Write Off Revenue Journal Entry

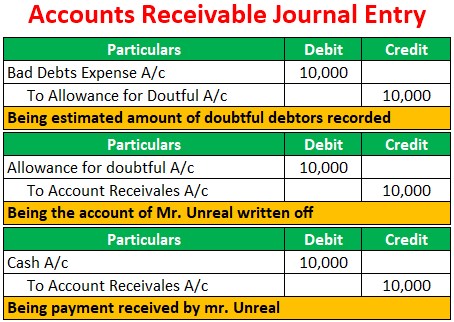

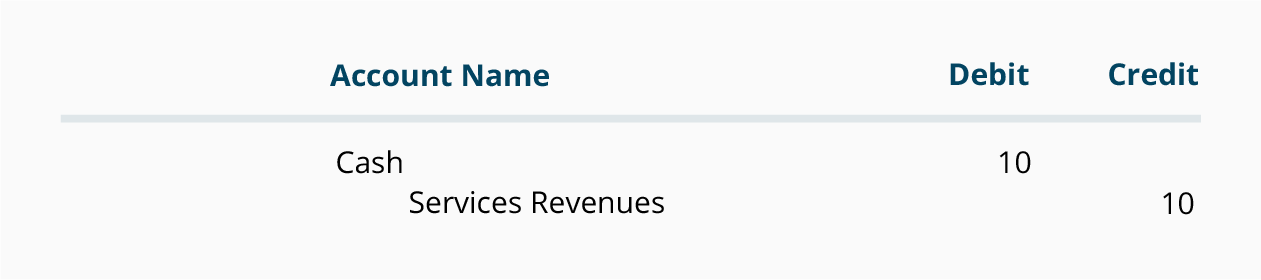

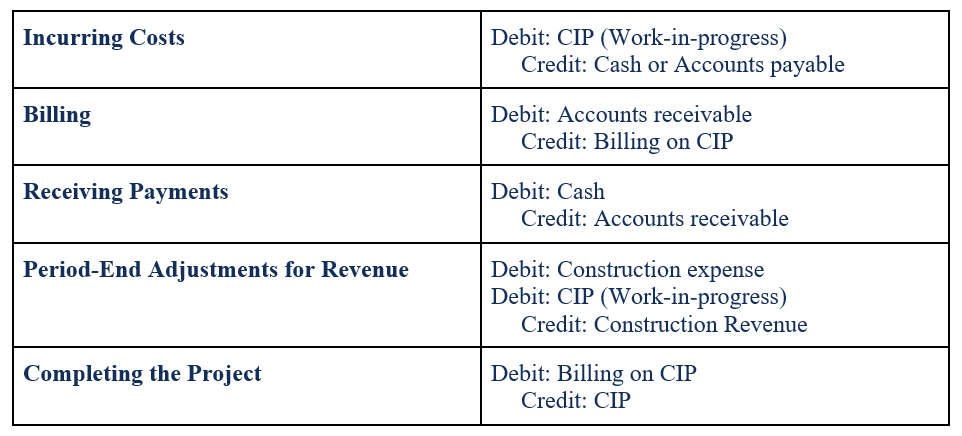

The journal entry is a debit to the bad debt expense account and a credit to the accounts receivable account.

