Do You Debit Or Credit Deferred Revenue

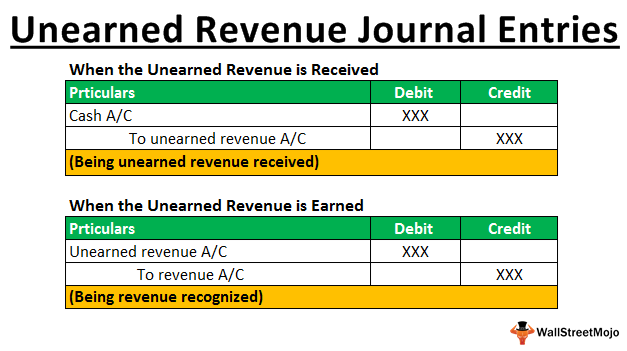

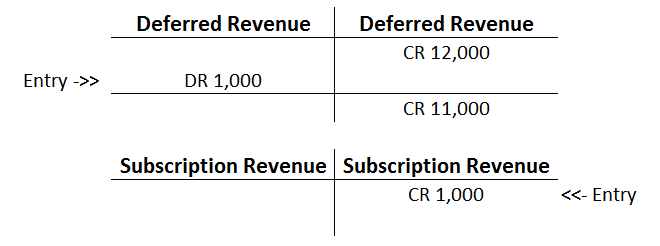

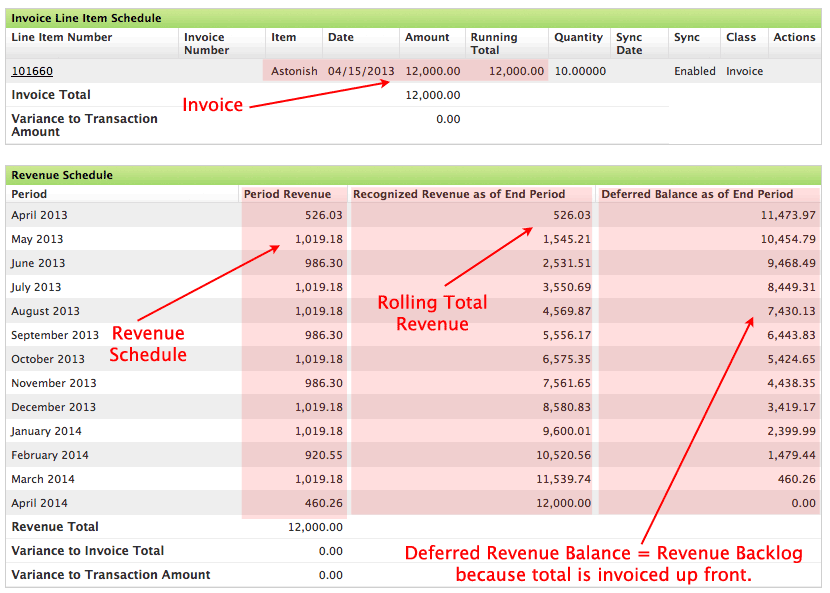

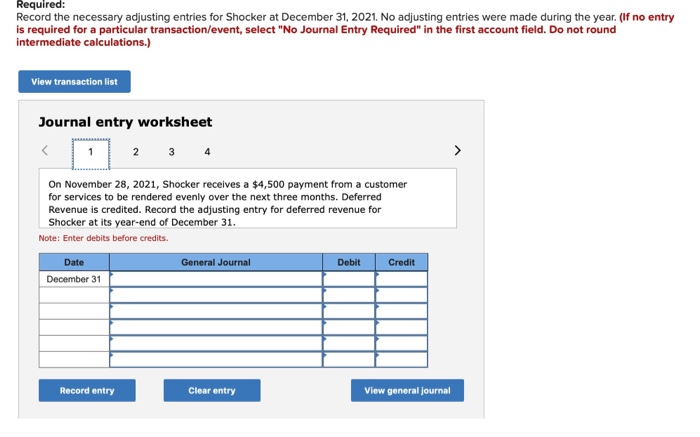

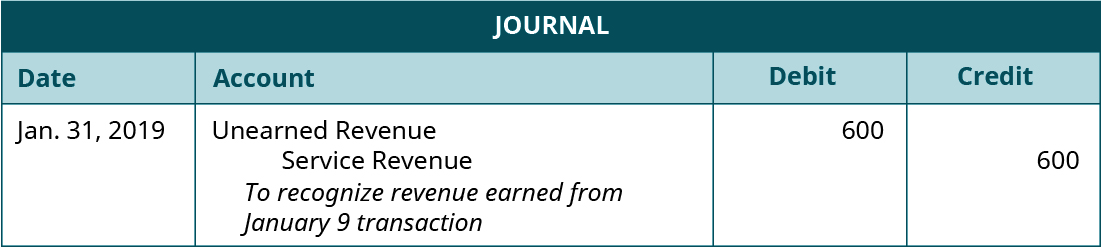

As the recipient earns revenue over time it reduces the balance in the deferred revenue account with a debit and increases the balance in the revenue account with a credit.

