Explain Expense And Revenue Accounts For Prepayments And Accruals

An accrued expense refers to when a company makes purchases on credit and enters liabilities in its general ledger acknowledging its obligations to its creditors.

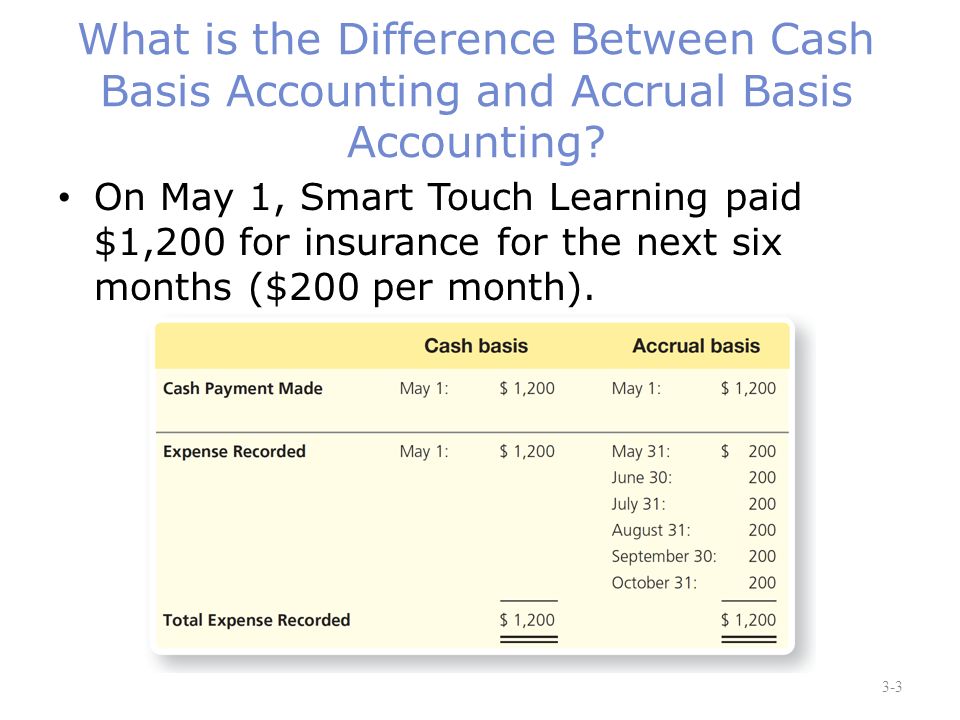

Explain expense and revenue accounts for prepayments and accruals. The year end accrual is the 3 000 expense that has not been paid in cash. You receive the insurance bill 1 january 201x but the period to which the invoice relates to is the whole year ahead that is 1 january to 31 december 201x. Prepayments are the opposite of accruals where the business pays up front for a service that they haven t actually received yet. An example of a prepayment would be an invoice for building insurance.

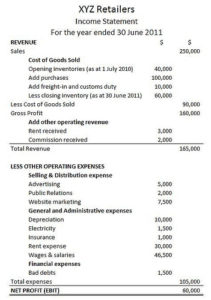

The double entry required is. Under the revenue recognition principles of accrual accounting revenue can only be recorded as earned in a period when all goods and services have been performed or delivered. Accrued expense is a concept in accrual accrual accounting in financial accounting accruals refer to the recording of revenues that a company has earned but has yet to receive payment for and the accounting that refers to expenses that are recognized when incurred but not yet paid. Accounting treatment of accruals.

Test your understanding 1. Matching principle requires accountants to record revenues and expenses in the period in which they are incurred. Interest expense accruals interest expenses that are owed but unpaid. Accruals or accrued expenses are expenses which relate to the.

A payment for an expense or income that was paid received in a previous financial period but relates to an expense income incurred in the current financial period. Ledger accounts and accrued expenses. Common accrued expenses include. One of these principles is the matching principle which states that you should match each item of revenue with an item of expense.

The following are a series of scenarios looking accruals and prepayments for both an expense and income account. The recording of accruals and prepayments ensure that accounting data is recorded as and when the incomes or expenses are made known instead of waiting for the funds to actually exchange hands. Dr electricity expense 3 000. Accruals include accrued expenses and accrued income whereas prepayments include prepaid income and prepaid expenses.