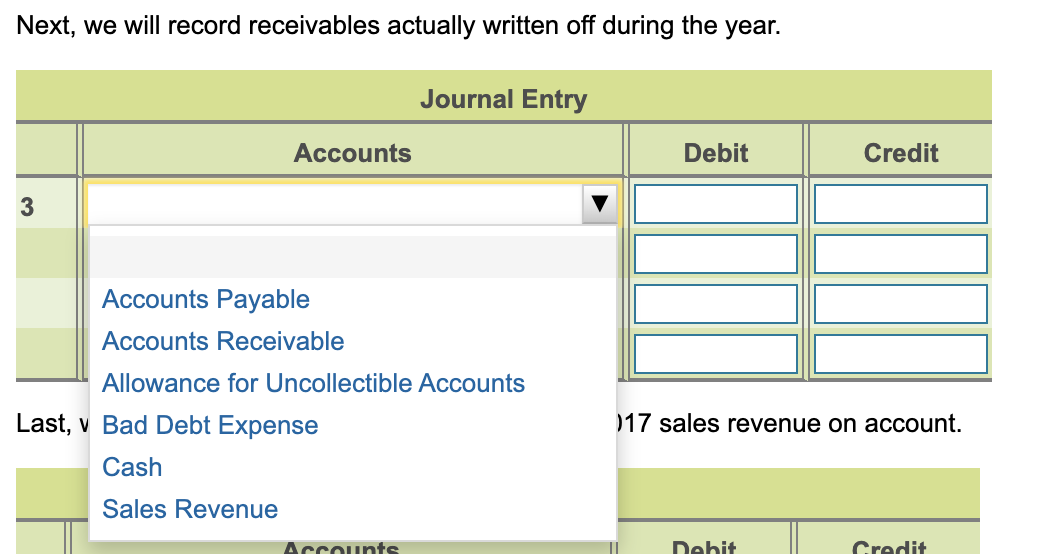

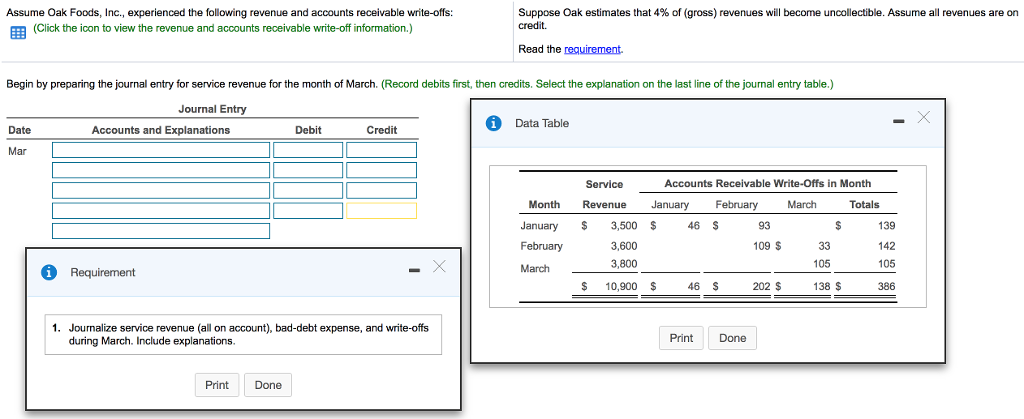

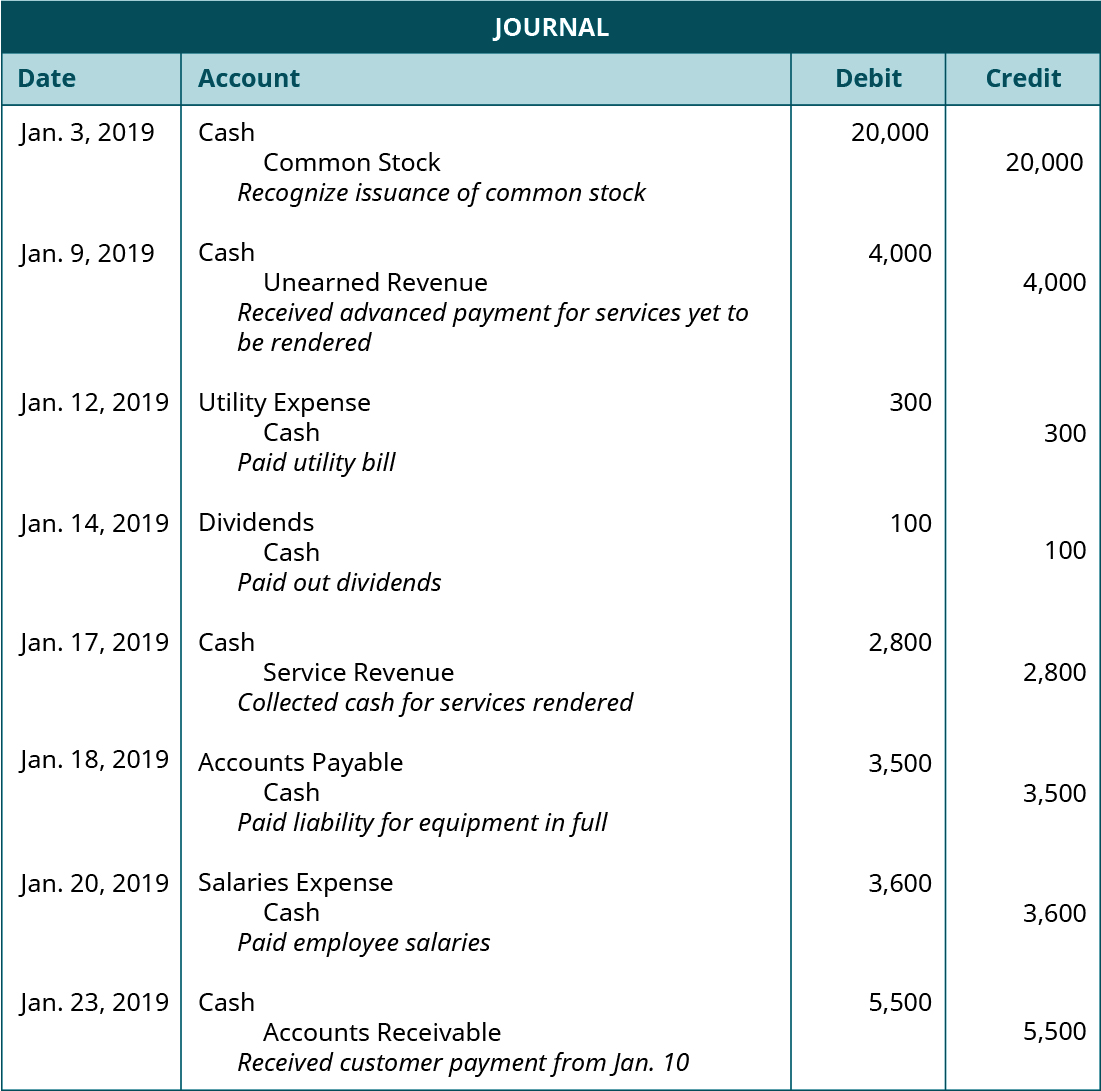

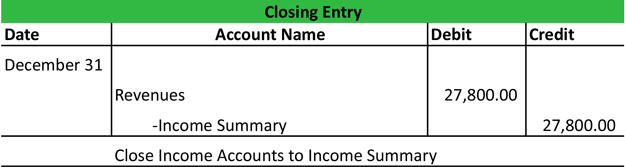

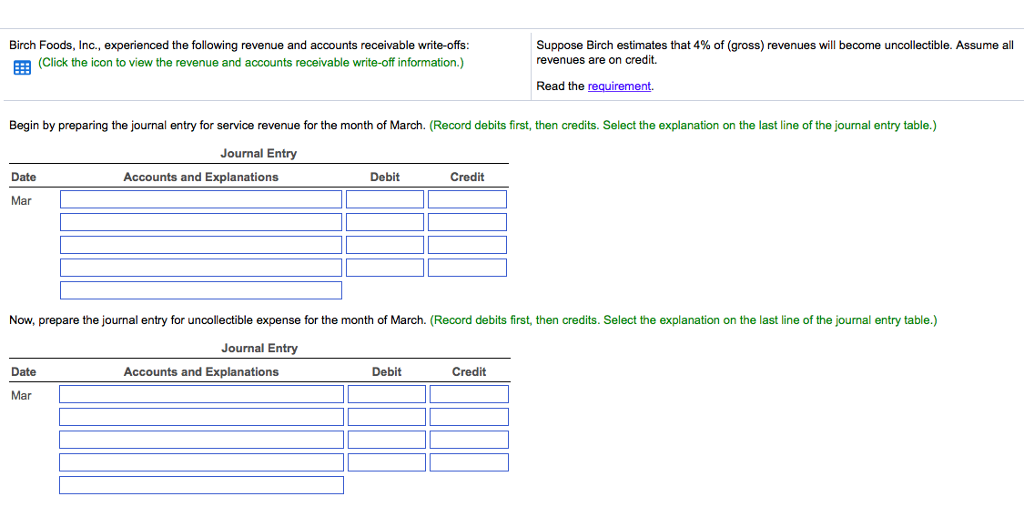

Write off revenue journal entry. This entry will write off the total or partial of the account payable that creditor cancels from the company balance sheet. In simple terms deferred revenue means the revenue that has not yet been earned by the products services are delivered to the customer and is receivable from the same. Journal entry to record the write off of accounts receivable. Accta february 9 2018 journal entry examples.

