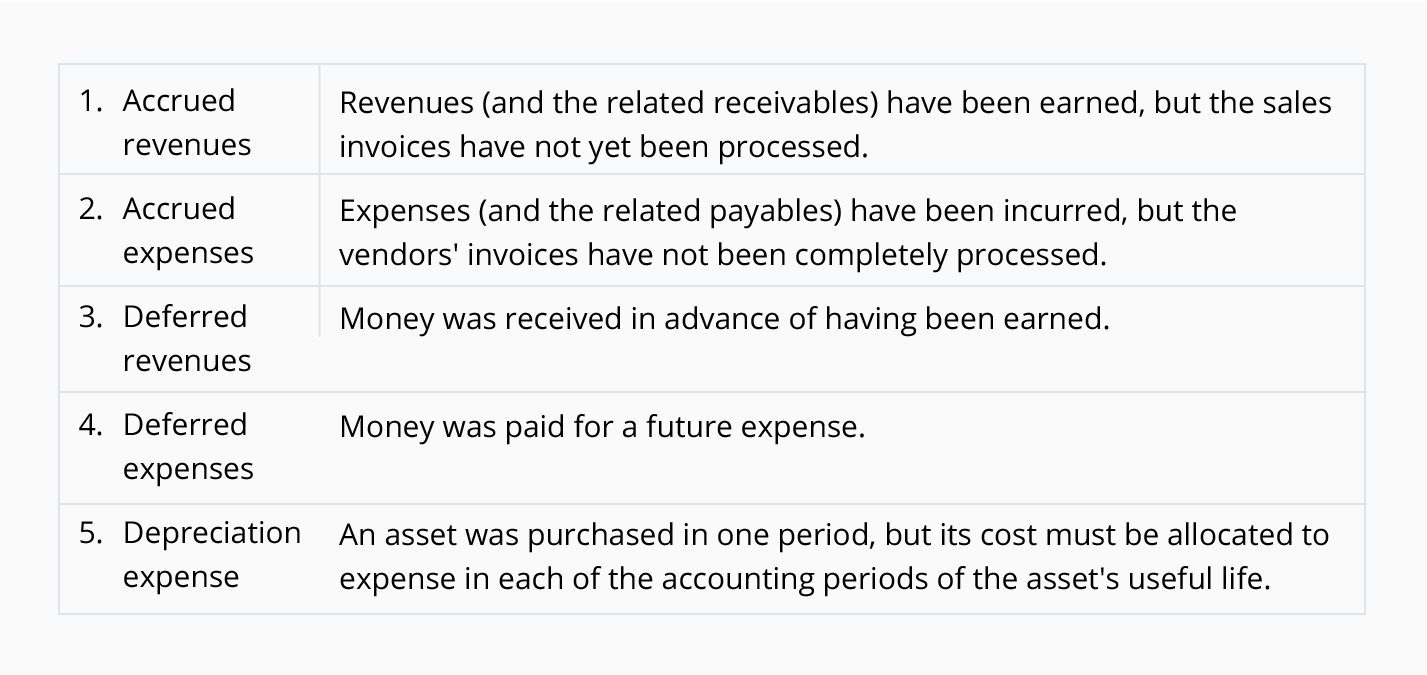

Deferred revenue which is also referred to as unearned revenue is listed as a liability on the balance sheet because under accrual accounting the revenue recognition process has not been. Hence 1000 of deferred income will be recognized as service revenue. The recipient of such prepayment records unearned revenue as a. The seller records this payment as a liability because it has not yet been earned deferred revenue is common among software and insurance providers who require up front payments in exchange for service periods that may last for many months.

The company that receives the prepayment records the amount as deferred revenue a liability on itsbalance sheet. As you deliver goods or perform services parts of the deferred revenue become earned revenue. As a result the unearned amount must be deferred to the company s balance sheet where it will be reported as a liability. Valuing the deferred revenue liability would mainly be important in a business combination situation.

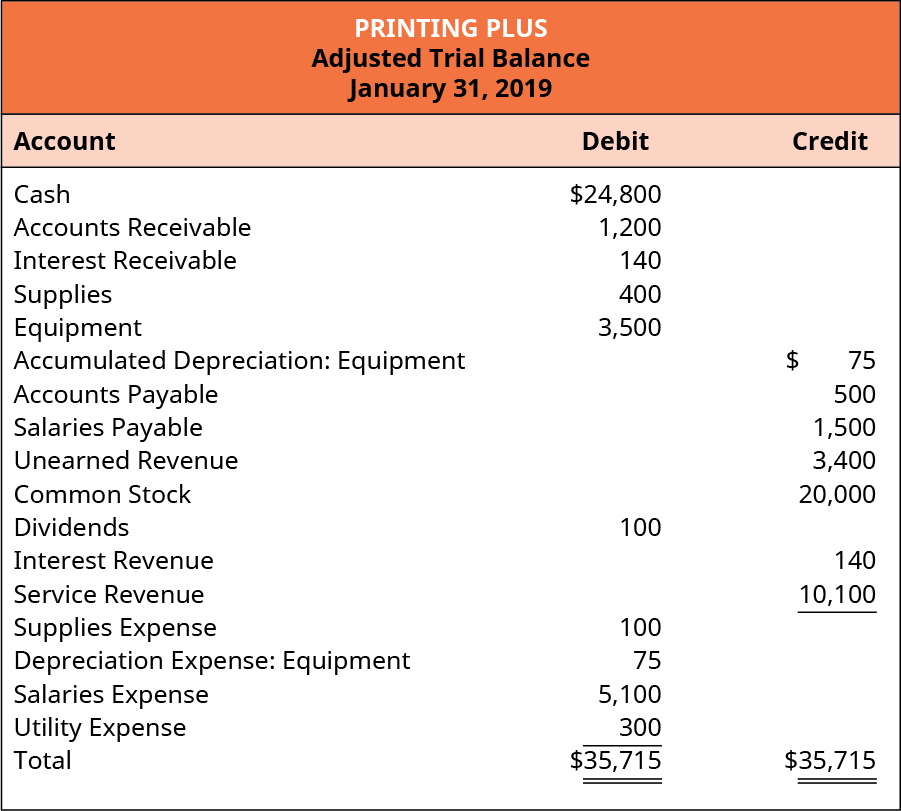

Deferred revenue or unearned revenue refers to advance payments for products or services that are to be delivered in the future. For example if you charge a customer 1 200 for 12 months of services 100 per month will turn into earned revenue while the remaining amount will still be deferred revenue. Thus it will accrue its earning. Deferred revenue also known asunearned normal balance revenue refers to advance payments a company receives for products or services that are to be delivered or performed in the future.

What is deferred revenue. The normal balance of any account is the balance debit or credit which you would expect the account have and is governed by the accounting equation. Deferred revenue is sometimes called unearned revenue deferred income or unearned income. Each of the accounts in a trial balance extracted from the bookkeeping ledgers will either show a debit or a credit balance.

Deferred revenue is a payment from a customer for future goods or services. In other words deferred revenues are not yet revenues and therefore cannot yet be reported on the income statement.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

%20(1).png?width=780&name=unbilled-receivable%20(1)%20(1).png)