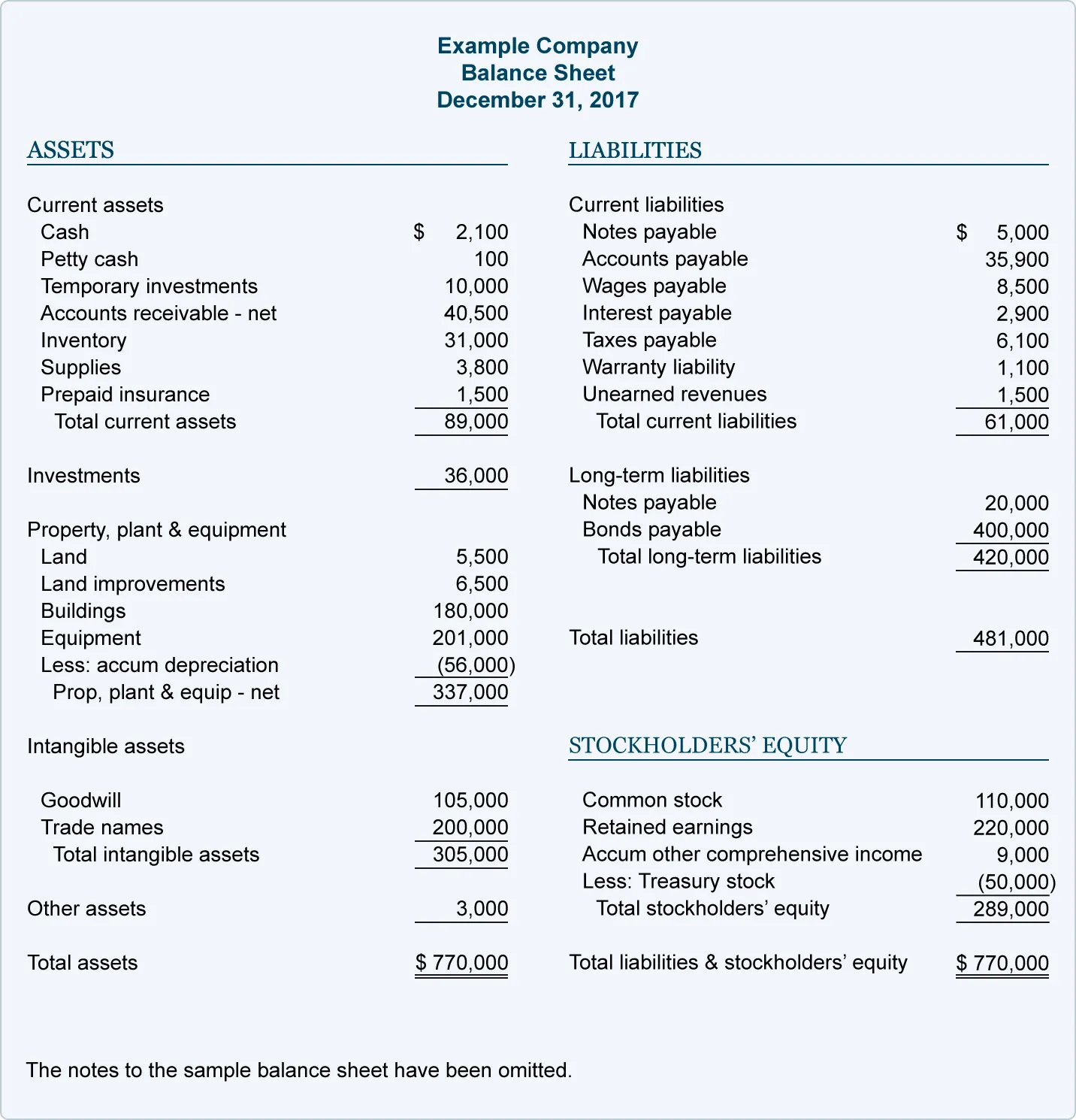

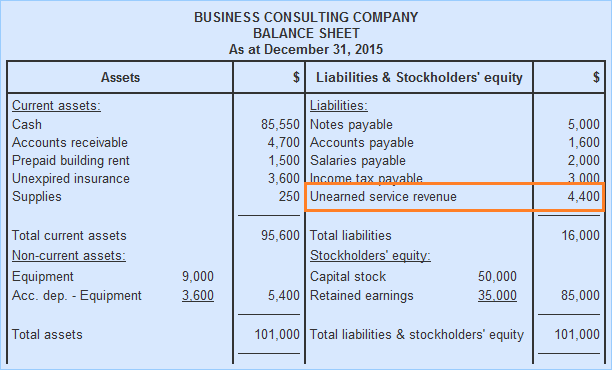

Do you debit or credit deferred revenue. These accounts normally have credit balances that are increased with a credit entry. You should go on adjusting the balance sheet and income statement as long as you are providing the service until you have nothing to owe so the liability to the customer reaches zero. You must lodge a guarantee and comply with the conditions of the authorisation. Debit cash total amount credit deferred revenue total amount upon completion debit deferred revenue total amount credit subscription revenue total amount if you recognize this revenue within a monthly period which should be done to facilitate your annual returns then you simply repeat step 2 with the partial.

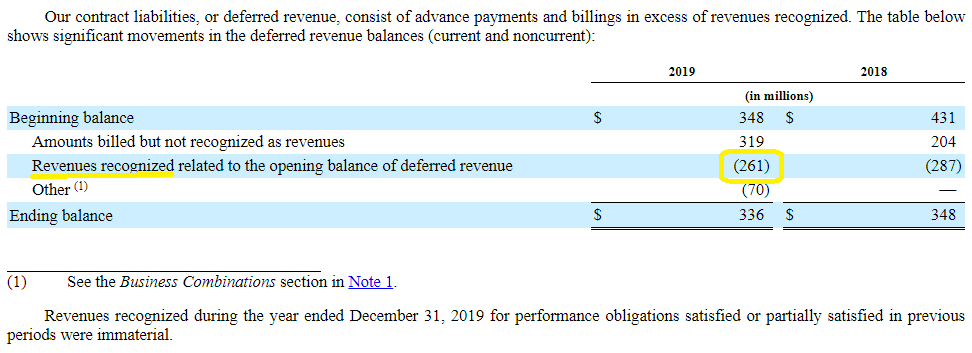

Make records until all the revenue is earned. The consolidated statement of cash flows is the other place where you should be able to see changes in deferred. This added a credit increase to revenue and a debit decrease to deferred revenue liability. The business now has an asset trade accounts receivable or trade debtor for the amount due.

The exceptions to this rule are the accounts sales returns sales allowances and sales discounts these accounts have debit balances because they are reductions to sales. In a t account their balances will be on the right side. When you receive the money you will debit it to your cash account because the amount of cash your business has increased. And you will credit your deferred revenue account because the amount of deferred revenue is increasing.

Depending on the contract terms the selling entity may not be allowed to recognize revenue until all goods have been delivered and or services completed. In essence through the fiscal year 2019 261 million of deferred revenue liability was recognized as revenue in the income statement. A debit is an entry made on the left side of an account. You need to make a deferred revenue journal entry.

A customer pays you 180 for a 12 month candy subscription. For example you would debit the purchase of a new computer by entering the asset gained on the left. Debit cash credit deferred or unearned revenue subscription sales as the subscriptions are fulfilled if the total amount of a subscription for 12 monthly magazines is 120 00 then each. Debit deferred revenue 30.

It either increases an asset or expense account or decreases equity liability or revenue accounts. If a debit increases an account you will decrease the opposite account with a credit. Debit the customer owes the business the money for the services until they are paid for. These charges include customs duty vat at import excise duty and vrt.