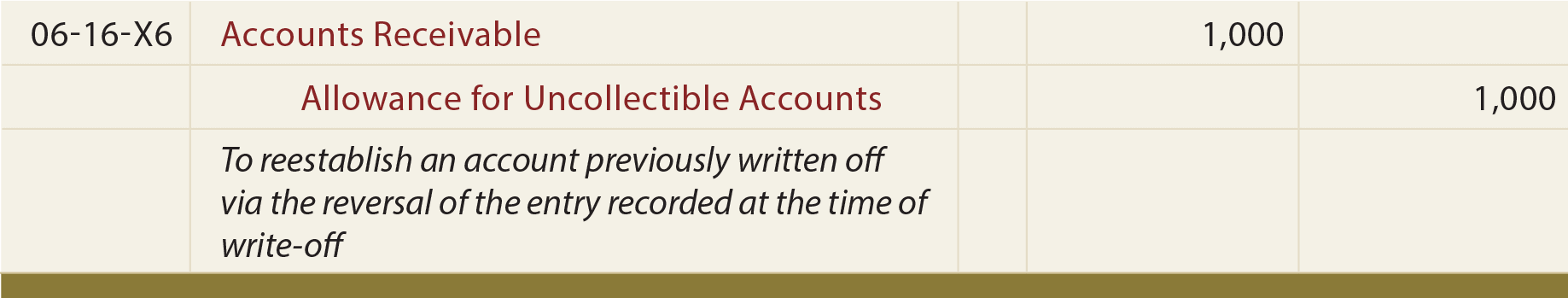

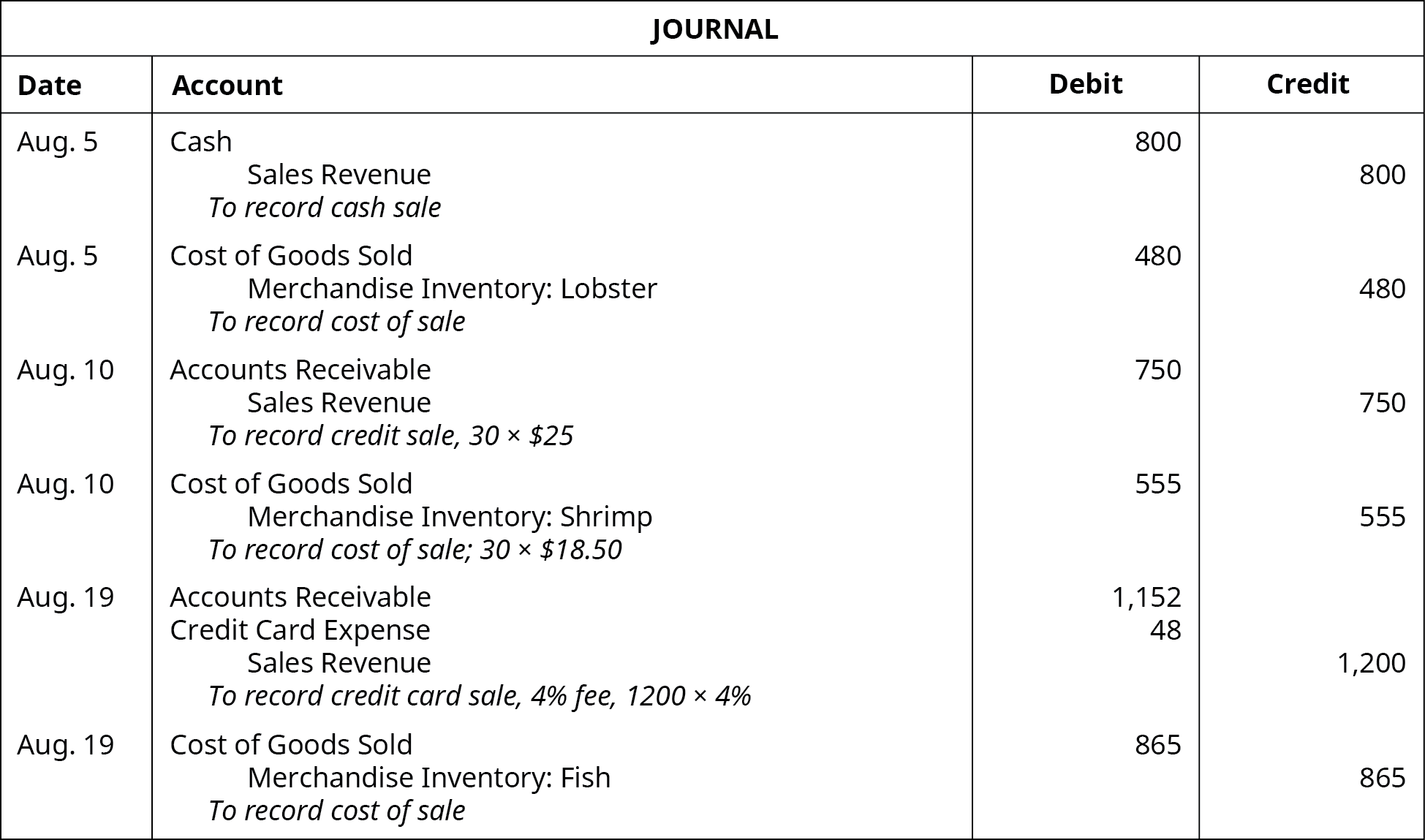

The direct write off method is simpler than the allowance method since it only requires one journal entry and doesn t utilize estimates. Nate should pass the following journal entry in his books to write off serena from his accounts receivable. The original invoice would have been posted to the accounts receivable so the balance on the customers account before the bad debt write off is 200. Create a write off journal for a customer.

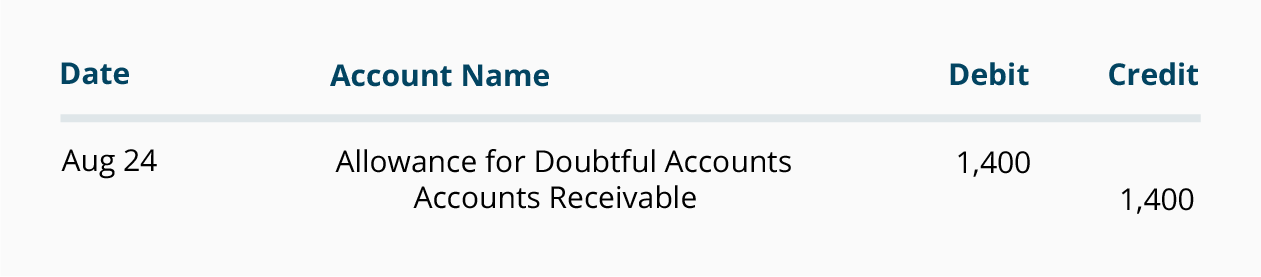

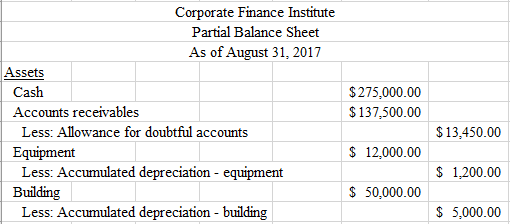

The seller can charge the amount of an invoice to the bad debt expense account when it is certain that the invoice will not be paid. 2 minutes to read. Write off of accounts receivable decreases the balance of accounts receivable and the corresponding balance of allowance for doubtful accounts. Direct write off method.

Accounts receivable cr 9 000. Essentially you write off ar balances one customer account at a time when it s pretty clear that it s unlikely the customer will ever pay what is owed. Bad debt write off journal entry a customer has been invoiced 200 for goods and the business has decided the debt will not be paid and needs to post a bad debt write off. This task guide will show you how to set up the parameters for write offs and then write off transactions from the collections page the open customer invoices page and the customer page.

