Revenue In Advance Journal Entry

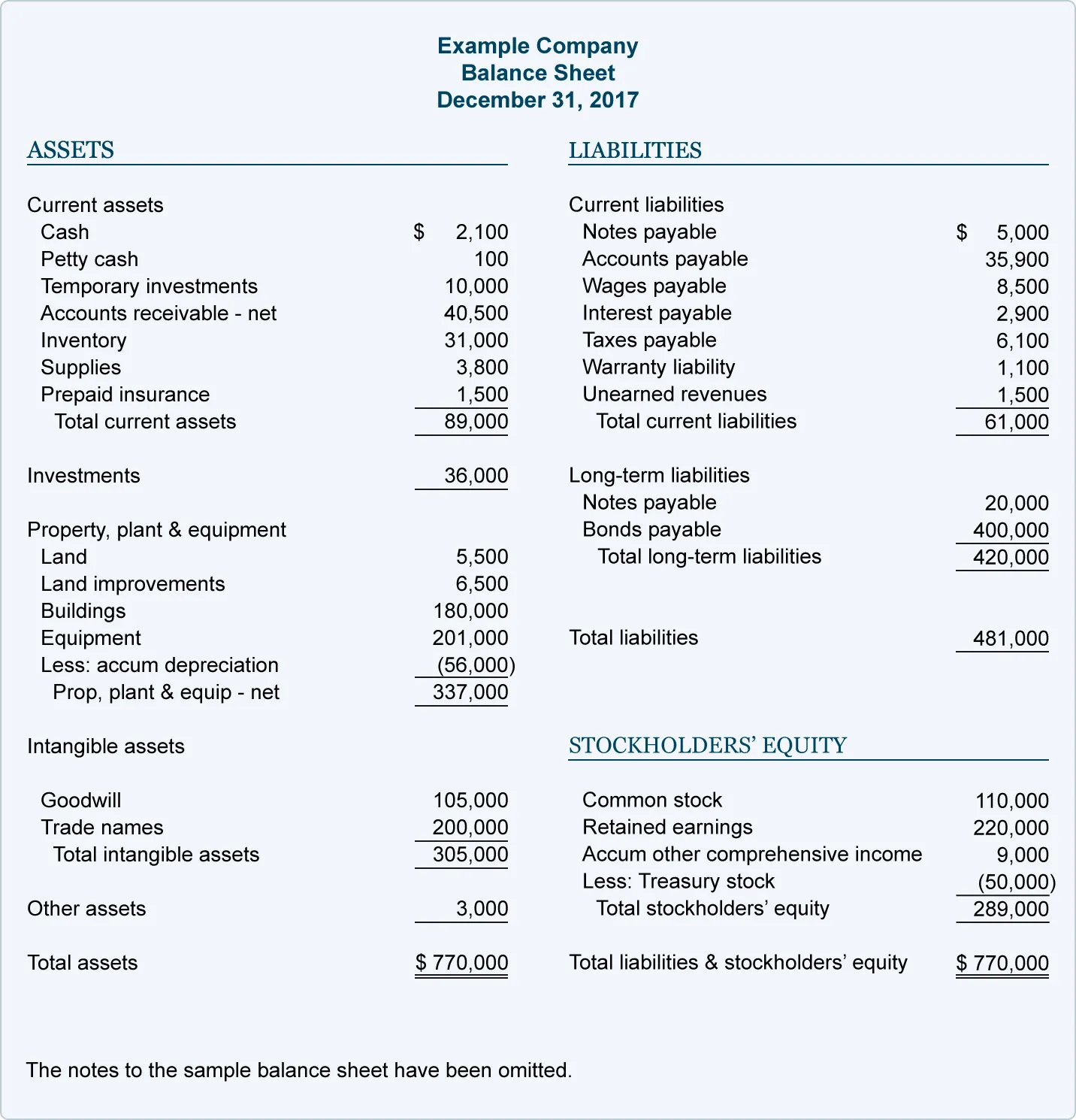

It is a personal account and shown on the liability side of a balance sheet.

