Advance Revenue Journal Entry

It is the revenue that the company has not earned yet.

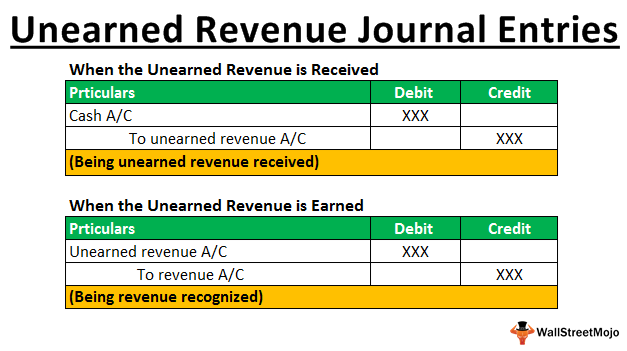

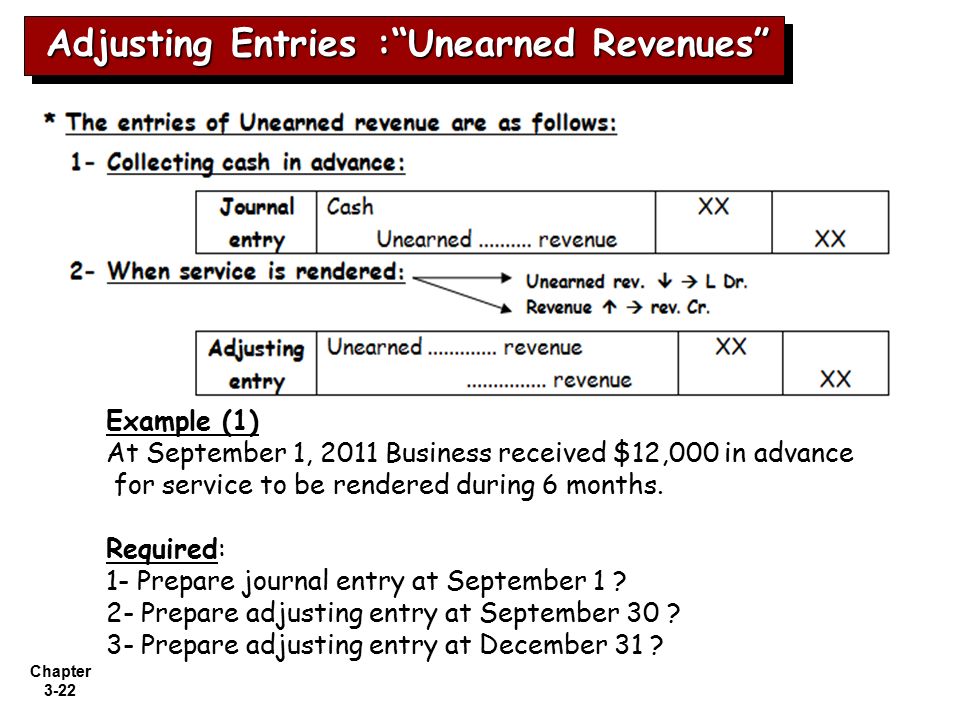

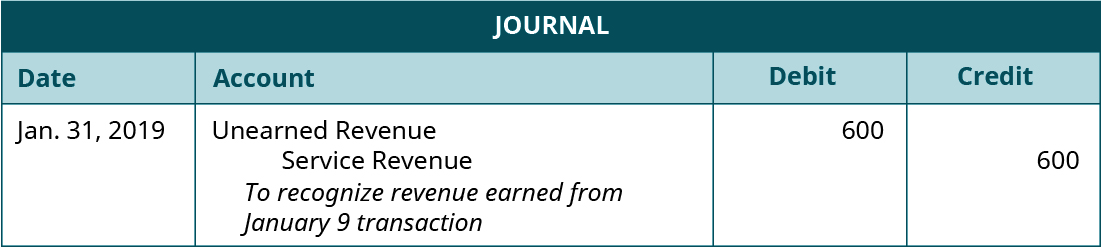

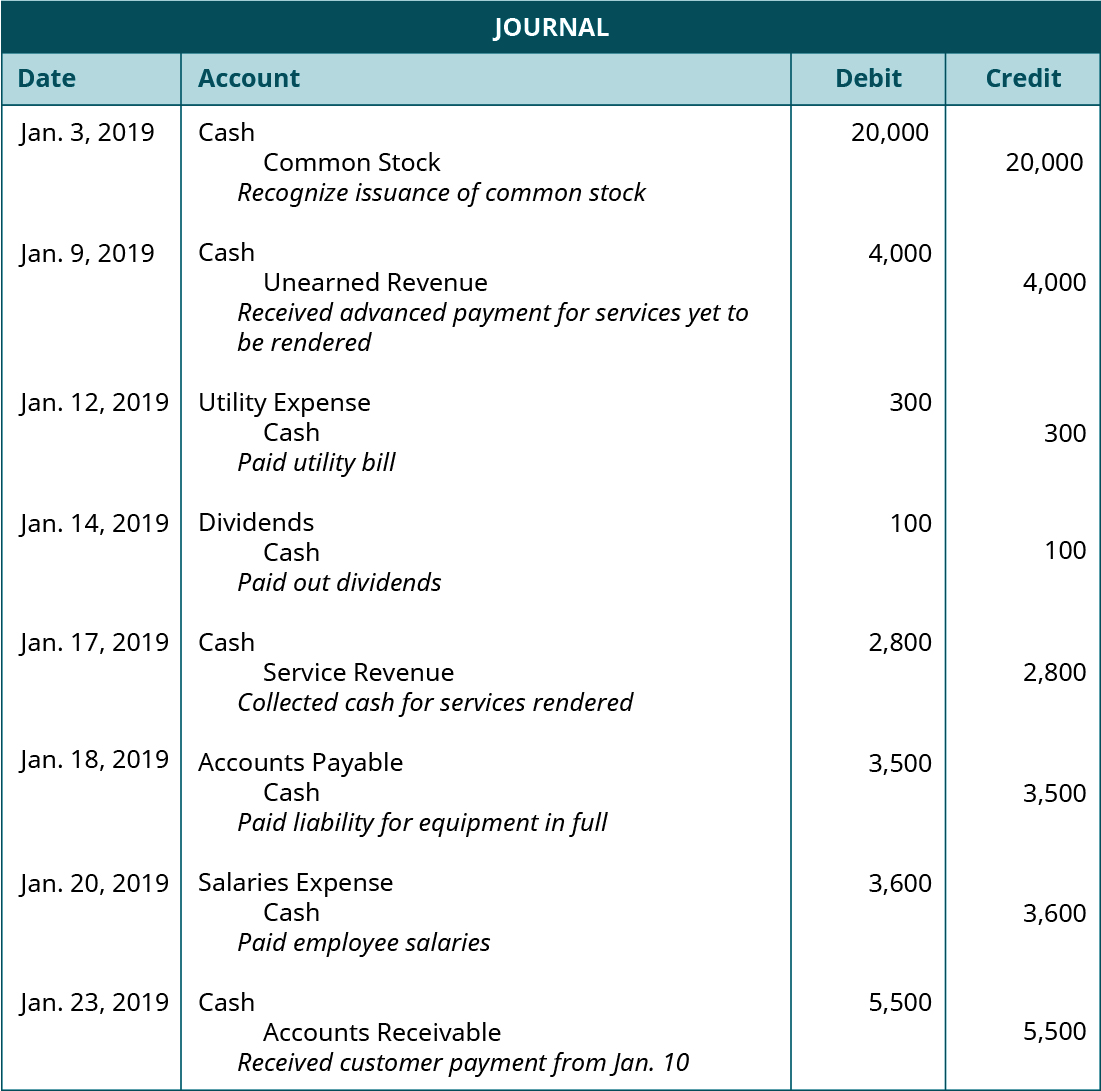

Advance revenue journal entry. Adjusting journal entries are a feature of accrual accounting as a result of revenue recognition and matching principles. As a result journal entry for advance received from a customer is entered in the books. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. Journal entry for advance received from a customer.

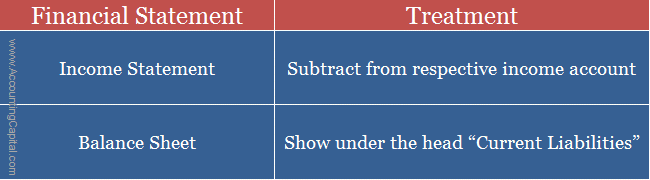

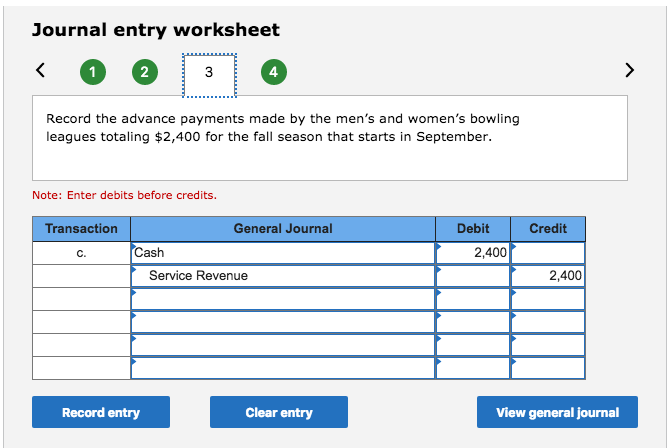

Also known as unearned income it is income which is received in advance however the related benefits are yet to be provided it belongs to a future accounting period and is still to be earned. Deferred revenue journal entry overview. The double entry bookkeeping journal entry to show the revenue received in advance is as follows. Once you ve identified exactly how the standard will affect your industry and your business it s time to identify how to make a more accurate journal entry for revenue recognition.

A business received revenue in advance of 4 000 from a customer for services yet to be provided. Journal entry for income received in advance recognizes the accounting rule of credit the increase in liability. In certain types of business transactions it is a requirement for the customer to pay a part of the total amount or the entire sum in advance for example security deposit to rent a property customized items bulk orders insurance premium etc. How to record the journal entries.

Customer revenue received in advance. Deferred revenue is the payment the company received for the goods or services that it has yet to deliver or perform.