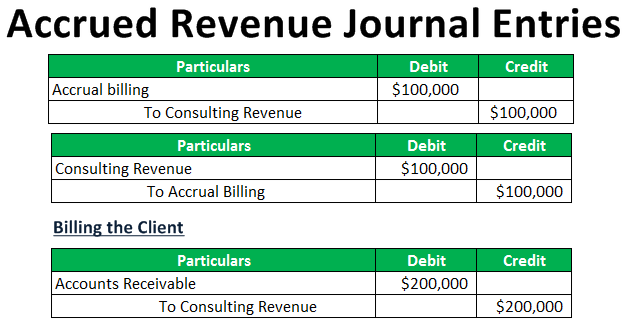

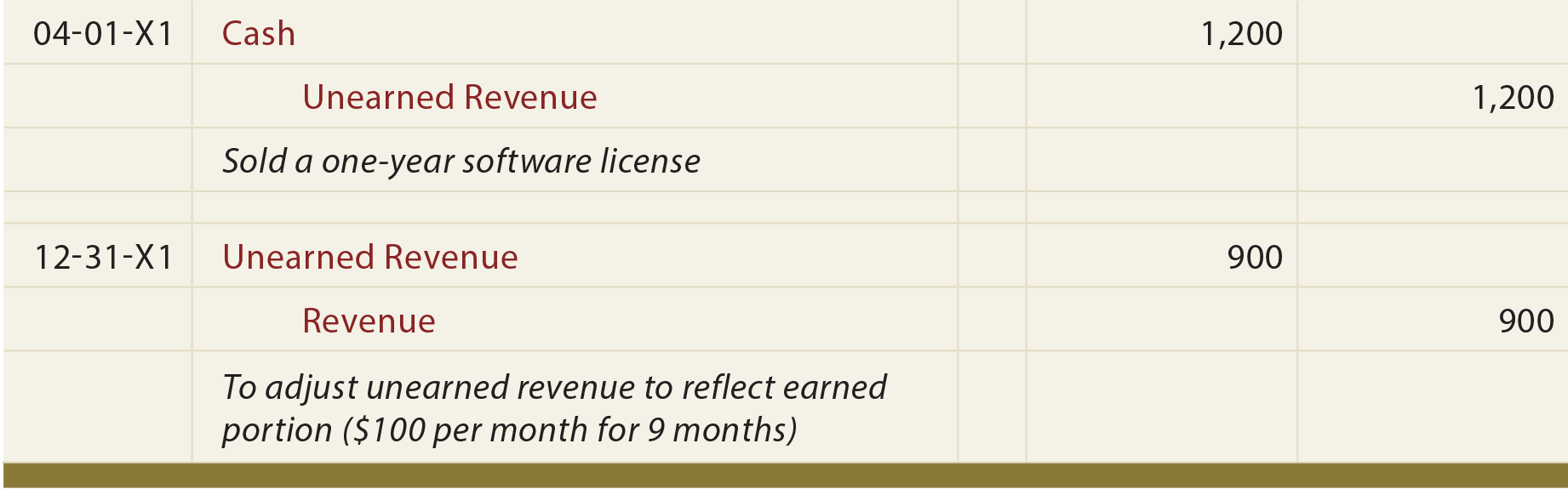

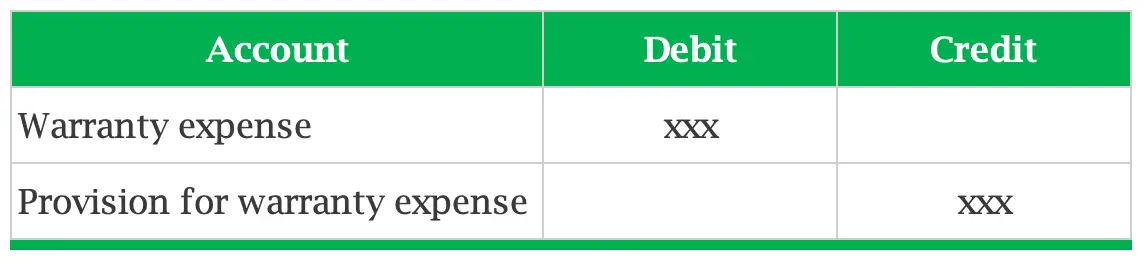

For example suppose a business provides web design services and invoices for annual maintenance of 12 000 in advance. The difference between a write off and a write down is just a matter of degree. A deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance. For example the amount of account payable to be canceled is also 4 000 the same the above example then here is the example of journal entry.

Journal entry of deferred revenue. Sec staff accounting bulletin topic 13 asc 605. A write down is performed in accounting to reduce the value of an asset to. Bad debt expense dr 9 000.