Revenue Is Not Recognized Until

Obtain sales authorization revenue is not recognized until such approval is obtained even though product delivery is made and approval by the customer is anticipated.

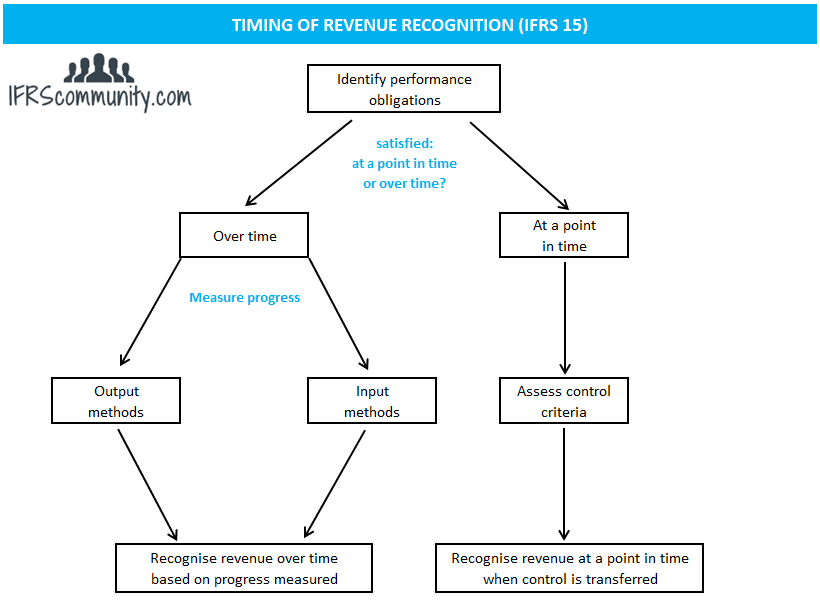

Revenue is not recognized until. Revenue should be recorded when the business has earned the revenue. Revenue can also be deferred if a service transaction cannot be reliably measured. When the complementary driving lesson has been provided. Gaap revenue recognition principles.

Revenue is deferred until the driving lesson has been provided. The revenue cannot be recognized from a service arrangement until the expiry of right of refund. The revenue should not be recognized as earned until the services have been performed tuovila 2020. Definition and explanation revenue recognition principle of accounting also known as realization concept guides us when to recognize revenue in accounting records.

Revenue related to the sales of services is recognized on a discernible pattern and if it does not exist straight line method will be appropriate to use. In other words companies shouldn t wait until revenue is actually collected to record it in their books. Since the contract was signed in december with the services to be performed in january the revenue should not be recorded in december as the revenue is not yet recognized as earned. Since the consignor retains the risks of ownership it postpones revenue recognition until sale to a third party occurs 5.

Revenue is recognized for the sale of the car 18 050 but not for the complementary driving lesson because it has not yet been provided. According to this concept the revenue is not recognized until it is earned and it is realized or at least realizable. The revenue is not recognized until after the return period has expired all sales are recognized but a reduction is made to take account of possible returns all sales are recognized and. Generally the staff believes that in view of the company s business practice of requiring a written sales agreement for this class of as.

It is treated as a liability because the revenue has still not been earned and represents products or services owed to a customer. Consignment arrangement the consignor physically transfers the goods to the other company the consignee but the consignor retains legal title. Before exploring the concept of revenue recognition further through a few examples we. The language from sab 101 is as follows.

Revenue typically should not be recognized until actual delivery to the customer occurs 4. Since the revenue is not recognized until the work has been performed and the from comm 457 at university of british columbia. But which is not recognized as income until a later date.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)