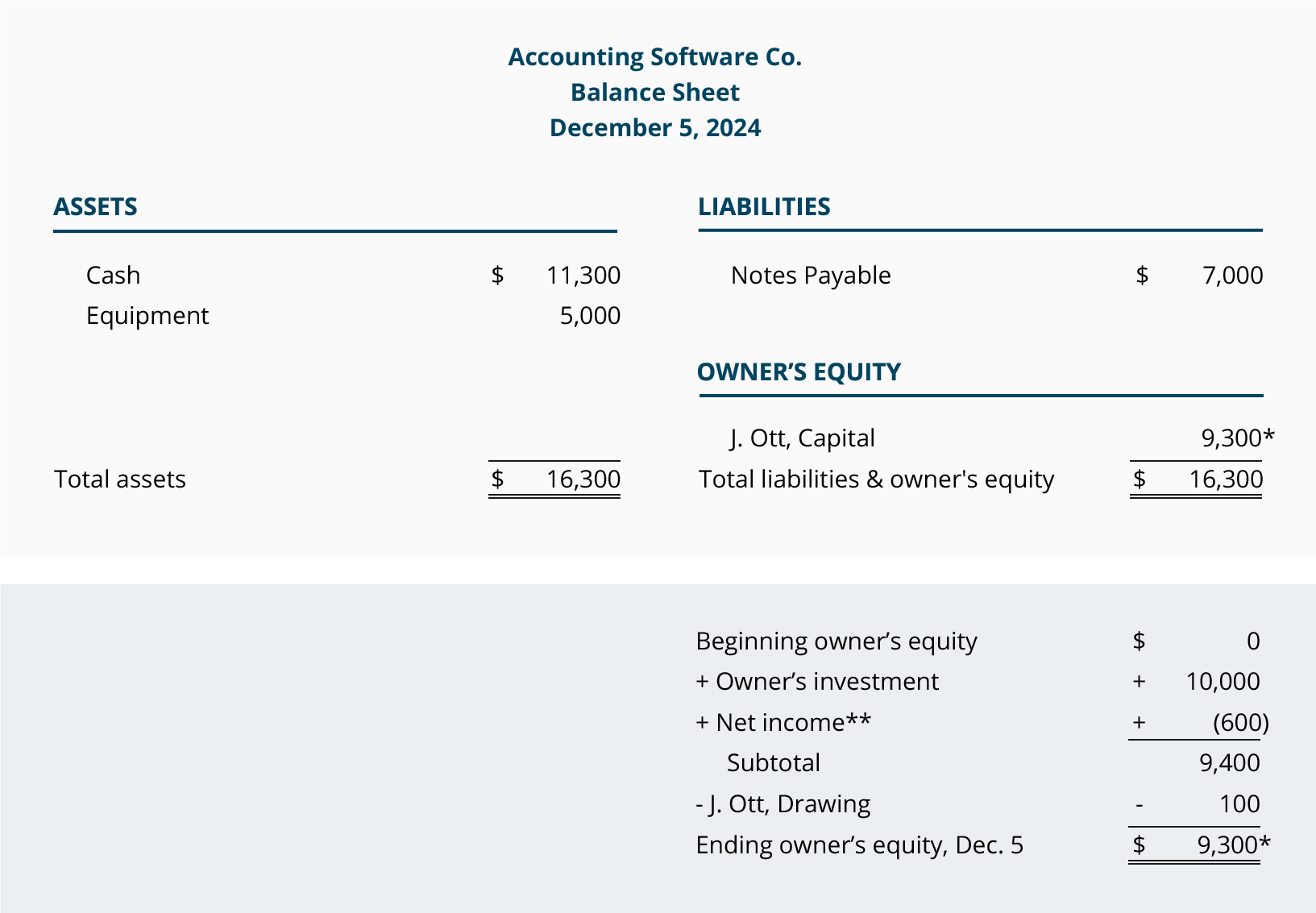

In accounting it is an expense incurred but not yet paid. What do the general ledger accounts look like. Accruals are expenses incurred but not yet paid while prepayments are payments for expenses for that are not yet incurred. At the end of an accounting period accruals and prepayments need to be calculated and journal entries prepared to record the adjustments in the relevant accounts.

Know the income statement charge.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)