Act Revenue Direct Debit

Payment options for rates and land tax payments including fire emergency services levy and the city centre marketing and improvements levy are.

Act revenue direct debit. The act revenue office is responsible for the administration of act taxation laws various assistance schemes and rental bonds. This will ensure that revenue only requests one payment from your bank. Payment due dates will also be extended to one month after the date of issue to provide cash flow support to. If your due date falls on a weekend or holiday a deduction from your bank account will be processed the following business day.

Direct debit terms and conditions general. Delay of annual notices. The act revenue office may require the customer to provide details in writing of their request to suspend the direct debitarrangement. Act 2020 provides for a number of temporary income tax measures to assist self employed individuals who have been adversely impacted by the covid 19 restrictions.

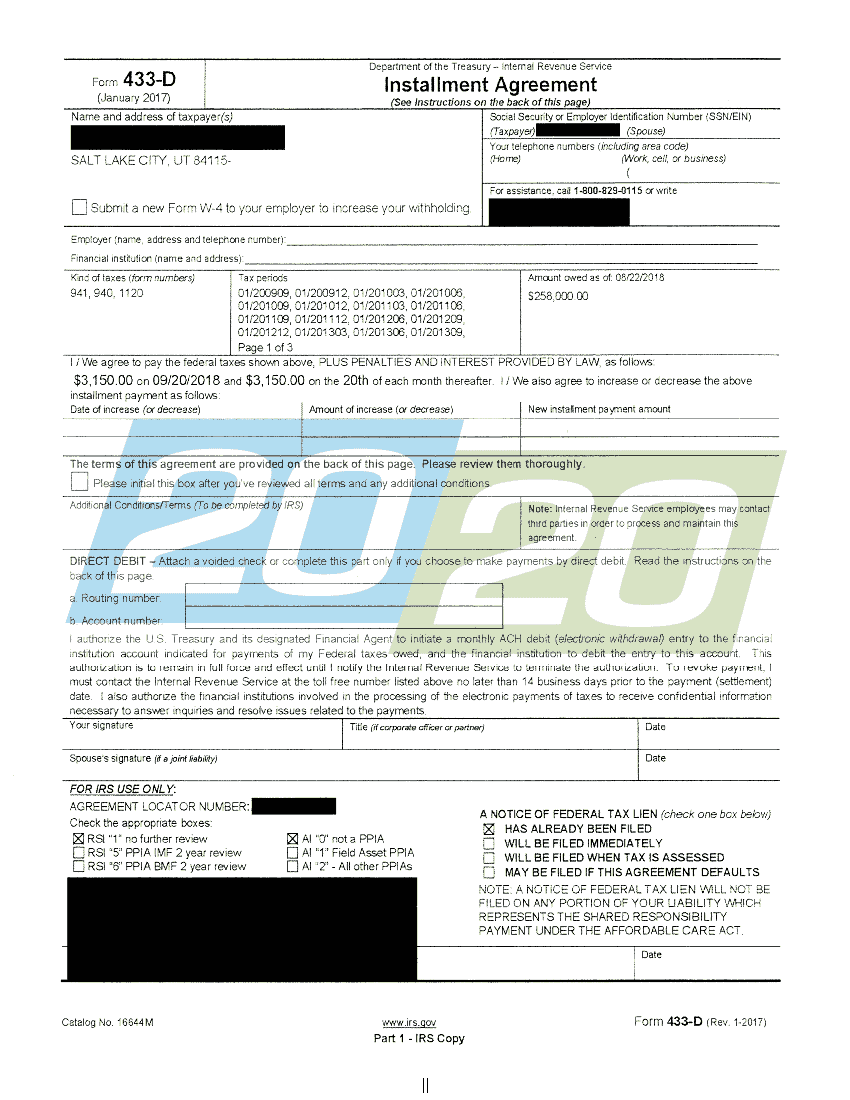

This agreement sets out the terms and conditions upon which the act revenue office will provide for the processing of payments to rates land tax land rent and deferred duty accounts by direct debit entries from a customer s account held with a financial institution. For information on how to amend or cancel a monthly direct debit payment. For more information read the direct debit terms and conditions or contact the act revenue office. Home owners in the act pay rates to fund a range of services for the act community.

Please complete the online direct debit request form. Revenue announced the warehousing of these tax debts in may 2020 and in july 2020 as. Online direct debit application form external site direct debit terms and. Act home loan portfolio.

Make your payment online by visa or mastercard through online payments access canberra external site. Once you have set up a variable direct debit you are not obligated to make a separate payment via an alternative payment method for example a ros debit. Covid 19 assistance if you ve been impacted by the covid 19 pandemic you may be eligible for assistance with act rates and other taxes. If you are currently on a fixed direct debit you need to cancel this before setting up a new variable direct debit.