Industrial Revenue Bonds Georgia

The governmental body that issues a bond is referred to as the issuer of that bond.

Industrial revenue bonds georgia. The bond issue is sponsored by a government entity but the proceeds are directed to a private for profit business. Industrial revenue bonds irb are municipal debt securities issued by a government agency on behalf of a private sector company and intended to build or acquire factories or other heavy equipment. A bond is an obligation to repay borrowed money. Corporations can borrow money by issuing bonds on their own in the commercial marketplace in which case they must offer investors the prevailing rate of interest.

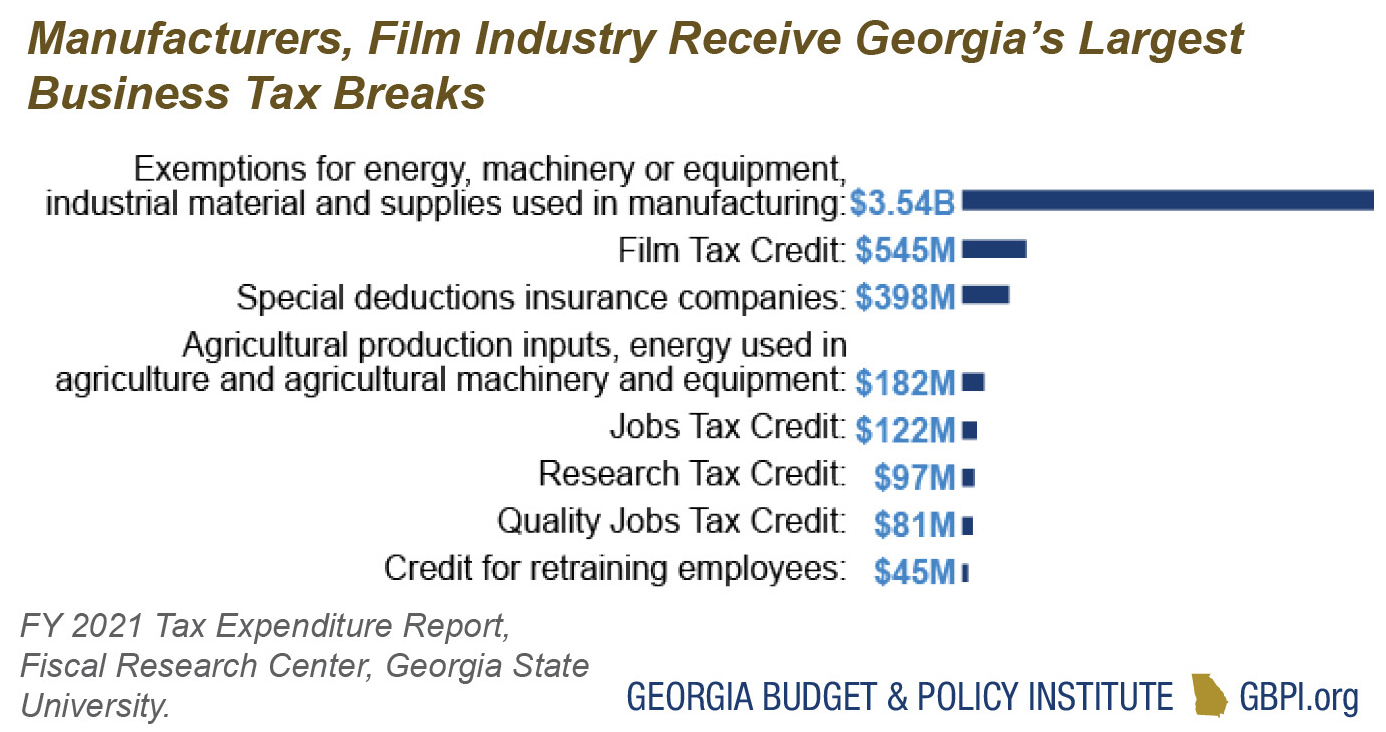

In georgia industrial development revenue bonds are generally issued by development authorities but may also be issued by counties municipalities and authorities of other types. Georgia is authorized to use up to 105 per capita a year or 1 114 829 415 for 2020 projects ranging from the traditional industrial development bond idb for manufacturing concerns and mortgage revenue bonds mrb for single family mortgages to bonds for multi family housing development and exempt facility bonds. Kpabac meets quarterly to allocate the cap. To finance the construction or renovation of an industrial building a city or county may issue industrial revenue bonds irbs for a private business.

Industrial revenue bonds irbs one of the ways in which state and local governments can subsidize private business is by providing low cost financing via the issuance of bonds. Reba is a job creation incentive program run by the state of georgia to encourage business relocation into the state of georgia. Industrial revenue bonds can be used primarily for acquisition of land construction of a building and acquisition of equipment. The private entity may transfer ownership of the property to the city or county for the length of the bond and lease the property from the city or county.

For cy 2016 the total state ceiling amount is approximately 442 509 200. The portion of the project financed with tax exempt bonds is restricted to the core manufacturing component and certain ancillary facilities.

:max_bytes(150000):strip_icc()/GettyImages-1075439388-0c5834aa38c9485ab552acdbe393975e.jpg)