Service Revenue Balance Sheet Classification

It is shown as the first item in the body of the income statement of a service business.

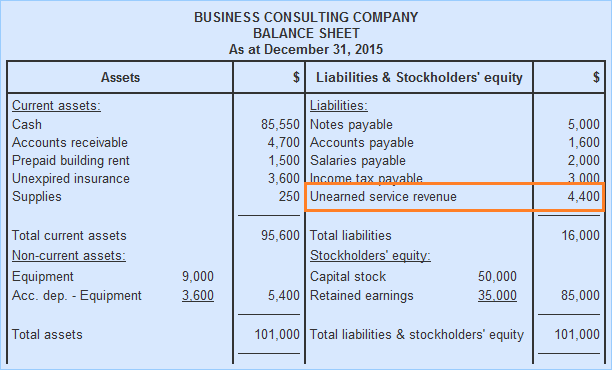

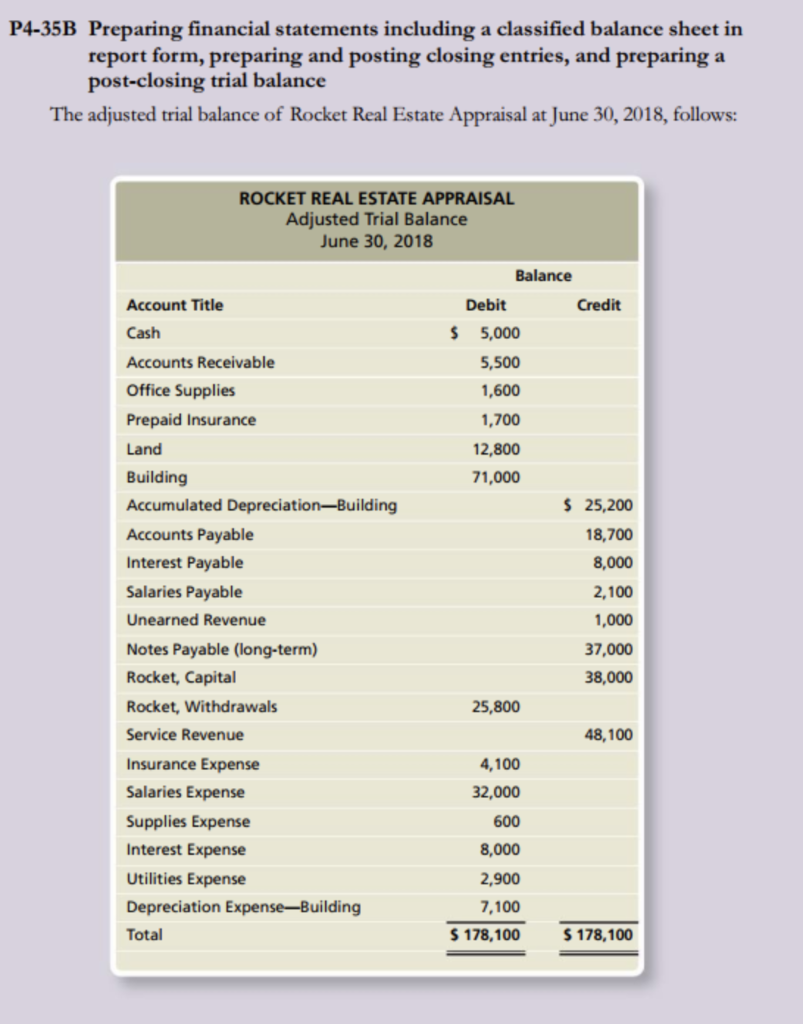

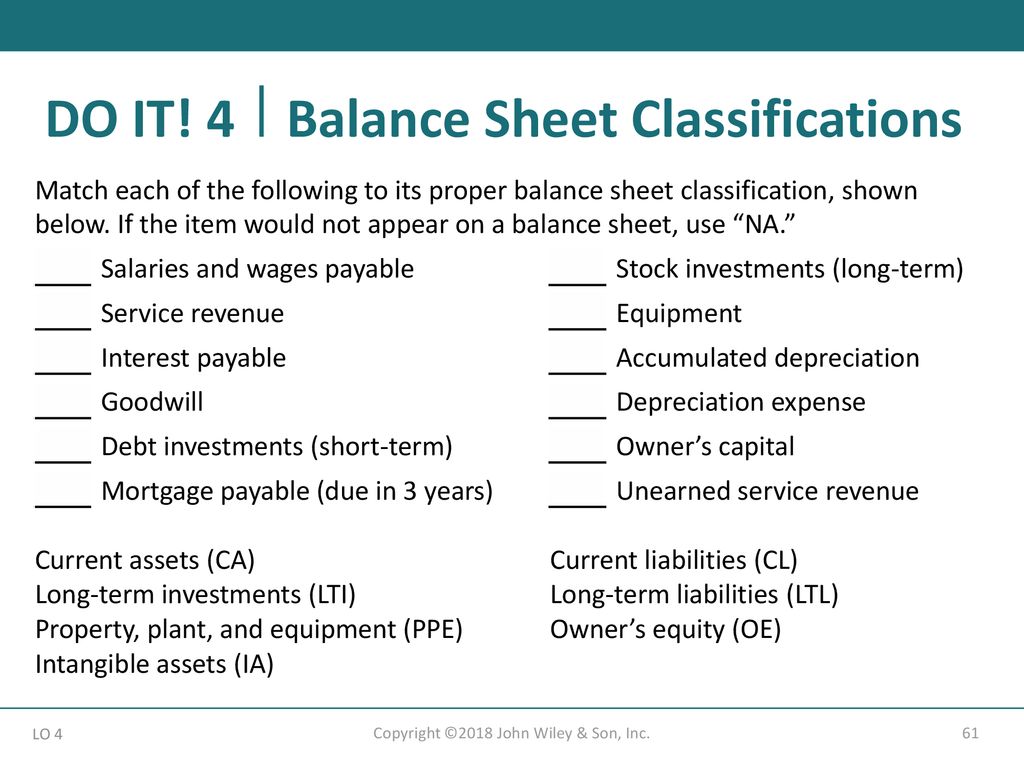

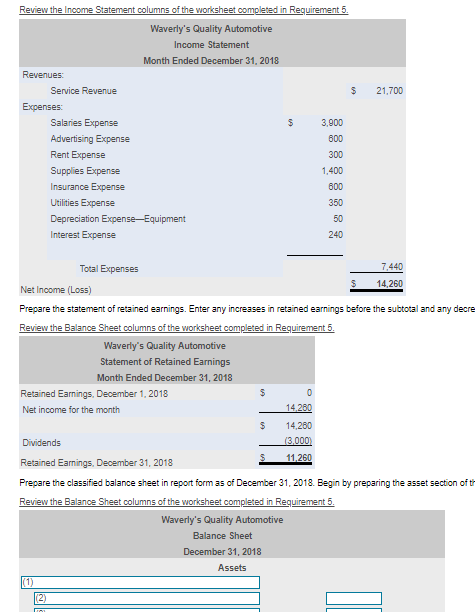

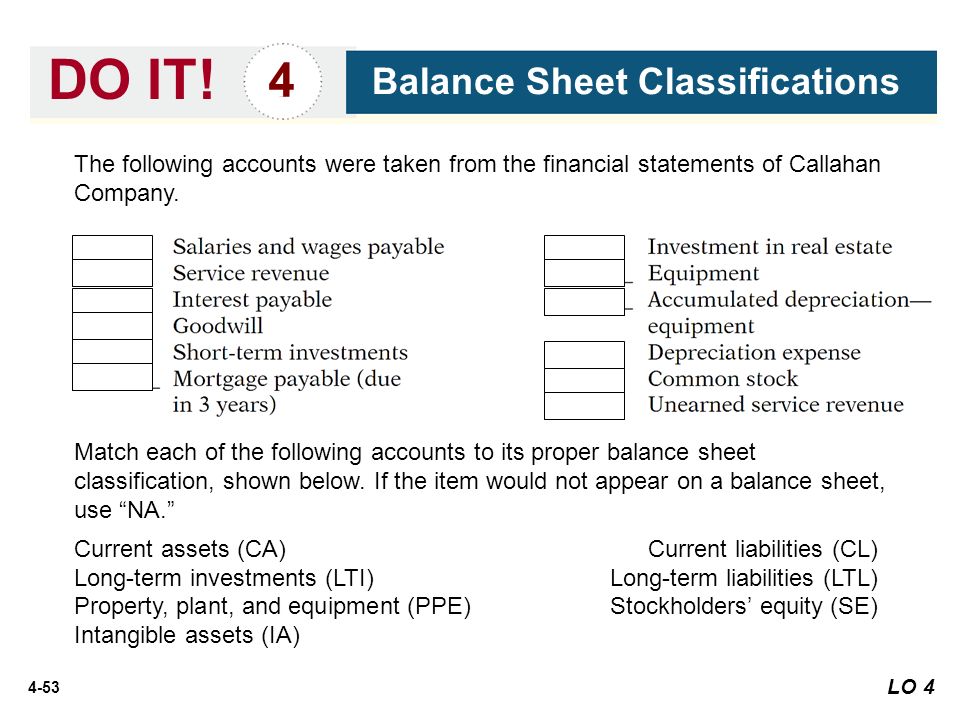

Service revenue balance sheet classification. Service revenue is the account used in a service company doctor accountant etc to accumulate revenues earned for the period. Classified balance sheet is the type balance sheet in which all the balance sheet accounts are presented after breaking them into the different small categories which makes it easier for the user of the balance sheet to have a clear understanding by organizing accounts into a format which is more readable. Certificate income statement. This preview shows page 4 5 out of 5 pages.