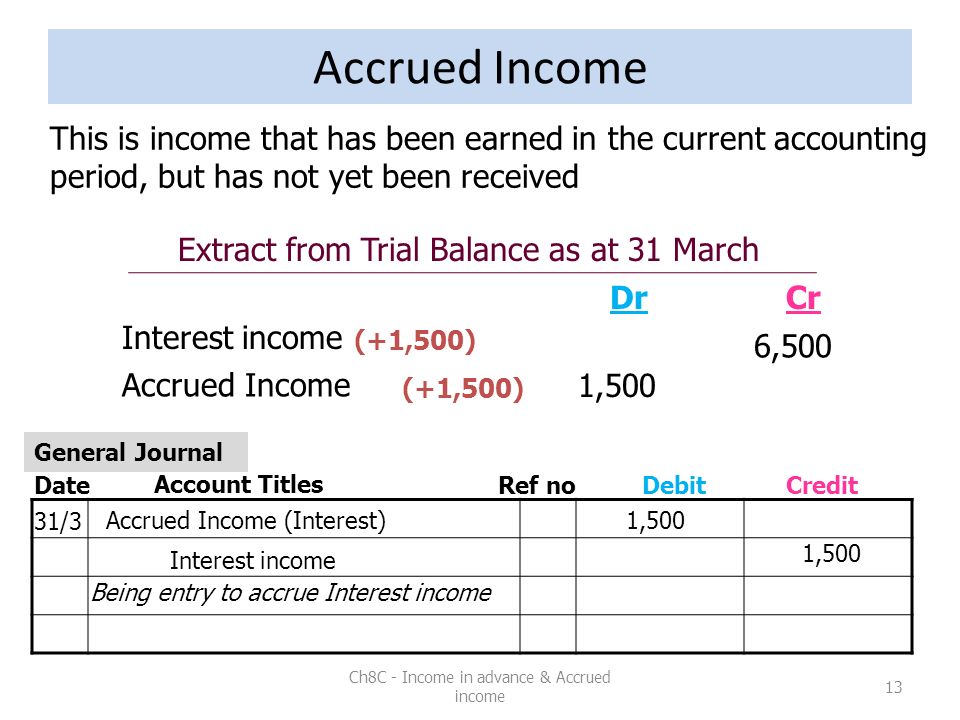

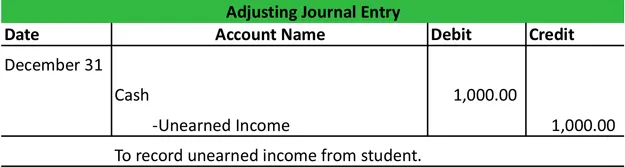

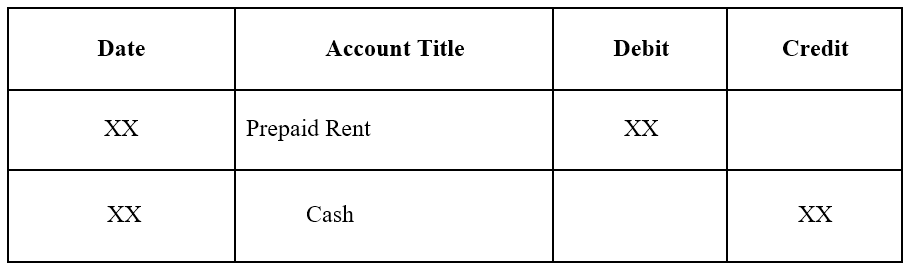

Revenue in advance journal entry. Collected 142 000 cash in advance for merchandise to be available and shipped during february of the next accounting year the accounting period ends december 31. An adjusting journal entry is usually made at the end of an accounting period to recognize an income or expense in the period that it is incurred. Journal entry for advance received from a customer. It is the revenue that the company has not earned yet.

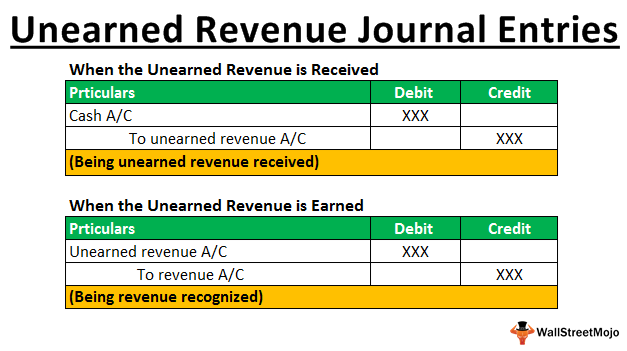

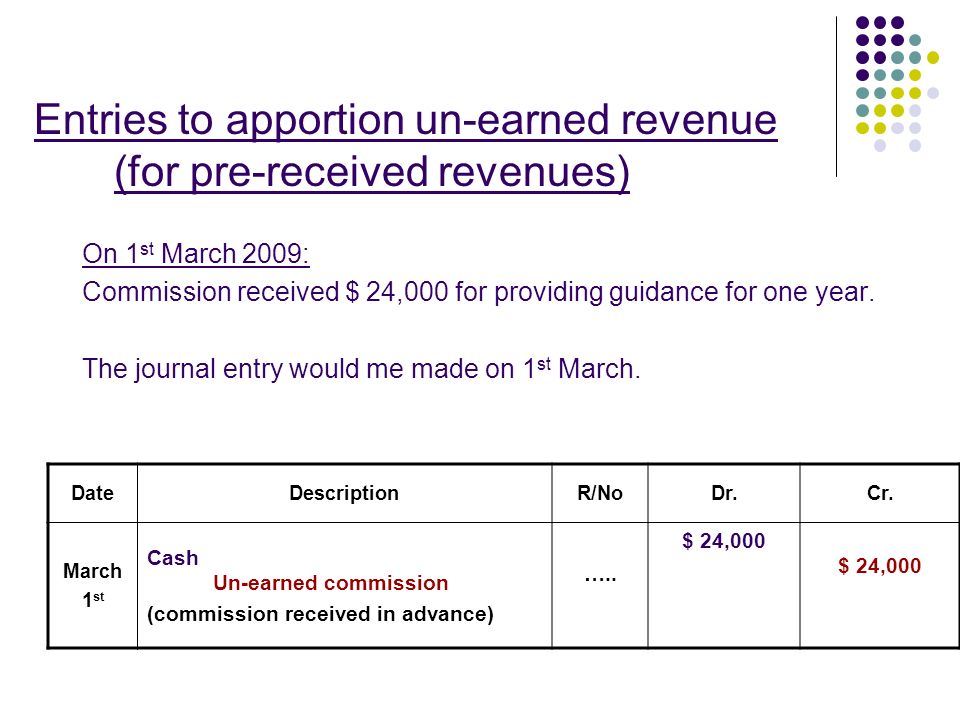

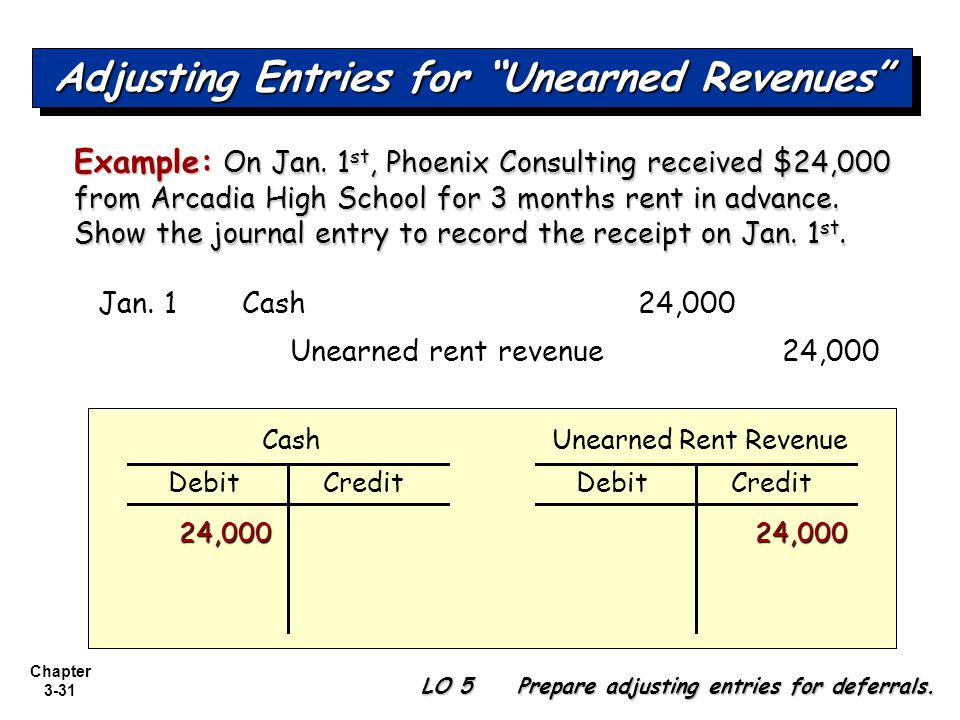

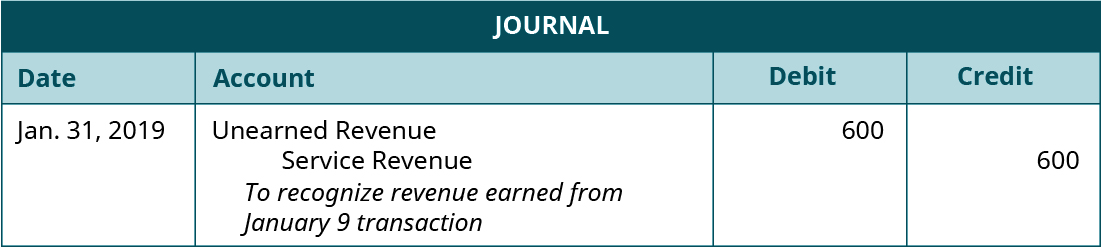

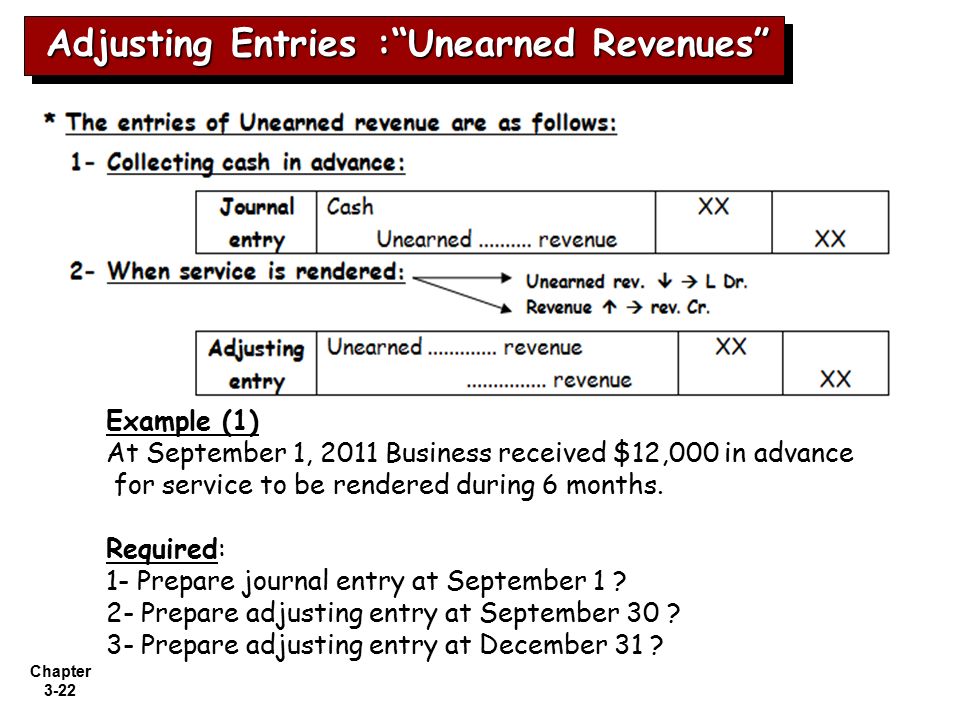

Deferred revenue journal entry overview. Adjusting journal entries are a feature of accrual accounting as a result of revenue recognition and matching principles. The following unearned revenue journal entry example provides an understanding of the most common type of situations where such a journal entry account for and how one can record the same as there are many situations where the journal entry for unearned revenue pass it is not possible to provide all the types of examples. A deferred revenue journal entry is needed when a business supplies its services to a customer and the services are invoiced in advance.