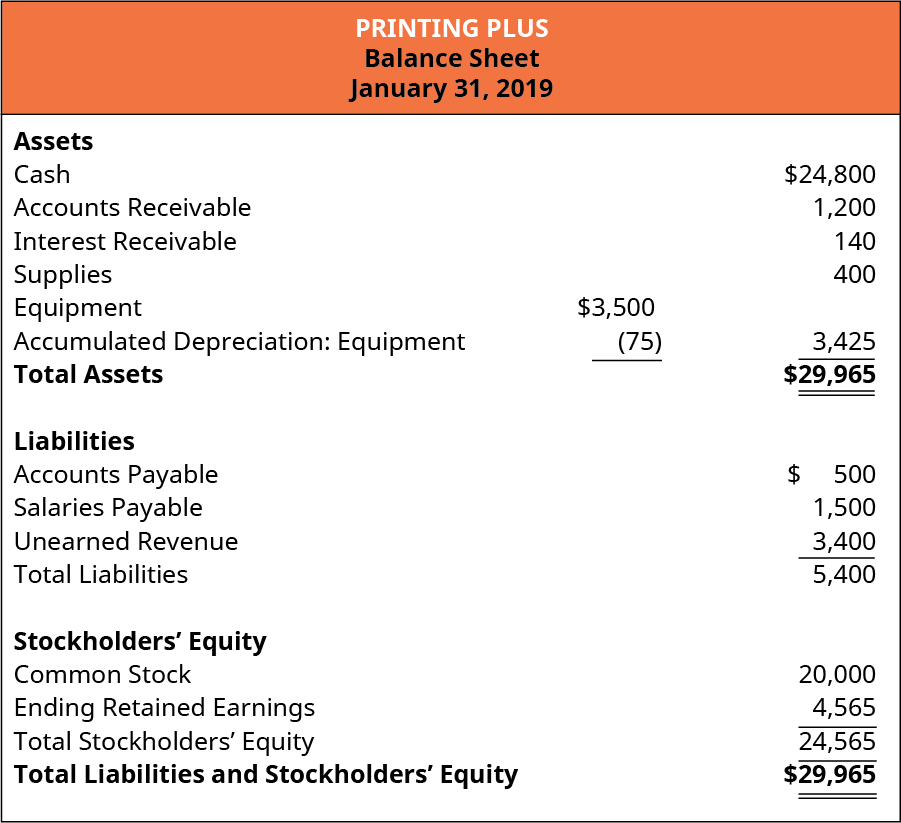

Under the accrual basis of accounting revenues received in advance of being earned are reported as a liability. If they will be earned within one year they should be listed as a current liability. Where does revenue received in advance go on a balance sheet. The service revenue account is found on the income statement and not on the balance sheet.

They become part of service revenue. Service revenues include work completed whether or not it was billed. Accumulated depreciation equipment. Capital is included in owner s equity.

Balance sheet liability service revenue 100 000 income statement revenue rent expense 20 000 income statement expense unearned revenue 1 000 balance sheet liability interest expense 500 income statement expense accounts receivable 5 000 balance sheet asset equipment 45 000 balance sheet asset dividends 6 000 statement of cash flows cash. Current asset balance sheet debit. Current liability balance sheet credit. The balance sheet reveals the assets liabilities and equity of a company.

In examining a balance sheet always be mindful that all components listed in a balance sheet are not necessarily at fair value. Service revenues is an operating revenue account and will appear at the beginning of the company s income statement. Service revenue is a revenue or income account. Definition of revenue received in advance.

Certificate cash flow statement. In a sole proprietorship the capital account is used to represent owner s. It is important to note that advanced collections from clients or customers are not treated as service revenue yet. Some assets are carried at historical cost and other assets are not reported at all such as the value of a company s brand name patents.

It is extremely useful to include classifications since information is then organized into a format that is more readable than a simple listing of all the accounts. Classification and presentation of service revenue. Your sales revenue formula is more directly relevant to your income statement than to your balance sheet. A classified balance sheet presents information about an entity s assets liabilities and shareholders equity that is aggregated or classified into subcategories of accounts.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)