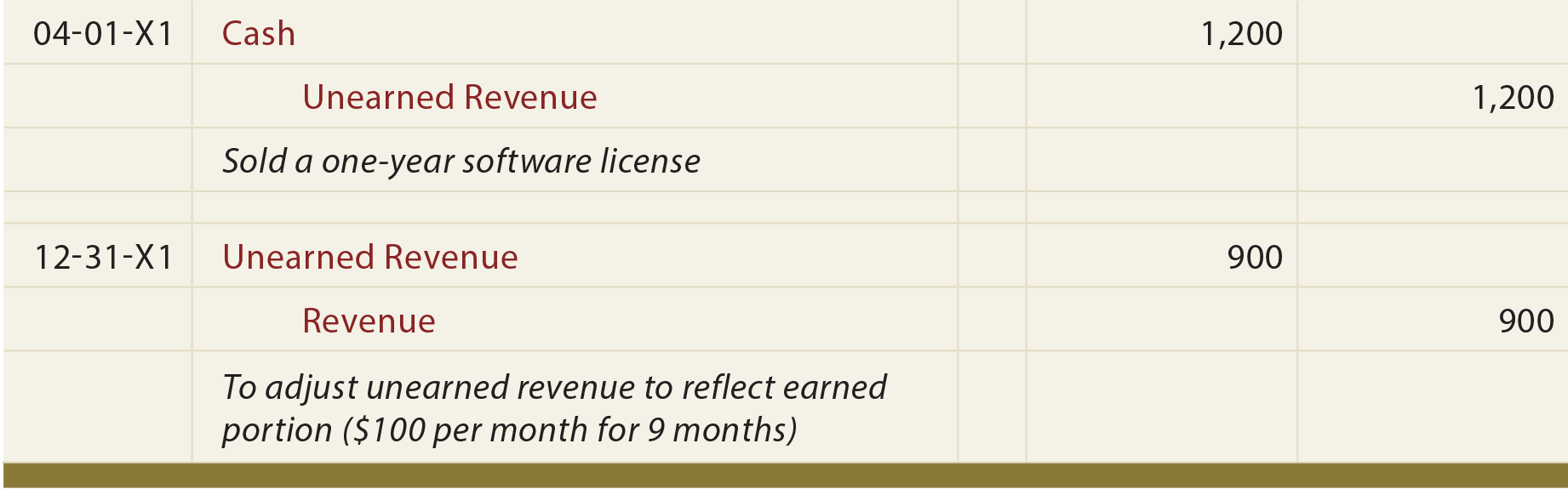

Likewise the company needs to properly make the journal entry for this type of advance payment as deferred revenue not revenue. Deferred revenue is the payment the company received for the goods or services that it has yet to deliver or perform. As a result journal entry for advance received from a customer is entered in the books. If they will be earned within one year they should be listed as a current liability.

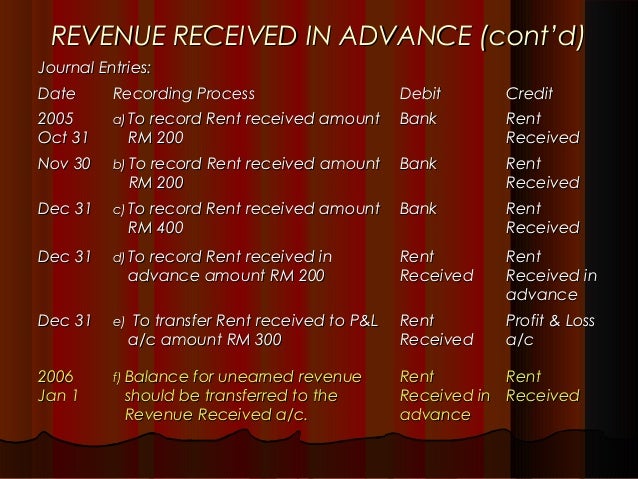

Journal entry of deferred revenue. In certain types of business transactions it is a requirement for the customer to pay a part of the total amount or the entire sum in advance for example security deposit to rent a property customized items bulk orders insurance premium etc. Journal entries of unearned revenue. Definition of revenue received in advance.

On december 26 boomingdale co. In simple terms deferred revenue means the revenue that has not yet been earned by the products services are delivered to the customer and is receivable from the same. The following deferred revenue journal entry provides an outline of the most common journal entries in accounting. Where does revenue received in advance go on a balance sheet.

For example suppose a business provides web design services and invoices for annual maintenance of 12 000 in advance.